IBM's Drop in Revenue Drags Stock Lower

October 17 2018 - 11:46AM

Dow Jones News

By Jay Greene

Investors drove shares of International Business Machines Corp.

lower Wednesday after the company, just three quarters removed from

a a nearly six-year string of shrinking revenue, reported a drop in

its top line again.

Shares sank more than 7% in morning trading to $134.95, shaving

about 70 points off the Dow Jones Industrial Average. The drop

erased IBM's 2.8% gain Tuesday and then some, and that level would

be the stock's lowest close of the year. The stock is down more

than 11% year to date.

Shortly after the closing bell, IBM reported adjusted profit

that topped Wall Street's forecast. Its 2.1% slide in revenue from

a year ago, though, served as a reminder of the company's yearslong

struggle to ditch its legacy image as a computer maker and refocus

on fast-growing businesses such as cloud computing and services

driven by artificial intelligence.

For years, Chief Executive Ginni Rometty preached patience as

the company worked through its turnaround. IBM finally achieved

seemed to get there when in January it reported higher revenue for

the first time in 23 quarters and signaled more growth ahead.

Tuesday's report showed there is more work to be done. "Another

typical IBM quarter," Stifel Financial Corp. analyst David Grossman

wrote in a research note, with some good and some not-so-good

results. Revenue, he said, was in line with the company's flat

expectations, while services continued to improve and software was

weaker than expected.

Overall, IBM reported revenue fell to $18.76 billion, primarily

from declining sales in its Cognitive Solutions segment, which

includes services tied to its Watson supercomputer and artificial

intelligence. IBM finance chief James Kavanaugh in an interview

specifically pointed to an 8% drop in its transaction-processing

software business, which he expects will rebound in the current

quarter.

The report also showed IBM again got less than half its

quarterly revenue from a closely watched group it calls strategic

imperatives, which includes cloud computing, data analytics and

other faster-growing businesses. Three months ago, the company

reported that for the first time it generated more than half of its

revenue from strategic imperatives.

Three years ago, IBM said it expected those businesses to

generate $40 billion in revenue this year, a target Mr. Kavanaugh

said those businesses are on track to meet.

Wedbush analyst Moshe Katri said in a note Tuesday that IBM has

yet to show consistent growth in such strategic areas.

Profit fell 1.2% to $2.69 billion. Excluding some

acquisition-related and retirement-benefit charges, IBM posted

earnings of $3.42 a share. Analysts expected adjusted profit of

$3.40 a share.

Mr. Kavanaugh sought to dispel concerns on the company's Monday

call with analysts, citing IBM's expanding margins in its service

businesses as well as the long-term growth of its strategic

imperatives. IBM maintained its expectation that full-year profits

would hit at least $11.60 a share.

Despite the IBM stock drop, some investors aren't ready to bail

just because of a one-quarter setback.

The earnings report "doesn't change our position on IBM," said

Charles Robinson, founder and investment chief at Robinson Value

Management Ltd., which in June invested about 3% of its roughly $90

million equity portfolio in the company. "IBM is not going to light

the world on fire, it's not going to become the next Apple, but

they have solid businesses that are stable and improving."

Sarah E. Needleman contributed to this article.

(END) Dow Jones Newswires

October 17, 2018 11:31 ET (15:31 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

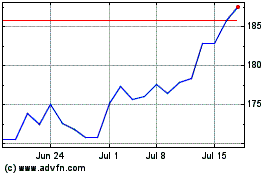

International Business M... (NYSE:IBM)

Historical Stock Chart

From Mar 2024 to Apr 2024

International Business M... (NYSE:IBM)

Historical Stock Chart

From Apr 2023 to Apr 2024