Current Report Filing (8-k)

October 23 2018 - 4:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) October

23, 2018

AMERIPRISE FINANCIAL, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-32525

|

|

13-3180631

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

|

|

|

|

|

|

|

55 Ameriprise Financial Center

Minneapolis, Minnesota

|

|

55474

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code

(612) 671-3131

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 2.02

Results of Operations and Financial Condition.

On October 23, 2018, Ameriprise Financial, Inc. (the “Company,” “we,” or “our”) issued a press release announcing its financial results for the third quarter of 2018. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference and furnished herewith. In addition, the Company furnishes herewith, as Exhibit 99.2, its Statistical Supplement for the quarterly period ended September 30, 2018.

We follow accounting principles generally accepted in the United States (“GAAP”). The press release furnished as Exhibit 99.1 and the financial information furnished as Exhibit 99.2 include information on both a GAAP and non-GAAP adjusted basis. Certain non-GAAP performance measures in these exhibits exclude the impact of consolidating certain investment entities (“CIEs”), as well as certain integration/restructuring charges, the impact of our annual review of insurance and annuity valuation assumptions and model changes ("unlocking"), market impact on variable annuity guaranteed benefits, market impact on indexed universal life benefits, market impact on fixed index annuity benefits, market impact of hedges to offset interest rate changes on unrealized gains or losses for certain investments, net realized investment gains (losses) and income (loss) from discontinued operations. Management believes that the presentation of these non-GAAP financial measures better reflects the underlying performance of our 2018 and 2017 core operations and facilitates a more meaningful trend analysis. Exhibits 99.1 and 99.2 also contain certain non-GAAP debt, capital and shareholders’ equity measures, along with financial ratios incorporating such measures that exclude amounts related to items such as the following: accumulated other comprehensive income (“AOCI”), fair value of hedges, unamortized discount, debt issuance costs, capital lease obligations and the impact of consolidating the assets and liabilities of certain CIEs. Management believes that these non-GAAP debt, capital and shareholders’ equity measures, and the corresponding ratios, better represent our capital structure. Management uses certain of these non-GAAP measures to evaluate our financial performance on a basis comparable to that used by some securities analysts and investors. Also, certain of these non-GAAP measures are taken into consideration, to varying degrees, for purposes of business planning and analysis and for certain compensation-related matters.

Our non-GAAP financial measures included in Exhibits 99.1 and 99.2, which our management views as important indicators of financial performance, include the following: adjusted operating earnings; adjusted operating earnings per diluted share; adjusted operating effective tax rate; adjusted operating expenses; adjusted operating general and administrative expense; adjusted operating return on equity excluding AOCI; adjusted operating total net revenues; basic adjusted operating earnings per share; net adjusted operating earnings; net adjusted operating revenues; net pretax adjusted operating margin; pretax adjusted operating earnings; pretax adjusted operating margin; return on equity excluding AOCI; total Ameriprise Financial capital excluding fair value of hedges, unamortized discount, debt issuance costs, capital lease obligations and equity of CIEs; total Ameriprise Financial long-term debt excluding fair value of hedges, unamortized discount, debt issuance costs and capital lease obligations; total Ameriprise Financial long-term debt to total Ameriprise Financial capital excluding fair value of hedges, unamortized discount, debt issuance costs, capital lease obligations and equity of CIEs; total equity excluding AOCI; total equity excluding CIEs; total equity excluding CIEs and AOCI; and various financial measures that exclude the impact of unlocking.

Item 9.01

Financial Statements and Exhibits.

(d)

Exhibits.

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

|

|

Press Release dated October 23, 2018 announcing financial results for the third quarter of 2018

|

|

|

|

|

|

|

|

Statistical Supplement for the quarterly period ended September 30, 2018

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

|

|

|

|

|

|

AMERIPRISE FINANCIAL, INC.

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

Date: October 23, 2018

|

By

|

/s/ Walter S. Berman

|

|

|

|

Walter S. Berman

|

|

|

|

Executive Vice President and

|

|

|

|

Chief Financial Officer

|

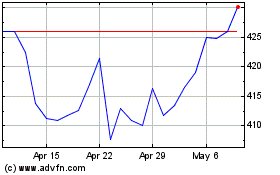

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Apr 2023 to Apr 2024