By Nicole Friedman

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 19, 2018).

Hurricane Florence is unlikely to dent property insurers'

third-quarter earnings, especially when compared with the

devastation from last year's hurricane season.

Florence, which made landfall in North Carolina on Sept. 14,

caused significantly more flooding damage than wind damage. While

insurers typically cover wind damage, most residential flooding

damage is either covered by the federal government or

uninsured.

Florence caused between $1.7 billion and $4.6 billion in insured

losses due to wind and storm surge, according to an estimate by

catastrophe modeler AIR Worldwide. In contrast, insurers in the

third quarter of 2017 faced three massive hurricanes -- Harvey,

Irma and Maria -- that, combined, caused about $92 billion in

insured losses, according to Swiss Re.

"It seems like Florence didn't have as big of an impact as

initially expected" for insurance losses, said Mike Zaremski,

analyst at Credit Suisse. "It was definitely a much bigger flood

event."

Travelers Cos. kicked off the insurance earning season Thursday,

posting core operating earnings of $687 million, or $2.54 a share,

up from $253 million, or 91 cents a share, in the year-earlier

period.

Overall, the New York--based insurer reported a profit of $709

million, or $2.62 a share, up from $293 million, or $1.05 a share,

a year earlier. Total revenue, which includes investment income,

rose 5.4% to $7.72 billion.

Travelers, part of the Dow Jones Industrial Average, is one of

the first big property-casualty insurers to report quarterly

earnings, and its results are watched closely as a bellwether for

others that follow.

The insurer said Thursday its pretax catastrophe losses, net of

reinsurance, totaled $264 million during the quarter due to

Hurricane Florence and other storms, compared with $700 million a

year earlier.

The company is among the largest sellers of insurance to U.S.

businesses and sells car and home insurance to individuals and

families.

Travelers has closed more than 90% of its homeowners claims tied

to Florence, chief executive Alan Schnitzer said on a conference

call, adding that the company expects significant losses from

Hurricane Michael, which made landfall in Florida on Oct. 10.

Also on Thursday, American International Group Inc. and Allstate

Corp. pre-announced their third-quarter catastrophe losses. AIG

expects pretax catastrophe losses of $1.5 billion to $1.7 billion

due to Florence, natural disasters in Japan and other events.

Allstate said it expects pretax catastrophe losses of $625 million,

including about $88.5 million due to Florence.

Insurance and reinsurance companies set to report earnings next

week include Chubb Ltd., Hartford Financial Services Group Inc.,

Cincinnati Financial Corp. and Everest Re Group Ltd.

As of Oct. 3, more than 282,000 insurance claims representing

about $1.7 billion in insured losses had been filed due to

Hurricane Florence, not including the state's insurers of last

resort, according to the North Carolina Department of Insurance. Of

those claims, about 25% were for federal flood insurance.

Florence's uninsured flood losses in North Carolina, South

Carolina and Virginia could range from $13 billion to $18.5

billion, according to an estimate from analytics firm

CoreLogic.

Michael could be more expensive for the insurance industry, but

its financial impact is still being tallied.

Many of the biggest U.S. homeowners insurers have a small

presence in Florida, and small to midsize Florida-based companies

provide a large portion of the state's home insurance. Those

companies rely heavily on reinsurance.

As of midday Wednesday, private-sector insurers had received

nearly 70,000 claims for about $680 million in insured losses due

to Michael, according to the Florida Office of Insurance

Regulation.

--Allison Prang contributed to this article.

Write to Nicole Friedman at nicole.friedman@wsj.com

(END) Dow Jones Newswires

October 19, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

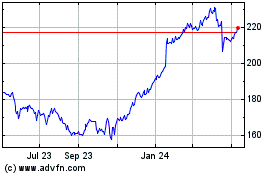

The Travelers Companies (NYSE:TRV)

Historical Stock Chart

From Mar 2024 to Apr 2024

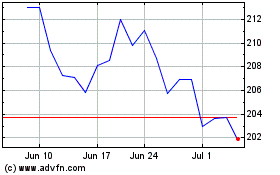

The Travelers Companies (NYSE:TRV)

Historical Stock Chart

From Apr 2023 to Apr 2024