Funds Press for Change at Bunge -- WSJ

October 09 2018 - 3:02AM

Dow Jones News

D.E. Shaw joins with Continental Grain in seeking board seats at

the grain trading firm

By Dana Mattioli and Cara Lombardo

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 9, 2018).

D.E. Shaw & Co. has boosted its stake in Bunge Ltd. and is

pushing the grain trader to make operational improvements and add

board members, according to people familiar with the matter.

The hedge fund is working with Continental Grain Co., an

agricultural-investment firm. The firms, which together own less

than 5%, have been speaking to Bunge's management in recent weeks

and could reach a settlement with the company, the people said.

The investors are trying to convince the White Plains, N.Y.,

grain trader to make its operations more focused, improve margins,

and replace board members. They aren't pushing for a sale of the

company, which in recent years has received takeover interest from

Archer Daniels Midland Co. and Glencore PLC, but eventually could

do so, the people said.

"We have been engaged in ongoing dialogue with D.E. Shaw and

Continental Grain and value their combined input, as we do with all

our shareholders, with the objective of enhancing shareholder

value," a Bunge spokeswoman said.

It isn't clear how much of Bunge D.E. Shaw owns, but the people

said it is more than the 0.06% the hedge-fund firm disclosed as of

the end of June.

Continental Grain owns more than 1% of Bunge's shares.

In March, The Wall Street Journal reported that Continental

Grain was preparing to push Bunge to consider strategic options.

Bunge, which has a market value of about $10 billion, was then in

talks to sell itself to ADM. At the time, the negotiations were

progressing at a slow pace and they later fell apart.

Last year, Glencore, a Swiss commodity trader, made a takeover

approach to Bunge, but the two sides didn't come to a deal.

Based in White Plains, N.Y., Bunge is among the world's biggest

dealers in basic foodstuffs such as soybeans, corn and wheat. Its

shares have returned 6.9% over the past 10 years including

dividends, much less than the S&P 500's 13.8% total return,

according to FactSet.

Agricultural companies like Bunge and ADM have struggled with a

growing glut of crops world-wide, brought on by consecutive bumper

harvests in North and South America. Prospects this year have

improved due partly to a drought in Argentina, which trimmed

soybean stockpiles and helped lift prices.

Bunge in August surprised investors with a $12 million

second-quarter loss, driven by derivatives positions designed to

protect the company's soybean-processing profits. Bunge Chief

Executive Soren Schroder said the company stood by its $1.3 billion

full-year profit forecast, assuring investors the company has

locked in favorable profit margins over the remainder of the year.

The company is also cutting costs, and expects to eliminate $150

million in expenses this year.

D.E. Shaw -- which has been increasing its activist practice

after hiring Quentin Koffey from Elliott Management Corp. --

typically prefers to work with management behind the scenes. The

fund early this year shook up the board at Lowe's Cos. after

presenting the home-improvement retailer research that included an

analysis of satellite imagery of the number of cars in its parking

lot compared to that of rival Home Depot Inc.

Jacob Bunge contributed to this article.

Write to Dana Mattioli at dana.mattioli@wsj.com and Cara

Lombardo at cara.lombardo@wsj.com

(END) Dow Jones Newswires

October 09, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

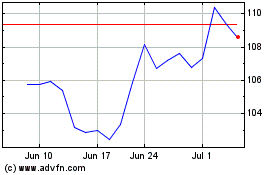

Bunge Global (NYSE:BG)

Historical Stock Chart

From Mar 2024 to Apr 2024

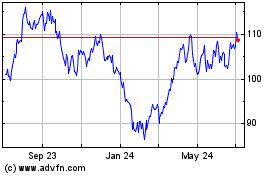

Bunge Global (NYSE:BG)

Historical Stock Chart

From Apr 2023 to Apr 2024