voxeljet AG Announces Closing of Public Offering of ADSs

October 22 2018 - 4:12PM

Business Wire

voxeljet AG (the “Company” or “voxeljet”) today announced the

closing of its previously announced public offering of 4,860,000

American Depositary Shares (“ADSs”) at a public offering price of

$2.57 per ADS (the “Public Offering Price”). The Company has also

granted the underwriter a 30-day option to purchase up to an

additional 720,000 ADSs at the Public Offering Price, less the

underwriting discounts and commissions, to cover over-allotments,

if any.

The net proceeds of the offering to the Company were

approximately $11.10 million after deducting underwriting discounts

and commissions and estimated offering expenses.

Piper Jaffray & Co. acted as the sole underwriter. The

offering of the ADSs was made only by means of a prospectus, copies

of which can be obtained from:

Piper Jaffray & Co.Attention: Prospectus Department800

Nicollet Mall, J12S03Minneapolis, MN

55402800-747-3924prospectus@pjc.com

Important Additional Information

This announcement is for informational purposes only. It is

neither an offer to buy, sell, exchange or transfer securities nor

a solicitation to submit an offer to purchase securities of

voxeljet AG in the United States of America, Germany or any other

country. Neither this announcement nor its contents may be

distributed in connection with any offer in any country.

This announcement is neither an advertisement nor a prospectus

and does not constitute a recommendation with respect to the

securities described in this announcement.

A registration statement relating to the ordinary shares has

been filed with the U.S. Securities and Exchange Commission (SEC)

and has become effective. The prospectus in the registration

statement, the related prospectus supplement and the other

documents that voxeljet AG files with the SEC contain information

about voxeljet AG and the capital increase. You may obtain the

preliminary prospectus supplement for the capital increase, the

registration statement and the other documents for free by visiting

EDGAR on the SEC’s website located at www.sec.gov. Copies of the

preliminary prospectus supplement and accompanying prospectus may

also be obtained from voxeljet AG, Paul-Lenz-Straße 1a, 86316

Friedberg, Germany, Attention: Investor Relations Department, or by

calling +49 821 7483 100.

Forward-Looking Statements

To the extent this document contains forward-looking statements,

such statements are not statements of fact and are made using words

such as "expect", "believe", "estimate", "intend", "strive",

"assume" and similar expressions. These statements are an

expression of the intentions, views or current expectations and

assumptions of voxeljet AG and are based on current plans,

estimates and forecasts made by voxeljet AG on the basis of its

best knowledge, but do not constitute any statement with respect to

their future accuracy. You should not place undue reliance on these

statements. voxeljet AG cannot provide assurances that the matters

described in this press release will be successfully completed.

Forward-looking statements are subject to risks and uncertainties,

which are usually difficult to predict and ordinarily not in the

domain of influence of voxeljet AG. These risks and other factors

are discussed in more detail in the company’s public filings with

the Securities and Exchange Commission. It should be noted that

actual events or developments could materially differ from the

events and developments described or included in the

forward-looking statements. Statements made herein are as of the

date hereof and should not be relied upon as of any subsequent

date. The company disclaims any obligation to update any

forward-looking statements except as may be required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181022005889/en/

voxeljetInvestors and MediaJohannes PeschDirector,

Investor Relations and Business

Developmentjohannes.pesch@voxeljet.de+49-821-7483-172

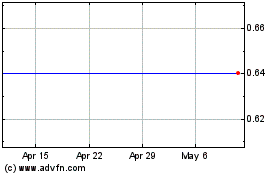

Voxeljet (NASDAQ:VJET)

Historical Stock Chart

From Mar 2024 to Apr 2024

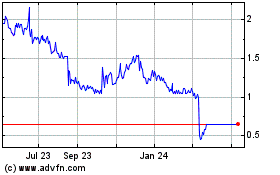

Voxeljet (NASDAQ:VJET)

Historical Stock Chart

From Apr 2023 to Apr 2024