President said the 'Fed has gone crazy,' complaining about its

policy on interest rates

By Corrie Driebusch

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 11, 2018).

The Dow industrials extended their steepest October retreat

since the financial crisis Wednesday, posting an 832-point decline

that raises fresh concern about the health of the nine-year-old

bull market for stocks.

The selling was led by the technology shares that have fueled

much of the 2018 advance in U.S. stocks, with Netflix Inc. dropping

8.4%, Amazon.com Inc. declining 6.2% and Apple Inc. off 4.6%.

Combined the three companies shed nearly $120 billion in market

value on Wednesday.

Selling accelerated toward the end of the day and losses spread

well beyond tech stocks; bank stocks were pummeled along with

companies exposed to global trade such as Caterpillar Inc.

Investors turned to shares deemed likely to do better in tougher

economic times, such as utilities companies. That rotation out of

tech and other growth stocks has been sparked in part by the recent

jump in government bond yields and the Federal Reserve's interest

rate increases.

When asked about Wednesday's market decline, President Trump

said "the Fed has gone crazy."

The Fed's more-restrictive stance has joined with other signals

to unsettle investors even as major U.S. indexes rose to new highs.

The market's worries aren't all aligned -- some investors are

worried a strong economy will lead the Fed to rate increases that

hurt stocks, while others on Wednesday pointed to recent indicators

in housing and autos that suggested the economy is losing steam. A

shared concern, however, is that trade tensions between the U.S.

and China appear to be worsening and that a slowdown in the Chinese

economy could spill over into global markets.

Chinese authorities have stepped up their efforts to keep money

flowing in the world's second-largest economy amid concerns about

the ramifications of a yearslong increase in Chinese debt

issuance.

The result: A simultaneous selling of 2018's biggest

stock-market winners in the U.S.

Heading into the fourth quarter, investors were piling into many

of the same trades, particularly in large U.S. tech stocks, said

Andrew Slimmon, senior portfolio manager with Morgan Stanley

Investment Management. "If everyone is on one side of the boat and

they suddenly realize this, everyone would scramble."

The shift has come as the yield on the benchmark U.S. Treasury

note has risen to seven-year highs. It settled at 3.221% Wednesday,

up from 3.055% at the end of September.

The S&P 500 tumbled 3.3% Wednesday, its fifth consecutive

session of declines and longest losing streak in nearly two years.

The Dow Jones Industrial Average dropped 3.1% to 25599, falling

4.6% from its all-time high notched Oct. 3. Both indexes registered

their biggest losses on a percentage basis since Feb. 8.

All sectors in the S&P 500 slumped Wednesday, with

technology stocks down nearly 5%. Other growth sectors including

consumer-discretionary and communications shares posted big

declines as well. The tech-heavy Nasdaq Composite dropped 4.1%,

extending its declines for the month to 7.8%. The index is

suffering its worst start to a fourth quarter since 2008, when it

fell 21%.

Traders and portfolio managers said trading during Wednesday's

declines was largely orderly and that phones weren't ringing off

the hook with upset clients. Even so, some on trading floors were

struggling to reconcile the strong financial results of large tech

firms with the day's heavy selling.

"It really doesn't make any sense to me that some of these

stocks are getting beaten up as much as they are," said Mark

Stoeckle, chief executive of Adams Funds.

Some Vanguard customers had problems logging on to their

accounts online and by phone, and some took to Twitter to complain

about the technical issues.

"Vanguard today experienced periodic network connectivity

issues," a spokeswoman said in a statement, adding the technical

issues weren't a result of more customers trying to log on.

Possibly exacerbating the decline for tech stocks is the absence

of one of their biggest buyers: the companies themselves. In the

weeks leading up to reporting their corporate results, companies

typically don't repurchase their own shares due to regulations.

Analysts have said record stock buybacks have underpinned the stock

market's recent gains, and some traders said the elimination of

this support could be worsening the selloff.

Investors' bet on tech companies with strong earnings growth has

been a crowded one in 2018, according to Ann Larson, managing

director of global quantitative research at AllianceBernstein. Her

firm identifies crowded trades by looking at the top positions of

active managers, which stakes they have been building over the past

several quarters, and which names have a high proportion of "buy"

ratings from bank analysts who cover the companies. The model also

considers how well an investment has done compared with the rest of

the market.

On Wednesday, just 17 stocks in the S&P 500 rose, or about

3% of the broad index. Some of the buying centered on

consumer-staple companies, which investors tend to favor for their

durability during tough economic conditions and the generous

dividends they pay. General Mills Inc. and J.M. Smucker Co. both

added 1.5%, Wednesday, while Campbell Soup Co. rose 0.5%, leaving

consumer-staple stocks in the S&P 500 off 1.3% for the day.

Utilities, which also generate hefty dividends, fell only 0.5%,

the least of all other S&P 500 sectors.

For most of 2018, the bets on tech and growth stocks served

investors well. Even with the recent drawdowns, Amazon shares are

up 50% so far this year, while Netflix has risen roughly 70% and

Apple is up nearly 30%. Of the so-called FAANG group of big U.S.

tech names, only Facebook Inc. shares are down for the year.

"Crowded trades are popular for a reason. They're good stocks.

There's just risk attached to them," said Ms. Larson.

The risks have borne out in the past when other popular trades

have unraveled. Bets against volatility fed the stock market's

tumble in February after the implosion of a number of

exchange-traded products that had risen in value when gauges of

volatility declined. Similarly, bitcoin investments tumbled at the

beginning of the year on doubts about the practical utility of

cryptocurrencies. And stocks with high dividends sold off following

the 2016 presidential election as investors bet big on growth

stocks.

This time around, some investors say such a pullback -- so long

as it's not prolonged -- is a good thing after tech's seemingly

unceasing climb higher for so many months.

"As much as it's painful short term, it's actually really

healthy longer term that they're pulling back," said Mr. Slimmon,

who added that after a reset in these momentum stocks, he could see

these company shares rising again into the end of the year.

Write to Corrie Driebusch at corrie.driebusch@wsj.com

(END) Dow Jones Newswires

October 11, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

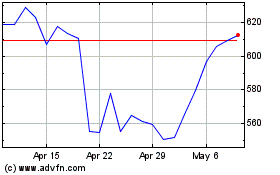

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

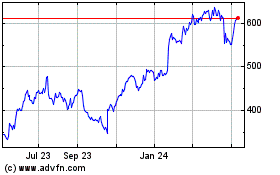

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Apr 2023 to Apr 2024