Kimberly Changes CEOs as Sales Lag -- WSJ

October 23 2018 - 3:02AM

Dow Jones News

By Kimberly Chin

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 23, 2018).

Kimberly-Clark Corp. said it was switching chief executives in

the midst of a restructuring program intended to boost profits as

the maker of Kleenex tissues, Scott toilet paper and Huggies

diapers struggles with weak sales.

Current President and Chief Operating Officer Michael Hsu is set

to become chief executive officer effective Jan. 1, succeeding CEO

Thomas Falk, who has served in this position since 2002. Mr. Falk,

who has been chairman since 2003, will become executive chairman,

the company said.

Before his promotion to COO last year, Mr. Hsu was group

president of the company's personal care and consumer tissue

business in North America. He remains a member of the company's

board.

Earlier this year, the company launched a restructuring program

aimed at reducing between $500 million and $550 million in costs by

the end of the year by slashing its workforce and slimming its

manufacturing supply chain. It also said it would exit or divest

from some of its low-margin businesses.

Mr. Hsu said in a call with analysts that he would like to

reinvest some of the savings from the restructuring program, both

in core areas like personal care as well as its digital and

e-commerce operations.

However, he said rising commodity costs and weakened foreign

currency, particularly from its Latin American markets, will be a

drag on earnings in the coming quarters. The company, which

reported its earnings on Monday, said its profit was hurt by $120

million of higher input costs over the latest quarter.

Kimberly-Clark has dealt with rising costs for commodities like

pulp, which is the material used in tissues and toilet paper,

polymer and other raw materials. Mr. Hsu said those contracts are

"unlikely to be as favorable as they are this year" due to the

current environment.

Mr. Hsu said the company will focus on selling its more popular

items, as well as introducing a mix of larger packs to offset

weaker categories.

In August, Kimberly-Clark said it would increase its list prices

and change package counts in the U.S. and Canada for several

brands, including Cottonelle bathroom tissue and Huggies diapers,

to offset rising commodity costs. The price increases will mostly

go into effect in the first quarter of next year.

Several consumer-products makers, including rival Procter &

Gamble Co., have also raised prices on some of their products in

North America.

Kimberly-Clark also said Monday that third-quarter sales fell 2%

to $4.58 billion from the same period a year ago, compared with the

$4.53 billion forecast of analysts polled by Refinitiv.

Kimberly-Clark reported its profit fell 20% to $451 million, or

$1.29 a share, from a year earlier. Excluding special items, it

reported earnings of $1.71 a share, topping analysts' expectations

of $1.63 a share, according to a Refinitiv poll.

The Dallas-based company said it would further cut its earnings

guidance for the full year. It expects to earn between $3.29 and

$3.79 a share, compared with the $3.37 to $3.87 a share it

previously forecast. It maintained its organic sales growth target

of about 1%.

Write to Kimberly Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

October 23, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

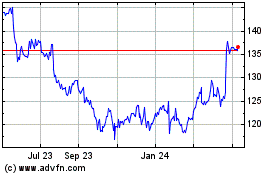

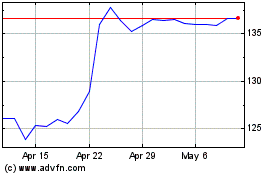

Kimberly Clark (NYSE:KMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kimberly Clark (NYSE:KMB)

Historical Stock Chart

From Apr 2023 to Apr 2024