Coca-Cola Names Company Veteran as New CFO in Leadership Shuffle -- Update

October 18 2018 - 6:04PM

Dow Jones News

By Ezequiel Minaya and Jennifer Maloney

Coca-Cola Co., which is attempting to keep pace with

increasingly health-conscious consumers, named a new finance chief

Thursday amid plans for current CFO and company veteran Kathy

Waller to retire next year.

Ms. Waller, who has been at the center of the Atlanta-based

company's push in recent years to expand beyond sugary soft drinks,

is scheduled to retire in March.

Ms. Waller joined Coca-Cola in 1987 as a senior accountant and

has had to balance cost-cutting with the company's drive to

innovate new products during her tenure as CFO. She rose to the

post in 2014.

She will be succeeded by John Murphy, who is currently president

of Coke's Asia Pacific group. Mr. Murphy has worked in a number of

finance, strategy and operational roles since joining the company

in 1988.

Ms. Waller "leaves a great legacy as a leader, including as a

mentor who created a strong organization and put the building

blocks in place to continue to transform and modernize our finance

function," Coke Chief Executive James Quincey said in a

statement.

In an interview, Ms. Waller said she was proud of helping create

a pipeline of women leaders at Coke. She also pointed to instilling

greater efficiency and the beverage giant's acquisitions under her

tenure as points of pride.

Between 2015 and 2017, selling, general and administrative

expenses at the company were cut 24% to offset a 20% decline in

revenue, according to company filings. During the period, gross

margin strengthened to 62% from 60.2%, according to FactSet.

The company this year made the largest brand acquisition in its

history, saying it would pay $5.1 billion for British coffee-shop

chain Costa.

"We're doing the right things," she said. "And John [Murphy]

will continue that with the organization."

Mr. Murphy, who has long been touted as a rising star at Coke,

said last month that the company had to focus on developing a

performance-based culture, building brands that connect with

consumers, and moving the business toward an asset-light,

high-margin and high-return model.

"Over the last couple of years, we've been working towards an

ambition...to become a total beverage company evolving from our

traditional focus around sparkling beverages," he said Sept. 26 at

the Bernstein Strategic Decisions CEO Conference, according to a

transcript of the event.

The CFO transition was part of a shuffle of leadership at the

soft-drink giant, with Coke also appointing new chief operating and

chief technical officers.

Mr. Quincey has aimed to get the iconic company to shed a

culture of cautiousness, expand into new categories and bring

products to market faster.

Before Mr. Quincey was named CEO in May 2017, investors and

analysts criticized Coke for focusing too long on sugary drinks.

Coke since then has pushed harder to diversify, launching more than

500 new products and variants last year.

During the company's latest quarter ending in June, sales

declined 8% from a year earlier to $8.9 billion, as a result of the

divestiture of its bottling operations. Coke posted a profit of

$2.3 billion, compared with $1.4 billion a year ago.

Micah Maidenberg contributed to this article.

Write to Ezequiel Minaya at ezequiel.minaya@wsj.com and Jennifer

Maloney at jennifer.maloney@wsj.com

(END) Dow Jones Newswires

October 18, 2018 17:49 ET (21:49 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

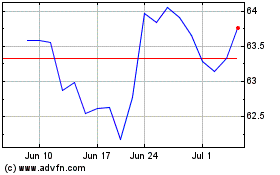

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024