Porsche Slams the Brakes on IPO Speculation--Update

October 15 2018 - 9:05AM

Dow Jones News

By William Boston

BERLIN -- Porsche AG, the sports car maker owned by Volkswagen

AG, reined in its finance chief on Monday after he fueled

speculation that the company was discussing a potential listing of

a super luxury group combining Porsche, Lamborghini, Bugatti and

Bentley that could value the group at up to EUR70 billion ($81

billion).

In an official statement, Porsche sought to walk back the

comments, rejecting "speculation" about a possible listing of some

or all of the company.

"Porsche does not currently have any plans to pursue a (partial)

initial public offering. The Stuttgart-based sports car

manufacturer denies all reports to the contrary that claim an IPO

is in progress," the company said in a statement.

Porsche CFO Lutz Meschke made the comments on the sidelines of a

media event at Porsche on Friday, but they weren't reported until

Monday. Porsche didn't deny that Mr. Meschke made the comments or

claim he had been misrepresented in reports.

When asked by reporters about a possible listing of all or part

of Porsche, Mr. Meschke said a luxury car group combining

Volkswagen brands Porsche, Lamborghini, Bentley and Bugatti, would

be worth many times more than Ferrari, which went public in 2015

and is worth about EUR19 billion. He said a valuation of the

Porsche-led luxury group of EUR60 billion to EUR70 billion "doesn't

sound like a stretch," according to media reports.

Mr. Meschke also said he had raised the issue with the Porsche

family, Volkswagen's biggest shareholder, and with Volkswagen

executives, adding that any decision about an IPO rested with

Porsche's parent Volkswagen, according to the reports.

He appears to have spoken in such detail that analysts and

investors considered his comments a clear indication that

Volkswagen was, in fact, seriously discussing a potential listing

of its most valuable brands -- something many analysts have urged

the group to consider.

"We believe that a separate listing (preferably as a spin off)

of Porsche AG is one of the most obvious and logical ways for VW

Group to unlock value," said Arndt Ellinghorst, London-based

automotive analysts at Evercore ISI, in a note to clients on

Monday.

Analysts have long complained that through its conglomerate

structure grouping more than a dozen brands and businesses, the

market dramatically undervalues Volkswagen. Mr. Ellinghorst

suggested that if the company were to spin off minority stakes in

various brands and businesses Volkswagen's market value could rise

to EUR150 billion from around EUR70 billion today.

"The VW Group is a story of locked up value," Mr. Ellinghorst

said.

That's why investors latched onto the Porsche CFO's comments on

Monday, driving Volkswagen share up nearly 2% by midday,

outperforming the broader Dax index of German blue chips listed on

the Frankfurt Stock Exchange.

Volkswagen is also preparing its trucks business, Traton AG, for

a listing, but it has yet to set a date for the offering.

Volkswagen transformed the trucks business into a separate

wholly-owned stock company to prepare it for a potential

listing.

Ferrari's listing three years ago put pressure on the owners of

other sports and luxury car brands to consider spinning off their

valuable assets. Investors like the opportunity to trade on the

individual businesses as both the listed unit and its parent

company tend to be valued higher after an IPO.

In the case of Ferrari, its parent company Fiat Chrysler

Automobiles NV saw its shares rise in the wake of the spinoff. In

Volkswagen's case, a Porsche listing could add substantial value to

the company's market value if it were valued as a luxury brand,

like Ferrari, Mr. Ellinghorst said.

While analysts are confident Porsche could succeed in selling

itself to investors as a luxury manufacturer, there is a risk of a

lower valuation if investors don't buy the pitch.

Aston Martin Lagonda Global Holdings PLC pitched itself to

investors as a luxury brand, often comparing itself to Ferrari, as

a justification to value the company at more than six billion

pounds. But when it went public last months, it had to lower its

asking price for the shares and ultimately listed at a valuation of

about GBP4.3 billion ($5.7 billion).

Write to William Boston at william.boston@wsj.com

(END) Dow Jones Newswires

October 15, 2018 08:50 ET (12:50 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

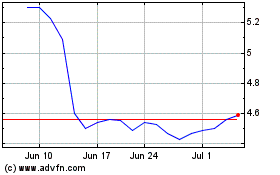

Porsche Automobile (PK) (USOTC:POAHY)

Historical Stock Chart

From Mar 2024 to Apr 2024

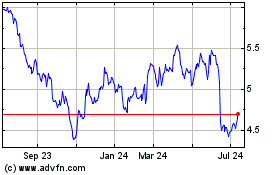

Porsche Automobile (PK) (USOTC:POAHY)

Historical Stock Chart

From Apr 2023 to Apr 2024