Kimco Realty Anticipates Significant Value Creation Opportunities from Sears Holdings Announcement

October 15 2018 - 7:30AM

Business Wire

Company’s Exposure Limited to Less Than 1% of

Total Annualized Base Rent

Potential Recapture of Below-Market Leases

Offers Sizable Long-Term Mark-to-Market and Redevelopment

Opportunities

Kimco Realty Corp. (NYSE:KIM) announced today that it expects to

benefit from considerable mark-to-market and long-term

redevelopment opportunities in the wake of the recently announced

Sears Holdings (“Sears/Kmart”) bankruptcy filing. Overall, Kimco’s

exposure is limited to 14 leases (three Sears and eleven Kmart, one

of which is subleased to At Home), representing just 0.6% of

annualized base rent and 1.9% of the company’s total gross leasable

area.

“Today’s announcement may afford us the long-awaited opportunity

to recapture boxes with significant mark-to-market potential in our

core markets, and sparks several new redevelopment opportunities

within our portfolio,” said Conor Flynn, Kimco’s Chief Executive

Officer. “Given the highly favorable demographics of these

locations, along with the continued demand for well-located,

high-quality real estate, we expect to build on our past success in

creating value by re-tenanting and redeveloping these below-market

anchor spaces and activating underutilized parking fields.”

Sears/Kmart pays among the lowest rents of any tenant in Kimco’s

portfolio. The 14 Sears/Kmart leases have an average base rent of

$5.25 per square foot, which is significantly below the company’s

portfolio average of $15.95. Demographics across the 14 locations

are desirable, with a population of 129,000 within a three-mile

radius with an average household income of $88,000.

Select opportunities include:

- Whittwood Town Center, an infill

site in the densely populated Los Angeles suburb of Whittier,

California, serving a population of approximately 175,000 within a

three-mile radius with an average household income of over

$93,000.

- Bridgehampton Commons in

Bridgehampton, New York, serving the affluent Hamptons community,

with an average household income of over $193,000 in a three-mile

radius.

- Kendale Lakes Plaza in Miami,

Florida, with a population of 215,000 within a three-mile radius in

this strong South Florida market.

Since 2015, Kimco has proactively reduced its overall exposure

to Sears/Kmart and has recognized the benefits of recapturing eight

Sears/Kmart locations, achieving an average rent spread of 211%.

The recaptures triggered the redevelopment of four of those

centers, including:

- Hylan Plaza in Staten Island,

New York, where a former Kmart has been demolished to make way for

The Boulevard, Kimco’s $186 million Signature Series redevelopment

scheduled to open in 2020, featuring tenants such as Alamo

Drafthouse, Marshalls, Ulta, LA Fitness and ShopRite, which

replaced Kmart at a rent spread of 727%.

- Vermont-Slauson Shopping Center

in Los Angeles, California, where a former Kmart was re-leased to

Ross Dress for Less and dd’s Discounts for a total rent spread of

748%.

- Bayhill Plaza in Orlando,

Florida, where a Kmart box was re-tenanted with a PGA Superstore

and Ross Dress for Less for a total rent spread of 127%.

- Fullerton Plaza in Baltimore,

Maryland, where Kmart was replaced by Weis Markets for a rent

spread of 191%.

About Kimco

Kimco Realty Corp. (NYSE:KIM) is a real estate investment trust

(REIT) headquartered in New Hyde Park, N.Y., that is one of North

America’s largest publicly traded owners and operators of open-air

shopping centers. As of September 30, 2018, the company owned

interests in 450 U.S. shopping centers comprising 78 million square

feet of leasable space primarily concentrated in the top major

metropolitan markets. Publicly traded on the NYSE since 1991, and

included in the S&P 500 Index, the company has specialized in

shopping center acquisitions, development and management for 60

years. For further information, please visit www.kimcorealty.com,

the company’s blog at blog.kimcorealty.com, or follow Kimco on

Twitter at www.twitter.com/kimcorealty.

The company announces material information to its investors

using the company’s investor relations website

(investors.kimcorealty.com), SEC filings, press releases, public

conference calls, and webcasts. The company also uses social media

to communicate with its investors and the public, and the

information the company posts on social media may be deemed

material information. Therefore, the company encourages investors,

the media, and others interested in the company to review the

information that it posts on the company’s blog

(blog.kimcorealty.com) and social media channels, including

Facebook (www.facebook.com/kimcorealty), Twitter

(www.twitter.com/kimcorealty), YouTube

(www.youtube.com/kimcorealty) and LinkedIn

(www.linkedin.com/company/kimco-realty-corporation). The list of

social media channels that the company uses may be updated on its

investor relations website from time to time.

Safe Harbor Statement

The statements in this news release state the company’s and

management’s intentions, beliefs, expectations or projections of

the future and are forward-looking statements. It is important to

note that the company’s actual results could differ materially from

those projected in such forward-looking statements. Factors which

may cause actual results to differ materially from current

expectations include, but are not limited to, (i) general adverse

economic and local real estate conditions, (ii) the inability of

major tenants to continue paying their rent obligations due to

bankruptcy, insolvency or a general downturn in their business,

(iii) financing risks, such as the inability to obtain equity, debt

or other sources of financing or refinancing on favorable terms to

the company, (iv) the company’s ability to raise capital by selling

its assets, (v) changes in governmental laws and regulations and

management’s ability to estimate the impact of such changes, (vi)

the level and volatility of interest rates and foreign currency

exchange rates and management’s ability to estimate the impact

thereof, (vii) risks related to the Company’s international

operations, (viii) the availability of suitable acquisition,

disposition, development and redevelopment opportunities, and risks

related to acquisitions not performing in accordance with our

expectations, (ix) valuation and risks related to the company’s

joint venture and preferred equity investments, (x) valuation of

marketable securities and other investments, (xi) increases in

operating costs, (xii) changes in the dividend policy for the

company’s common and preferred stock and the company’s ability to

pay dividends at current levels, (xiii) the reduction in the

company’s income in the event of multiple lease terminations by

tenants or a failure by multiple tenants to occupy their premises

in a shopping center, (xiv) impairment charges and (xv)

unanticipated changes in the company’s intention or ability to

prepay certain debt prior to maturity and/or hold certain

securities until maturity. Additional information concerning

factors that could cause actual results to differ materially from

those forward-looking statements is contained from time to time in

the company’s SEC filings. Copies of each filing may be obtained

from the company or the SEC.

The company refers you to the documents filed by the company

from time to time with the SEC, specifically the section titled

“Risk Factors” in the company’s Annual Report on Form 10-K for the

year ended December 31, 2017, as may be updated or supplemented in

the company’s Quarterly Reports on Form 10-Q and the company’s

other filings with the SEC, which discuss these and other factors

that could adversely affect the company’s results. The company

disclaims any intention or obligation to update the forward-looking

statements, whether as a result of new information, future events

or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181015005477/en/

David F. BujnickiSenior Vice President, Investor Relations and

StrategyKimco Realty

Corp.1-866-831-4297dbujnicki@kimcorealty.com

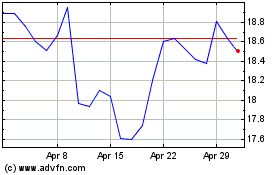

Kimco Realty (NYSE:KIM)

Historical Stock Chart

From Mar 2024 to Apr 2024

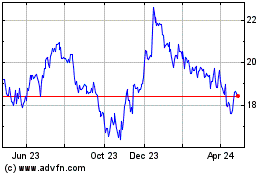

Kimco Realty (NYSE:KIM)

Historical Stock Chart

From Apr 2023 to Apr 2024