Argentum 47, Inc. - Market Update

October 11 2018 - 10:33AM

InvestorsHub NewsWire

Dubai,UAE -- October 11, 2018 -- InvestorsHub NewsWire

-- Argentum 47, Inc.

(www.arg47.com), formerly known as Global Equity

International, Inc., (OTCQB: ARGQ) and its

fully-owned foreign subsidiaries, a specialist in both Retail and

Corporate Financial Services, Corporate Consultancy and Human

Resources, with offices located in Dubai and the United Kingdom,

today would like to Update the Market on the current status of the

Company´s affairs and also on its achievements and up and

coming milestones.

Towards the end of September 2018, we agreed an extremely

advantageous addendum to a loan the Company received in 2013. This

loan, amounting to $480,000 (inclusive of principal, interest and

penalties), was non-convertible and had been dormant on our books

for years. We contractually agreed to pay a total of 220,000 GBP or

US$286,642 at a rate of just US$3,000 a month for 36 months and a

bullet or ad hoc payment on or before month 36. This agreement has

allowed our Company to write off US$193,358 as a gain on debt

extinguishment, which was healthy for our balance sheet.

Yesterday, October 10, 2018, the Company received a further

US$653,000 of funding from Xantis Aion Securitisation Fund

(Luxembourg). The funding agreement signed with Xantis Aion in June

of 2018 calls for an obligatory conversion into equity no earlier

than 366 days post receipt of each tranche of investment at a

minimum of $0.02 per share or higher. There are no provisions in

the funding agreement that call for a possible discount in this

minimum conversion price of $0.02.

This recent round of funding from Xantis Aion is yet another

significant step in the acquisition program our Company has

currently underway. The target companies are very well

identified, researched and analyzed for the best value proposition

for our Company, Argentum 47 Inc. and its subsidiaries. This recent

tranche of funding clearly demonstrates the continual long term

goals of the Company to acquire suitable assets at the right price

at the right time and to build the funds under administration and

associated passive and non passive revenue streams.

As of today, the Company is extremely proud to reiterate that it

has not issued a single common share since December of 2017.

Also, we expect the "Appointed Representation Agreement" with

Aurum Wealth Limited to be fully approved by the UK Financial

Authority (FCA) and operational sometime next week. Aurum stated in

their quote in our last PR that they have the capacity to grow, by

3 to 5 million GBP per month the Funds under Administration of our

recently acquired financial advisory firm, Cheshire Trafford (UK)

Limited, that currently has US$39 million under administration.

This meteoric growth will obviously translate into a substantial

uplift of Cheshire Trafford´s annual revenues.

Finally, our CEO, Peter Smith, will be doing an interview with

Uptick Newswire this afternoon (West Coast time). Peter will

endeavor to expand on our progress during Q3 2018 and also

management´s recent trip to South East Asia.

Peter Smith, CEO of Argentum 47, Inc.,

said: “Our process of acquisition is a medium to

long term project whereby we will continually be seeking the right

targets and raising the required funding for execution on those

targets. Our first acquisition, the UK FCA regulated Cheshire

Trafford, is undergoing some great development plans to grow the

business; we are appointing a very experienced individual, Mr.

Nicholas Tuke, to manage this growth and development and build the

UK arm of our business further. These next rounds of funding will

acquire further assets in the UK and in South East Asia where we

are still contemplating the true value and economics of what can be

acquired. As a business, we are in a very good shape at the moment

and will continue to grow over the coming months and years. Our

capital markets client, Creditum Limited, is also developing quite

nicely with further updates from us and them sometime in Q4 when we

will kick-start a listing on a major Stock Exchange for this

client.”

About Argentum 47, Inc. and Subsidiaries.

Argentum 47, Inc. (“Argentum”) is a full service Financial

Intermediary, Corporate Consultancy, Retail and Corporate Financial

Services and Human Resources Company. Through its wholly-owned

foreign subsidiaries, it advises both business and retail customers

with their most critical decisions and opportunities pertaining to

growth, capital needs, structure and the development of their

financial plans. With offices in Dubai and he United Kingdom,

Argentum has developed significant relationships in the US, UK,

Central Europe, the Middle East and South East Asia to assist

clients in realizing their full value and potential. Bringing

business to external capital and resources, and retail customers to

a suite of secure effective financial solutions. Furthermore, as

Argentum has offices in key financial centers of the world, they

are able to introduce their clients to the right financial partner

without geographical constraints.

Safe Harbor Statement

This press release may include forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995, including statements related to anticipated revenues,

expenses, earnings, operating cash flows, the outlook for markets

and the demand for products. Forward-looking statements are no

guarantees of future performance and are inherently subject to

uncertainties and other factors which could cause actual results to

differ materially from the forward-looking statements. Such

statements are based upon, among other things, assumptions made by,

and information currently available to, management, including

management’s own knowledge and assessment of the Company’s industry

and competition. The Company refers interested persons to its most

recent Annual Report on Form 10-K and its other SEC filings for a

description of additional uncertainties and factors, which may

affect forward-looking statements. The company assumes no duty to

update its forward-looking statements.

Contact details:

Mr. Peter J. Smith

Director and CEO of Argentum 47, Inc.

Tel. + (971) 42 76 75 76

Mr. Enzo Taddei

Director and CFO of Argentum 47, Inc.

Tel. + (1) 321 200 0142

Email: Info@arg47.com

Web: www.arg47.com

UpTick NewsWire

Ms. Diana Eidson

Director of Business Development

Tel. +(1) 602 441 3474

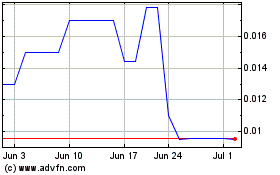

Argentum 47 (PK) (USOTC:ARGQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

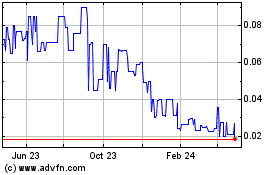

Argentum 47 (PK) (USOTC:ARGQ)

Historical Stock Chart

From Apr 2023 to Apr 2024