UnitedHealth Boosts Earnings Outlook -- WSJ

October 17 2018 - 3:02AM

Dow Jones News

By Anna Wilde Mathews and Kimberly Chin

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 17, 2018).

UnitedHealth Group Inc. raised its full-year earnings projection

for 2018 and offered reassurance about its early outlook for next

year, as the company pointed to growth drivers including the

continuing expansion of private Medicare plans.

UnitedHealth said Tuesday it expects to earn $12.80 a share on

an adjusted basis this year, compared with the range of $12.50 to

$12.75 a share it previously suggested.

UnitedHealth Chief Executive David Wichmann said on a conference

call with analysts and investors that for next year, analysts'

consensus projection "captures our 2019 outlook within a typically

sized range," and he said that longer term, the company expects its

performance to reflect its goal of 13% to 16% earnings growth.

"We have a lot of tailwinds, and they surpass our headwinds," he

said.

Analysts said in research notes that the 2019 consensus estimate

reflects earnings-per-share growth of around 13%.

UnitedHealth, the parent of the nation's largest health insurer

as well as Optum, its growing health-services arm, said net income

in the third quarter rose 28% from a year earlier to $3.19 billion,

or $3.24 a share.

UnitedHealth's adjusted profit, which excludes

acquisition-related intangible amortization and other items, rose

to $3.41 a share. Analysts polled by Refinitiv expected the company

to earn $3.29 a share on an adjusted basis.

Revenue rose 12% to $56.56 billion; analysts had expected $56.34

billion. Revenue from its UnitedHealthcare segment grew 13% while

sales from its Optum health-services arm grew 11%.

UnitedHealth slightly beat projections for its medical-loss

ratio, or the share of premiums spent on health-care costs, in its

third-quarter results. Analysts at J.P. Morgan had written in an

early-morning note that "consensus expectations were slightly

nervous" for UnitedHealth because it had fallen slightly short of

some analysts' expectations with its second-quarter MLR.

John Rex, UnitedHealth's chief financial officer, linked the

company's MLR performance to a pharmacy and hospital inpatient

spending growth trend coming at the low end of projections.

UnitedHealth also said it retains its optimistic view about the

Medicare Advantage business, an important source of growth for the

company and the broader managed-care sector. The company said it

was expecting very strong expansion and was pleased with its

position as the 2019 open-enrollment season gets under way.

When asked about the future role of pharmacy-benefit managers,

amid questions about industry practices including its handling of

rebates obtained from drugmakers, UnitedHealth executives said they

see a continued important role, even if the industry's approach

evolves.

The company also said it is positioning its PBM as a provider of

an array of pharmacy services, including through its recent

acquisition of two specialty pharmacy operators that it said will

bolster offerings in behavioral health and oncology.

Shares in UnitedHealth, which have gained 18% this year, rose

3.93% in midday trading on the New York Stock Exchange.

Write to Anna Wilde Mathews at anna.mathews@wsj.com and Kimberly

Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

October 17, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

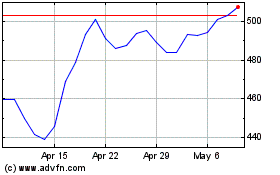

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Mar 2024 to Apr 2024

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Apr 2023 to Apr 2024