Quickening Retreat From Tech Sinks Market

October 10 2018 - 4:40PM

Dow Jones News

By Corrie Driebusch

U.S. stocks suffered their biggest decline in more than seven

months Wednesday, as investors accelerated their retreat from

fast-growing technology stocks in favor of shares that have been

overlooked.

Major indexes have started the fourth quarter on their weakest

footing since the beginning of 2016, and the swift fall has some

investors wondering if this is a brief stumble or an overdue

reckoning for U.S. stocks after months of outperforming global

markets.

The rotation out of tech and other growth stocks -- among the

most popular trades of the year -- to so-called safety stocks, such

as utilities companies, was sparked in part by the recent jump in

government bond yields and the Federal Reserve's bid to tighten

monetary policy.

But there have been other warnings signals that made investors

nervous. Recent data has showed a slowdown in both housing and auto

sales, both of which are closely watched indicators of U.S.

economic health. Even more concerning: trade tensions between the

U.S. and China appear to be worsening.

The result: A simultaneous selling of 2018's biggest

stock-market winners.

Heading into the fourth quarter, there was a lot of common

positioning, particularly in large U.S. tech stocks, said Andrew

Slimmon, senior portfolio manager with Morgan Stanley Investment

Management. "If everyone is on one side of the boat and they

suddenly realize this, everyone would scramble."

The S&P 500 tumbled 3.3% Wednesday afternoon, its fifth

consecutive session of declines and longest losing streak in nearly

two years. The Dow Jones Industrial Average dropped 827 points, or

3.1%, at 25604, falling 4.4% since notching its all-time high a

week ago. Both indexes registered their biggest loss on a

percentage basis since Feb. 8.

All 11 sectors in the S&P 500 slumped Wednesday, with

technology stocks down more than 3%. Other growth sectors including

consumer-discretionary and communications shares posted big

declines as well. The tech-heavy Nasdaq Composite dropped 2.5%,

extending its declines for the month to 6.3%. The index is

suffering its worst start to a fourth quarter since 2008 when it

fell 21%.

The recent selloff has sent highflying consumer tech companies

like Netflix Inc. and Amazon.com Inc. down more than 10% since the

start of the fourth quarter, and Google parent Alphabet Inc. down

more than 5%. It's not just big-name tech companies; smaller

companies have also struggled, with semiconductor companies, as

measured by the PHLX Semiconductor index, down 2.9% on

Wednesday.

As those stocks have stumbled, investors have rushed into

utilities stocks, which are generally considered safer in a

volatile environment. Those shares rose 0.5% in the S&P 500

Wednesday, bringing their gains for the month to 3.6%.

Investors' bet on tech companies with strong earnings growth has

been a crowded one in 2018, according to Ann Larson, managing

director of quantitative research at AllianceBernstein. Her firm

identifies crowded trades by looking at the top positions of active

managers, which stakes they have been building over the past

several quarters, and which names have a high proportion of "buy"

ratings from bank analysts who cover the companies. The model also

considers how well an investment has done compared with the rest of

the market.

In the third quarter, Facebook Inc., Amazon, Microsoft Corp. and

Alphabet were among the stocks that most frequently appeared in the

largest 10 holdings of hedge funds, according to Goldman Sachs. By

another measure of concentration, global fund managers have

identified bets on the FAANG-BAT trade of Facebook, Amazon, Apple

Inc., Netflix and Alphabet as well as Chinese firms Baidu Inc.,

Alibaba Group Holding Ltd. and Tencent Holdings Ltd. as the most

crowded trade identified by investors for eight straight months,

according to a September survey by Bank of America Merrill

Lynch.

For most of 2018, these bets served investors well. Even with

the recent drawdowns, Amazon shares are up more than 50% so far

this year, while Netflix has risen roughly 75% and Apple is up more

than 30%. Of the FAANG group, only Facebook shares are down for the

year.

"Crowded trades are popular for a reason. They're good stocks.

There's just risk attached to them," said Ms. Larson.

The risks have borne out in the past when other popular trades

have unraveled. Bets against volatility fed the stock market's

tumble in February after the implosion of a number of

exchange-traded products that had risen in value when gauges of

volatility declined. Similarly, bitcoin investments tumbled at the

beginning of the year on doubts about the practical utility of

cryptocurrencies. And stocks with high dividends sold off following

the 2016 presidential election as investors bet big on growth

stocks.

This time around, some investors say such a pullback -- so long

as it's not prolonged -- is a good thing after tech's seemingly

unceasing climb higher for so many months.

"As much as it's painful short term, it's actually really

healthy longer term that they're pulling back," said Mr. Slimmon,

who added that after a reset in these momentum stocks, he could see

these company shares rising again into the end of the year.

Write to Corrie Driebusch at corrie.driebusch@wsj.com

(END) Dow Jones Newswires

October 10, 2018 16:25 ET (20:25 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

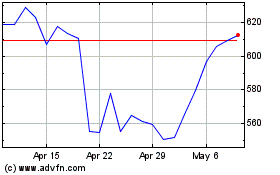

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

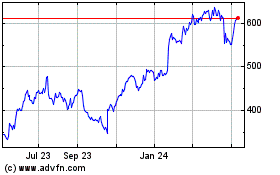

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Apr 2023 to Apr 2024