P&G Posts Strongest Sales Growth in Five Years -- 2nd Update

October 19 2018 - 9:18AM

Dow Jones News

By Aisha Al-Muslim

Procter & Gamble Co. booked its strongest quarterly sales

growth in five years, driven by gains in the beauty segment, as the

consumer-products giant snapped a stretch of lackluster growth.

The maker of Tide detergent and Gillette razors said organic

sales, a closely watched metric that strips out currency moves,

acquisitions and divestitures, rose 4% in the fiscal first quarter.

Beauty products fueled the gains, rising 7%, but the company

reported growth across a number of categories including grooming,

health care and fabric.

The Cincinnati-based company has struggled to boost sales in an

industry facing more competition and higher costs of raw materials

and transportation. In recent quarters, the company's organic sales

have generally risen 2% or less. They rose 1% in the fiscal year

ended June 30, below the company's goal of 2% to 3%.

After more than a year of trying to combat weak demand by

lowering prices, P&G recently changed course, saying it would

charge more for its Pampers, Bounty, Charmin and Puffs brands. The

increases, which the company said would go into effect later this

year or in early 2019, have the potential to more broadly influence

pricing and demand given P&G's size and clout. P&G said

pricing, overall, was neutral during the quarter.

P&G posted a 4% gain in organic sales in its long troubled

grooming business, where Gillette has lost market share to online

upstarts like Dollar Shave Club. The only P&G segment that

reported a decline in organic sales was the baby business, which

includes Pampers and Luvs diapers.

Consumer-products makers got a boost this week when Unilever PLC

and Nestlé SA said inflation in many markets allowed them to charge

more for their products, fueling stronger sales for those companies

in the latest quarter. Many consumer-goods makers in recent

quarters have struggled to raise prices amid weak inflation, but

commodity-price increases and a stronger U.S. dollar have changed

that.

P&G said profit rose 12% to $3.2 billion, or $1.22 cents a

share, in the first quarter, which ended Sept. 30. Net sales rose

0.2% to $16.69 billion from $16.65 billion, but unfavorable foreign

exchange fluctuations hurt sales by 3%.

The company's earnings results were impacted by unfavorable

foreign-exchange fluctuations due to the strengthening of the U.S.

dollar, which hurt sales by 3%.

Shares rose 5% to $84.24 in premarket trading Friday. Shares are

down 12.4% in the past year.

For fiscal 2019, P&G said it is maintaining its guidance for

organic sales growth in the range of 2% to 3%. The company now

estimates overall sales to be down 2% for the full year due to

foreign-exchange headwinds, compared with the previous outlook of

flat to up 1%.

The company also maintained its expectation for core

earnings-per-share growth of 3% to 8% for fiscal 2019. The outlook

includes an estimated $1.3 billion headwind from foreign exchange

and higher commodity costs.

Write to Aisha Al-Muslim at aisha.al-muslim@wsj.com

(END) Dow Jones Newswires

October 19, 2018 09:03 ET (13:03 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

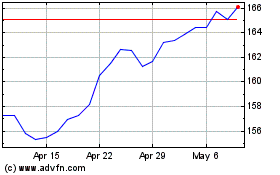

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

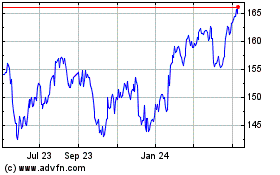

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024