Shares jump 8.8% on strongest gains in years

By Aisha Al-Muslim

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 20, 2018).

Procter & Gamble Co. snapped out of a long funk, booking its

strongest quarterly sales gains in five years on the back of

healthy global demand for bathroom staples like Head &

Shoulders shampoo and Gillette razors.

The gains were a signal that the consumer products giant may be

entering a period of more robust growth after a yearslong struggle

to adapt to rising competition, higher costs and a consumer shift

toward smaller brands. P&G's woes led to the costliest board

fight in history and promises by executives of dramatic changes,

but there were few signs that the moves were taking hold.

Investors cheered the results on Friday, sending P&G shares

up 8.3% to $87 -- its highest percentage gain in a decade. The

shares are still down on the year, having missed out on the broader

stock market rally.

The Cincinnati-based company reported sales increases across

most of its categories, including shaving razors, health care and

laundry detergent. P&G executives said the growth came from

increased demand in the U.S. and abroad, not the company's recent

decision to increase prices on some items.

Despite the strong start to its fiscal year, executives sought

to tamp down expectations and stuck with their full-year forecast

for organic sales to rise 2% to 3%. Jon Moeller, P&G's finance

chief, said he would refrain from calling it a "breakout

quarter."

The company is "certainly not sitting here today declaring

victory," Mr. Moeller said on a conference call with analysts.

"There's a lot of work and volatility ahead of us."

P&G said organic sales, a closely watched metric that strips

out currency moves, acquisitions and divestitures, rose 4% in the

fiscal first quarter. Beauty products -- with brands including

Pantene, Olay and Old Spice -- fueled the gains, rising 7%.

Overall, organic sales increased in nine of the company's 10 global

categories, Mr. Moeller said in an interview.

"Beauty had a very good quarter, but the story is not beauty,"

he said. "If you look at the difference between the prior quarters

and this quarter, the most defining difference was simply the

number of businesses that were growing, and that reflects the

implementation of our strategy."

The company has been working on productivity, making better

packaging and creating more products that solve consumers' problems

and are convenient, Mr. Moeller said. Some of the company's

fast-growing products in the quarter were Tide Pods detergent and

Always Discreet, an adult diaper targeted at women with sensitive

bladders launched in 2014, he said.

Mr. Moeller said the company raised prices in some emerging

markets to offset currency swings but that overall prices were

neutral in the September quarter. Shipment volumes rose 3% from a

year ago.

The company now estimates overall sales to be down 2% for the

full year due to foreign-exchange headwinds, compared with the

previous outlook of flat to up 1%.

In recent quarters, the company's organic sales have generally

risen 2% or less. They rose 1% in the fiscal year ended June 30,

below the company's goal of 2% to 3%.

After more than a year of trying to combat weak demand by

lowering prices, P&G recently changed course, saying it would

charge more for its Pampers, Bounty, Charmin and Puffs brands. The

increases, which the company said would take effect later this year

or in early 2019, have the potential to more broadly influence

pricing and demand given P&G's size and clout. P&G said

pricing overall was neutral during the quarter.

P&G posted a 4% gain in organic sales in its long troubled

grooming business, where Gillette has lost market share to online

upstarts like Dollar Shave Club. Grooming sales in the U.S. grew

10% in the quarter, though Mr. Moeller cautioned that the company

will still continue to face challenges in the business. The only

P&G segment that reported a decline in organic sales was the

baby business, which includes Pampers and Luvs diapers.

Consumer-products makers got a boost this week when Unilever PLC

and Nestlé SA said inflation in many markets allowed them to charge

more for their products, fueling stronger sales for those companies

in the latest quarter. Many consumer-goods makers in recent

quarters have struggled to raise prices amid weak inflation, but

commodity-price increases and a stronger U.S. dollar have changed

that.

P&G said profit rose 12% to $3.2 billion, or $1.22 cents a

share, in the first quarter, which ended Sept. 30. Core earnings

were $1.12 a share, beating the $1.09 a share analysts polled by

Refinitiv were looking for.

Net sales rose 0.2% to $16.69 billion.

The company's earnings were affected by unfavorable

foreign-exchange fluctuations due to the strengthening of the U.S.

dollar, which hurt sales by 3%.

P&G said price increases to offset foreign-exchange and

commodity pressures will begin to go into effect later in the

fiscal second quarter and pick up in the second half of the year.

The cost and foreign-exchange challenges "will persist and likely

worsen" as the company moves into the second quarter, Mr. Moeller

said.

The price increases may negatively affect overall consumption,

Mr. Moeller said. "We will simply have to adjust as we go on, as we

learn," he said.

The company also maintained its expectation for core

earnings-per-share growth of 3% to 8% for fiscal 2019, although Mr.

Moeller said the company isn't currently at the high end of this

range. The outlook includes an estimated $1.3 billion headwind from

foreign exchange and higher commodity costs, such as crude oil, as

well as higher transportation costs.

Write to Aisha Al-Muslim at aisha.al-muslim@wsj.com

(END) Dow Jones Newswires

October 20, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

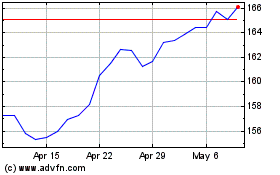

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

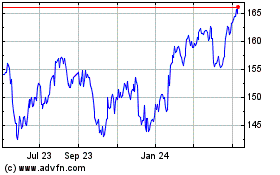

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024