Verizon Adds Phone Customers But Oath Revenue Weakens -- Update

October 23 2018 - 12:36PM

Dow Jones News

By Sarah Krouse

Verizon Communications Inc. added to its pool of wireless phone

subscribers in the third quarter while pressing forward with its

bet that it is better to focus on building a faster network than

trying to own the content that flows through it.

The largest U.S. wireless carrier by subscribers added a net

295,000 new phone connections during the period, after adding a net

199,000 of those customers in the prior quarter.

Revenue from Verizon's wireless unit -- its largest -- grew, but

the carrier reported declines in its wireline and Oath media and

advertising businesses. It also acknowledged that it is unlikely to

meet longer-term targets set for Oath, whose former leader Tim

Armstrong recently stepped aside.

Verizon has put building a faster, 5G network at the center of

its long-term strategy.

Meanwhile, it faces intense competition for subscribers in a

saturated wireless market. To woo customers who pay for unlimited

data plans, the company has promoted its mix-and-match plans, which

allow customers to select from three unlimited packages. In August,

it began offering customers on unlimited plans six months of free

access to Apple Inc.'s music-streaming service.

Verizon topped some Wall Street estimates of its phone

subscriber growth. Wells Fargo analysts expected the carrier to add

a net 200,000 postpaid phone subscribers during the quarter.

Shares rose 4% in Tuesday afternoon trading, even as the broader

stock market tumbled. Verizon shares, at $57.06, are trading near

their highest levels since 2000.

Verizon had 116.8 million wireless connections at the end of

September, compared with 116.5 million at the end of June. It is

the first major U.S. carrier to report quarterly results. Rival

AT&T Inc. is slated to update investors on Wednesday.

Quarterly revenue in the Oath business, which houses AOL, Yahoo

and other brands, was $1.8 billion in the third quarter, down about

7% from the same period a year earlier. Last quarter, executives

faced questions from analysts about when that unit would post

revenue growth, and on Tuesday Verizon acknowledged that core parts

of Oath's business -- search and desktop usage -- are under

pressure and that it is struggling to meet performance targets.

Verizon said Tuesday the unit's revenue is likely to be "flat in

the near term", adding that it doesn't expect to meet its stated

goal of Oath generating $10 billion in revenue by 2020.

Chief Financial Officer Matt Ellis said the business is focusing

on news, finance, sports and entertainment content viewed on mobile

devices. "When we do that, we'll be able to increase the

monetization that comes through the ad technology" Oath owns, he

said in an interview.

In all, net income attributable to Verizon was $4.92 billion, up

from $3.62 billion a year earlier. Revenue rose 2.8% to $32.6

billion.

Verizon and other carriers have turned to gadgets such as

smartwatches and connected vehicles to boost revenue. The company

said it added 300,000 connections for smartwatches, connected

vehicles and other gadgets, while losing 80,000 tablet

connections.

Verizon's primary focus is on so-called postpaid customers who

pay their bill at the end of the month under long-term contracts

and are seen by carriers as valuable because they provide a stable

source of revenue.

In its landline business, Verizon added 54,000 home broadband

connections during the third quarter and lost 63,000 Fios video

customers, continuing to suffer from customer preferences shifting

toward streaming video, rather than traditional cable

television.

Hans Vestberg became Verizon's new chief executive partway

through the quarter, succeeding Lowell McAdam on Aug. 1.

Since then, the company has begun installing its in-home, 5G

broadband service to a small subset of its customers. As part of

its cost-cutting efforts, it has offered voluntary severance

packages to more than 40,000 workers and signed a $700 million

outsourcing agreement with Indian firm Infosys Ltd.

Verizon said it was too early to quantify how much the severance

packages would cost the firm during the fourth quarter or the

savings the reduced headcount would deliver in 2019.

Verizon has also taken steps to add to its network

infrastructure, applying to bid in the Federal Communications

Commission's upcoming millimeter-wave auctions.

Mr. Ellis said the firm was open to deals, but the carrier is

"focused on running the business we have. We think most of the

opportunities in front of us are ones we can develop

ourselves."

Write to Sarah Krouse at sarah.krouse@wsj.com

(END) Dow Jones Newswires

October 23, 2018 12:21 ET (16:21 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

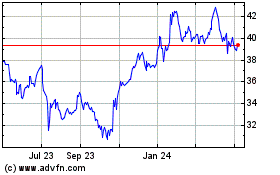

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

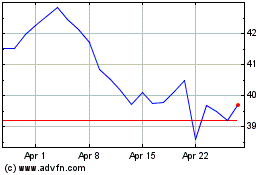

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Apr 2023 to Apr 2024