As filed with the Securities and Exchange Commission on October 10,

2018

Registration No. 333-_______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

IMAGEWARE SYSTEMS,

INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

|

7372

|

33-0224167

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(Primary

standard industrial

classification code number)

|

(I.R.S. Employer

Identification Number)

|

10815 Rancho Bernardo Road, Suite 310

San Diego, California 92127

(858) 673-8600

(Address, Including Zip Code, and Telephone Number, Including Area

Code, of Registrant’s Principal Executive

Offices)

S. James Miller, Jr.

President and Chief Executive Officer

ImageWare Systems, Inc.

10815 Rancho Bernardo Road, Suite 310

San Diego, California 92127

(858) 673-8600

(Name, Address, Including Zip Code, and Telephone Number, Including

Area Code, of Agent for Service)

Copies to

Daniel W. Rumsey, Esq.

Jessica R. Sudweeks, Esq.

Disclosure Law Group, a Professional Corporation

600 West Broadway, Suite 700

San Diego, CA 92101

(619) 272-7050

Approximate date of

commencement of proposed sale to the public

: From time to time after this registration

statement becomes effective, as determined by market conditions and

other factors.

If

any of the securities being registered on this form are to be

offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, other than securities offered only in

connection with dividend or interest reinvestment plans, check the

following box. [X]

If

this form is filed to register additional securities for an

offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration

statement number of the earlier effective registration statement

for the same offering. [ ]

If

this form is a post-effective amendment filed pursuant to Rule

462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier

effective registration statement for the same

offering. [ ]

If

this form is a post-effective amendment filed pursuant to Rule

462(d) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier

effective registration statement for the same

offering. [ ]

Indicate

by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, smaller reporting

company, or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated

filer,” “smaller reporting company,” and

“emerging growth company” in Rule 12b-2 of the Exchange

Act. (Check one):

|

Large accelerated filer

|

|

[ ]

|

|

Accelerated

filer

|

|

[X]

|

|

|

|

|

|

|

|

|

Non-accelerated

filer

|

|

[ ]

|

|

Smaller reporting company

|

|

[X]

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging

growth company

|

|

[ ]

|

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 7(a)(2)(B) of the Securities Act. [

]

CALCULATION OF REGISTRATION FEE

|

Title of each class of securities to

be registered

|

Amount to be Registered

(1)

|

Proposed Maximum Aggregate

Offering Price

(2)

|

Amount of Registration

Fee

|

|

Common

Stock, par value $0.01 per share

|

11,031,000

(3)

|

$

10,920,690

|

$

1,323.59

|

|

(1)

|

In

accordance with Rule 416 under the Securities Act of 1933, as

amended (the “

Securities

Act

”), the shares being registered hereunder include

such indeterminate number of shares of common stock as may be

issuable with respect to the shares being registered hereunder as a

result of stock splits, stock dividends or similar

transactions.

|

|

(2)

|

Estimated

solely for the purpose of calculating the registration fee for the

offering pursuant to Rule 457(c) under the Securities Act, based on

the average of the high and low prices of the Registrant’s

common stock on the OTCQB Marketplace on October 4,

2018.

|

|

(3)

|

Includes

(i) 10,000,000 shares of common stock issuable upon the conversion

of shares of the Company’s Series C Convertible Preferred

Stock, par value $0.01 per share (“

Series C Preferred

”) held by the

selling stockholders (“

Conversion Shares

”), and (ii) an

estimated 1,031,000 shares of common stock issuable as payment of

accrued dividends on shares of Series C Preferred held by selling

stockholders within 12 months from the date of this Registration

Statement (any shares of common stock issuable as dividends on

shares of Series C Preferred, the “

Dividend Shares

”). The number of

Dividend Shares issuable over the next 12 months are estimated

based on the closing price of the Registrant’s common stock

on October 4, 2018, as reported on the OTCQB

Marketplace.

|

The Registrant hereby amends this registration statement on such

date or dates as may be necessary to delay its effective date until

the registrant shall file a further amendment which specifically

states that this registration statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act of

1933 or until the registration statement shall become effective on

such date as the Commission, acting pursuant to said section 8(a),

may determine.

|

|

|

|

|

|

The information in this prospectus is not complete and may be

changed. The selling stockholders may not sell these securities

until the registration statement filed with Securities and Exchange

Commission is effective. This prospectus is not an offer to sell

these securities and is not soliciting an offer to buy these

securities in any state where the offer or sale is not

permitted.

|

|

|

|

|

|

Subject to completion, dated October 10, 2018

PRELIMINARY PROSPECTUS

11,031,000

SHARES

COMMON STOCK

This

prospectus relates to the sale from time to time of up to

11,031,000 shares of our common stock, par value $0.01 per share

(“

Common

Stock

”) by the selling stockholders identified in this

prospectus, which amount includes (i) 10,000,000 shares of Common

Stock that that may be issued to them from time to time upon

conversion of shares of our Series C Convertible Preferred Stock,

par value $0.01 per share ( “

Series C Preferred

”) (the

“

Conversion

Shares

”), and (ii) an estimated 1,031,000 shares of

Common Stock issuable as payment of accrued dividends on shares of

Series C Preferred held by selling stockholders within 12 months

from the date of this prospectus (any shares of Common Stock

issuable as dividends on shares of Series C Preferred, the

“

Dividend

Shares

”). We issued the Series C Preferred shares to

the selling stockholders in private placement transactions

completed on September 10, 2018 and September 21, 2018.

The prices at which the selling

stockholders may sell the shares will be determined by the

prevailing market price for the shares or in negotiated

transactions.

We are registering the Conversion Shares and

Dividend Shares to provide the selling stockholders with freely

tradable securities. This prospectus does not necessarily mean that

the selling stockholders will offer or sell those shares. Up to

11,031,000 shares may be sold from time to time after the

effectiveness of the registration statement, of which this

prospectus forms a part. See “

Description of Private

Placement

”

on page

15

below for more

information.

We

will not receive proceeds from the sale of the shares by the

selling stockholders. All selling and other expenses incurred by

the selling stockholders will be paid by the selling stockholders,

except for certain legal fees and expenses, which will be paid by

us.

Our

Common Stock is quoted on the OTCQB Marketplace under the symbol

“IWSY.” The last reported sale price of our common

stock on October 10, 2018 was $0.96 per share.

Our business and investing in our securities involves significant

risks. You should review carefully the risks and uncertainties

referenced under the heading “

Risk

Factors

” beginning on

page 6 of this prospectus.

Neither the Securities and Exchange Commission nor any state

securities commission has approved or disapproved of these

securities or passed upon the adequacy or accuracy of this

prospectus. Any representation to the contrary is a criminal

offense.

The date of this prospectus is

,

2018

IMAG

EWARE SYSTEMS, INC.

|

|

|

|

|

|

|

PAGE

|

|

|

|

|

|

|

|

1

|

|

|

|

|

|

|

|

2

|

|

|

|

|

|

|

|

6

|

|

|

|

|

|

|

|

13

|

|

|

|

|

|

|

|

14

|

|

|

|

|

|

|

|

15

|

|

|

|

|

|

|

|

16

|

|

|

|

|

|

|

|

17

|

|

|

|

|

|

|

|

19

|

|

|

|

|

|

|

|

21

|

|

|

|

|

|

|

|

22

|

|

|

|

|

|

|

|

24

|

|

|

|

|

|

|

|

38

|

|

|

|

|

|

|

|

61

|

|

|

|

|

|

|

|

72

|

|

|

|

|

|

|

|

75

|

|

|

|

|

|

|

|

77

|

|

|

|

|

|

|

|

77

|

|

|

|

|

|

|

|

77

|

|

|

|

|

ABOUT THIS PROSPECTUS

This prospectus is part of a

registration statement on Form S-1 that we filed with the

Securities and Exchange Commission (the “

SEC

”). Under this registration statement, the

selling stockholders may, from time to time, sell up to an

aggregate of 11,031,000 shares of our Common Stock, which includes

(i) 10,000,000 shares that may be issued upon

conversion of

outstanding shares of our Series C Preferred, and (ii) an estimated

1,031,000 shares of Common Stock issuable as payment of accrued

dividends on shares of Series C Preferred held by selling

stockholders within 12 months from the date of this

prospectus

. The registration statement

we filed with the SEC, of which this prospectus forms a part,

includes exhibits that provide more detail of the matters discussed

in this prospectus. You should read this prospectus and the related

exhibits filed with the SEC before making your investment

decision.

You

should rely only on the information contained in this

prospectus. Neither we nor the selling stockholders have

authorized any other person to provide you with different

information. If anyone provides you with different or

inconsistent information, you should not rely on it. Neither

we nor the selling stockholders are making offers to sell or

solicitations to buy the securities in any jurisdiction in which an

offer or solicitation is not authorized, or in which the person

making that offer or solicitation is not qualified to do so or to

anyone to whom it is unlawful to make an offer or

solicitation. You should not assume that the information in

this prospectus is accurate as of any date other than its

respective date. Our business, financial condition,

results of operations and prospects may have changed since those

dates.

|

|

This summary highlights information contained elsewhere in this

prospectus or incorporated by reference herein. This summary does

not contain all of the information you should consider before

investing in our securities. Before deciding to invest in our

securities, you should read this entire prospectus carefully,

including the section of this prospectus entitled “Risk

Factors” beginning on page 6.

Overview

We

develop mobile and cloud-based identity management solutions

providing biometric, secure credential and law enforcement

technologies. Our patented biometric product line includes our

flagship product, the IWS Biometric Engine®, a hardware and

algorithm independent multi-biometric engine that enables the

enrollment and management of unlimited population sizes. Our

identification products are used to manage and issue secure

credentials, including national IDs, passports, driver licenses and

access control credentials. Our digital booking products provide

law enforcement with integrated mug shots, fingerprint LiveScan and

investigative capabilities. We also provide comprehensive

authentication security software using biometrics to secure

physical and logical access to facilities or computer networks or

internet sites. We are headquartered in San Diego, California,

with offices in Portland, Oregon, Mexico and Ottawa,

Ontario.

We are also a leading developer of mobile and

cloud-based identity management solutions providing patented

biometric authentication solutions for the enterprise. We deliver

next-generation biometrics as an interactive and scalable

cloud-based solution. We bring together cloud and mobile technology

to offer multi-factor authentication for smartphone users, for the

enterprise, and across industries. We have introduced a set of

mobile and cloud solutions to provide biometric user

authentication, including the GoVerifyID® mobile application

and cloud-based SaaS solutions. These solutions include GoMobile

Interactive (“

GMI

”), which provides patented, secure, dynamic

messaging. More recently we have introduced GoVerifyID®

Enterprise Suite, which provides turnkey integration with Microsoft

Windows, Microsoft Active Directory, and security products from CA,

HPE, IBM, and SAP. These solutions are marketed and sold to

businesses across many industries. For the healthcare industry, we

also developed and market a patented, FDA-Cleared,

biometrically-secured, enterprise-level platform for patient

engagement and medication adherence.

Historically,

we have marketed our products to government entities at the

federal, state and local levels; however, the emergence of cloud

based computing, a mobile market that demands increased security

and interoperable systems, and the proven success of our products

in the government markets, has enabled us to enlarge our target

market focus to include the emerging consumer and non-government

enterprise marketplace.

Our biometric technology is a core software

component of an organization’s security infrastructure and

includes a multi-biometric identity management solution for

enrolling, managing, identifying and verifying the identities of

people by the physical characteristics of the human body. We

develop, sell and support various identity management capabilities

within government (federal, state and local), law enforcement,

commercial enterprises, and transportation and aviation markets for

identification and verification purposes. Our IWS Biometric Engine

is a patented biometric identity management software platform for

multi-biometric enrollment, management and authentication, managing

population databases of virtually unlimited sizes. It is hardware

agnostic and can utilize different types of biometric

algorithms. It allows different types of biometrics to be

operated at the same time on a seamlessly integrated

platform. It is also offered as a Software Development Kit

(“

SKD

”) based search engine, enabling developers

and system integrators to implement a biometric solution or

integrate biometric capabilities into existing applications without

having to derive biometric functionality from pre-existing

applications. The IWS Biometric Engine combined with our

secure credential platform, IWS EPI Builder, provides a

comprehensive, integrated biometric and secure credential solution

that can be leveraged for high-end applications such as passports,

driver licenses, national IDs, and other secure

documents.

Our

law enforcement solutions enable agencies to quickly capture,

archive, search, retrieve, and share digital images, fingerprints

and other biometrics as well as criminal history records on a

stand-alone, networked, wireless or web-based platform. We develop,

sell and support a suite of modular software products used by law

enforcement and public safety agencies to create and manage

criminal history records and to investigate crime. Our IWS Law

Enforcement solution consists of five software modules: Capture and

Investigative modules, which provide a criminal booking system with

related databases as well as the ability to create and print mug

photo/SMT image lineups and electronic mug-books; a Facial

Recognition module, which uses biometric facial recognition to

identify suspects; a Web module, which provides access to centrally

stored records over the Internet in a connected or wireless

fashion; and a LiveScan module, which incorporates LiveScan

capabilities into IWS Law Enforcement providing integrated

fingerprint and palm print biometric management for civil and law

enforcement use. The IWS Biometric Engine is also available to

our law enforcement clients and allows them to capture and search

using other biometrics such as iris or DNA.

|

|

|

|

|

|

|

|

Our

secure credential solutions empower customers to create secure and

smart digital identification documents with complete ID systems. We

develop, sell and support software and design systems which utilize

digital imaging and biometrics in the production of photo

identification cards, credentials and identification systems. Our

products in this market consist of IWS EPI Suite and IWS EPI

Builder. These products allow for production of digital

identification cards and related databases and records and can be

used by, among others, schools, airports, hospitals, corporations

or governments. We have added the ability to incorporate multiple

biometrics into the ID systems with the integration of IWS

Biometric Engine to our secure credential product

line.

Our GoVerifyID products support multi-modal

biometric authentication including, but not limited to, face,

voice, fingerprint, iris, palm, and more. All the biometrics can be

combined with or used as replacements for authentication and access

control tools, including tokens, digital certificates, passwords,

and PINS, to provide the ultimate level of assurance,

accountability, and ease of use for corporate networks, web

applications, mobile devices, and PC desktop environments.

GoVerifyID provides patented multi-modal biometric identity

authentication that can be used in place of passwords or as a

strong second factor authentication method. GoVerifyID is provided

as a cloud-based Software-as-a-Service (“

SaaS

”) solution; thereby, eliminating complex IT

deployment of biometric software and eliminating startup costs.

GoVerifyID works with existing mobile devices, eliminating the need

for specialized biometric scanning devices typically used with most

biometric solutions.

GoVerifyID

was built to work seamlessly with our patented technology

portfolio, including GoMobile Interactive®, the secure dynamic

messaging system, and the ultra-scalable IWS Biometric Engine that

provides anonymous biometric matching and storage. GoVerifyID is

secure, simple to use, and designed to provide instant identity

authentication by engaging with the biometric capture capabilities

of each user’s mobile device. GoVerifyID also provides a

fully open SDK for organizations that require the utmost in

flexibility.

Our

GoVerifyID Enterprise Suite for Windows easily and seamlessly

integrates with a user’s existing Microsoft

ecosystem/infrastructure to support the user’s extended

workforce. GoVerifyID Enterprise Suite secures corporate networks

from end-to-end – both applications and data – on

client, server, and cloud systems with flexible user login policies

to address varied trust requirements. Our GoVerifyID Enterprise

Suite works with the smart devices that the workforce already uses,

including iOS/Android smartphones and tablets.

Our GoVerifyID Enterprise Suite for Windows

provides biometric authentication for the Microsoft ecosystem that

secures enterprise security without compromising agility,

productivity, or user experience. Its comprehensive architecture

offers biometric authentication for the complete range of

enterprise stakeholders, delivering secure enterprise applications

and workspaces to internal employees, partners, suppliers and

vendors, even customers. Out-of-band authentication is provided via

universally available devices, such as smartphones and tablets.

In-band authentication can be enabled via fingerprint readers, iris

scanners, and any Windows Biometric Framework compatible device.

The server component provides easy centralized management of

biometric authentication policies for all users, using a standard

Snap-In to the Microsoft Management Console. It provides greater

user assurance and Single Sign-On (“

SSO

”) convenience for all corporate systems and

cloud applications. There is no compromise in agility or user

experience.

GoVerifyID Enterprise Suite also provides options

for seamless integration with leading Enterprise Identity and

Access Management (“

IAM

”) solutions including CA SSO, IBM Security

Access Manager (“

ISAM

”), SAP Cloud Platform, and HPE’s

Aruba ClearPass. These turnkey integrations provide multi-modal

biometric authentication to replace or augment passwords for use

with enterprise and consumer class systems.

Our

Pillphone® Platform:

●

Improves

medication adherence and manages chronic conditions by enriching

the relationship between the care team and the patient via its

enterprise level, mobile communication platform;

●

Digitally

connects healthcare providers with patients and provides support

when the patients are outside of the medical facility;

●

Streamlines

workflows and improves care team communication and collaboration

with the patient by offering personalized, two-way interactive,

secure messaging and real-time remote medication monitoring;

and

●

Enhances

the human connection of the care team that is essential for quality

patient-centered care.

|

|

|

|

|

|

|

|

Risk Factors

Our business is subject to substantial risk.

Please carefully consider the section titled

“

Risk

Factors

” beginning on

page 6 of this prospectus for a discussion of the factors you

should carefully consider before investing in our

securities.

Additional

risks and uncertainties not presently known to us or that we

currently deem immaterial may also impair our business operations.

You should be able to bear a complete loss of your

investment.

Corporate Information

We were

incorporated in the state of Delaware in 2005, and previously

incorporated in California in 1987 as a California corporation. Our

principal place of business is located at 10815 Rancho Bernardo

Road, Suite 310, San Diego, California 92127. Our telephone number

is (858) 673-8600. We maintain a corporate website

at http://www.iwsinc.com.

The information

contained on our website is not, and should not be interpreted to

be, a part of this prospectus.

Private Placements

On September 10, 2018 (the

“

Closing

Date

”), we entered into

securities purchase agreements with certain accredited investors

(the “

Investors

”), pursuant to which we sold a total of 890

shares of our Series C Preferred at a purchase price of $10,000 per

share (the “

Stated

Value

”), and on September

21, 2018, we entered into securities purchase agreements with

additional Investors, pursuant to which we sold an additional 110

shares of Series C Preferred (together, the

“

Series C

Financing

”). Shares of

Series C Preferred accrue dividends at a rate of 8% per annum

if paid in cash, or 10% per annum if paid by the issuance of shares

of the Common Stock, and are payable on a quarterly basis

(“

Dividend

Shares

”). In addition,

each share of Series C Preferred is convertible into that number of

shares of the Company’s Common Stock

(“

Conversion

Shares

”) equal to the

Stated Value, divided by $1.00, which conversion rate is subject to

adjustment in accordance with the terms of the Certificate of

Designations, Preferences, and Rights of Series C Convertible

Preferred Stock.

In connection with the sale of the Series C

Preferred, we granted certain registration rights to the Investors

with respect to the Conversion Shares and Dividend Shares, pursuant

to a Registration Rights Agreement by and among us and the

Investors (the “

Registration Rights

Agreement

”), each of whom

are also the selling stockholders identified in this prospectus in

the section titled “

Selling

Stockholder

s.” We are

filing the registration statement, of which this prospectus forms a

part, pursuant to the terms of the Registration Rights Agreement

requiring us to file a registration statement no later than 30 days

after the Closing Date to register the Conversion Shares and the

Dividend Shares.

|

|

|

|

|

|

|

THE OFFERING

|

|

|

|

The following summary contains

general information about this offering. The summary is not

intended to be complete. You should read the full text and more

specific details contained elsewhere in this prospectus.

|

|

|

|

|

|

|

|

|

|

Common Stock being offered by selling stockholders

|

|

Up to 11,031,000 shares.

|

|

|

|

|

|

|

|

|

|

Common Stock outstanding as of October 4, 2018

|

|

96,727,726 shares.

|

|

|

|

|

|

|

|

|

|

Use of Proceeds

|

|

The selling stockholders will receive all of the proceeds from the

sale of the shares of Common Stock offered for sale under this

prospectus. We will not receive any proceeds from the sale of

shares of our Common Stock by the selling

stockholders.

|

|

|

|

|

|

|

|

|

|

Plan of Distribution

|

|

The

selling stockholders may sell the shares of Common

Stock from time-to-time on the principal market on which the shares

of Common Stock are traded at the prevailing market price or in

negotiated transactions. See “

Plan of

Distribution

.

”

|

|

|

|

|

|

|

|

|

|

Risk Factors

|

|

An investment in our securities involves a high degree of risk. See

“Risk Factors” for a discussion of factors you should

consider carefully before making an investment

decision.

|

|

|

|

|

|

|

|

|

|

OTCQB Trading Symbol

|

|

IWSY

|

|

|

|

|

|

|

|

|

|

The

number of shares of our Common Stock outstanding is based on

96,727,726 shares of Common Stock outstanding as of October 4,

2018, and excludes:

●

7,264,843

shares of our Common Stock issuable upon the exercise of stock

options outstanding at a weighted-average exercise price of $1.33

per

share;

●

1,763,856

shares of Common Stock issuable upon the exercise of warrants at a

weighted-average exercise price of $0.16 per

share;

●

770,177 shares of Common Stock reserved for future

issuance under our 1999 Stock Award Plan (the

“

1999

Plan

”);

●

32,616,575 shares of Common Stock issuable upon

conversion of 37,468 outstanding shares of Series A Convertible

Preferred

Stock

(“

Series A

Preferred

”);

●

47,043 shares of Common Stock issuable upon

conversion of 239,400 outstanding shares of Series B Convertible

Preferred

Stock

(“

Series B

Preferred

”);

and

●

10,010,959 shares of Common Stock issuable upon

conversion of 1,000 outstanding shares of Series C Convertible

Preferred

Stock

(“

Series C

Preferred

”).

Unless otherwise indicated, all information in this

prospectus assumes:

●

no conversion of outstanding shares of Series A

Preferred;

●

no conversion of outstanding shares of Series B

Preferred;

●

no conversion of outstanding shares of Series C

Preferred; and

●

no exercise of outstanding warrants or the

outstanding stock options issued under the 1999 Plan, as described

above.

|

|

Investing in our Common Stock involves a high degree of risk. You

should consider carefully the risks and uncertainties described

below, together with all of the other information in this

prospectus, including our financial statements and related notes,

before deciding whether to purchase shares of our Common Stock. If

any of the following risks are realized, our business,

financial condition, results of operations and prospects could be

materially and adversely affected. In that event, the price of our

Common Stock could decline and you could lose part or all of your

investment.

Risks Related to Our Business

We have a history of significant recurring losses totaling

approximately $177.7 million at June 30, 2018 and

$170.5 million at December 31, 2017, and these losses may

continue in the future.

As of June 30, 2018 and December 31, 2017, we had

an accumulated deficit of approximately $177.7 million and

$170.5

million,

respectively, and these losses may continue in the future. We

expect to continue to incur significant sales and marketing,

research and development, and general and administrative expenses.

As a result, we will need to generate significant revenues to

achieve profitability, and we may never achieve

profitability.

Our operating results have fluctuated in the past and are likely to

fluctuate significantly in the future.

Our

operating results have fluctuated in the past. These

fluctuations in operating results are the consequence of, amongst

others:

●

varying

demand for and market acceptance of our technology and

products;

●

changes

in our product or customer mix;

●

the

gain or loss of one or more key customers or their key customers,

or significant changes in the financial condition of one or more of

our key customers or their key customers;

●

our

ability to introduce, certify and deliver new products and

technologies on a timely basis;

●

the

announcement or introduction of products and technologies by our

competitors;

●

competitive

pressures on selling prices;

●

costs

associated with acquisitions and the integration of acquired

companies, products and technologies;

●

our

ability to successfully integrate acquired companies, products and

technologies;

●

our

accounting and legal expenses; and

●

general

economic conditions.

These

factors, some of which are not within our control, will likely

continue in the future. To respond to these and other factors, we

may need to make business decisions that could result in failure to

meet financial expectations. If our quarterly operating results

fail to meet or exceed the expectations of securities analysts or

investors, our stock price could drop suddenly and significantly.

Most of our expenses, such as employee compensation

and inventory, are relatively fixed in the short term.

Moreover, our expense levels are based, in part, on our

expectations regarding future revenue levels. As a result, if our

revenue for a particular period was below our expectations, we

would not be able to proportionately reduce our operating expenses

for that period. Any revenue shortfall would have a

disproportionately negative effect on our operating results for the

period.

We depend upon a

small number of large system sales ranging from $100,000 to in

excess of $2,000,000 and we may fail to achieve one or more large

system sales in the future

.

Historically,

we have derived a substantial portion of our revenues from a small

number of sales of large, relatively expensive systems, typically

ranging in price from $100,000 to $2,000,000. If we fail to receive

orders for these large systems in a given sales cycle on a

consistent basis, our business could be significantly harmed.

Further, our quarterly results are difficult to predict because we

cannot predict in which quarter, if any, large system sales will

occur in a given year. As a result, we believe that

quarter-to-quarter comparisons of our results of operations are not

a good indication of our future performance. In some future

quarters, our operating results may be below the expectations of

securities analysts and investors, in which case the market price

of our common stock may decrease significantly.

Our lengthy sales

cycle may cause us to expend significant resources for one year or

more in anticipation of a sale to certain customers, yet we still

may fail to complete the sale

.

When

considering the purchase of a large computerized identity

management system, potential customers may take as long as eighteen

months to evaluate different systems and obtain approval for the

purchase. Under these circumstances, if we fail to complete a sale,

we will have expended significant resources and received no revenue

in return. Generally, customers consider a wide range of issues

before committing to purchase our products, including product

benefits, ability to operate with their current systems, product

reliability and their own budgetary constraints. While potential

customers are evaluating our products, we may incur substantial

selling costs and expend significant management resources in an

effort to accomplish potential sales that may never occur. In times

of economic recession, our potential customers may be unwilling or

unable to commit resources to the purchase of new and costly

systems.

A significant

number of our customers and potential customers are government

agencies that are subject to unique political and budgetary

constraints and have special contracting requirements, which may

affect our ability to obtain new and retain current government

customers

.

A

significant number of our customers are government agencies. These

agencies often do not set their own budgets and therefore have

little control over the amount of money they can spend from

quarter-to-quarter or year-to-year. In addition, these agencies

experience political pressure that may dictate the manner in which

they spend money. Due to political and budgetary processes and

other scheduling delays that may frequently occur relating to the

contract or bidding process, some government agency orders may be

canceled or substantially delayed, and the receipt of revenue or

payments from these agencies may be substantially delayed. In

addition, future sales to government agencies will depend on our

ability to meet government contracting requirements, certain of

which may be onerous or impossible to meet, resulting in our

inability to obtain a particular contract. Common requirements in

government contracts include bonding requirements, provisions

permitting the purchasing agency to modify or terminate at will the

contract without penalty, and provisions permitting the agency to

perform investigations or audits of our business practices, any of

which may limit our ability to enter into new contracts or maintain

our current contracts.

One customer accounted for approximately 43% of our total revenues

during the six months ended June 30, 2018, and approximately 25% of

our total revenues during the year ended December 31, 2017. In the

event of any material decrease in revenue from this customer, or if

we are unable to replace the revenue through the sale of our

products to additional customers, our financial condition and

results from operations could be materially and adversely

affected.

During the six months ended

June 30, 2018 and year ended December 31, 2017, one customer

accounted for approximately 43% or $1,121,000

of our total revenue

, and 25% o

r $1,089,000

of

our total revenue

,

respectively. If this customer were to

significantly reduce its relationship with the Company, or in the

event the we are unable to replace the revenue through the sale of

our products to additional customers, our financial condition and

results from operations could be negatively impacted, and such

impact would be material.

We occasionally

rely on systems integrators to manage our large projects, and if

these companies do not perform adequately, we may lose

business

.

We

occasionally act as a subcontractor to systems integrators who

manage large projects that incorporate our systems, particularly in

foreign countries. We cannot control these companies, and they may

decide not to promote our products or may price their services in

such a way as to make it unprofitable for us to continue our

relationship with them. Further, they may fail to perform under

agreements with their customers, in which case we might lose sales

to these customers. If we lose our relationships with these

companies, our business, financial condition and results of

operations may suffer.

We are dependent upon third parties for the successful integration

of our products, and/or the launch of our products. Any delay in

the integration of our products or the launch of third-party

products may materially affect our results from operations and

financial condition.

Our current marketing

strategy involves the distribution of our products through larger

product partners and/or resellers that will either resell our

product alongside theirs, OEM a white label version of our

products, or sell our products fully integrated into their

offerings. Our strategy leaves us largely dependent upon the

successful rollout of our products by our distribution partners. We

have experienced delays in the rollout of our products due to these

factors during the years ended December 31, 2016 and 2017, and no

assurances can be given that we will not experience delays in the

future. Any delays negatively affect our results from operations

and financial condition.

If the patents we

own or license, or our other intellectual property rights, do not

adequately protect our products and technologies, we may lose

market share to our competitors and our business, financial

condition and results of operations would be adversely

affected

.

Our success depends significantly on our ability

to protect our rights to the technologies used in our products. We

rely on patent protection, trade secrets, as well as a combination

of copyright and trademark laws and nondisclosure, confidentiality

and other contractual arrangements to protect our technology.

However, these legal means afford only limited protection and may

not adequately protect our rights or permit us to gain or keep any

competitive advantage. In addition, we cannot be assured that any

of our current and future pending patent applications will result

in the issuance of a patent to us. The U.S. Patent and Trademark

Office (“

PTO

”) may deny or require significant narrowing

of claims in our pending patent applications, and patents issued as

a result of the pending patent applications, if any, may not

provide us with significant commercial protection or may not be

issued in a form that is advantageous to us. We could also incur

substantial costs in proceedings before the PTO. These proceedings

could result in adverse decisions as to the claims included in our

patents.

Our

issued and licensed patents and those that may be issued or

licensed in the future may be challenged, invalidated or

circumvented, which could limit our ability to stop competitors

from marketing related products. Additionally, upon expiration of

our issued or licensed patents, we may lose some of our rights to

exclude others from making, using, selling or importing products

using the technology based on the expired patents. We also must

rely on contractual rights with the third parties that license

technology to us to protect our rights in the technology licensed

to us. Although we have taken steps to protect our intellectual

property and technology, there is no assurance that competitors

will not be able to design around our patents. We also rely on

unpatented proprietary technology. We cannot assure you that we can

meaningfully protect all our rights in our unpatented proprietary

technology or that others will not independently develop

substantially equivalent proprietary products or processes or

otherwise gain access to our unpatented proprietary technology. We

seek to protect our know-how and other unpatented proprietary

technology with confidentiality agreements and intellectual

property assignment agreements with our employees. However, such

agreements may not provide meaningful protection for our

proprietary information in the event of unauthorized use or

disclosure or other breaches of the agreements or in the event that

our competitors discover or independently develop similar or

identical designs or other proprietary information. In addition, we

rely on the use of registered and common law trademarks with

respect to the brand names of some of our products. Our common law

trademarks provide less protection than our registered trademarks.

Loss of rights in our trademarks could adversely affect our

business, financial condition and results of

operations.

Furthermore,

the laws of foreign countries may not protect our intellectual

property rights to the same extent as the laws of the United

States. If we fail to apply for intellectual property protection or

if we cannot adequately protect our intellectual property rights in

these foreign countries, our competitors may be able to compete

more effectively against us, which could adversely affect our

competitive position, as well as our business, financial condition

and results of operations.

If third parties

claim that we infringe their intellectual property rights, we may

incur liabilities and costs and may have to redesign or discontinue

selling certain products

.

Whether a product infringes a patent involves

complex legal and factual issues, the determination of which is

often uncertain. We face the risk of claims that we have infringed

on third parties’ intellectual property rights. Searching for

existing intellectual property rights may not reveal important

intellectual property and our competitors may also have filed for

patent protection, which is not yet a matter of public knowledge,

or claimed trademark rights that have not been revealed through our

availability searches. Our efforts to identify and avoid infringing

on third parties’ intellectual property rights may not always

be successful. Any claims of patent or other intellectual property

infringement, even those without merit,

could:

●

increase

the cost of our products;

●

be

expensive and time consuming to defend;

●

result

in us being required to pay significant damages to third

parties;

●

force

us to cease making or selling products that incorporate the

challenged intellectual property;

●

require

us to redesign, reengineer or rebrand our products;

●

require

us to enter into royalty or licensing agreements in order to obtain

the right to use a third party’s intellectual property, the

terms of which may not be acceptable to us;

●

require

us to indemnify third parties pursuant to contracts in which we

have agreed to provide indemnification to such parties for

intellectual property infringement claims;

●

divert

the attention of our management; and

●

result

in our customers or potential customers deferring or limiting their

purchase or use of the affected products until the litigation is

resolved.

In

addition, new patents obtained by our competitors could threaten a

product’s continued life in the market even after it has

already been introduced.

If our security measures or those of our third-party data center

hosting facilities, cloud computing platform providers, or

third-party service partners, are breached, and unauthorized access

is obtained to a customer’s data, our data or our IT systems,

or authorized access is blocked or disabled, our services may be

perceived as not being secure, customers may curtail or stop using

our services, and we may incur significant legal and financial

exposure and liabilities.

Our

services involve the storage and transmission of our

customers’ and our customers’ customers’

proprietary and other sensitive data, including financial

information and other personally identifiable information. While we

have security measures in place, they may be breached as a result

of efforts by individuals or groups of hackers and sophisticated

organizations, including state-sponsored organizations or

nation-states. Our security measures could also be compromised by

employee error or malfeasance, which could result in someone

obtaining unauthorized access to, or denying authorized access to

our IT systems, our customers’ data or our data, including

our intellectual property and other confidential business

information. Additionally, third parties may attempt to

fraudulently induce employees or customers into disclosing

sensitive information such as user names, passwords or other

information to gain access to our customers’ data, our data

or our IT systems.

We

take extraordinary measures to ensure identity authentication of

users who access critical IT infrastructure, including but not

limited to, two-factor, multi-factor and biometric identity

verification. This substantially reduces the threat of unauthorized

access by bad actors using compromised user

credentials.

Because

the techniques used to breach, obtain unauthorized access to, or

sabotage IT systems change frequently, grow more complex over time,

and generally are not recognized until launched against a target,

we may be unable to anticipate or implement adequate measures to

prevent against such techniques.

Our

services operate in conjunction with and are dependent on products

and components across a broad ecosystem and, as illustrated by the

recent Spectre and Meltdown threats, if there are security

vulnerabilities in one of these components, a security breach could

occur. In addition, our internal IT systems continue to evolve and

we are often early adapters of new technologies and new ways of

sharing data and communicating internally and with partners and

customers, which increases the complexity of our IT systems. These

risks are mitigated by our ability to maintain and improve business

and data governance policies and processes and internal security

controls, including our ability to escalate and respond to known

and potential risks.

In

addition, our customers may authorize third-party technology

providers to access their customer data, and some of our customers

may not have adequate security measures in place to protect their

data that is stored on our servers. Because we do not control our

customers or third-party technology providers, or the processing of

such data by third-party technology providers, we cannot ensure the

integrity or security of such transmissions or processing.

Malicious third parties may also conduct attacks designed to

temporarily deny customers access to our services.

A

security breach could expose us to a risk of loss or inappropriate

use of proprietary and sensitive data, or the denial of access to

this data. A security breach could also result in a loss of

confidence in the security of our services, damage our reputation,

negatively impact our future sales, disrupt our business and lead

to legal liability. Finally, the detection, prevention and

remediation of known or potential security vulnerabilities,

including those arising from third-party hardware or software may

result in additional direct and indirect costs, for example

additional infrastructure capacity to mitigate any system

degradation that could result from remediation

efforts.

We operate in

foreign countries and are exposed to risks associated with foreign

political, economic and legal environments and with foreign

currency exchange rates

.

We

have significant foreign operations. As a result, we are exposed to

risks, including among others, risks associated with foreign

political, economic and legal environments and with foreign

currency exchange rates. Our results may be adversely affected by,

among other things, changes in government policies with respect to

laws and regulations, anti-inflation measures, currency

conversions, collection of receivables abroad and rates and methods

of taxation.

We depend on key personnel, the loss of any of whom could

materially adversely affect future operations

.

Our

success will depend to a significant extent upon the efforts and

abilities of our executive officers and other key personnel. The

loss of the services of one or more of these key employees and any

negative market or industry perception arising from the loss of

such services could have a material adverse effect on us and the

trading price of our Common Stock. Our business will also be

dependent upon our ability to attract and retain qualified

personnel. Acquiring and keeping these personnel could prove more

difficult or cost substantially more than estimated and we cannot

be certain that we will be able to retain such personnel or attract

a high caliber of personnel in the future.

We may have additional tax liabilities

.

We are subject to income taxes in the United

States. Significant judgments are required in determining our

provisions for income taxes. In the course of preparing our tax

provisions and returns, we must make calculations where the

ultimate tax determination may be uncertain. Our tax returns are

subject to examination by the Internal Revenue Service

(“

IRS

”) and state tax authorities. There

can be no assurance as to the outcome of these examinations. If the

ultimate determination of taxes owed is for an amount in excess of

amounts previously accrued, our operating results, cash flows, and

financial condition could be adversely

affected.

We face competition from companies with greater financial,

technical, sales, marketing and other resources, and, if we are

unable to compete effectively with these competitors, our market

share may decline and our business could be

harmed

.

We

face competition from other established companies. A number of our

competitors have longer operating histories, larger customer bases,

significantly greater financial, technological, sales, marketing

and other resources than we do. As a result, our competitors

may be able to respond more quickly than we can to new or changing

opportunities, technologies, standards or client requirements, more

quickly develop new products or devote greater resources to the

promotion and sale of their products and services than we

can. Likewise, their greater capabilities in these areas may

enable them to better withstand periodic downturns in the identity

management solutions industry and compete more effectively on the

basis of price and production. In addition, new companies may

enter the markets in which we compete, further increasing

competition in the identity management solutions

industry.

We

believe that our ability to compete successfully depends on a

number of factors, including the type and quality of our products

and the strength of our brand names, as well as many factors beyond

our control. We may not be able to compete successfully against

current or future competitors, and increased competition may result

in price reductions, reduced profit margins, loss of market share

and an inability to generate cash flows that are sufficient to

maintain or expand the development and marketing of new products,

any of which would adversely impact our results of operations and

financial condition.

Risks Related to Our Securities

Our Common Stock

is subject to “penny stock” rules

.

Our

Common Stock is currently defined as a “penny stock”

under Rule 3a51-1 promulgated under the Exchange Act. “Penny

stocks” are subject to Rules 15g-2 through 15g-7 and Rule

15g-9, which impose additional sales practice requirements on

broker-dealers that sell penny stocks to persons other than

established customers and institutional accredited investors. Among

other things, for transactions covered by these rules, a

broker-dealer must make a special suitability determination for the

purchaser and have received the purchaser’s written consent

to the transaction prior to sale. Consequently, these rules may

affect the ability of broker-dealers to sell our Common Stock and

affect the ability of holders to sell their shares of our Common

Stock in the secondary market. To the extent our Common Stock is

subject to the penny stock regulations, the market liquidity for

our shares will be adversely affected.

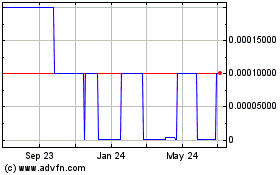

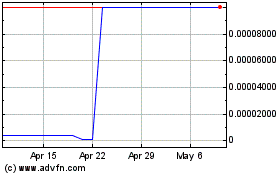

Our stock price

has been volatile, and your investment in our Common Stock could

suffer a decline in value

.

There

has been significant volatility in the market price and trading

volume of equity securities, which is unrelated to the financial

performance of the companies issuing the securities. These broad

market fluctuations may negatively affect the market price of our

Common Stock. You may not be able to resell your shares at or above

the price you pay for those shares due to fluctuations in the

market price of our Common Stock caused by changes in our operating

performance or prospects and other factors.

Some

specific factors that may have a significant effect on our Common

Stock market price include:

●

actual

or anticipated fluctuations in our operating results or future

prospects;

●

our

announcements or our competitors’ announcements of new

products;

●

the

public’s reaction to our press releases, our other public

announcements and our filings with the SEC;

●

strategic

actions by us or our competitors, such as acquisitions or

restructurings;

●

new

laws or regulations or new interpretations of existing laws or

regulations applicable to our business;

●

changes

in accounting standards, policies, guidance, interpretations or

principles;

●

changes

in our growth rates or our competitors’ growth

rates;

●

developments

regarding our patents or proprietary rights or those of our

competitors;

●

our

inability to raise additional capital as needed;

●

substantial

sales of Common Stock underlying warrants and preferred

stock;

●

concern

as to the efficacy of our products;

●

changes

in financial markets or general economic conditions;

●

sales

of Common Stock by us or members of our management team;

and

●

changes

in stock market analyst recommendations or earnings estimates

regarding our Common Stock, other comparable companies or our

industry generally.

Our future sales

of our Common Stock could adversely affect its price and our future

capital-raising activities could involve the issuance of equity

securities, which would dilute shareholders’ investments and

could result in a decline in the trading price of our Common

Stock

.

We

may sell securities in the public or private equity markets if and

when conditions are favorable, even if we do not have an immediate

need for additional capital at that time. Sales of substantial

amounts of our Common Stock, or the perception that such sales

could occur, could adversely affect the prevailing market price of

our Common Stock and our ability to raise capital. We may issue

additional Common Stock in future financing transactions or as

incentive compensation for our executive management and other key

personnel, consultants and advisors. Issuing any equity securities

would be dilutive to the equity interests represented by our

then-outstanding shares of Common Stock. The market price for our

Common Stock could decrease as the market takes into account the

dilutive effect of any of these issuances. Furthermore, we may

enter into financing transactions at prices that represent a

substantial discount to the market price of our Common Stock. A

negative reaction by investors and securities analysts to any

discounted sale of our equity securities could result in a decline

in the trading price of our Common Stock.

The holders of our

preferred stock have certain rights and privileges that are senior

to our Common Stock, and we may issue additional shares of

preferred stock without stockholder approval that could have a

material adverse effect on the market value of the Common

Stock

.

Our Board of Directors has the authority to issue

a total of up to four million shares of preferred stock and to fix

the rights, preferences, privileges, and restrictions, including

voting rights, of the preferred stock, which typically are senior

to the rights of the Common Stock, without any further vote or

action by the holders of our Common Stock. The rights of the

holders of our Common Stock will be subject to, and may be

adversely affected by, the rights of the holders of the preferred

stock that have been issued, or might be issued in the future.

Preferred stock also could have the effect of making it more

difficult for a third party to acquire a majority of our

outstanding voting stock. This could delay, defer, or prevent a

change in control. Furthermore, holders of preferred stock may have

other rights, including economic rights, senior to the Common

Stock. As a result, their existence and issuance could have a

material adverse effect on the market value of the Common Stock. We

have in the past issued, and may from time to time in the future

issue, preferred stock for financing or other purposes with rights,

preferences, or privileges senior to the Common Stock. As of

October 4, 2018 we had three series of preferred stock outstanding,

Series A Convertible Preferred Stock (“

Series A

Preferred

”), Series B

Convertible Preferred Stock (“

Series B

Preferred

”) and Series C

Convertible Preferred Stock (“

Series C

Preferred

”).

The

provisions of our Series A Preferred prohibit the payment of

dividends on our Common Stock unless the dividends on our preferred

shares are first paid. In addition, upon a liquidation, dissolution

or sale of our business, the holders of our Series A Preferred will

be entitled to receive, in preference to any distribution to the

holders of Common Stock, initial distributions of $1,000 per share,

plus all accrued but unpaid dividends. As of June 30, 2018 and

December 31, 2017, we had cumulative undeclared dividends on our

Series A Preferred of $0.

The

provisions of our Series B Preferred prohibit the payment of

dividends on our Common Stock unless the dividends on our preferred

shares are first paid. In addition, upon a liquidation, dissolution

or sale of our business, the holders of our Series B Preferred will

be entitled to receive, in preference to any distribution to the

holders of Common Stock, initial distributions of $2.50 per share,

plus all accrued but unpaid dividends. As of June 30, 2018 and

December 31, 2017, we had cumulative undeclared dividends on our

Series B Preferred of approximately $8,000.

The

provisions of our Series C Preferred prohibit the payment of

dividends on our Common Stock unless the dividends on our preferred

shares are first paid. In addition, upon a liquidation, dissolution

or sale of our business, the holders of our Series C Preferred will

be entitled to receive, in preference to any distribution to the

holders of Common Stock, initial distributions of $10,000 per

share, plus all accrued but unpaid dividends. As of June 30, 2018

and December 31, 2017, there were no shares of Series C Preferred

outstanding; therefore, there were no cumulative undeclared

dividends on our Series C Preferred as of such dates.

Certain

large shareholders may have certain personal interests that may

affect the Company.

As a result of the securities issued to Goldman

Capital Management and related entities controlled by Neal Goldman,

a member of our Board of Directors (together,

“

Goldman

”), Goldman beneficially owns, in the

aggregate, approximately 39.9% of the Company’s outstanding

voting securities as of October 4, 2018. As a result,

Goldman has the potential ability to exert influence over both the

actions of the Board of Directors and the outcome of issues

requiring approval by the Company’s shareholders. This

concentration of ownership may have effects such as delaying or

preventing a change in control of the Company that may be favored

by other shareholders or preventing transactions in which

shareholders might otherwise recover a premium for their shares

over current market prices.

Our corporate

documents and Delaware law contain provisions that could

discourage, delay or prevent a change in control of the

Company

.

Provisions

in our certificate of incorporation and bylaws may discourage,

delay or prevent a merger or acquisition involving us that our

stockholders may consider favorable. For example, our certificate

of incorporation authorizes preferred stock, which carries special

rights, including voting and dividend rights. With these rights,

preferred stockholders could make it more difficult for a third

party to acquire us.

We

are also subject to the anti-takeover provisions of Section 203 of

the Delaware General Corporation Law. Under these provisions, if

anyone becomes an “interested stockholder,” we may not

enter into a “business combination” with that person

for three years without special approval, which could discourage a

third party from making a takeover offer and could delay or prevent

a change of control. For purposes of Section 203, “interested

stockholder” means, generally, someone owning 15% or more of

our outstanding voting stock or an affiliate of ours that owned 15%

or more of our outstanding voting stock during the past three

years, subject to certain exceptions as described in Section

203.

We do not expect

to pay cash dividends on our Common Stock for the foreseeable

future

.

We

have never paid cash dividends on our Common Stock and do not

anticipate that any cash dividends will be paid on the Common Stock

for the foreseeable future. The payment of any cash dividend by us

will be at the discretion of our Board of Directors and will depend

on, among other things, our earnings, capital, regulatory

requirements and financial condition. Furthermore, the terms of our

Series A Preferred, Series B Preferred and Series C Preferred

directly limit our ability to pay cash dividends on our Common

Stock.

C

AUTIONARY NOTES REGA

RDING FORWARD-LOOKING

STATEMENTS

This

prospectus contains forward-looking statements that involve

substantial risks and uncertainties. All statements contained in

this prospectus other than statements of historical facts,

including statements regarding our strategy, future operations,

future financial position, future revenue, projected costs,

prospects, plans, objectives of management and expected market

growth, are forward-looking statements. These statements involve

known and unknown risks, uncertainties and other important factors

that may cause our actual results, performance or achievements to

be materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements.

The

words “anticipate,” “believe,”

“estimate,” “expect,” “intend,”

“may,” “plan,” “predict,”

“project,” “target,”

“potential,” “will,” “would,”

“could,” “should,” “continue,”

and similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain

these identifying words. These forward-looking statements include,

among other things, statements about:

●

the

availability of capital to satisfy our working capital

requirements;

●

the

accuracy of our estimates regarding expenses, future revenues and

capital requirements;

●

anticipated

trends and challenges in our business and the markets in which we

operate;

●

our

ability to anticipate market needs or develop new or enhanced

products to meet those needs;

●

our

expectations regarding market acceptance of our

products;

●

the

success of competing products by others that are or become

available in the market in which we sell our products;

●

our

ability to protect our confidential information and intellectual

property rights;

●

our

ability to manage expansion into international

markets;

●

our

ability to maintain or broaden our business relationships and

develop new relationships with strategic alliances, suppliers,

customers, distributors or otherwise;

●

developments

in the U.S. and foreign countries; and

●

other risks and uncertainties, including

those

described under

“

Risk

Factors

” and elsewhere

in this prospectus

.

These

forward-looking statements are only predictions and we may not

actually achieve the plans, intentions or expectations disclosed in

our forward-looking statements, so you should not place undue

reliance on our forward-looking statements. Actual results or

events could differ materially from the plans, intentions and

expectations disclosed in the forward-looking statements we make.

We have based these forward-looking statements largely on our

current expectations and projections about future events and trends

that we believe may affect our business, financial condition and

operating results. We have included important factors in the

cautionary statements included in this prospectus, as well as

certain information incorporated by reference into this prospectus,

that could cause actual future results or events to differ

materially from the forward-looking statements that we make. Our

forward-looking statements do not reflect the potential impact of

any future acquisitions, mergers, dispositions, joint ventures or

investments we may make.

You

should read this prospectus with the understanding that our actual

future results may be materially different from what we expect. We

do not assume any obligation to update any forward-looking

statements whether as a result of new information, future events or

otherwise, except as required by applicable law.

S

ELECTED CONSOLIDATED FINANCIAL

DATA

The

summary consolidated statement of operations and balance sheet data

for the years ended and as of December 31, 2017 and December 31,

2016 presented below are derived from our audited consolidated

financial statements included elsewhere in this prospectus. The

selected consolidated statement of operations data for the six

months ended June 30, 2018 and June 30, 2017 and the selected

consolidated balance sheet data as of June 30, 2018 have been

derived from our unaudited consolidated interim financial

information included elsewhere in this prospectus, which, in the

opinion of our management, includes all adjustments necessary to

present fairly our results of operations and financial condition at

the dates and for the periods presented. The results for the six

months ended June 30, 2018 are not necessarily indicative of the

results that you should expect for the entire year ending December

31, 2018, or any other period.

This

financial information should be read in conjunction with

“

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

” and our consolidated financial statements,

including the notes thereto, included elsewhere in this

prospectus.

Statements

of Operations Data:

(dollars in thousands, except for per share data

figures)

|

|

Six Months Ended

June 30,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue:

|

|

|

|

|

|

Product

|

$

1,279

|

$

680

|

$

1,614

|

$

1,249

|

|

Maintenance

|

1,322

|

1,309

|

2,679

|

2,563

|

|

|

2,601

|

1,989

|

4,293

|

3,812

|

|

Cost of revenue:

|

|

|

|

|

|

Product

|

165

|

90

|

152

|

243

|

|

Maintenance

|

390

|

423

|

839

|

827

|

|

Gross

profit

|

2,046

|

1,476

|

3,302

|

2,742

|

|

|

|

|

|

|

|

Operating expense:

|

|

|

|

|

|

General

and administrative

|

2,190

|

1,934

|

4,192

|

3,722

|

|

Sales

and marketing

|

1,680

|

1,463

|

2,816

|

3,021

|

|

Research

and development

|

3,664

|

3,096

|

5,953

|

5,332

|

|

Depreciation

and amortization

|

24

|

38

|

68

|

129

|

|

|

7,558

|

6,531

|

13,029

|

12,204

|

|

Loss

from operations

|

(5,512

)

|

(5,055

)

|

(9,727

)

|

(9,462

)

|

|

|

|

|

|

|

|

Interest

expense, net

|

356

|

264

|

591

|

245

|

|

Other

income, net

|

—

|

(50

)

|

(125

)

|

(201

)

|

|