Reflecting

Currency-Neutral Growth of Approximately 8% to 9% vs. 2017 Adjusted

Diluted EPS of $4.72

Regulatory News:

2018 Third-Quarter

- Reported and adjusted diluted earnings

per share of $1.44, up by $0.17 or 13.4% versus $1.27 in 2017

- Excluding unfavorable currency of

$0.09, adjusted diluted earnings per share up by $0.26 or 20.5%

versus $1.27 in 2017 as detailed in the attached Schedule 2

- Cigarette and heated tobacco unit

shipment volume of 203.7 billion, down by 2.1%, or up by 1.1%

excluding the net impact of total estimated distributor inventory

movements, reflecting:

- Cigarette shipment volume of 195.1

billion units, down by 3.4 billion units or 1.7%

- Heated tobacco unit shipment volume of

8.7 billion units, down by 1.1 billion units or 11.0%

- Net revenues of $7.5 billion, up by

0.4%

- Excluding unfavorable currency of $213

million, net revenues up by 3.3% as detailed in the attached

Schedule 3

- Operating income of $3.2 billion, up by

2.2%

- Excluding unfavorable currency of $167

million, operating income up by 7.6% as detailed in the attached

Schedule 5

- Adjusted operating income, reflecting

the items detailed in the attached Schedule 6, of $3.2 billion, up

by 2.2%

- Excluding unfavorable currency of $167

million, adjusted operating income up by 7.6% as detailed in the

attached Schedule 6

2018 Nine Months Year-to-Date

- Reported diluted earnings per share of

$3.85, up by $0.42 or 12.2% versus $3.43 in 2017

- Adjusted diluted earnings per share of

$3.85, up by $0.46 or 13.6% versus $3.39 in 2017

- Excluding unfavorable currency of

$0.02, adjusted diluted earnings per share up by $0.48 or 14.2%

versus $3.39 in 2017 as detailed in the attached Schedule 2

- Cigarette and heated tobacco unit

shipment volume of 579.3 billion, down by 1.2%, or up by 0.3%

excluding the net impact of total estimated distributor inventory

movements, reflecting:

- Cigarette shipment volume of 550.1

billion units, down by 15.5 billion units or 2.7%

- Heated tobacco unit shipment volume of

29.2 billion units, up by 8.7 billion units or 42.4%

- Net revenues of $22.1 billion, up by

8.2%

- Excluding favorable currency of $351

million, net revenues up by 6.5% as detailed in the attached

Schedule 4

- Operating income of $8.7 billion, up by

5.3%

- Excluding unfavorable currency of $4

million, operating income up by 5.3% as detailed in the attached

Schedule 5

- Adjusted operating income, reflecting

the items detailed in the attached Schedule 6, of $8.7 billion, up

by 5.3%

- Excluding unfavorable currency of $4

million, adjusted operating income up by 5.3% as detailed in the

attached Schedule 6

2018 Full-Year Forecast

PMI reaffirms its 2018 full-year reported diluted earnings per

share forecast to be in a range of $4.97 to $5.02, at prevailing

exchange rates, representing a projected increase of approximately

28% to 29% versus reported diluted earnings per share of $3.88 in

2017.

- Excluding an unfavorable currency

impact, at prevailing exchange rates, of approximately $0.12, the

forecast range represents a projected increase of approximately 8%

to 9% versus adjusted diluted earnings per share of $4.72 in 2017

as detailed in the attached Schedule 2.

2018 Full-Year Forecast Overview & Assumptions

As previously communicated, this forecast assumes:

- A total cigarette and heated tobacco

unit shipment volume decline for PMI of approximately 2% versus an

estimated total international industry volume decline, excluding

China and the U.S., of approximately 2.5%;

- Significant growth of PMI's in-market

heated tobacco unit sales volume, driven by all launch markets,

notably the EU Region, Japan, Korea and Russia, reaching 44 to 45

billion units in 2018;

- Heated tobacco unit shipments of 41 to

42 billion units in 2018, including an anticipated full-year

distributor inventory reduction -- concentrated in the third

quarter of 2018 -- of approximately three billion units, reflecting

approximately four billion unit reduction in Japan partly offset by

approximately one billion unit increase in other markets; and

- Currency-neutral net revenue growth of

approximately 3%, which also includes the move to highly

inflationary accounting in Argentina resulting in the treatment of

the U.S. dollar as the functional currency of the company’s

Argentinian affiliates, effective July 1, 2018.

As previously communicated, this forecast further assumes:

- An estimated strong combustible product

pricing variance of approximately 7%;

- Net incremental investment behind RRPs

of approximately $600 million for the full year;

- Operating cash flow of approximately $9

billion, subject to year-end working capital requirements;

- Capital expenditures of approximately

$1.5 billion;

- An effective tax rate of approximately

24%; and

- No share repurchases.

This forecast excludes the impact of any future acquisitions,

unanticipated asset impairment and exit cost charges, future

changes in currency exchange rates, further developments related to

the Tax Cuts and Jobs Act, and any unusual events. Factors

described in the Forward-Looking and Cautionary Statements section

of this release represent continuing risks to these

projections.

2018 THIRD-QUARTER CONSOLIDATED

RESULTS

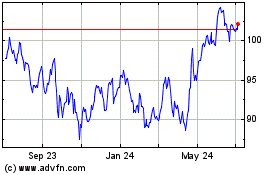

Philip Morris International Inc. (NYSE: PM) today announced its

2018 third-quarter results.

"Our third-quarter results demonstrate that our underlying

business performance is in good shape. Excluding distributor

inventory movements, our total shipment volume was up in the

quarter and year-to-date, reflecting the continued growth of our

heat-not-burn products as well as the solid performance of our

combustible products. Our total market share was up by 0.5 and 0.6

points in the quarter and year-to-date, respectively. In addition,

supported by our leading brand portfolio, pricing was strong. As a

result, we continue to forecast currency-neutral EPS growth for the

full year of 8-9%," said André Calantzopoulos, Chief Executive

Officer.

"We remain focused on our smoke-free transformation and are very

encouraged by the continued progress of our smoke-free products and

initiatives, especially across the EU and Russia. As previously

announced, this quarter existing IQOS device and consumable

inventories were rightsized in Japan ahead of the upcoming global

launch of our new IQOS 3 and IQOS 3 Multi devices. Importantly, our

worldwide in-market sales of heated tobacco units this year remain

set to almost double and we continue to anticipate shipments of

approximately 41-42 billion units."

"Overall, as we stated recently at our Investor Day, our

business is showing great momentum. As we enter this year’s final

quarter, I am confident that the strategies and initiatives we have

put in place set the stage for an even better business performance

in 2019."

Conference Call

A conference call, hosted by Martin King, Chief Financial

Officer, will be webcast at 9:00 a.m., Eastern Time, on October 18,

2018. Access is at www.pmi.com/2018Q3earnings. The audio webcast may

also be accessed on iOS or Android devices by downloading PMI’s

free Investor Relations Mobile Application at www.pmi.com/irapp.

Impact of U.S. Tax Reform

PMI's 2018 full-year diluted earnings per share forecast assumes

a full-year effective tax rate of approximately 24%, reflecting the

current analysis, interpretation and clarifications of the scope

and impact of the Tax Cuts and Jobs Act (the “Act”).

The Act has significant complexity, and PMI's final full-year

effective tax rate may differ from this assumption, due to, among

other things, additional guidance that may be issued by the U.S.

Treasury Department and the Internal Revenue Service, related

interpretations and clarifications of tax law, and earnings mix by

taxing jurisdiction.

U.S. GAAP Treatment of Argentina as a Highly Inflationary

Economy

Following the categorization of Argentina by the International

Practices Task Force of the Center for Audit Quality as a country

with a three-year cumulative inflation rate greater than 100%, the

country is considered highly inflationary in accordance with U.S.

GAAP. Consequently, PMI began to account for the operations of its

Argentinian affiliates as highly inflationary, and to treat the

U.S. dollar as the functional currency of the affiliates, effective

July 1, 2018.

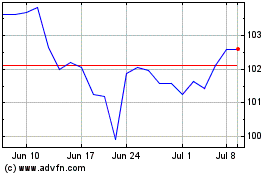

Dividends

During the quarter, PMI declared a regular quarterly dividend of

$1.14, representing an annualized rate of $4.56 per common share.

Since its spin-off in March 2008, PMI has increased its regular

quarterly dividend by 147.8% from the initial annualized rate of

$1.84 per common share, or a compound annual growth rate of

9.5%.

Investor Day

During the quarter, PMI's senior management reviewed the

company’s business outlook and long-term growth strategies at its

investor meeting at the Operations Center in Lausanne, Switzerland.

A copy of the presentation slides, transcript, glossary of key

terms and definitions, as well as reconciliations of non-GAAP

measures to the most directly comparable GAAP measures, have been

made available at www.pmi.com/2018InvestorDay. The archive of the

audio webcast will be available until Friday, October 26, 2018, and

may also be accessed on iOS or Android devices by downloading PMI’s

free Investor Relations Mobile Application at www.pmi.com/irapp.

PMI's Latest Nonclinical Results: A Step Further Toward

Confirming Risk-Reduction

On August 20, 2018, PMI submitted to the U.S. FDA the results of

its 18-month chronic toxicity and carcinogenicity animal study that

compared the exposure to IQOS aerosol with cigarette smoke. This

study adds to the extensive body of evidence already presented to

the agency in support of PMI’s pending application for

authorization of IQOS as a modified risk tobacco product.

The A/J mouse is a suitable model to study lung cancer and

Chronic Obstructive Pulmonary Disease (COPD), two of the most

common smoking-related diseases, because it is highly susceptible

to lung tumors and emphysema. This 18-month inhalation study

included female mice exposed to either fresh air, cigarette smoke

(3R4F reference cigarette), or IQOS aerosol at low, medium or high

exposure levels. In addition, the study included male mice exposed

to either fresh air or the high exposure level of IQOS aerosol. The

study assessed chronic toxicity and carcinogenicity of IQOS aerosol

compared to cigarette smoke in alignment with OECD Guidelines. The

study also included lung inflammation and COPD endpoints.

Lifelong exposure to IQOS aerosol, even at an exposure level

twice that of cigarette smoke, resulted in only mild systemic

toxicity and did not cause an increase in lung inflammation,

emphysema or lung tumorigenicity compared to air exposure. In

contrast, cigarette smoke exposure resulted in moderate to severe

chronic toxicity, lung inflammation, emphysema and an increase in

lung tumorigenicity as compared to fresh air.

This animal study provides direct evidence connecting the

reduction in exposure to the harmful chemicals in cigarette smoke

to a reduction in smoking-related diseases. In the absence of

long-term epidemiological data for IQOS on smoking-related diseases

such as lung cancer and COPD, these results provide further context

and strengthen the evidence that IQOS presents less risk of harm

and has the potential to reduce the risk of smoking-related

disease. The results have been presented at scientific conferences

and the full results will be submitted for publication in a

peer-reviewed journal.

"This is a ground-breaking study," said Miroslaw Zielinski,

PMI's President Science and Innovation. "It is the first-ever in

vivo lung cancer study that provides scientific evidence of the

potential impact of a smoke-free product on lung cancer. The study

results further strengthen the body of scientific evidence that

IQOS presents less risk of harm and has the potential to reduce the

risk of smoking-related disease."

SHIPMENT VOLUME

PMI Shipment Volume by Region

Third-Quarter Nine Months Year-to-Date

(million units) 2018 2017

Change 2018 2017 Change

Cigarettes European Union 48,223

49,114 (1.8)% 135,878 141,412 (3.9)% Eastern Europe 29,801 31,749

(6.1)% 80,294 88,426 (9.2)% Middle East & Africa 37,406 37,088

0.9% 100,831 101,399 (0.6)% South & Southeast Asia 45,840

44,731 2.5% 130,846 124,655 5.0% East Asia & Australia 14,186

15,331 (7.5)% 43,391 48,364 (10.3)% Latin America & Canada

19,612 20,452 (4.1)% 58,829

61,301 (4.0)%

Total PMI 195,068

198,465 (1.7)% 550,069 565,557

(2.7)% Heated Tobacco Units European Union

1,730 464 +100% 3,853 1,040 +100% Eastern Europe 1,152 180 +100%

2,667 351 +100% Middle East & Africa 1,152 247 +100% 2,832 410

+100% South & Southeast Asia — — —% — — —% East Asia &

Australia 4,575 8,826 (48.2)% 19,755 18,697 5.7% Latin America

& Canada 43 8 +100% 98

12 +100%

Total PMI 8,652

9,725 (11.0)% 29,205 20,510

42.4% Cigarettes and Heated Tobacco Units

European Union 49,953 49,578 0.8% 139,731 142,452 (1.9)% Eastern

Europe 30,953 31,929 (3.1)% 82,961 88,777 (6.6)% Middle East &

Africa 38,558 37,335 3.3% 103,663 101,809 1.8% South &

Southeast Asia 45,840 44,731 2.5% 130,846 124,655 5.0% East Asia

& Australia 18,761 24,157 (22.3)% 63,146 67,061 (5.8)% Latin

America & Canada 19,655 20,460

(3.9)% 58,927 61,313 (3.9)%

Total

PMI 203,720 208,190 (2.1)% 579,274

586,067 (1.2)%

Third-Quarter

PMI's total shipment volume decreased by 2.1%, principally due

to:

- Eastern Europe, reflecting lower

cigarette shipment volume, principally in Russia, Kazakhstan and

Ukraine, partly offset by higher heated tobacco unit shipment

volume, notably in Russia;

- East Asia & Australia, reflecting:

lower cigarette shipment volume, notably in Japan and Korea; lower

heated tobacco unit shipment volume in Japan due to net unfavorable

estimated distributor inventory movements described in the East

Asia & Australia Region section; partly offset by higher

cigarette shipment volume in Taiwan, as well as higher heated

tobacco unit shipment volume in Korea; and

- Latin America & Canada, reflecting

lower cigarette shipment volume, principally in Argentina, Brazil,

Canada and Colombia, partly offset by Mexico;

partly offset by

- the EU, reflecting higher heated

tobacco unit shipment volume, as well as higher cigarette shipment

volume in Germany and Poland, partly offset by lower cigarette

shipment volume, principally in France and Italy;

- Middle East & Africa, reflecting

higher cigarette shipment volume, principally in the GCC, notably

Saudi Arabia, and Turkey, as well as higher heated tobacco unit

shipment volume, primarily in PMI Duty Free; and

- South & South East Asia, reflecting

higher cigarette shipment volume, principally in Indonesia and

Thailand, partly offset by Pakistan.

Excluding the net unfavorable impact of total estimated

distributor inventory movements of approximately 6.7 billion units,

essentially reflecting unfavorable heated tobacco unit inventory

movements of approximately 6.9 billion units, mainly due to Japan,

partly offset by favorable cigarette inventory movements of

approximately 0.2 billion units, PMI's total shipment volume

increased by 1.1%.

Nine Months Year-to-Date

Year-to-date, PMI's total shipment volume decreased by 1.2%,

principally due to:

- the EU, primarily reflecting lower

cigarette shipment volume in France, Germany and Italy, partly

offset by higher heated tobacco unit shipment volume across the

Region;

- Eastern Europe, reflecting lower

cigarette shipment volume, principally in Russia and Ukraine,

partly offset by higher heated tobacco unit shipment volume, mainly

in Russia and Ukraine;

- East Asia & Australia, reflecting:

lower cigarette shipment volume, principally in Japan and Korea;

lower heated tobacco unit shipment volume in Japan due to net

unfavorable estimated distributor inventory movements described in

the East Asia & Australia Region section; partly offset by

higher heated tobacco unit shipment volume in Korea; and

- Latin America & Canada, reflecting

lower cigarette shipment volume, notably in Argentina, Canada,

Colombia and Mexico;

partly offset by

- Middle East & Africa, reflecting

higher cigarette shipment volume in Turkey, as well as higher

heated tobacco unit shipment volume, mainly in PMI Duty Free,

partly offset by lower cigarette shipment volume in the GCC,

notably Saudi Arabia and the UAE; and

- South & Southeast Asia, reflecting

higher cigarette shipment volume, principally in Pakistan, the

Philippines and Thailand.

Excluding the net unfavorable impact of total estimated

distributor inventory movements of approximately 8.6 billion units,

reflecting unfavorable heated tobacco unit inventory movements of

approximately 9.5 billion units, partly offset by favorable

cigarette inventory movements of approximately 0.9 billion units,

both driven mainly by Japan, PMI's total shipment volume increased

by 0.3%.

PMI shipment volume by brand is shown in the table below.

PMI Shipment Volume by Brand

Third-Quarter Nine Months Year-to-Date

(million units) 2018 2017

Change 2018 2017 Change

Cigarettes Marlboro 69,121

68,886 0.3% 195,987 200,115 (2.1)% L&M 24,329 23,809 2.2%

66,751 69,091 (3.4)% Chesterfield 15,821 15,116 4.7% 44,622 40,311

10.7% Philip Morris 13,505 12,838 5.2% 36,687 36,133 1.5% Sampoerna

A 10,333 10,482 (1.4)% 29,131 31,012 (6.1)% Parliament 11,588

11,354 2.1% 31,041 31,723 (2.1)% Bond Street 8,595 9,912 (13.3)%

23,960 28,675 (16.4)% Dji Sam Soe 7,578 6,425 17.9% 21,151 15,692

34.8% Lark 6,058 6,403 (5.4)% 17,604 18,627 (5.5)% Fortune 4,052

3,451 17.4% 11,791 9,761 20.8% Others 24,088 29,789

(19.1)% 71,344 84,417

(15.5)%

Total Cigarettes 195,068 198,465

(1.7)% 550,069 565,557 (2.7)% Heated

Tobacco Units 8,652 9,725 (11.0)%

29,205 20,510 42.4%

Total PMI

203,720 208,190 (2.1)% 579,274

586,067 (1.2)% Note: Sampoerna A includes Sampoerna;

Philip Morris includes Philip Morris/Dubliss; and Lark includes

Lark Harmony.

Third-Quarter

PMI's cigarette shipment volume of the following brands

decreased:

- Sampoerna A in Indonesia, partly

reflecting the impact of its retail price increasing past its round

pack price point in the fourth quarter of 2017;

- Bond Street, mainly due to Kazakhstan,

Russia and Ukraine;

- Lark, mainly due to Japan; and

- "Others," mainly due to: mid-price

brands, notably Sampoerna U in Indonesia, partly reflecting the

impact of above-inflation retail price increases; the successful

portfolio consolidation of local, low price brands into

international trademarks, notably in Colombia, Mexico and Russia;

and low price Jackpot in the Philippines, reflecting uptrading as a

result of narrowed price gaps.

PMI's cigarette shipment volume of the following brands

increased:

- Marlboro, mainly driven by Algeria, the

GCC, notably Saudi Arabia, Indonesia, Mexico, the Philippines and

Turkey, partly offset by Argentina, Italy, Japan, Korea and PMI

Duty Free;

- L&M, mainly driven by the GCC,

notably Saudi Arabia, Poland and Thailand, partly offset by North

Africa, notably Egypt, Russia and Turkey;

- Chesterfield, mainly driven by

Colombia, Mexico and Turkey, partly offset by Russia;

- Philip Morris, mainly driven by Russia,

partly offset by Argentina and the Philippines;

- Parliament, mainly driven by Japan and

Turkey, partly offset by Korea and Russia;

- Dji Sam Soe in Indonesia, notably

reflecting the continued strong performance of its Magnum Mild 16s

variant; and

- Fortune in the Philippines, reflecting

the favorable impact of its narrowed retail price gap to

competitors' products.

The decrease in PMI's heated tobacco unit shipment volume was

due to Japan, reflecting the previously disclosed expectation of a

full-year net distributor inventory reduction of approximately

three billion units (an estimated four billion unit reduction in

Japan and one billion unit increase in other markets) with the

reduction in Japan concentrated in the third quarter of 2018.

Nine Months Year-to-Date

PMI's cigarette shipment volume of the following brands

decreased:

- Marlboro, mainly due to France, the

GCC, notably Saudi Arabia and the UAE, Italy, Japan and Korea,

partly offset by Indonesia, North Africa and Turkey;

- L&M, mainly due to the GCC, notably

Saudi Arabia, North Africa, notably Egypt, Russia, Turkey and

Ukraine, partly offset by Kazakhstan, Serbia and Thailand;

- Sampoerna A in Indonesia, partly

reflecting the impact of its retail price increasing past its round

pack price point in the fourth quarter of 2017;

- Parliament, mainly due to Korea and

Russia, partly offset by Turkey;

- Bond Street, mainly due to Russia and

Ukraine;

- Lark, mainly due to Japan, partly

offset by Turkey; and

- "Others," mainly due to: mid-price

brands, notably Sampoerna U in Indonesia, partly reflecting the

impact of above-inflation retail price increases; the successful

portfolio consolidation of local, low price brands into

international trademarks, notably in Brazil, Colombia, Mexico and

Russia; low price Jackpot in the Philippines, reflecting uptrading

as a result of narrowed price gaps; partly offset by low-price

Morven in Pakistan.

PMI's cigarette shipment volume of the following brands

increased:

- Chesterfield, mainly driven by

Argentina, Brazil, Colombia, the GCC, notably Saudi Arabia, Mexico

and Turkey, partly offset by Portugal, Russia and Taiwan;

- Philip Morris, mainly driven by Russia,

partly offset by Argentina, Italy and the Philippines;

- Dji Sam Soe in Indonesia, notably

reflecting the continued strong performance of its Magnum Mild 16s

variant launched in the second quarter of 2017; and

- Fortune in the Philippines, reflecting

the favorable impact of its narrowed retail price gap to

competitors' products.

The increase in PMI's heated tobacco unit shipment volume was

driven by all IQOS Regions, reflecting growth in: the EU, notably

Italy; EE, notably Russia and Ukraine; ME&A, notably PMI Duty

Free; and EA&A, notably Korea, partly offset by Japan, due to

net unfavorable estimated distributor inventory movements described

in the East Asia & Australia Region section below.

FINANCIAL SUMMARY

Third-Quarter

Financial Summary -Quarters Ended September 30,

ChangeFav./(Unfav.)

VarianceFav./(Unfav.) 2018 2017

Total Excl.Curr. Total

Cur-rency Price

Vol/Mix Cost/Other (in

millions) Net

Revenues $ 7,504 $ 7,473 0.4% 3.3%

31 (213) 483 (310) 71 Cost of

Sales (2,618) (2,735) 4.3% 3.1%

117 32 — 118 (33)

Marketing, Administration

andResearch Costs

(1,710) (1,629) (5.0)% (5.8)%

(81) 14 — — (95) Amortization

of Intangibles (20) (21) 4.8%

4.8% 1 — —

— 1 Operating Income $ 3,156

$ 3,088 2.2% 7.6% 68 (167)

483 (192) (56) Asset Impairment & Exit

Costs — — —% —% — — — — —

Adjusted Operating Income $ 3,156 $ 3,088

2.2% 7.6% 68 (167) 483

(192) (56)

Adjusted Operating

IncomeMargin

42.1% 41.3% 0.8pp 1.8pp

“Cost/Other” also includes the

currency-neutral net revenue variance, unrelated to volume/mix and

price components, attributable to fees forcertain distribution

rights billed to customers in certain markets in the ME&A

Region. This immaterial presentational change, made in

conjunctionwith the new revenue recognition standard, is

prospective only.

Net revenues, excluding unfavorable currency, increased by 3.3%,

primarily reflecting a favorable pricing variance, driven by all

Regions, and a favorable "cost/other" variance, as described above,

partly offset by unfavorable volume/mix due mainly to EA&A,

principally Japan, partly offset by the EU.

Operating income, excluding unfavorable currency, increased by

7.6%, reflecting: a favorable pricing variance and the favorable

margin impact of lower IQOS device sales, partly offset by

unfavorable volume/mix due mainly to EA&A, principally Japan,

partly offset by the EU. The favorable pricing variance was also

partly offset by higher costs, notably higher manufacturing and

marketing, administration and research costs, primarily related to

increased investment behind reduced-risk products across all

Regions, predominantly the EU.

Adjusted operating income margin, excluding currency, increased

by 1.8 points to 43.1%, reflecting the factors mentioned above, as

detailed in the attached Schedule 7.

Nine Months Year-to-Date

Financial Summary -Nine Months Ended September 30,

ChangeFav./(Unfav.)

VarianceFav./(Unfav.) 2018 2017

Total Excl.Curr. Total

Cur-rency Price

Vol/Mix Cost/Other (in

millions) Net

Revenues $ 22,126 $ 20,454 8.2%

6.5% 1,672 351 1,165 (6)

162 Cost of Sales (7,977) (7,431)

(7.3)% (4.6)% (546) (205) —

(340) (1)

Marketing, Administration

andResearch Costs

(5,411) (4,717) (14.7)% (11.5)%

(694) (150) — — (544)

Amortization of Intangibles (63) (65)

3.1% 3.1% 2 —

— — 2 Operating Income

$ 8,675 $ 8,241 5.3% 5.3% 434

(4) 1,165 (346) (381) Asset Impairment

& Exit Costs — — —% —% — — —

— —

Adjusted Operating Income $ 8,675 $

8,241 5.3% 5.3% 434 (4)

1,165 (346) (381)

Adjusted Operating

IncomeMargin

39.2% 40.3% (1.1)pp (0.4)pp

“Cost/Other” also includes the

currency-neutral net revenue variance, unrelated to volume/mix and

price components, attributable to fees forcertain distribution

rights billed to customers in certain markets in the ME&A

Region. This immaterial presentational change, made in

conjunctionwith the new revenue recognition standard, is

prospective only.

Net revenues, excluding favorable currency, increased by 6.5%,

primarily reflecting a favorable pricing variance, driven by EU,

EE, S&SA, EA&A and LA&C, and a favorable "cost/other"

variance as described above. Despite an unfavorable volume variance

in Japan and Saudi Arabia, volume/mix was essentially flat, notably

reflecting a favorable volume variance driven by heated tobacco

units.

Operating income, excluding unfavorable currency, increased by

5.3%, reflecting: a favorable pricing variance; partly offset by

unfavorable volume/mix, due mainly to lower mix in Indonesia, lower

volume in Japan, lower volume/mix in Russia and lower volume in

Saudi Arabia, partly offset by higher volume in Korea. The

favorable pricing variance was also partly offset by higher

marketing, administration and research costs, primarily related to

increased investment behind reduced-risk products, predominantly in

the EU and EA&A.

Adjusted operating income margin, excluding currency, decreased

by 0.4 points to 39.9%, reflecting the factors mentioned above, as

detailed in the attached Schedule 7.

NET REVENUES BY PRODUCT CATEGORY

PMI Net Revenues Third-Quarter

Nine Months Year-to-Date (in millions)

Excl. Excl. 2018

2017 Change Curr.

2018 2017 Change

Curr. Combustible Products European Union $ 2,225 $

2,139 4.0% 2.7% $ 6,381 $ 5,909 8.0% (0.6)% Eastern Europe 705 696

1.2% 7.2% 1,926 1,900 1.4% 2.5% Middle East & Africa 1,019

1,045 (2.5)% 6.8% 2,813 2,970 (5.3)% (2.4)% South & Southeast

Asia 1,197 1,129 6.0% 13.2% 3,434 3,206 7.1% 11.2% East Asia &

Australia 789 760 3.8% 4.4% 2,348 2,363 (0.6)% (2.4)% Latin America

& Canada 748 755 (1.0)% 2.3% 2,254

2,108 6.9% 9.8%

Total PMI $ 6,681 $

6,526 2.4% 5.8% $ 19,156 $ 18,457

3.8% 2.4% RRPs European Union $ 242 $

65 +100% +100% $ 577 $ 145 +100% +100% Eastern Europe 73 9 +100%

+100% 179 19 +100% +100% Middle East & Africa 124 31 +100%

+100% 313 45 +100% +100% South & Southeast Asia — — —% —% — —

—% —% East Asia & Australia 377 841 (55.1)% (56.4)% 1,887 1,786

5.7% 2.4% Latin America & Canada 5 1 +100%

+100% 14 2 +100% +100%

Total PMI $

823 $ 947 (13.2)% (14.2)% $ 2,970

$ 1,997 48.7% 43.6% Combustible

Products and RRPs European Union $ 2,467 $ 2,204 11.9% 10.6% $

6,958 $ 6,054 14.9% 5.8% Eastern Europe 778 705 10.4% 16.9% 2,105

1,918 9.7% 11.1% Middle East & Africa 1,143 1,078 6.0% 15.0%

3,126 3,017 3.6% 6.4% South & Southeast Asia 1,197 1,129 6.0%

13.2% 3,434 3,206 7.1% 11.2% East Asia & Australia 1,166 1,601

(27.2)% (27.5)% 4,235 4,149 2.1% (0.3)% Latin America & Canada

753 756 (0.4)% 2.9% 2,268 2,110

7.5% 10.4%

Total PMI $ 7,504 $ 7,473

0.4% 3.3% $ 22,126 $ 20,454 8.2%

6.5% Note: Sum of product categories or Regions might not

foot to total PMI due to rounding.

EUROPEAN UNION REGION

Third-Quarter

Financial Summary -Quarters Ended September 30,

ChangeFav./(Unfav.)

VarianceFav./(Unfav.) 2018 2017

Total Excl.Curr. Total

Cur-rency Price

Vol/Mix Cost/Other (in

millions) Net

Revenues $ 2,467 $ 2,204 11.9%

10.6% 263 30 77 156 —

Operating Income $ 1,179 $ 1,025

15.0% 13.2% 154 19 77 110

(52) Asset Impairment & Exit Costs — — —%

—% — — — — —

Adjusted Operating

Income $ 1,179 $ 1,025 15.0% 13.2%

154 19 77 110 (52)

Adjusted Operating

IncomeMargin

47.8% 46.5% 1.3pp 1.1pp

Net revenues, excluding favorable currency, increased by 10.6%,

reflecting: a favorable pricing variance, driven principally by

Germany and Italy, partly offset by France; and favorable

volume/mix, primarily reflecting favorable volume across the

Region, driven by heated tobacco unit volume, partly offset by

France.

Operating income, excluding favorable currency, increased by

13.2%, mainly reflecting: a favorable pricing variance; and

favorable volume/mix across the Region; partially offset by higher

manufacturing costs and marketing, administration and research

costs, primarily related to investments behind reduced-risk

products.

Adjusted operating income margin, excluding currency, increased

by 1.1 points to 47.6%, reflecting the factors mentioned above, as

detailed on Schedule 7.

Nine Months Year-to-Date

Financial Summary -Nine Months Ended September 30,

ChangeFav./(Unfav.)

VarianceFav./(Unfav.) 2018 2017

Total Excl.Curr. Total

Cur-rency Price

Vol/Mix Cost/Other (in

millions) Net

Revenues $ 6,958 $ 6,054 14.9% 5.8%

904 553 194 157 —

Operating Income $ 3,096 $ 2,717 13.9%

3.0% 379 298 194 62 (175)

Asset Impairment & Exit Costs — — —% —% —

— — — —

Adjusted Operating Income $

3,096 $ 2,717 13.9% 3.0% 379

298 194 62 (175)

Adjusted Operating

IncomeMargin

44.5% 44.9% (0.4)pp (1.2)pp

Net revenues, excluding favorable currency, increased by 5.8%,

reflecting a favorable pricing variance, driven principally by

Germany and Italy, partly offset by France, and favorable

volume/mix, notably Bulgaria, the Czech Republic, Italy and Poland,

driven by heated tobacco unit volume, partly offset by unfavorable

volume in France.

Operating income, excluding favorable currency, increased by

3.0%, mainly due to: a favorable pricing variance; favorable

volume/mix, notably in Bulgaria, the Czech Republic and Poland,

driven by heated tobacco unit volume, partly offset by France and

Germany; partly offset by higher manufacturing costs and marketing,

administration and research costs, primarily related to investments

behind reduced-risk products.

Adjusted operating income margin, excluding currency, decreased

by 1.2 points to 43.7%, reflecting the factors mentioned above, as

detailed on Schedule 7.

Total Market, PMI Shipment & Market Share

Commentaries

European Union Key Data Third-Quarter

Nine Months Year-to-Date Change

Change 2018 2017

% / pp 2018 2017 % / pp

Total Market (billion units) 131.3 131.7 (0.3)% 365.3 372.7

(2.0)%

PMI Shipment Volume (million units) Cigarettes

48,223 49,114 (1.8)% 135,878 141,412 (3.9)% Heated Tobacco Units

1,730 464 +100.0% 3,853 1,040 +100.0%

Total EU 49,953 49,578 0.8%

139,731 142,452 (1.9)% PMI Market

Share Marlboro 18.5% 18.7% (0.2) 18.4% 18.7% (0.3) L&M 7.0%

6.8% 0.2 6.9% 6.9% — Chesterfield 5.9% 6.1% (0.2) 5.9% 6.0% (0.1)

Philip Morris 2.9% 3.0% (0.1) 3.0% 3.1% (0.1) HEETS 1.2% 0.3% 0.9

1.0% 0.2% 0.8 Others 3.0% 3.2% (0.2) 3.2% 3.2%

—

Total EU 38.5% 38.1% 0.4

38.4% 38.1% 0.3

Third-Quarter

The estimated total market in the EU decreased by 0.3% to 131.3

billion units, or by 1.0% excluding the net impact of favorable

estimated trade inventory movements, mainly due to:

- France, down by 8.6%, primarily

reflecting the impact of significant excise-tax driven price

increases in November 2017 and March 2018, and an increase in the

prevalence of illicit trade; and

- Italy, down by 2.4%, primarily

reflecting the impact of retail price increases in March 2018;

partly offset by

- Poland, up by 6.5%, partly reflecting a

favorable comparison with the third quarter of 2017 which decreased

by 2.9%.

PMI's total shipment volume increased by 0.8% to 50.0 billion

units, notably driven by:

- Germany, up by 2.8%, primarily driven

by higher market share, notably of Marlboro, and higher heated

tobacco unit shipment volume; and

- Poland, up by 7.4%, primarily

reflecting the higher total market;

partly offset by

- France, down by 6.7%, primarily due to

a lower total market, partly offset by higher market share

primarily driven by Marlboro, benefiting from its narrowed price

gap with competitors' alternatives following its positioning to the

round price of €8.00/pack as of March 2018, and the positive

momentum of Philip Morris initiated with its price repositioning in

November 2017 and extended with its XXL line variant in March 2018;

and

- Italy, down by 3.8%, reflecting the

lower total market and lower cigarette market share, partly offset

by higher heated tobacco unit shipment volume.

PMI's total market share increased by 0.4 points to 38.5%, with

gains notably in Belgium, Bulgaria, Croatia, France, Germany,

Greece, Hungary, the Netherlands, Poland, Portugal, the Slovak

Republic and Sweden, partly offset by declines in the Czech

Republic, Denmark, Italy, Romania, Spain, Switzerland and the

United Kingdom.

Nine Months Year-to-Date

The estimated total market in the EU decreased by 2.0% to 365.3

billion units, notably due to:

- France, down by 10.1%, reflecting the

same factors as in the quarter;

- Germany, down by 2.6%, primarily

reflecting the impact of price increases in 2017 and in March

2018;

- Italy, down by 2.1%, reflecting the

same factor as in the quarter; and

- the United Kingdom, down by 5.7%,

primarily reflecting the impact of price increases.

partly offset by

- Poland, up by 2.7%, primarily

reflecting a decrease in the prevalence of illicit trade.

PMI's total shipment volume decreased by 1.9% to 139.7 billion

units, or by 1.4% excluding the net impact of unfavorable estimated

distributor inventory movements, notably due to:

- France, down by 6.7%, primarily

reflecting the same factors as in the quarter;

- Germany, down by 2.2%, primarily due to

the lower total market, partly offset by higher market share;

and

- Italy, down by 4.1%, or by 2.6%

excluding unfavorable estimated distributor inventory movements

associated with the timing of price increases in March 2018, partly

offset by higher heated tobacco unit shipment volume.

PMI's total market share increased by 0.3 points to 38.4%, with

gains notably in Belgium, Bulgaria, Croatia, Denmark, France,

Germany, Greece, Hungary, the Netherlands, Portugal, Romania, the

Slovak Republic, partly offset by declines in Austria, the Czech

Republic, Italy, Poland, Spain, Sweden, Switzerland and the United

Kingdom.

EASTERN EUROPE REGION

Third-Quarter

Financial Summary -Quarters Ended September 30,

ChangeFav./(Unfav.)

VarianceFav./(Unfav.) 2018 2017

Total Excl.Curr. Total

Cur-rency Price

Vol/Mix Cost/Other (in

millions) Net

Revenues $ 778 $ 705 10.4% 16.9%

73 (46) 91 28 —

Operating Income $ 270 $ 244 10.7%

33.6% 26 (56) 91 (10) 1

Asset Impairment & Exit Costs — — —% —% —

— — — —

Adjusted Operating Income $

270 $ 244 10.7% 33.6% 26

(56) 91 (10) 1

Adjusted Operating

IncomeMargin

34.7% 34.6% 0.1pp 5.0pp

Net revenues, excluding unfavorable currency, increased by

16.9%, reflecting a favorable pricing variance, mainly driven by

Russia and Ukraine, and favorable volume/mix, primarily due to

Russia and Ukraine driven by heated tobacco units.

Operating income, excluding unfavorable currency, increased by

33.6%, mainly reflecting a favorable pricing variance, partly

offset by unfavorable volume/mix, predominantly due to unfavorable

mix in Russia.

Adjusted operating income margin, excluding currency, increased

by 5.0 points to 39.6%, reflecting the factors mentioned above, as

detailed on Schedule 7.

Nine Months Year-to-Date

Financial Summary -Nine Months Ended September 30,

ChangeFav./(Unfav.)

VarianceFav./(Unfav.) 2018 2017

Total Excl.Curr. Total

Cur-rency Price

Vol/Mix Cost/Other (in

millions) Net

Revenues $ 2,105 $ 1,918 9.7% 11.1%

187 (26) 243 (30) —

Operating Income $ 682 $ 627 8.8%

19.8% 55 (69) 243 (98)

(21) Asset Impairment & Exit Costs — — —%

—% — — — — —

Adjusted Operating

Income $ 682 $ 627 8.8% 19.8%

55 (69) 243 (98) (21)

Adjusted Operating

IncomeMargin

32.4% 32.7% (0.3)pp 2.5pp

Net revenues, excluding unfavorable currency, increased by

11.1%, reflecting a favorable pricing variance, mainly driven by

Russia and Ukraine, partly offset by unfavorable volume/mix,

primarily due to Russia.

Operating income, excluding unfavorable currency, increased by

19.8%, mainly reflecting: a favorable pricing variance and lower

manufacturing costs; partly offset by unfavorable volume/mix,

predominantly due to Russia, and higher marketing, administration

and research costs notably reflecting increased investments behind

reduced-risk products in Russia.

Adjusted operating income margin, excluding currency, increased

by 2.5 points to 35.2%, reflecting the factors mentioned above, as

detailed on Schedule 7.

Total Market, PMI Shipment & Market Share

Commentaries

PMI Shipment Volume

Third-Quarter Nine Months Year-to-Date

(million units) 2018 2017

Change 2018 2017 Change

Cigarettes 29,801 31,749 (6.1)% 80,294 88,426

(9.2)% Heated Tobacco Units 1,152 180 +100.0%

2,667 351 +100.0%

Total Eastern Europe

30,953 31,929 (3.1)% 82,961

88,777 (6.6)%

Third-Quarter

The estimated total market in Eastern Europe decreased, notably

due to:

- Russia, down by 7.8%, primarily

reflecting the timing and impact of excise tax-driven retail price

increases, as well as an increase in the prevalence of illicit

trade; and

- Ukraine, down by 9.4%, primarily

reflecting the timing and impact of excise-tax driven retail price

increases and an increase in the prevalence of illicit trade.

PMI's total shipment volume decreased by 3.1% to 31.0 billion

units, or by 5.1% excluding the net favorable impact of estimated

distributor inventory movements, notably in:

- Russia, down by 3.0%, or by 5.3%

excluding the net favorable impact of estimated distributor

inventory movements, mainly due to the lower total market; lower

cigarette market share, as measured by Nielsen, largely due to

mid-price L&M , and low price Bond Street and Next, reflecting

the impact of down-trading to competitive products, partly offset

by Philip Morris; partially offset by higher heated tobacco unit

shipment volume;

- Kazakhstan, down by 9.2%, mainly due to

the lower total market, partly offset by higher market share;

and

- Ukraine, down by 3.7%, mainly due to

the lower total market, partly offset by higher heated tobacco unit

shipment volume.

Nine Months Year-to-Date

The estimated total market in Eastern Europe decreased, notably

due to:

- Russia, down by 8.6%, mainly reflecting

the same factors as in the quarter; and

- Ukraine, down by 8.2%, mainly

reflecting the same factors as in the quarter.

PMI's total shipment volume decreased by 6.6% to 83.0 billion

units, notably in:

- Russia, down by 8.8%, mainly due to the

same factors as in the quarter; and

- Ukraine, down by 8.3%, mainly due to

the same factors as in the quarter.

MIDDLE EAST & AFRICA REGION

Third-Quarter

Financial Summary -Quarters Ended September 30,

ChangeFav./(Unfav.)

VarianceFav./(Unfav.) 2018 2017

Total Excl.Curr. Total

Cur-rency Price

Vol/Mix Cost/Other (in

millions) Net

Revenues $ 1,143 $ 1,078 6.0% 15.0%

65 (97) 19 72 71

Operating Income $ 491 $ 495 (0.8)%

18.8% (4) (97) 19 59 15

Asset Impairment & Exit Costs — — —% —% —

— — — —

Adjusted Operating Income $

491 $ 495 (0.8)% 18.8% (4)

(97) 19 59 15

Adjusted Operating

IncomeMargin

43.0% 45.9% (2.9)pp 1.5pp

“Cost/Other” also includes the

currency-neutral net revenue variance, unrelated to volume/mix and

price components, attributable to fees forcertain distribution

rights billed to customers in certain markets in the ME&A

Region. This immaterial presentational change, made in

conjunctionwith the new revenue recognition standard, is

prospective only.

Net revenues, excluding unfavorable currency, increased by

15.0%, reflecting: a favorable pricing variance, mainly driven by

Egypt and Turkey; favorable volume/mix, principally driven by

favorable volume in the GCC, notably Saudi Arabia, as well as PMI

Duty Free and Turkey, partly offset by Egypt; and a favorable

"cost/other" variance, as described above.

Operating income, excluding unfavorable currency, increased by

18.8%, mainly reflecting a favorable pricing variance; favorable

volume/mix, principally driven by favorable volume in the GCC,

notably Saudi Arabia, as well as PMI Duty Free and Turkey; and

lower marketing, administration and research costs primarily

related to the favorable "cost/other" variance.

Adjusted operating income margin, excluding currency, increased

by 1.5 points to 47.4%, reflecting the factors mentioned above, as

detailed on Schedule 7.

Nine Months Year-to-Date

Financial Summary -Nine Months Ended September 30,

ChangeFav./(Unfav.)

VarianceFav./(Unfav.) 2018 2017

Total Excl.Curr. Total

Cur-rency Price

Vol/Mix Cost/Other (in

millions) Net

Revenues $ 3,126 $ 3,017 3.6% 6.4%

109 (83) (32) 62 162

Operating Income $ 1,268 $ 1,463

(13.3)% (3.6)% (195) (143) (32)

9 (29) Asset Impairment & Exit Costs — —

—% —% — — — — —

Adjusted

Operating Income $ 1,268 $ 1,463 (13.3)%

(3.6)% (195) (143) (32) 9

(29)

Adjusted Operating

IncomeMargin

40.6% 48.5% (7.9)pp (4.5)pp

“Cost/Other” also includes the

currency-neutral net revenue variance, unrelated to volume/mix and

price components, attributable to fees forcertain distribution

rights billed to customers in certain markets in the ME&A

Region. This immaterial presentational change, made in

conjunctionwith the new revenue recognition standard, is

prospective only.

Net revenues, excluding unfavorable currency, increased by 6.4%,

reflecting: a favorable "cost/other" variance, as described above;

favorable volume/mix, primarily driven by favorable volume in PMI

Duty Free and Turkey, partly offset by the GCC, notably Saudi

Arabia; partly offset by an unfavorable pricing variance, due

mainly to Saudi Arabia, partly offset by Egypt.

Operating income, excluding unfavorable currency, decreased by

3.6%, mainly reflecting: an unfavorable pricing variance, and

higher manufacturing costs, partly due to PMI Duty Free relating to

reduced-risk products. The unfavorable pricing and higher

manufacturing costs were partly offset by favorable volume/mix,

primarily driven by favorable volume in PMI Duty Free and Turkey,

partly offset by Saudi Arabia.

Adjusted operating income margin, excluding currency, decreased

by 4.5 points to 44.0%, reflecting the factors mentioned above, as

detailed on Schedule 7.

Total Market, PMI Shipment & Market Share

Commentaries

PMI Shipment Volume Third-Quarter

Nine Months Year-to-Date (million units)

2018 2017 Change 2018

2017 Change Cigarettes 37,406

37,088 0.9% 100,831 101,399 (0.6)% Heated

Tobacco Units 1,152 247 +100.0% 2,832 410

+100.0%

Total Middle East & Africa 38,558

37,335 3.3% 103,663 101,809 1.8%

Third-Quarter

The estimated total market in the Middle East & Africa

increased, notably driven by:

- Turkey, up by 11.3%, notably reflecting

a reduction in the prevalence of illicit trade;

partly offset by

- North Africa, down by 4.4%, mainly due

to Egypt reflecting the impact of retail price increases in

November 2017 and July 2018.

PMI's total shipment volume increased by 3.3% to 38.6 billion

units, notably in:

- the GCC, notably: Saudi Arabia, up by

18.5%, reflecting higher market share;

- Turkey, up by 12.3%, reflecting a

higher total market; and

- PMI Duty Free, up by 4.4%, reflecting

higher heated tobacco unit shipment volume;

partly offset by

- Egypt, down by 16.6%, reflecting a

lower total market and lower market share.

Nine Months Year-to-Date

The estimated total market in the Middle East & Africa

increased, notably due to:

- Turkey, up by 13.1%, primarily

reflecting the same factor as in the quarter;

partly offset by

- North Africa, notably: Algeria, down by

5.2%, or by 1.4% excluding the unfavorable impact of trade

inventory movements; and

- Saudi Arabia and the UAE, down by 24.5%

and 30.4%, respectively, primarily reflecting the impact of price

increases and the introduction of the new excise tax in 2017, and

VAT in January 2018.

PMI's total shipment volume increased by 1.8% to 103.7 billion

units, notably in:

- Turkey, up by 13.2%, reflecting a

higher total market; and

- PMI Duty Free, up by 15.0%, mainly

reflecting higher heated tobacco shipment volume;

partly offset by

- the GCC, notably: Saudi Arabia, down by

42.8%, and the UAE, down by 64.2%, reflecting the lower total

market and market share due to the impact of excise tax and

VAT-driven price increases.

SOUTH & SOUTHEAST ASIA REGION

Third-Quarter

Financial Summary -Quarters Ended September 30,

ChangeFav./(Unfav.)

VarianceFav./(Unfav.) 2018 2017

Total Excl.Curr. Total

Cur-rency Price

Vol/Mix Cost/Other (in

millions) Net

Revenues $ 1,197 $ 1,129 6.0% 13.2%

68 (81) 150 (1) —

Operating Income $ 455 $ 411 10.7%

21.2% 44 (43) 150 (18)

(45) Asset Impairment & Exit Costs — — —%

—% — — — — —

Adjusted Operating

Income $ 455 $ 411 10.7% 21.2%

44 (43) 150 (18) (45)

Adjusted Operating

IncomeMargin

38.0% 36.4% 1.6pp 2.6pp

Net revenues, excluding unfavorable currency, increased by

13.2%, reflecting: a favorable pricing variance, driven principally

by Indonesia and the Philippines, partly offset by Thailand.

Essentially flat volume/mix largely reflected unfavorable mix in

Indonesia and Thailand offset by favorable volume in Thailand.

Operating income, excluding unfavorable currency, increased by

21.2%, mainly reflecting: a favorable pricing variance; partly

offset by unfavorable volume/mix, mainly due to Indonesia, partly

offset by Thailand, and higher manufacturing costs and marketing,

administration and research costs, partly due to Indonesia and

Thailand.

Adjusted operating income margin, excluding currency, increased

by 2.6 points to 39.0%, reflecting the factors mentioned above, as

detailed on Schedule 7.

Nine Months Year-to-Date

Financial Summary -Nine Months Ended September 30,

ChangeFav./(Unfav.)

VarianceFav./(Unfav.) 2018 2017

Total Excl.Curr. Total

Cur-rency Price

Vol/Mix Cost/Other (in

millions) Net

Revenues $ 3,434 $ 3,206 7.1% 11.2%

228 (130) 401 (43) —

Operating Income $ 1,324 $ 1,100 20.4%

27.1% 224 (74) 401 (90)

(13) Asset Impairment & Exit Costs — — —%

—% — — — — —

Adjusted Operating

Income $ 1,324 $ 1,100 20.4% 27.1%

224 (74) 401 (90) (13)

Adjusted Operating

IncomeMargin

38.6% 34.3% 4.3pp 4.9pp

Net revenues, excluding unfavorable currency, increased by

11.2%, reflecting: a favorable pricing variance, driven principally

by Indonesia and the Philippines, partly offset by Thailand; partly

offset by unfavorable volume/mix, mainly due to unfavorable mix in

Indonesia and Thailand, partly offset by favorable volume in

Pakistan and Thailand.

Operating income, excluding unfavorable currency, increased by

27.1%, mainly driven by a favorable pricing variance, partly offset

by unfavorable volume/mix, mainly due to Indonesia, partly offset

by Pakistan and Thailand.

Adjusted operating income margin, excluding currency, increased

by 4.9 points to 39.2%, reflecting the factors mentioned above, as

detailed on Schedule 7.

Total Market, PMI Shipment & Market Share

Commentaries

PMI Shipment Volume Third-Quarter

Nine Months Year-to-Date (million units)

2018 2017 Change 2018

2017 Change Cigarettes 45,840

44,731 2.5% 130,846 124,655 5.0% Heated

Tobacco Units — — —% — — —%

Total

South & Southeast Asia 45,840 44,731

2.5% 130,846 124,655 5.0%

Third-Quarter

The estimated total market in South & Southeast Asia

increased, notably driven by:

- Indonesia, up by 1.4%, reflecting

slightly improved macro-economics; and

- Pakistan, up by 6.1% or approximately

0.8 billion units, reflecting an increase in the duty-paid market

driven by a lower prevalence of illicit trade, as well as the

timing impact of estimated trade inventory movements related to

excise tax changes in 2017 and 2018. Excluding the net impact of

favorable estimated trade inventory movements, the total market was

up by 5.6%;

partly offset by

- the Philippines, down by 1.4%,

reflecting the impact of excise tax-driven retail price increases;

and

- Thailand, down by 9.0%, primarily

reflecting the impact of excise tax-driven price increases.

PMI's total shipment volume increased by 2.5% to 45.8 billion

units, mainly driven by:

- Indonesia, up by 1.2%, mainly

reflecting the higher total market; and

- Thailand, up by 85.7%, mainly

reflecting higher market share driven by the price repositioning of

the L&M 7.1 variant in the third quarter of 2017 and its

subsequent distribution expansion during 2018;

partly offset by

- Pakistan, down by 11.2%, mainly

reflecting lower market share, disproportionately impacted by the

estimated trade inventory movements mentioned above, partly offset

by a higher total market.

Nine Months Year-to-Date

The estimated total market in South & Southeast Asia

increased, notably driven by:

- Pakistan, up by 43.8% or approximately

13.4 billion units, notably reflecting an increase in the duty-paid

market driven by a reduction in the prevalence of illicit trade

resulting from excise tax reform in May 2017. Excluding the net

impact of favorable estimated trade inventory movements, as

mentioned above, the total market was up by 23.2%;

partly offset by

- Indonesia, down by 0.5%, primarily

reflecting soft consumer spending in the first half of 2018 and

above inflation excise tax-driven retail price increases;

- the Philippines, down by 3.0%,

primarily reflecting the same factor as in the quarter; and

- Thailand, down by 9.8%, primarily

reflecting the same factor as in the quarter.

PMI's total shipment volume increased by 5.0% to 130.8 billion

units, notably driven by:

- Pakistan, up by 43.4%, reflecting the

higher total market;

- the Philippines, up by 1.1%, mainly

reflecting higher market share, partly offset by a lower total

market; and

- Thailand, up by 64.2%, mainly

reflecting the same factors as in the quarter.

EAST ASIA & AUSTRALIA REGION

Third-Quarter

Financial Summary -Quarters Ended September 30,

ChangeFav./(Unfav.)

VarianceFav./(Unfav.) 2018 2017

Total Excl.Curr. Total

Cur-rency Price

Vol/Mix Cost/Other (in

millions) Net

Revenues $ 1,166 $ 1,601 (27.2)%

(27.5)% (435) 6 86 (527)

— Operating Income $ 426 $ 648

(34.3)% (33.3)% (222) (6) 86

(307) 5 Asset Impairment & Exit Costs — —

—% —% — — — — —

Adjusted

Operating Income $ 426 $ 648 (34.3)%

(33.3)% (222) (6) 86 (307)

5

Adjusted Operating

IncomeMargin

36.5% 40.5% (4.0)pp (3.3)pp

Net revenues, excluding favorable currency, decreased by 27.5%,

reflecting: an unfavorable volume/mix, primarily due to heated

tobacco unit volume in Japan resulting from the adjustment of

estimated distributor inventories described below, partly offset by

favorable heated tobacco unit volume in Korea. The unfavorable

volume/mix was partly offset by a favorable pricing variance.

Operating income, excluding unfavorable currency, decreased by

33.3%, mainly reflecting: unfavorable volume/mix, primarily due to

heated tobacco unit volume in Japan resulting from the adjustment

of estimated distributor inventories described below, partly offset

by favorable heated tobacco unit volume in Korea; and higher

marketing, administration and research costs, notably in Japan. The

unfavorable volume/mix and higher marketing, administration and

research costs were partly offset by a favorable pricing variance

and favorable manufacturing costs related to Japan.

Adjusted operating income margin, excluding currency, decreased

by 3.3 points to 37.2%, reflecting the factors mentioned above, as

detailed on Schedule 7.

Nine Months Year-to-Date

Financial Summary -Nine Months Ended September 30,

ChangeFav./(Unfav.)

VarianceFav./(Unfav.) 2018 2017

Total Excl.Curr. Total

Cur-rency Price

Vol/Mix Cost/Other (in

millions) Net

Revenues $ 4,235 $ 4,149 2.1%

(0.3)% 86 99 65 (78) —

Operating Income $ 1,439 $ 1,630

(11.7)% (12.0)% (191) 5 65

(162) (99) Asset Impairment & Exit Costs —

— —% —% — — — — —

Adjusted

Operating Income $ 1,439 $ 1,630 (11.7)%

(12.0)% (191) 5 65 (162)

(99)

Adjusted Operating

IncomeMargin

34.0% 39.3% (5.3)pp (4.6)pp

Net revenues, excluding favorable currency, decreased by 0.3%,

reflecting an unfavorable volume/mix, due to unfavorable volume in

Australia and Japan, partly offset by favorable heated tobacco unit

volume and IQOS device sales in Korea. The unfavorable volume/mix

was partly offset by a favorable pricing variance.

Operating income, excluding favorable currency, decreased by

12.0%, mainly reflecting: unfavorable volume/mix, mainly due to

unfavorable volume in Australia and Japan, partly offset by

favorable heated tobacco unit volume and IQOS device sales in

Korea; and higher marketing, administration and research costs,

primarily related to investments behind reduced-risk products;

partly offset by a favorable pricing variance, as well as favorable

manufacturing costs related to Japan.

Adjusted operating income margin, excluding currency, decreased

by 4.6 points to 34.7%, reflecting the factors mentioned above, as

detailed on Schedule 7.

Total Market, PMI Shipment & Market Share

Commentaries

PMI Shipment Volume Third-Quarter

Nine Months Year-to-Date (million units)

2018 2017 Change 2018

2017 Change Cigarettes 14,186

15,331 (7.5)% 43,391 48,364 (10.3)% Heated

Tobacco Units 4,575 8,826 (48.2)% 19,755

18,697 5.7%

Total East Asia & Australia

18,761 24,157 (22.3)% 63,146

67,061 (5.8)%

Third-Quarter

The estimated total market in East Asia & Australia

increased, notably driven by:

- Japan, up by 10.1%, primarily

reflecting the favorable impact of estimated trade and consumer

inventory movements ahead of the October 1, 2018 excise tax-driven

retail price increases. Excluding these inventory movements, the

estimated total market decreased by 2.1%; and

- Taiwan, up by +100%, primarily

reflecting a favorable comparison with the third quarter of 2017

that was impacted by the reversal of estimated trade inventory

movements following the excise tax-driven retail price increases in

June 2017. Excluding these inventory movements, the total estimated

market decreased by 11.6%, primarily reflecting the impact of the

retail price increases;

partly offset by

- Korea, down by 5.8%, primarily

reflecting an unfavorable comparison with the third quarter of 2017

that benefited from estimated trade inventory movements ahead of

public holidays in the fourth quarter of 2017. Excluding these

inventory movements, the estimated total market decreased by

2.4%.

PMI's total shipment volume decreased by 22.3% to 18.8 billion

units, reflecting lower cigarette shipment volume, notably in Japan

and Korea, and lower heated tobacco unit shipment volume in Japan,

partly offset by higher cigarette shipment volume in Taiwan, as

well as higher heated tobacco unit shipment volume in Korea.

Excluding the net unfavorable impact of an estimated 7.4 billion

units of total distributor inventory movements, primarily related

to heated tobacco units in Japan, PMI's total shipment volume

increased by 9.1%.

PMI's total shipment volume in Japan was down by 35.4%.

Excluding the impact of estimated distributor inventory movements,

PMI's total shipment volume in Japan was up by 11.0%, reflecting an

increase of heated tobacco unit shipment volume of 42.5%, partly

offset by a decline of cigarette shipment volume of 6.7%.

The net unfavorable estimated distributor inventory movements in

Japan primarily reflected the impact of higher heated tobacco unit

inventory movements in the third quarter of 2017 of approximately

3.1 billion units and lower heated tobacco unit inventory movements

in the third quarter of 2018 of approximately 4.3 billion

units.

Nine Months Year-to-Date

The estimated total market in East Asia & Australia

decreased, notably due to:

- Australia, down by 6.2%, primarily

reflecting the impact of excise tax-driven retail price increases

in 2017 and the first quarter of 2018;

- Korea, down by 3.3%, or by 2.3%

excluding the impact of the estimated trade inventory movements

mentioned above; and

- Taiwan, down by 23.3%, or by 16.7%

excluding the impact of the estimated trade inventory movements

mentioned above, primarily reflecting the impact of excise

tax-driven retail price increases in June 2017;

partly offset by

- Japan, up by 2.1%, or down by 2.1%

excluding the impact of the estimated trade and consumer inventory

movements mentioned above.

PMI's total shipment volume decreased by 5.8% to 63.1 billion

units, reflecting lower cigarette shipment volume, principally in

Japan and Korea, and lower heated tobacco unit shipment volume in

Japan, partly offset by higher heated tobacco unit shipment volume

in Korea.

Excluding the net unfavorable impact of an estimated 9.2 billion

units of total distributor inventory movements, primarily in Japan,

reflecting net unfavorable heated tobacco unit inventory movements

of approximately 10.3 billion units, partly offset by net favorable

cigarette inventory movements of approximately 1.1 billion units,

PMI's total shipment volume increased by 8.4%.

PMI's total shipment volume in Japan was down by 11.9%.

Excluding the impact of estimated distributor inventory movements,

PMI's total shipment volume in Japan was up by 9.6%, reflecting an

increase of heated tobacco unit shipment volume of 63.1%, partly

offset by a decline of cigarette shipment volume of 14.0%.

The net unfavorable estimated distributor inventory movements in

Japan of approximately 9.3 billion units, primarily reflecting

higher heated tobacco unit inventory movements year-to-date 2017 of

approximately 5.7 billion units, lower cigarette inventory

movements year-to-date 2017 of approximately 1.0 billion units, and

lower heated tobacco unit inventory movements year-to-date 2018 of

approximately 4.6 billion units.

LATIN AMERICA & CANADA REGION

Third-Quarter

Financial Summary -Quarters Ended September 30,

ChangeFav./(Unfav.)

VarianceFav./(Unfav.) 2018 2017

Total Excl.Curr. Total

Cur-rency Price

Vol/Mix Cost/Other (in

millions) Net

Revenues $ 753 $ 756 (0.4)% 2.9%

(3) (25) 60 (38) —

Operating Income $ 335 $ 265 26.4%

20.4% 70 16 60 (26) 20

Asset Impairment & Exit Costs — — —% —% —

— — — —

Adjusted Operating Income $

335 $ 265 26.4% 20.4% 70 16

60 (26) 20

Adjusted Operating

IncomeMargin

44.5% 35.1% 9.4pp 5.9pp

Net revenues, excluding unfavorable currency, increased by 2.9%,

reflecting: a favorable pricing variance, notably in Canada and

Mexico, partly offset by Argentina, partially reflecting the

adoption of highly inflationary accounting; partly offset by

unfavorable volume/mix, mainly due to unfavorable volume in

Argentina and Canada, partly offset by favorable volume in Mexico

reflecting a favorable comparison with the third quarter of

2017.

Operating income, excluding favorable currency, increased by

20.4%, reflecting: a favorable pricing variance; and favorable

costs, mainly reflecting lower manufacturing costs in Argentina,

partially reflecting the adoption of highly inflationary

accounting, and Mexico; partly offset by unfavorable volume/mix,

mainly in Argentina and Canada, partly offset by Mexico.

Adjusted operating income margin, excluding currency, increased

by 5.9 points to 41.0%, principally driven by the factors mentioned

above, as detailed on Schedule 7.

Nine Months Year-to-Date

Financial Summary -Nine Months Ended September 30,

ChangeFav./(Unfav.)

VarianceFav./(Unfav.) 2018 2017

Total Excl.Curr. Total

Cur-rency Price

Vol/Mix Cost/Other (in

millions) Net

Revenues $ 2,268 $ 2,110 7.5% 10.4%

158 (62) 294 (74) —

Operating Income $ 866 $ 704 23.0%

26.0% 162 (21) 294 (67)

(44) Asset Impairment & Exit Costs — — —%

—% — — — — —

Adjusted Operating

Income $ 866 $ 704 23.0% 26.0%

162 (21) 294 (67) (44)

Adjusted Operating

IncomeMargin

38.2% 33.4% 4.8pp 4.7pp

Net revenues, excluding unfavorable currency, increased by

10.4%, reflecting a favorable pricing variance across the Region,

notably in Argentina, Canada and Mexico, partly offset by

unfavorable volume/mix, mainly due to unfavorable volume in

Argentina and Canada.

Operating income, excluding unfavorable currency, increased by

26.0%, largely reflecting a favorable pricing variance, partly

offset by: unfavorable volume/mix, mainly in Argentina and Canada,

as well as higher manufacturing and marketing, administration and

research costs, primarily related to increased investment behind

reduced-risk products in the Region, coupled with an unfavorable

comparison to 2017 related to the sale of assets, primarily in the

Dominican Republic.

Adjusted operating income margin, excluding currency, increased

by 4.7 points to 38.1%, principally driven by the factors mentioned

above, as detailed on Schedule 7.

Total Market, PMI Shipment & Market Share

Commentaries

PMI Shipment Volume Third-Quarter

Nine Months Year-to-Date (million units)

2018 2017 Change 2018

2017 Change Cigarettes 19,612

20,452 (4.1)% 58,829 61,301 (4.0)% Heated

Tobacco Units 43 8 +100.0% 98 12

+100.0%

Total Latin America & Canada 19,655

20,460 (3.9)% 58,927 61,313

(3.9)%

Third-Quarter

The estimated total market in Latin America & Canada

decreased, notably due to:

- Argentina, down by 8.5%, primarily

reflecting the impact of retail price increases in 2017 and 2018;

and

- Brazil, down by 12.5%, primarily

reflecting the impact of retail price increases in 2017 and August

2018;

partly offset by

- Mexico, up by 7.3%, or down by 0.6%

excluding estimated trade inventory movements related to the timing

of price increases in June 2018 compared to July of the prior

year.

PMI's total shipment volume decreased by 3.9% to 19.7 billion

units, mainly due to:

- Argentina, down by 9.2%, reflecting the

lower total market;

- Brazil, down by 7.0%, reflecting the

lower total market, partly offset by higher market share;

- Canada, down by 6.7%, reflecting the

lower total market; and

- Colombia, down by 15.9%, reflecting the

lower total market;

partly offset by

- Mexico, up by 15.0%, reflecting the

favorable impact of the estimated trade inventory movements

described above.

Nine Months Year-to-Date

The estimated total market in Latin America & Canada

decreased, notably due to:

- Argentina, down by 3.9% , primarily

reflecting the same factor as in the quarter;

- Brazil, down by 9.7%, primarily

reflecting the same factor as in the quarter; and

- Colombia, down by 10.9%, primarily

reflecting the impact of excise tax-driven retail price

increases.

PMI's total shipment volume decreased by 3.9% to 58.9 billion

units, notably due to:

- Argentina, down by 5.1%, reflecting the

lower total market and lower market share;

- Canada, down by 2.9%, reflecting the

lower total market, partly offset by higher market share; and

- Colombia, down by 7.7%, reflecting the

lower total market.

Philip Morris International: Building a Smoke-Free

Future

Philip Morris International (PMI) is leading a transformation in

the tobacco industry to create a smoke-free future and ultimately

replace cigarettes to the benefit of adults who would otherwise

continue to smoke, society, the company and its shareholders. PMI

is a leading international tobacco company engaged in the

manufacture and sale of cigarettes, smoke-free products and

associated electronic devices and accessories, and other

nicotine-containing products in markets outside the U.S. PMI is

building a future on a new category of smoke-free products that,

while not risk-free, are a much better choice than continuing to

smoke. Through multidisciplinary capabilities in product

development, state-of-the-art facilities and scientific

substantiation, PMI aims to ensure that its smoke-free products

meet adult consumer preferences and rigorous regulatory

requirements. PMI's smoke-free IQOS product portfolio includes

heated tobacco and nicotine-containing vapor products. As of

September 30, 2018, PMI estimates that approximately 5.9 million

adult smokers around the world have already stopped smoking and

switched to PMI’s heated tobacco product, which is currently

available for sale in 43 markets in key cities or nationwide under

the IQOS brand. For more information, please visit www.pmi.com and www.pmiscience.com.

Forward-Looking and Cautionary Statements

This press release contains projections of future results and

other forward-looking statements. Achievement of future results is

subject to risks, uncertainties and inaccurate assumptions. In the

event that risks or uncertainties materialize, or underlying

assumptions prove inaccurate, actual results could vary materially

from those contained in such forward-looking statements. Pursuant

to the “safe harbor” provisions of the Private Securities

Litigation Reform Act of 1995, PMI is identifying important factors

that, individually or in the aggregate, could cause actual results

and outcomes to differ materially from those contained in any

forward-looking statements made by PMI.

PMI's business risks include: excise tax increases and

discriminatory tax structures; increasing marketing and regulatory

restrictions that could reduce our competitiveness, eliminate our

ability to communicate with adult consumers, or ban certain of our

products; health concerns relating to the use of tobacco products

and exposure to environmental tobacco smoke; litigation related to

tobacco use; intense competition; the effects of global and

individual country economic, regulatory and political developments,

natural disasters and conflicts; changes in adult smoker behavior;

lost revenues as a result of counterfeiting, contraband and

cross-border purchases; governmental investigations; unfavorable

currency exchange rates and currency devaluations, and limitations

on the ability to repatriate funds; adverse changes in applicable

corporate tax laws; adverse changes in the cost and quality of

tobacco and other agricultural products and raw materials; and the

integrity of its information systems and effectiveness of its data

privacy policies. PMI's future profitability may also be adversely

affected should it be unsuccessful in its attempts to produce and

commercialize reduced-risk products or if regulation or taxation do

not differentiate between such products and cigarettes; if it is

unable to successfully introduce new products, promote brand

equity, enter new markets or improve its margins through increased

prices and productivity gains; if it is unable to expand its brand

portfolio internally or through acquisitions and the development of

strategic business relationships; or if it is unable to attract and

retain the best global talent. Future results are also subject to

the lower predictability of our reduced-risk product category's

performance.

PMI is further subject to other risks detailed from time to time

in its publicly filed documents, including the Form 10-Q for the

quarter ended June 30, 2018. PMI cautions that the foregoing list

of important factors is not a complete discussion of all potential

risks and uncertainties. PMI does not undertake to update any

forward-looking statement that it may make from time to time,

except in the normal course of its public disclosure

obligations.

Key Terms, Definitions and Explanatory Notes

General

- "PMI" refers to Philip Morris

International Inc. and its subsidiaries. Trademarks and service

marks that are the registered property of, or licensed by, the

subsidiaries of PMI, are italicized.

- Comparisons are made to the same

prior-year period unless otherwise stated.

- Unless otherwise stated, references to

total industry, total market, PMI shipment volume and PMI market

share performance reflect cigarettes and heated tobacco units.

- Key market data regarding total market

size, PMI shipments and market share can be found in Appendixes 1

and 2 provided with this press release.

- References to total international

market, defined as worldwide cigarette and heated tobacco unit

volume excluding the United States, total industry, total market

and market shares are PMI estimates for tax-paid products based on

the latest available data from a number of internal and external

sources and may, in defined instances, exclude the People's

Republic of China and/or PMI's duty free business.

- "OTP" is defined as "other tobacco

products," primarily roll-your-own and make-your-own cigarettes,

pipe tobacco, cigars and cigarillos, and does not include

reduced-risk products.

- "Combustible products" is the term PMI

uses to refer to cigarettes and OTP, combined.

- In-market sales, or "IMS," is defined

as sales to the retail channel, depending on the market and

distribution model.

- "Total shipment volume" is defined as

the combined total of cigarette shipment volume and heated tobacco

unit shipment volume.

- Effective January 1, 2018, PMI began

managing its business in six reporting segments as follows: the

European Union Region (EU); the Eastern Europe Region (EE); the

Middle East & Africa Region (ME&A), which includes PMI Duty

Free; the South & Southeast Asia Region (S&SA); the East

Asia & Australia Region (EA&A); and the Latin

America & Canada Region (LA&C).

- "North Africa" is defined as Algeria,

Egypt, Libya, Morocco and Tunisia.

- "The GCC" (Gulf Cooperation Council) is

defined as Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the

United Arab Emirates (UAE).

- [NEW] From time to time, PMI’s

shipment volumes are subject to the impact of distributor inventory

movements, and estimated total industry/market volumes are subject

to the impact of inventory movements in various trade channels that

include estimated trade inventory movements of PMI’s competitors

arising from market-specific factors that significantly distort

reported volume disclosures. Such factors may include changes to

the manufacturing supply chain, shipment methods, consumer demand,

timing of excise tax increases or other influences that may affect

the timing of sales to customers. In such instances, in addition to

reviewing PMI shipment volumes and certain estimated total