SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c) of the Securities

Exchange Act of 1934

Check the appropriate box:

[ ] Preliminary Information Statement

[ ] Confidential, For Use of the Commission only (as permitted by

Rule 14c-5(d)(2))

[X] Definitive Information Statement

NATURALSHRIMP INCORPORATED

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

[X] No Fee Required

[ ] Fee computed on table below per Exchange Act Rules 14c-5(g) and

0-11.

(1) Title of each class of securities to which transaction

applies:

(2) Aggregate number of securities to which transaction

applies:

(3) Per unit price or other underlying value of transaction

computed pursuant to Exchange Act Rule 0-11 (set forth the amount

on which the filing fee is calculated and state how it was

determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

[_] Fee paid previously with preliminary materials:

[_] Check box if any part of the fee is offset as provided by

Exchange Act Rule 0-11(a)(2) and identify the filing for which the

offsetting fee was paid previously. Identify the previous filing by

registration statement number, or the form or schedule and the date

of its filing.

(1) Amount previously paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing party:

(4) Date filed:

SCHEDULE 14C INFORMATION STATEMENT

(Pursuant to Regulation 14C of the Securities Exchange

Act

of 1934 as amended)

NATURALSHRIMP INCORPORATED

5080

Spectrum Drive, Suite 1000

Addison,

TX 75001

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

This Information Statement is furnished by the Board of Directors

of NaturalShrimp Incorporated, a Nevada corporation, to the holders

of record at the close of business on the record date, October 8,

2018 (the “Record Date”), of the Company's outstanding

common stock, $0.0001 par value per share (the “Common

Stock”), pursuant to Rule 14c-2 promulgated under the

Securities Exchange Act of 1934, as amended. Except as otherwise

indicated by the context, references in this information statement

to “Company,” “we,” “us,” or

“our” are references to NaturalShrimp

Incorporated.

This Information Statement is being furnished to such stockholders

for the purpose of informing the stockholders that the Board of

Directors and the majority shareholder of the Company have approved

a corporate action. The corporate action was approved by written

consent of NaturalShrimp Holdings, Inc. (“NSH”), which

is controlled by the Company’s CEO (Bill G. Williams) and

President (Gerald Easterling), and is the owner of 5,000,000 shares

of the Series A Preferred Stock constituting 76.52% of our

outstanding common and preferred stock voting power on the Record

Date.

The Board of Directors and the majority shareholder of the Company

have approved an amendment to our Articles of Incorporation to

increase our authorized common shares to 900,000,000 from the

current 300,000,000. The par value of the common shares will not be

changed.

The Company will, when permissible following the expiration of the

appropriate periods mandated by Rule 14c and the provisions of the

Nevada Revised Statutes, file Articles of Amendment to amend our

Articles of Incorporation (the “Articles of Amendment”)

increasing our authorized shares.

The proposed Articles of Amendment will become effective when it is

filed with the Nevada Secretary of State. We anticipate that such

filing will occur no earlier than twenty (20) days after this

Information Statement is first mailed to shareholders.

The entire cost of furnishing this Information Statement will be

borne by the Company. We will request brokerage houses, nominees,

custodians, fiduciaries and other like parties to forward this

Information Statement to the beneficial owners of the Common Stock

held of record by them.

The Board of Directors has fixed the close of business on October

8, 2018 as the record date for the determination of shareholders

who are entitled to receive this Information Statement. There were

92,056,880 shares of common stock issued and outstanding on October

8, 2018. We anticipate that this Information Statement will be

mailed on or about October 10, 2018 to all shareholders of record

as of the Record Date.

Only one Information Statement is being delivered to two or more

security holders who share an address unless we have received

contrary instruction from one or more of the security holders. We

will promptly deliver upon written or oral request a separate copy

of the Information Statement to a security holder at a shared

address to which a single copy of the document was delivered. If

you would like to request additional copies of the Information

Statement, or if in the future you would like to receive multiple

copies of information or proxy statements, or annual reports, or,

if you are currently receiving multiple copies of these documents

and would, in the future, like to receive only a single copy,

please so instruct us by writing to the corporate secretary at the

Company’s executive offices at the address specified

above.

PLEASE NOTE THAT THIS IS NOT A REQUEST FOR YOUR VOTE OR A PROXY

STATEMENT, BUT RATHER AN INFORMATION STATEMENT DESIGNED TO INFORM

YOU OF THE AMENDMENTS TO OUR ARTICLES OF

INCORPORATION.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND

US A PROXY.

DESCRIPTION OF THE COMPANY’S CAPITAL STOCK

The

following is a description of the material provisions of our

capital stock. The following description is intended to be a

summary and does not describe all of the provisions of our articles

of incorporation or bylaws or Nevada law applicable to

us

General

As of

October 8, 2018, the Company’s authorized capital stock

consisted of 300,000,000 shares of Common Stock, par value $0.0001

per share, and 200,000,000 authorized shares of Preferred Stock,

par value $0.0001 per share, with 5,000,000 of the Preferred Stock

being designated as Series A Preferred Stock. As of October 8,

2018, 92,056,880 shares of Common Stock were issued and outstanding

and 5,000,000 shares of Series A Preferred Stock were issued and

outstanding.

Common Stock

The

holders of Common Stock are entitled to one vote for each share

held. The affirmative vote of a majority of votes cast at a meeting

which commences with a lawful quorum is sufficient for approval of

most matters upon which shareholders may or must vote, including

the questions presented for approval or ratification at an annual

meeting of shareholders. However, amendment of the articles of

incorporation require the affirmative vote of a majority of the

total voting power for approval. Common shares do not carry

cumulative voting rights, and holders of more than 50% of the

Common Stock voting power have the power to elect all directors

and, as a practical matter, to control the company. Holders of

Common Stock are not entitled to preemptive rights.

Series A Preferred Stock

The Series A Preferred Stock is not entitled to dividends, but

carries liquidation rights upon the dissolution, liquidation or

winding up of the Company, whether voluntary or involuntary, at

which time the holders of the Series A Preferred Stock shall

receive the sum of $0.001 per share before any payment or

distribution shall be made on the Company’s common stock, or

any class ranking junior to the Series A Preferred Stock. The

shares of Series A Preferred Stock shall vote together as a single

class with the holders of the Company’s common stock for all

matters submitted to the holders of common stock, including the

election of directors, and shall carry voting rights of 60 common

shares for every share of Series A Preferred Stock. Any time after

the two year anniversary of the initial issuance date of the Series

A Preferred Stock, the Series A Preferred Stock shall be

convertible at the written consent of a majority of the outstanding

shares of Series A Preferred Stock, in an amount of shares of

common stock equal to 100% of the then outstanding shares of common

stock at the time of such conversion.

Quorum

The

presence, in person or by proxy, of holders of at least a majority

of the issued and outstanding shares entitled to vote at a meeting

of stockholders shall constitute a quorum for the transaction of

business.

Stock Transfer Agent

The stock transfer agent for our securities is Island Stock

Transfer of Clearwater, Florida. Their address is 15500 Roosevelt

Boulevard, Suite 301, Clearwater, FL 33760. Their phone number is

(727) 289-0010.

Our Common Stock is quoted under the symbol

“SHMP.”

MANAGEMENT

Set

forth below are the names of the directors and officer of the

Company, all positions and offices with the Company held, the

period during which they have served as such, and the business

experience during at least the last five years:

|

Name

|

|

Age

|

|

Positions and

Offices Held

|

|

Bill G.

Williams

|

|

84

|

|

Chairman

of the Board, CEO

|

|

Gerald

Easterling

|

|

70

|

|

President,

Secretary, Director

|

|

William

Delgado

|

|

59

|

|

Treasurer,

CFO, Director

|

Bill G. Williams – Co-Founder, Chairman of the Board and

Chief Executive Officer

Mr. Williams has served as Chairman of the Board and CEO of NSH

since its inception in 2001. From 1997 to 2003, he was Chairman and

CEO of Direct Wireless Communications, Inc. and its successor

Health Discovery Corporation, a public company listed on the OTCBB

exchange. From 1990 to 1997, Mr. Williams was Chairman and CEO of

Cafe Quick Enterprises, which uses a unique, patented air

impingement technology to cook fresh and frozen food in vending

machines. From 1985 to 1990, Mr. Williams was Chairman and CEO of

Ameritron Corporation, a multi-business holding company. Mr.

Williams has also served a member of the board of directors of

NaturalShrimp Corporation and NaturalShrimp Global, Inc. since

2001.

Gerald Easterling – Co-Founder, President and

Director

Mr. Easterling has served as President and a director of NSH since

its inception in 2001. Mr. Easterling has experience in the food

business and related industries. In the five years prior to the

formation of NSH, Mr. Easterling was Chairman of the Board of Excel

Vending Companies. He also was President and Director of Cafe Quick

Enterprises and has been a member of the board since 1988. Mr.

Easterling has also served a member of the board of directors of

NaturalShrimp Corporation and NaturalShrimp Global, Inc. since

2001.

William J. Delgado – Treasurer, Chief Financial Officer

(former President of Multiplayer Online Dragon, Inc.) and

Director

Mr. Delgado has served as Director of the Company since May 19,

2014. Since August 2004, Mr. Delgado has served as a Director,

President, Chief Executive Officer and Chief Financial Officer of

Global Digital Solutions, Inc. (“GDSI”), a publicly

traded company that provides cyber arms manufacturing,

complementary security and technology solutions and

knowledge-based, cyber-related, culturally attuned social

consulting in unsettled areas. Effective August 12, 2013, Mr.

Delgado assumed the position of Executive Vice President of GDSI.

He began his career with Pacific Telephone in the Outside Plant

Construction. He moved to the network engineering group and

concluded his career at Pacific Bell as the Chief Budget Analyst

for the Northern California region. Mr. Delgado founded All Star

Telecom in late 1991, specializing in OSP construction and

engineering and systems cabling. All Star Telecom was sold to

International FiberCom in April 1999. After leaving International

FiberCom in 2002, Mr. Delgado became President/CEO of Pacific

Comtel in San Diego, California, which was acquired by GDSI in

2004. Mr. Delgado holds a BS with honors in Applied Economics from

the University of San Francisco and Graduate studies in

Telecommunications Management at Southern Methodist

University.

Family Relationships

There

are no family relationships among our directors and executive

officers. No director or executive officer has been a director or

executive officer of any business which has filed a bankruptcy

petition or had a bankruptcy petition filed against it. No director

or executive officer has been convicted of a criminal offense

within the past five years or is the subject of a pending criminal

proceeding. No director or executive officer has been the subject

of any order, judgment or decree of any court permanently or

temporarily enjoining, barring, suspending or otherwise limiting

his involvement in any type of business, securities or banking

activities. No director or officer has been found by a court to

have violated a federal or state securities or commodities

law.

Committees of the Board of Directors

There

are no committees of the Board of Directors.

INTERESTS OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS TO BE

ACTED UPON

Except as disclosed elsewhere in this Information Statement, since

January 1, 2018 being the commencement of the current fiscal year,

none of the following persons has any substantial interest, direct

or indirect, by security holdings or otherwise in any matter to be

acted upon:

1.

any

director or officer of the company;

2.

any

proposed nominee for election as a director of the company;

and

3.

any

associate or affiliate of any of the foregoing

persons.

The shareholdings of our directors and officers are listed below in

the section entitled “Principal Shareholders and Security

Ownership of Certain Beneficial Owners and Management

PRINCIPAL SHAREHOLDERS AND SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The

following sets forth the number of shares of our $0.0001 par value

common stock beneficially owned by (i) each person who, as of

October 8, 2018, was known by us to own beneficially more than five

percent (5%) of its common stock; (ii) our individual Officers and

Directors and (iii) our Officers and Directors as a group. A total

of 92,056,880 common shares were issued and outstanding as of

October 8, 2018.

|

Name and Address

of Beneficial Owner

(1)

|

Common Shares

Beneficially

Owned

(2)

|

Percentage of Common

Shares Beneficially

Owned

(2)

|

Series A Preferred

Shares Beneficially

Owned

(5)

|

Percentage of

Series A

Preferred

Shares

Beneficially

Owned

(5)

|

|

Directors

and Executive Officer

s

|

|

Bill G. Williams

(3)(6)

|

520,240

|

(7)

|

5,000,000

|

100%

|

|

Gerald Easterling

(3)(6)

|

520,240

|

(7)

|

5,000,000

|

100%

|

|

William Delgado

(4)

|

6,270,719

|

6.74%

|

0

|

0.00%

|

|

All directors and executive officers as a group (3

persons)

|

6,790,959

|

7.38%

|

5,000,000

|

100%

|

|

5% Stockholders

|

|

-

|

-

|

-

|

-

|

-

|

|

(1)

|

Beneficial

ownership has been determined in accordance with Rule 13d-3 under

the Exchange Act. Pursuant to the rules of the SEC, shares of

common stock which an individual or group has a right to acquire

within 60 days pursuant to the exercise of any option, warrant or

right, or through the conversion of a security, are deemed to be

outstanding for the purpose of computing the percentage ownership

of such individual or group, but are not deemed to be beneficially

owned and outstanding for the purpose of computing the percentage

ownership of any other person shown in the table.

|

|

(2)

|

Based

on 92,056,880 shares of our common stock issued and outstanding as

of October 8, 2018.

See footnote

7.

|

|

(3)

|

Bill G.

Williams is the indirect owner, together with Gerald Easterling, of

520,240 shares of common stock and 5,000,000 shares of Series A

Preferred Stock of the Company, which are directly held by

NaturalShrimp Holdings, Inc. Mr. Williams is the Chairman of the

Board and the Chief Executive Officer of NaturalShrimp Holdings,

Inc. and has shared voting and dispositive power over the shares

held by NaturalShrimp Holdings, Inc. Mr. Easterling is the

President of NaturalShrimp Holdings, Inc. and has shared voting and

dispositive power over the shares held by NaturalShrimp Holdings,

Inc.

|

|

(4)

|

William

Delgado is the indirect owner of 6,270,719 shares of common stock,

which are directly held by Dragon Acquisitions LLC. The shares of

common stock beneficially owned by Dragon Acquisitions LLC, and

indirectly owned by William Delgado, include 600,000 shares of

common stock issuable upon conversion of outstanding convertible

notes held by Dragon Acquisitions LLC. Mr. Delgado is the managing

member of Dragon Acquisitions LLC and has shared voting and

dispositive power over the shares held by Dragon Acquisitions

LLC.

|

|

(5)

|

On August 17, 2018, the Company, pursuant to approval by the

Company’s board of directors, filed a certificate of

designation (the “Certificate of Designation”) with the

state of Nevada in order to designate a class of preferred stock.

The class of preferred stock that was designated is referred to as

Series A Convertible Preferred Stock (the “Series A

Stock”), consists of 5,000,000 shares, and was designated

from the 200,000,000 authorized preferred shares of the Company.

The Series A Stock is not entitled to dividends, but carries

liquidation rights upon the dissolution, liquidation or winding up

of the Company, whether voluntary or involuntary, at which time the

holders of the Series A Stock shall receive the sum of $0.001 per

share before any payment or distribution shall be made on the

Company’s common stock, or any class ranking junior to the

Series A Stock. The shares of Series A Stock shall vote together as

a single class with the holders of the Company’s common stock

for all matters submitted to the holders of common stock, including

the election of directors, and shall carry voting rights of 60

common shares for every share of Series A Stock. Any time after the

two-year anniversary of the initial issuance date of the Series A

Stock, the Series A Stock shall be convertible at the written

consent of a majority of the outstanding shares of Series A Stock,

in an amount of shares of common stock equal to 100% of the then

outstanding shares of common stock at the time of such

conversion.

|

|

(6)

|

On August 21, 2018, the Company entered into a Stock Exchange

Agreement (the “Exchange Agreement”) with NaturalShrimp

Holdings, Inc. (“NaturalShrimp”), the Company’s

majority shareholder, which is controlled by the Company’s

CEO and President. Pursuant to the Exchange Agreement, the Company

and NaturalShrimp exchanged 75,000,000 shares of common stock for

5,000,000 shares of Series A Stock. The 75,000,000 shares of common

stock will be cancelled and returned to the authorized but unissued

shares of common stock of the Company. Bill G. Williams and Gerald

Easterling share voting and dispositive power of the shares

beneficially owned by NaturalShrimp Holdings, Inc.

|

|

(7)

|

*equals less than 1%

|

DESCRIPTION OF CONSENT ACTIONS

ITEM 1:

INCREASE IN THE NUMBER OF AUTHORIZED COMMON

SHARES

Our

current Articles of Incorporation state that the number of

authorized shares of Common Stock is limited to 300,000,000 shares.

As of October 8, 2018, a total of 92,056,880 shares of Common Stock

were issued and outstanding. The purpose of the increase in the

authorized Common Stock is to provide our Company’s

management with certain abilities including, but not limited to,

the issuance of Common Stock to be used for public or private

offerings, conversions of convertible securities, issuance of

options pursuant to employee stock option plans, acquisition

transactions and other general corporate purposes.

Our

Board of Directors and

majority

shareholders

approved the Amendment to increase the number

of authorized shares of Common Stock to 900,000,000

shares.

The

Amendment for the increase in authorized shares will become

effective upon filing of the Amendment promptly following the 20th

day after the mailing of this Information Statement to our

stockholders as of the Record Date.

Distribution and Costs

We will

pay the cost of preparing, printing and distributing this

Information Statement.

Absence of Dissenters’ Rights of Appraisal

Neither

the adoption by the board of directors nor the approval by the

Majority Stockholder of the amendment to our articles of

incorporation provides shareholders any right to dissent and obtain

appraisal of or payment for such shareholder's shares under the

Nevada Revised Statutes, the articles of incorporation or the

bylaws.

Potential Anti-Takeover Effects of Amendment

Release

No. 34-15230 of the staff of the SEC requires disclosure and

discussion of the effects of any stockholder proposal that may be

used as an anti-takeover device. The increase in authorized Common

Stock may make it more difficult or prevent or deter a third party

from acquiring control of our Company or changing our Board and

management, as well as inhibit fluctuations in the market price of

our Company’s shares that could result from actual or rumored

takeover attempts. The proposed increased in our authorized Common

Stock is not the result of any such specific effort, rather, as

indicated below, the purpose of the increase in the authorized

Common Stock is to provide our Company’s management with

certain abilities, and not to construct or enable any anti-takeover

defense or mechanism on behalf of our Company. While it is possible

that management could use the additional shares to resist or

frustrate a third-party transaction providing an above-market

premium that is favored by a majority of the independent

Shareholders, our Company presently has no intent or plan to employ

any additional authorized shares as an anti-takeover

device.

Other

than this proposal, our Board of Directors does not currently

contemplate the adoption of any other amendments to our Articles of

Incorporation that could be construed to affect the ability of

third parties to take over or change the control of the

Company.

Our

Articles of Incorporation and Bylaws contain certain provisions

that may have anti-takeover effects, making it more difficult for

or preventing a third party from acquiring control of the Company

or changing its board of directors and management. According to our

Bylaws and Articles of Incorporation, the holders of the

Company’s common stock do not have cumulative voting rights

in the election of our directors. The combination of the present

ownership by a few stockholders of a significant portion of the

Company’s issued and outstanding common stock and lack of

cumulative voting makes it more difficult for other stockholders to

replace the Company’s board of directors or for a third party

to obtain control of the Company by replacing its board of

directors.

Potential Dilution Effects of Amendment

The increase in our authorized shares could result in dilution to

our current shareholders, if the Company issues additional shares

of common stock. Any dilution to our current shareholders would

result in less voting power than was held by our current

shareholders prior to any issuance of additional common

shares.

INDEBTEDNESS OF EXECUTIVE OFFICERS AND DIRECTORS

No

executive officer, director or any member of these individuals'

immediate families or any corporation or organization with whom any

of these individuals is an affiliate is or has been indebted to us

since the beginning of our last fiscal year.

LEGAL PROCEEDINGS

As of

the date of this Information Statement, there are no material

proceedings against the Company or to which any of our directors,

executive officers, affiliates or stockholders is a party adverse

to us.

EXECUTIVE COMPENSATION AND RELATED MATTERS

Bill G. Williams

On April 1, 2015, the Company entered into an employment agreement

with Bill G. Williams as the Company’s Chief Executive

Officer. The agreement is terminable at will and provides for a

base annual salary of $96,000. In addition, the agreement provides

that the Mr. Williams is entitled, at the sole and absolute

discretion of the Company’s Board of Directors, to receive

performance bonuses. Mr. Williams will also be entitled to certain

benefits including health insurance and monthly allowances for cell

phone and automobile expenses.

The agreement provides that in the event Mr. Williams is terminated

without cause or resigns for good reason (each as defined in the

agreement), Mr. Williams will receive, as severance, his base

salary for a period of 60 months following the date of termination.

In the event of a change of control of the Company, Mr. Williams

may elect to terminate the agreement within 30 days thereafter and

upon such termination would receive a lump sum payment equal to

500% of his base salary. The agreement contains certain restrictive

covenants relating to non-competition, non-solicitation of

customers and non-solicitation of employees for a period of one

year following termination of the agreement.

Gerald Easterling

On April 1, 2015, the Company entered into an employment agreement

with Gerald Easterling as the Company’s President. The

agreement is terminable at will and provides for a base annual

salary of $96,000. In addition, the agreement provides that the Mr.

Easterling is entitled, at the sole and absolute discretion of the

Company’s Board of Directors, to receive performance bonuses.

Mr. Easterling will also be entitled to certain benefits including

health insurance and monthly allowances for cell phone and

automobile expenses.

The agreement provides that in the event Mr. Easterling is

terminated without cause or resigns for good reason (each as

defined in the agreement), Mr. Easterling will receive, as

severance, his base salary for a period of 60 months following the

date of termination. In the event of a change of control of the

Company, Mr. Easterling may elect to terminate the agreement within

30 days thereafter and upon such termination would receive a lump

sum payment equal to 500% of his base salary.

The agreement contains certain restrictive covenants relating to

non-competition, non-solicitation of customers and non-solicitation

of employees for a period of one year following termination of the

agreement.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTION

NaturalShrimp Holdings, Inc.

On November 26, 2014, Multiplayer Online Dragon, Inc., a Nevada

corporation (“MYDR”), entered into an Asset Purchase

Agreement (the “Agreement”) with NaturalShrimp

Holdings, Inc. a Delaware corporation (“NSH”), pursuant

to which MYDR was to acquire substantially all of the assets of NSH

which assets consist primarily of all of the issued and outstanding

shares of capital stock of NaturalShrimp Corporation

(“NSC”), a Delaware corporation, and NaturalShrimp

Global, Inc. (“NS Global”), a Delaware corporation, and

certain real property located outside of San Antonio, Texas (the

“Assets”).

On January 30, 2015, MYDR consummated the acquisition of the Assets

pursuant to the Agreement. In accordance with the terms of the

Agreement, the MYDR issued 75,520,240 shares of its common stock to

NSH as consideration for the Assets. As a result of the

transaction, NSH acquired 88.62% of MYDR’s issued and

outstanding shares of common stock, NSC and NS Global became

MYDR’s wholly-owned subsidiaries, and MYDR changed its

principal business to a global shrimp farming company.

There were no material relationships between the MYDR and NSH or

between the Company’s or NSH’s respective affiliates,

directors, or officers or associates thereof, other than in respect

of the Agreement. Effective March 3, 2015, MYDR amended its

Articles of Incorporation to change its name to

“NaturalShrimp Incorporated”.

On January 1, 2016 we entered into a note payable agreement with

NSH. Between January 16, 2016 and March 7, 2016, we borrowed

$134,750 under this agreement. An additional $601,361 was borrowed

under this agreement in the year ended March 31, 2017. The note

payable has no set monthly payment or maturity date with a stated

interest rate of 2%.

Bill G. Williams

We have entered into several working capital notes payable to Bill

Williams, an officer, a director, and a shareholder of the Company,

for a total of $486,500 since inception. These notes are demand

notes, had stock issued in lieu of interest and have no set monthly

payment or maturity date. The balance of these notes at March 31,

2018 and 2017 was $426,404 and $426,404, respectively, and is

classified as a current liability on the consolidated balance

sheets. At March 31, 2018 and 2017, accrued interest payable was

$206,920 and $172,808, respectively. We repaid $0 during the years

ended March 31, 2018 and 2017

William Delgado

Between January 1, 2017 and March 31, 2017, we entered into two

Private Placement Subscription Agreements and issued two Six

Percent (6%) Unsecured Convertible Notes to Dragon Acquisitions,

whose managing member is William Delgado, the Treasurer, Chief

Financial Officer, and a director of the Company. The first note

was issued on January 20, 2017, in the principal amount of $20,000,

and the second note was issued on March 14, 2017, in the principal

amount of $20,000. The notes accrue interest at the rate of six

percent (6%) per annum, and mature one (1) year from the date of

issuance. Upon an event of default, the default interest rate will

be increased to twenty-four percent (24%), and the total amount of

principal and accrued interest shall become immediately due and

payable at the holder’s discretion. The notes are convertible

into shares of our common stock at a conversion price of $0.30 per

share, subject to adjustment. The notes were repaid in full between

March and May 2017.

On April 20, 2017, the Company issued an additional Six Percent

(6%) Unsecured Convertible Note to Dragon Acquisitions in the

principal amount of $140,000. The note accrues interest at the rate

of six percent (6%) per annum and matures one (1) year from the

date of issuance. Upon an event of default, the default interest

rate will be increased to twenty-four percent (24%), and the total

amount of principal and accrued interest shall become immediately

due and payable at the holder’s discretion. The note is

convertible into shares of the Company’s common stock at a

conversion price of $0.30 per share, subject to adjustment. $52,400

of the note has been repaid during the year ended March 31,

2018.

Gerald Easterling

On January 10, 2017, we entered into a promissory note agreement

with Community National Bank in the principal amount of $245,000,

with an annual interest rate of 5% and a maturity date of January

10, 2020 (the “CNB Note”). The CNB Note is secured by

certain real property owned by the Company in La Coste, Texas, and

is also personally guaranteed by the Company’s President and

Chairman of the Board, as well as certain non-affiliated

shareholders of the Company. As consideration for the guarantee,

the Company issued 600,000 shares of common stock to the

guaranteeing shareholders, not including the Company’s

President and Chairman of the Board, which was recognized as debt

issuance costs. The fair value of this issuance is estimated to be

$264,000, based on the market value of our common stock on the date

of issuance. The balance of the CNB Note is $236,413 as of March

31, 2018.

COMMUNICATIONS WITH STOCKHOLDERS

Anyone

who has a concern about our conduct, including accounting, internal

accounting controls or audit matters, may communicate directly with

our President. Such communications may be confidential or

anonymous, and may be submitted in writing addressed care of Bill

G. Williams, Chief Executive Officer,

NaturalShrimp Incorporated

5080 Spectrum

Drive, Suite 1000, Addison, TX 75001. All such concerns will be

forwarded to the appropriate directors for their review, and will

be simultaneously reviewed and addressed by the proper executive

officers in the same way that other concerns are addressed by

us.

FINANCIAL AND OTHER INFORMATION

For more detailed information on our corporation, including

financial statements, you may refer to our periodic filings made

with the SEC from time to time. Copies of these documents are

available on the SEC's EDGAR database at www.sec.gov or by writing

our secretary at the address specified above.

SIGNATURE

By Order of the Board of Directors

October 8, 2018

NATURALSHRIMP INCORPORATED

Bill

G. Williams

Chief Executive

Officer

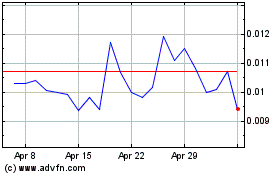

NaturalShrimp (QB) (USOTC:SHMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

NaturalShrimp (QB) (USOTC:SHMP)

Historical Stock Chart

From Apr 2023 to Apr 2024