PART I

ITEM 1.

BUSINESS

General Development of Business

Sangui BioTech, Inc. (

“

SBT

”

) was incorporated in Delaware on August 2, 1996 and began operations in October 1996. Shortly after the formation of SBT, the shareholders of SanguiBioTech AG (

“

Sangui GmbH

”

) and GlukoMediTech AG (

“

Gluko AG

”

) agreed to a share swap in which all of the outstanding shares held by the shareholders would be exchanged for shares of SBT, thereby making Sangui GmbH and Gluko AG wholly owned subsidiaries of SBT. In August 1997, a publicly held company, Citadel Investment System, Inc., a Colorado corporation (

“

Citadel

”

), acquired one hundred percent (100%) of the outstanding common shares of Sangui BioTech, Inc., and as a result, Sangui BioTech, Inc. became a wholly owned subsidiary of Citadel. Thereafter, Citadel changed its name to Sangui BioTech International, Inc. (the

“

Company

”

or

“

SGBI

”

).

Until the end of its fiscal year 2003, SGBI's business operations were conducted through the wholly owned subsidiaries. During the first quarter of the 2003 fiscal year, SBT sold its assets, and commenced a wind-down of its U.S. business operations. SBT was merged with and into SGBI effective December 31, 2002. Gluko AG was merged with Sangui GmbH effective June 30, 2003.

Sangui BioTech GmbH, (

“

Sangui GmbH

”

) develops hemoglobin-based artificial oxygen carriers for use as blood additives, blood volume substitutes and variant products thereof. Sangui GmbH has also developed an anti-aging cosmetic line and a number of related products aimed at improving oxygen supply to the skin. Enhanced oxygen supply is the key to improved wound healing; therefore the Company has extended its product portfolio to contain wound pads and other wound management products. The facilities of Sangui GmbH are located on the premises of the Forschungs- und Entwicklungszentrum of the University of Witten/Herdecke, Witten, Germany.

In December 2010, Sangui GmbH established a joint venture company with SanderStrothmann GmbH of Georgsmarienhuette, Germany, under the name of SastoMed GmbH. This enterprise was in charge of obtaining the CE mark certification authorizing the distribution of one of SGBI

’

s products in the member states of the European Union. Effective December 31, 2015, Sangui GmbH sold its stake in Sastomed GmbH to SanderStrohmann GmbH.

On or about June 18, 2018, Sangui GmbH together with Sastomed GmbH founded Sangui Know-how- und Patentverwertungsgesellschaft mbH & Co. KG (

“

Sangui KG

”

). Sangui KG is a limited partnership. On June 22, 2018, Sangui KG acquired all the rights in the license agreement made on December 17, 2010 between Sastomed GmbH and Sangui GmbH.

Given the Company

’

s business strength is primarily in research and product development, we have decided to partner with established distribution entities who license our marketable products, or those products that are close to market entry, for sale to end users. In pursuit of this strategy we have licensed the most promising product, a hemoglobin based wound spray technology to Sastomed GmbH, a former joint venture of SGBI, for distribution in several European, Latin American and Asian countries. In addition, we are entering the preclinical testing of hemoglobin based artificial oxygen carriers aiming at the remediation of ischemic conditions in human patients.

To date, neither SGBI nor its subsidiaries has had profitable operations. The Company has never been profitable, and through June 30, 2018, SGBI's accumulated deficit has exceeded $37.1 million. The Company may continue to incur substantial losses over the next several years as it pursues its development, marketing and market entry efforts, testing activities and other growth operations. No assurance can be given that our programs will be successful.

Business of the Company

Our mission is the development of novel and proprietary pharmaceutical, medical and cosmetic products. We develop our products through our German subsidiaries, Sangui GmbH and our limited partnership Sangui KG. Currently, we are seeking to market and sell our products through partnerships with industry partners worldwide.

Our focus has been the development of oxygen carriers capable of providing oxygen transport in humans in the event of acute and/or chronic lack of oxygen due to arterial occlusion, anemia or blood loss whether due to surgery, trauma, or other causes, as well as in the case of chronic wounds.

We have thus far focused our development and commercialization efforts on such artificial oxygen carriers by reproducing and synthesizing polymers out of native hemoglobin of defined molecular sizes.

In addition, we have developed external applications of oxygen transporters, in the medical and cosmetic fields, in the form of sprays for the healing of chronic wounds and of gels and emulsions for the regeneration of the skin.

A wound dressing spray we developed that shows outstanding properties in the support of wound healing is being distributed by SastoMed GmbH, under the Granulox brand name. Sastomed GmbH was initially a joint venture company in which SGBI held 25% ownership. We sold that 25% stake to our partner in the joint venture effective as of December 31, 2015.

We also market a wound dressing that shows outstanding wound healing support properties, which we call Chitoskin. SanguiGmbH holds the distribution rights for these Chitoskin wound pads for the European Union and various other countries. A European patent has been granted for the production and use of Chitoskin wound pads.

Our current key business focuses are: (a) selling our existing cosmetics and wound management products through distribution partners, or by way of direct sale, to end users; (b) identifying additional industrial and distribution partners for our patents, production techniques, and products; and, (c) obtaining the additional certifications on our products in development.

Sangui GmbH is ISO 9001:2000 (General Quality Management System) and ISO 13485:2003 (Quality Management System Medical Products) certified, and is subject to audits on a regular basis.

Products of the Company

Artificial Oxygen Carriers

We have developed several products based on polymers of purified natural porcine hemoglobin with oxygen carrying abilities that are similar to those of native hemoglobin. These are (1) oxygen carrying blood additives, and (2) oxygen carrying blood volume substitutes.

In December 1997, we decided that porcine hemoglobin should be used as the basic material for artificial oxygen carriers. In March 1999, we decided which hemoglobin hyperpolymer would go into preclinical investigation, that glutaraldehyde would be utilized as a cross linker, and further that the polymer hemoglobin be chemically masked to prevent protein interaction in blood plasma. The fine adjustment of the molecular formula of the artificial oxygen carriers, optimized for laboratory scale production, was finalized in the summer of 2000.

The experiments completed in our laboratories demonstrated that it is possible to polymerize hemoglobins isolated from porcine blood resulting in huge soluble molecules, so-called hyperpolymers. In August 2000, we finalized our work on the pharmaceutical formulation of the

oxygen carrier for laboratory scale. In February 2001, a pilot production in a laboratory scale was carried out in our clean room. The resulting product was successfully applied in animal tests, moreover, single volunteers underwent pilot self-experiments.

The blood additives and blood substitute projects were halted in 2003 due to the lack of financing for the pre-clinical test phase.

During the first quarter of our 2013 financial year, the European Patent Office granted a patent based on Sangui

’

s application (1299457)

“

Mammalian hemoglobin compatible with blood plasma, cross-linked and conjugated with polyalkylene oxides as artificial medical oxygen carriers, production and use thereof.

”

During the third quarter of our 2013 financial year, the company had a feasibility study prepared by external experts inquiring into market potentials and further preclinical and clinical development requirements. The study came to the conclusion that an approval of Sangui's hemoglobin hyperpolymers as a blood additive appears possible, expedient, and promising.

During the fourth quarter of our 2014 financial year, the company filed a patent application aimed at significantly expanding the protection of our hemoglobin formulations. It encompassed a greater array of ischemic conditions of the human body, an example of which would be the case of severe dysfunctions of the lung.

During the first quarter of our 2015 financial year, we began, together with Excellence Cluster Cardio-Pulmonary System (ECCPS) and TransMIT Gesellschaft für Technologietransfer mbH (TransMIT), to investigate therapeutic approaches to treating septic shock and acute respiratory distress syndrome (ARDS). The approach adopted by Sangui, ECCPS and TransMIT presupposes that self-perpetuating septic shock, that has so far been highly resistant to treatment, can be interrupted by Sangui's artificial hemoglobin-based oxygen carrier, which would ultimately lower mortality rates. The preclinical trials commenced at ECCPS were investigating the effect of various hemoglobin preparations on the oxygen supply of a number of organs in septic shock models and ARDS.

Also, during the first quarter of our 2015 financial year, we were notified that the period for objection against European Patent EP 2550973 (

“

Wound Spray

”

) elapsed without any objection being raised. The patent, therefore, has become effective.

During the second quarter of our 2015 financial year, the first phase of preclinical trials was concluded successfully. It was successfully demonstrated that applying an oxygen-carrying liquid (the hemoglobin hyperpolymer formulation SBT102) in the abdomen did significantly improve the oxygen supply to the intestines. The restoration of intestinal oxygenation should have an impact on tissue integrity and ultimately on patient survival.

During the third quarter of our 2015 financial year, the preclinical trials were concluded successfully, and the final results did fully confirm the interim results obtained in the second quarter.

According to regulatory requirements, all drugs must complete preclinical and clinical trials before approval (Government Regulation; No Assurance of Product Approval, see Certain Business Risks below) and market launch. Our management believes that the European and United States FDA approval process will take at a minimum several years to complete.

Our most promising potential product in the area of artificial oxygen carriers, the blood additive is still in an early development stage. In the pursuit of these projects we will need to obtain substantial additional capital to continue their development.

The blood additives project was halted in the second quarter of our financial year 2016 due to the lack of financing the further authorization.

Nano Formulations for the Regeneration of the Skin

Healthy skin is supplied with oxygen both from the inside, by way of the blood circulation, as well as through diffusion from the outside. A lack of oxygen will cause degenerative alterations, ranging from premature aging, to surface damage, and even as extensive as causing open wounds. The cause for the lack of oxygen may be a part of the normal aging process, but it may also be caused by burns, radiation, trauma, or a medical condition. Impairment of the blood flow, for example caused by diabetes mellitus or by chronic venous insufficiency, can also lead to insufficient oxygen supply and the resulting skin damage.

Our nano-emulsion-based preparations have been designed to support the regeneration of the skin by improving its oxygen supply. The products were thoroughly tested by an independent research institute and received top marks for skin moisturizing, and enhanced skin elasticity.

Sales of these preparations had remained at a low levels for years. After the end of the 2015 fiscal year we decided to discontinue our operations in this particular segment and to abandon the patent protection for this range of products.

Chitoskin Wound Pads

Usually, normal (

“

primary

”

) wounds tend to heal over a couple of days without leaving scars following a certain sequence of phases. Burns and certain diseases impede the normal wound healing process, resulting in large, hardly healing (

“

secondary

”

) wounds which only close by growing new tissue from the bottom. Wound dressings serve to safeguard the wound with its highly sensitive new granulation tissue from mechanical damage as well as from infection. Using the natural polymer chitosan, our Chitoskin wound dressings show outstanding properties in supporting wound healing.

It is our strategy to find industry partners ready to acquire or license this product range as a whole.

Hemoglobin Based Wound Spray Technology

Sangui GmbH has developed a novel medical product aimed at the healing of chronic wounds. Chronic wounds are a medical problem of increasing importance as they originate from widespread and increasingly common risk factors such as diabetes and obesity, as well as other personal lifestyle choices like smoking. A lack of oxygen supply to the cells in the wound ground is the main reason why these wounds lose their ability to self-heal. Based on our concept of artificial oxygen carriers, our Hemospray wound spray product bridges the watery wound surface and permits an enhanced afflux of oxygen to the wound ground.

In December 2010, Sangui GmbH established a joint venture company with SanderStrothmann GmbH of Georgsmarienhuette, Germany. Under the name of SastoMed GmbH this enterprise was in charge of obtaining the CE mark certification authorizing the distribution of the Hemospray wound spray in the member states of the European Union. Sangui GmbH has granted SastoMed GmbH global distribution rights for its Hemospray product.

The basic terms of the licensing contract agreement are that Sangui GmbH is awarded a fixed licensing fee as a percentage of the external revenues received from sales of the Granulox product (based on SastoMed selling prices). The percentage ranges in the uppermost zone of what is usually granted in the pharmaceutical and medical products industries and thus well above the average licensing rate of 7.5% of sales revenues as calculated by market analysts. In addition and complementing this basic agreement, the percentage will be permanently increased by one fourth of the current rate as soon as cumulated sales revenues at SastoMed have exceeded

€

50,000,000.

In September 2011, the Mexican Health Authorities registered the entire current range of Sangui wound management products and thus granted the authorization to apply and sell these products on a nationwide level.

On April 5, 2012, SastoMed GmbH notified Sangui GmbH that the wound spray product was granted a certification as class III medical product. The CE mark according to sections 6 and 7 of the German Medical Devices Act authorizes production, distribution and sales of the product in all member countries of the European Union. Sales of the product by SastoMed GmbH under the brand name

“

Granulox

”

started in Germany on April 16, 2012.

In December 2012, actual distribution of the product was initiated in Mexico under the management of SastoMed GmbH and their local distribution partner Bio-Mac Pharma. International distribution has been expanded since then through cooperation agreements with local distribution partners in the Benelux countries and South Eastern Europe.

In May 2013, the Company declared in the course of the filing of its nine-month report on form 10-QSB that it now expects the Granulox market entry phase to last longer than initially expected.

Since December 2013, international distribution outside Germany was initiated in collaboration with local partners in more than 40 countries in Europe and Latin American.

Effective December 31, 2015, Sangui GmbH sold its 25 % stake in Sastomed GmbH to SanderStrohmann GmbH. Also effective December 31, 2015, SanderStrohmann GmbH increased the capital of Sastomed GmbH by

€

500,000 to strengthen the capital base of Sastomed GmbH.

With effect from June 18, 2018 Sangui GmbH together with Sastomed GmbH founded Sangui Know-How- und Patentverwertungsgesellschaft mbH & Co. KG (

“

Sangui KG

”

). Sangui KG is a limited partnership. The Sangui GmbH has agreed as a fully liable compliant with 99.8% and the Sastomed GmbH as a limited partner with 0.2%. On June 22, 2018, Sangui KG has acquired all rights in the license agreement concluded on December 17, 2010 with Sastomed GmbH from Sangui GmbH.

Nevertheless, all material content of the existing license agreement remains unchanged even after the transition from Sangui GmbH to Sangui KG. This also applies to the pledging of the European patent EP 1485120 concerning the Hemo2 spray to the Sastomed GmbH.

It has to be noted, however, that Granulox sales by our distribution partner SastoMed GmbH have become more volatile and declining from time to time. We remain confident, however, that SastoMed will be able to considerably increase its sales along with more international markets entering actual distribution of the product.

Patents and Proprietary Rights

The Company seeks patent protection for all of its research and development projects, and all the most important modifications and improvements thereto. As of June 30, 2018 SanguiBioTech GmbH had been granted patents from three patent families, furthermore, it has applied for additional patents. Two of the patents have been filed in the United States of America (US), and three as international patent applications with the European Patent Office (EP). Validation of granted EP patents in all cases includes Germany, France, Great Britain, Italy, and Spain. Below are listed the most important of the rights held by the Company.

In the fiscal year, a patent in the USA expired.

1. Hemoglobin-Hyperpolymers

|

|

|

US 7,005,414

EP 1 294 386

|

“

Synthetic oxygen transport made from cross-linked modified human or porcine hemoglobin with improved properties, method for a preparation thereof from purified material and use thereof

”

(patents granted, end of duration 2020)

|

|

|

|

|

DE 10 2013 014 651

EP 14758344

US SN 14 569,846

|

“

Compositions for Improved Tissue Oxygenation by Peritoneal Ventilation

”

(patents pending)

|

2. Wound Management

|

|

|

EP 1 485 120

|

“

Use of one or more natural or modified oxygen carriers, devoid of plasma and cellular membrane constituents, for externally treating open, in particular chronic wounds

”

(patent granted, end of duration 2022)

|

Manufacturing, Marketing and Distribution

Manufacturing, marketing and distribution are not core competencies of the company. It is our strategy, therefore to outsource such business processes to external partners. In selecting and mandating them special attention is being paid to their experience, reputation and standing including the required quality management systems and certifications.

Research and Development

Research and development are charged to operations as they are incurred. Legal fees and other direct costs incurred in obtaining and protecting patents are expensed as incurred. Research and development costs totaled $23,003 and $16,530 during the fiscal years ended June 30, 2018 and 2017, respectively.

Government Regulation

Sangui BioTech International, Inc. and its former United States subsidiaries are and were subject to governmental regulation under the Occupational Safety and Health Act, the Environmental Protection Act, the Toxic Substances Control Act, and other similar laws of general application, as to all of which we believe we and our subsidiaries were in material compliance.

Although it is believed that we, and our former United States subsidiaries have been in material compliance with all applicable governmental and environmental laws, rules, regulations and policies, and although no government concerns were put forward during the operation of or after the closing of the US operations, there can be no assurance that the business, financial condition, and our results of operations of and those of our subsidiaries will not be materially adversely affected by future government claims with regard to unlikely, but not impossible, infringements on these or other laws resulting from our former United States operations.

Additionally, the clinical testing, manufacture, promotion and sale of a significant majority of the products and technologies, if those products and technologies are to be offered and sold in the United States, are subject to extensive regulation by numerous governmental authorities in the United

States, principally the Federal Drug Administration (

“

FDA

”

), and corresponding state regulatory agencies. To the extent those products and technologies are to be offered and sold in markets other than the United States, the clinical testing, manufacture, promotion and sale of those products and technologies will be subject to similar regulation by corresponding foreign regulatory agencies. In general, the regulatory framework for biological health care products is more rigorous than for non-biological health care products. Generally, biological health care products must be shown to be safe, pure, potent and effective. There are numerous state and federal, foreign and international statutes and regulations that govern or influence the testing, manufacture, safety, effectiveness, labeling, storage, record keeping, approval, advertising, distribution and promotion of biological health care products. Non-compliance with applicable requirements can result in, among other things, fines, injunctions, seizures of products, total or partial suspension of product marketing, and failure of the government to grant pre-market approval, withdrawal of marketing approvals, product recall and criminal prosecution.

Competition

The market for our products and technologies is highly competitive, and we expect competition to increase. Experiments and clinical testing in the field of artificial oxygen carriers are being carried out by Alliance Pharmaceutical Corp. of San Diego, California. In the fields of anti-aging and anti-cellulite cosmetics, all major cosmetic vendors are actively marketing proprietary formulations. Leading wound management product providers include Johnson & Johnson, Bristol-Myers Squibb, Coloplast A/S of Denmark as well as BSNmedical, a former part of Beiersdorf AG.

Dependence on Major Customers

As of June 30, 2018 and June 30, 2017, the majority of revenues and trade receivables were generated by SastoMed GmbH, the licensee of the global distribution rights of the Sangui developed wound spray technology known as Granulox.

Human Resources

We consider our relations with our employees to be favorable. As of June 30, 2018, the Company, and our subsidiary, had one fulltime employee, who was not involved in research and development. For management, research and development purposes, the Company has consulting arrangements with five individuals and one related entity.

Dividends

We anticipate that we will use any funds available to finance our growth and that we will not pay cash dividends to stockholders in the foreseeable future.

Reports to Security Holders

Copies of our reports, as filed with the Securities and Exchange Commission, are available and may be viewed as filed at the SEC

’

s Public Reference Room at 450 Fifth Street, N.W., Washington D.C. 20549 or by calling 1-800-SEC-0330. Additionally they can be accessed and downloaded via the internet at http://www.sec.gov/cgi-bin/srch-edgar by simply typing in

“

Sangui Biotech International

”

or via the web links at the corporate website http://www.sanguibiotech.com.

ITEM 1A.

RISK FACTORS

Investment in our common stock involves significant risk. You should carefully consider the information described in the following risk factors, together with the other information appearing elsewhere in this report, before making an investment decision regarding our common stock. If any of the events or circumstances described in these risks actually occur, our business, financial conditions, results of operations and future growth prospects would likely be materially and adversely affected. In these circumstances, the market price of our common stock could decline, and you may lose all or a part of your investment in our common stock.

The risks and uncertainties described below are not the only ones facing the company, and there may be additional risks that are not presently known or are currently deemed immaterial. All of these risks may impair business operations.

The Company's present and proposed business operations will be highly speculative and subject to the same types of risks inherent in any new or unproven venture, as well as risk factors particular to the industries in which it will operate, as well as other significant risks not normally associated with investing in equity securities of United States companies, among other things, those types of risk factors outlined below.

Risks Related to Our Business

Global economic crisis could result in decreases in customer spending

We operate in competitive and evolving markets locally, nationally and globally. These markets are subject to rapid technological change and changes in demand. In seeking market acceptance, we will encounter competition from many sources, including other well-established and dominant larger providers. Many of these competitors have substantially greater financial, marketing and other resources than does Sangui. Our revenue could be materially adversely affected if we are unable to compete successfully with these other providers. The current economic climate has resulted in a decrease in customer spending.

There is uncertainty relating to the ability of the Company to enforce its rights under agreements

Many of our agreements are with foreign entities and are governed by the laws of foreign jurisdictions. If a partner breaches an agreement, then we will incur the additional costs of determining our rights and obligations under the agreement, under applicable foreign laws, and enforcing the agreement in a foreign jurisdiction. We also may face practical difficulties in enforcing any of our rights in such jurisdictions. We may not be able to enforce such rights or in the alternative may determine that it would be too costly to enforce such rights.

The Company may be subject to other third-party intellectual property rights claims

Companies in our industry often own large numbers of patents, copyrights, trademarks and trade secrets and frequently enter into litigation based on allegations of infringement or other violations of intellectual property rights. As we face increasing competition, the possibility of intellectual property rights claims against us grows. Our technologies may not be able to withstand third-party claims or rights against their use. Intellectual property claims, whether having merit or otherwise, could be time consuming and expensive to litigate or settle and could divert management resources and attention. If litigation is successfully brought by a third party against the Company in respect of intellectual property, we may be required to cease distributing or marketing certain products or obtain licenses from the holders of the intellectual property at material cost, redesign affected products in such a way as to avoid infringing intellectual property rights, any or all of which could materially adversely affect our business, financial condition and results of operations. If those

intellectual property rights are held by a competitor, we may be unable to obtain the intellectual property at any price, which could also adversely affect our competitive position. An adverse determination could also prevent us from offering its products. Any of these results could harm the Company

’

s business, financial condition and results of operations.

Licenses and Consents

The utilization or other exploitation of the products and services developed by our Company or its subsidiary may require us to obtain licenses or consents from the producers or other holders of patents, trademarks, copyrights or other similar rights. In the event we are unable, if so required, to obtain any necessary license or consent on terms, which we consider to be reasonable, we may be required to cease developing, utilizing, or exploiting products or technologies affected by those Intellectual Property rights. In the event the holders of such Intellectual Property rights challenge us, there can be no assurance that we will have the financial or other resources to defend any resulting legal action, which could be significant.

Technological Factors

The market for our products and technology is characterized by rapidly changing technology, which could result in product obsolescence or short product life cycles. Similarly, the industry is characterized by continuous development and introduction of new products and technology to replace outdated products and technology. Accordingly, the ability of us to compete will be dependent upon the ability to provide new and innovative products and technology. There can be no assurance that competitors will not develop technologies or products that render the proposed products and technology obsolete or less marketable. We will be required to adapt to technological changes in the industry and develop products and technology to satisfy evolving industry or customer requirements, any of which could require the expenditure of significant funds and resources, and we do not have a source or commitment for any such funds and resources. Development efforts relating to the technological aspects of the various products and technologies to be developed are not substantially completed. Accordingly, we will continue to refine and improve those products and technologies. Continued refinement and improvement efforts remain subject to the risks inherent in new product development, including unanticipated technical or other problems, which could result in material delays in product commercialization or significantly increased costs. In addition, there can be no assurance that those products and technologies will prove to be sufficiently reliable or durable in wide spread commercial application. The products or technologies to be developed will be the result of significant efforts, which may result in errors that become apparent subsequent to widespread commercial utilization. In such event, we would be required to modify such products or technologies and continue with additional research and development, which could delay our plans and cause us to incur additional cost.

The Company is subject to foreign business, political and economic disruption risks

We contract with various entities around the world. As a result, we are exposed to foreign business, political and economic risks, which could adversely affect our financial position and results of operations, including:

·

difficulties in managing relationships from abroad;

·

political and economic instability;

·

less developed infrastructures in some emerging economies and countries;

·

susceptibility to business interruption in foreign areas due to war, terrorist attacks, medical epidemics, changes in political regimes, and general interest rate and currency instability;

·

·

exposure to possible litigation or claims in foreign jurisdictions; and,

·

competition from foreign-based providers and the existence of protectionist laws and business practices that favor such providers.

Early stage of the Company and its products

We have generated limited revenue from operations, and may not generate any significant or sufficient revenue from its current operations to continue future operations. A very limited number of our products are currently in the marketplace. However, to achieve profitable operations, either alone or with others, we must successfully initiate and maintain sales and distribution of our products. The time frame necessary to achieve market success for any individual product is uncertain. There can be no assurance that our efforts will be successful, or that any of our products will prove to meet the anticipated levels of approval or effectiveness, or that we will be able to obtain and sustain customer, as well as distribution approval.

Our results can also be affected by the ability of competition to introduce new products that have advantages over our own, or the competition's ability to adjust its pricing to reduce any competitive advantage we may have. Results will also be affected by strategic decisions made by the management regarding product volume, mix, and timing of orders received during operations. See

“

Description of Business.

”

Uncertainty of future profitability

We will require the commitment of substantial resources to increase our advertising, marketing and distribution of our existing products. While we believe that the additional advertising, marketing and distribution will further enhance our profitability, there can be no assurance our products will meet the expectations and effectiveness required to be competitive in the market place, and that we will enter into arrangements for commercialization, market our products successfully, or achieve customer acceptance.

Future capital requirements; uncertainty of future funding

Substantial expenditures will be required to enable us to conduct existing product research, manufacturing, marketing and distribution of our products and Intellectual Property. We may need to raise additional capital to facilitate growth and support its longterm manufacturing, and marketing programs. We have no established bank-financing arrangements and until we have sufficient assets, capital, and inventory or accounts receivable, it is not anticipated that we will secure any bank financing in the near future. Therefore, it is likely that we may need to seek additional financing through subsequent future public or private sales of its securities, including equity securities. We may also seek funding for the manufacturing, and marketing of its products through strategic partnerships and other arrangements with corporate partners. There can be no assurance, however, that such collaborative arrangements or additional funds will be available when needed, or on terms acceptable to the Company, if at all. Any such additional financing may result in significant dilution to existing stockholders. If adequate funds are not available, we may be required to curtail one or more of our programs. Our future cash requirements will be affected by the revenue generated from the sale of our products, the costs of production and marketing, as well as relationships with corporate partners, changes in the focus and direction of our programs, competitive and technological advances, and other factors.

Substantial Doubt that the Company Can Continue as a Going Concern

We expect to continue to incur significant capital expenses in pursuing our business plan to market our products and expand our product line, while obtaining additional financing through stock offerings or other feasible financing alternatives. In order for us to continue its operations at its existing levels, we will require significant additional funds over the next twelve months. Therefore,

we are dependent on funds raised through equity or debt offerings. Additional financing may not be available on terms favorable to the Company, or at all. If these funds are not available, we may not be able to execute our business plan or take advantage of business opportunities. The ability to obtain such additional financing and to achieve our operating goals is uncertain. In the event that we cannot obtain additional capital or are not able to increase cash flow through the increase of sales, there is a substantial doubt of our being able to continue as a going concern.

Future Capital Needs and Uncertainty of Additional Funding

We believe that our cash position is insufficient to cover its financing requirements for the current fiscal year, and anticipate that substantial funds will be required in order to enact our development plans. We will require additional cash for: (i) payment of increased operating expenses; (ii) payment of development expenses; and (iii) further implementation of its business strategies. Such additional capital may be raised by additional public or private financing, as well as borrowings and other resources. To the extent that additional capital is received by the sale of equity or equity-related securities, the issuance of such securities will result in dilution to our shareholders. There can be no assurance that additional funding will be available on favorable terms, if at all. We may also seek arrangements with collaborative partners in order to gain additional funding, marketing assistance or other contributions. However, such arrangements may require us to relinquish rights or reduce its interests in certain of our technologies or product candidates. The inability to access the capital markets or obtain acceptable financing could have a material adverse effect on the results of operations and financial condition of the Company. Moreover, if funds are not available from any sources, we may not be able to continue to operate.

Dependence on others; manufacturing capabilities and limited distribution capabilities

An important element of our strategy for the marketing and release of its products is to enter into various arrangements with distribution and retail partners. The success and commercialization of our products will be dependent, in part, upon our ability to enter into such arrangements and upon the ability of these third parties to perform their responsibilities. Although we believe that parties to any such arrangements would have an economic motivation to succeed in performing their contractual responsibilities, the amount and timing of resources to be devoted to these activities may not be within the control of the Company. There can be no assurance that any such arrangements will be available on terms acceptable to us, if any at all, and that such parties will perform their obligations as expected, or that any revenue will be derived from such arrangements. If we are not able to enter into such arrangements, we could encounter delays in introducing our products into the market. See

“

Business.

”

We may be dependent on other manufacturers for the production and manufacturing of certain products. In the event that we are unable to obtain or retain the necessary manufacturer

’

s products on acceptable terms, we may not be able to continue to commercialize and market our products as planned. The manufacture of our products will be subject to current good manufacturing practices (

“

GMP

”

) requirements prescribed by the Company in order to meet the specifications and other standards prescribed by us to satisfy the anticipated and appropriate levels of effectiveness when in use. There can be no assurance that we will be able to i) obtain adequate supplies of its products in a timely fashion at acceptable quality and prices, ii) enter into arrangements for the manufacture of its products with manufacturers whose facilities and procedures comply with our GMP or other regulatory requirements, iii) or that manufacturers will continue to comply with such standards, or iv) that such manufacturers will be able to adequately supply us with our product needs. Our dependence upon others for the manufacture of its proposed products may adversely affect the Company's ability to develop and deliver products on a timely and competitive basis.

In addition, we do not now have, nor do we have current plans to acquire or obtain, the facilities, or personnel necessary to conduct our own full-scale distribution of its products. Consequently, we will have to rely on existing commercial distribution channels for the sale of our

products. There can be no assurance that we will be able to secure sufficient distribution of any of its products on acceptable terms.

Changes of prices for products

While the prices of our products are projected to be in line with those from market competitors, there can be no assurance that they will not decrease in the future. Competition may cause us to lower prices in the future. Moreover, it is difficult to raise prices even if internal costs increase.

Creditworthiness of distributors is an ongoing concern

We may not always be able to collect all of the funds owed to us by our distributors. Some distributors may experience financial difficulties, which may adversely impact our collection of accounts receivable.

C Corporation tax status

We are presently a C Corporation under the Internal Revenue Code of 1986. All items of income and loss of the Company are taxed first at the corporate level and any dividends distributed to shareholders are taxed at the shareholder level as well.

Limited current sales and marketing capability

Though we have key personnel with experience in sales, marketing and distribution to market our products, we must either retain and hire the necessary personnel to distribute and market our products or enter into collaborative arrangements or distribution agreements with third parties who will market such products or develop their own marketing and sales force with technical expertise and supporting distribution capability. There can be no assurance that we will be able to retain or hire the personnel with sufficient experience and knowledge to distribute and market our products or be able to enter into collaborative or distribution arrangements or develop our own sales force, or that such sales and marketing efforts, including the efforts of the companies with which we have entered into collaborative agreements, will be successful.

We incur significant costs as a result of our operating as a public company and our management is required to devote substantial time to new compliance initiatives

As a public company with substantial operations, we incur increased legal, accounting and other expenses. The costs of preparing and filing annual, quarterly and current reports, proxy statements and other information with the SEC and furnishing audited reports to shareholders is time-consuming and costly.

It will also be time-consuming, difficult and costly for us to develop and implement the internal controls and reporting procedures required by the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act. Certain members of our management have limited or no experience operating a company whose securities are listed on a national securities exchange or with the rules and reporting practices required by the federal securities laws and applicable to a publicly traded company. We will need to recruit, hire, train and retain additional financial reporting, internal control and other personnel in order to develop and implement appropriate internal controls and reporting procedures. If we are unable to comply with the internal controls requirements of the Sarbanes-Oxley Act, we may not be able to obtain the independent accountant certifications required by the Sarbanes-Oxley Act.

If we fail to establish and maintain an effective system of internal controls, we may not be able to report our financial results accurately. Any inability to report and file our financial

results accurately and timely could harm our business and adversely affect the trading price of our common stock

We are required to establish and maintain internal controls over financial reporting and disclosure controls and procedures and to comply with other requirements of the Sarbanes-Oxley Act and the rules promulgated by the SEC. At present, we have instituted internal controls, but it may take time to implement them fully as a public company. Our management, including our Chief Executive Officer and Chief Financial Officer, cannot guarantee that our internal controls and disclosure controls and procedures will prevent all possible errors. Because of the inherent limitations in all control systems, no system of controls can provide absolute assurance that all control issues and instances of fraud, if any, within the company have been detected. These inherent limitations include the possibility that judgments in decision-making can be faulty and subject to simple error or mistake. Furthermore, controls can be circumvented by individual acts of some persons, by collusion of two or more persons, or by management override of the controls. The design of any system of controls is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions. Over time, a control may become inadequate because of changes in conditions or the degree of compliance with policies or procedures may deteriorate. Because of inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and may not be detected.

Dependence on Key Personnel

Our future success will depend on the service of our key scientific personnel and, additionally, our ability to identify, hire and retain additional qualified personnel. There is intense competition for qualified personnel in this industry and there can be no assurance that we will be able to attract and retain personnel necessary for the development of the business. Because of the intense competition, there can be no assurance that we will be successful in adding technical personnel if needed to satisfy our staffing requirements. Failure to attract and retain key personnel could have a material adverse effect on the Company.

The Company and its subsidiary are dependent on the efforts and abilities of their senior management. The loss of various members from management could have a material adverse effect on the business and our prospects. There can be no assurance that upon the departure of key personnel from our business, or that of our subsidiary, that a suitable replacement will be available.

Conflicts of Interest; Related Party Transactions

The possibility exists that we may acquire or merge with a business or company in which the Company's executive officers, directors, beneficial owners or their affiliates may have an ownership interest. Although there is no formal bylaw, stockholder resolution or agreement authorizing any such transaction, corporate policy does not forbid it and such a transaction may occur if management deems it to be in the best interests of the Company and its stockholders, after consideration of all factors. A transaction of this nature would present a conflict of interest to those parties with a managerial position and/or an ownership interest in both the Company and the acquired entity, and may compromise management's fiduciary duties to the Company's stockholders. An independent appraisal of the acquired company may or may not be obtained in the event a related party transaction is contemplated. Furthermore, because management and/or beneficial owners of the Company's common stock may be eligible for finder's fees or other compensation related to potential acquisitions by the Company, such compensation may become a factor in negotiations regarding such potential acquisitions. It is the Company's intention that all future transactions be entered into on such terms as if negotiated at arm

’

s length, unless the Company is able to receive more favorable terms from a related party.

Market Acceptance

There can be no assurance that our products and technologies will achieve a significant degree of market acceptance, and that acceptance, if achieved, will be sustained for any significant period or that product life cycles will be sufficient (or substitute products developed) to permit us to achieve or sustain market acceptance which could have a material adverse effect on the business, financial condition, and results of operations.

Government Regulation; No Assurance of Product Approval

The clinical testing, manufacture, promotion, and sale of biotechnology and pharmaceutical products are subject to extensive regulation by numerous governmental authorities in the United States, principally the Federal Drug Administration (

“

FDA

”

), and corresponding state and foreign regulatory agencies prior to the introduction of those products. Management believes that many of the potential products will be regulated by the FDA, subject to the then current regulations of the FDA. Other federal and state statutes and regulations may govern or influence the testing, manufacture, safety, effectiveness, labeling, storage, record-keeping, approval, advertising, distribution and promotion of certain products developed. Non-compliance with applicable requirements can result in, among other things, fines, injunctions, seizure of products, suspensions of regulatory approvals, product recalls, operating restrictions, re-labeling costs, delays in sales, cessation of manufacture of products, the imposition of civil or criminal sanctions, total or partial suspension of product marketing, failure of the government to grant pre-market approval, withdrawal of marketing approvals and criminal prosecution.

The FDA's requirements include lengthy and detailed laboratory and clinical testing procedures, sampling activities and other costly and time-consuming procedures. In particular, human therapeutic products are subject to rigorous pre-clinical and clinical testing and other approval requirements by the FDA, and corresponding agencies in other countries. Although the time required for completing such testing and obtaining such approvals is uncertain, satisfaction of these requirements typically takes a number of years and varies substantially based on the type, complexity and novelty of each product. Neither us nor our subsidiary can accurately predict when product applications or submissions for FDA or other regulatory review may be submitted. Management has no experience in obtaining regulatory clearance on these types of products. The lengthy process of obtaining regulatory approval and ensuring compliance with applicable law requires the expenditure of substantial resources. Any delays or failure by us or our subsidiary to obtain regulatory approval and ensure compliance with appropriate standards could adversely affect the commercialization of such products, the ability of us to earn product or royalty revenue, and our results of operations, liquidity and capital resources.

Pre-clinical testing is generally conducted in laboratory animals to evaluate the potential safety and effectiveness of a drug. The results of these studies are submitted to the FDA, which must be approved before clinical trials can begin. Typically, clinical evaluation involves a time consuming and costly three-phase process. In Phase I, clinical trials are conducted with a small number of subjects to determine the early safety profile, the pattern of drug distribution and metabolism. In Phase II, clinical trials are conducted with groups of patients afflicted with a specific disease in order to determine preliminary efficacy, optimal dosages and expanded evidence of safety. In Phase III, large-scale, multi-center, comparative trials are conducted with patients afflicted with a target disease in order to provide enough data to demonstrate the efficacy and safety required by the FDA. The FDA closely monitors the progress of each of the three phases of clinical trials and may, at its discretion, re-evaluate, alter, suspend or terminate the testing based upon the data which have been accumulated to that point and its assessment of the risk/benefit ratio to the patient.

Clinical trials and the marketing and manufacturing of products are subject to the rigorous testing and approval processes of the FDA and foreign regulatory authorities. The process of obtaining FDA and other required regulatory approvals is lengthy and expensive. There can be no

assurance we will be able to obtain the necessary approvals to conduct clinical trials for the manufacturing and marketing of products, that all necessary clearances will be granted to us or one of our licensors for future products on a timely basis, or at all, or that FDA review or other actions will not involve delays adversely affecting the marketing and sale of the products. In addition, the testing and approval process with respect to certain new products which we may seek to introduce is likely to take a substantial number of years and involve the expenditure of substantial resources. There can be no assurance that pharmaceutical products currently in development will be cleared for marketing by the FDA. Failure to obtain any necessary approvals or failure to comply with applicable regulatory requirements could have a material adverse effect on the business, financial condition or results of operations. Further, future government regulation could prevent or delay regulatory approval of the products.

There can be no assurance as to the length of the clinical trial period or the number of patients the FDA will require to be enrolled in the clinical trials in order to establish the safety and effectiveness of the products. We may encounter significant delays or excessive costs in our efforts to secure necessary approvals, and regulatory requirements are evolving and uncertain. Future United States or foreign legislative or administrative acts could also prevent or delay regulatory approval of the products. If commercial regulatory approvals are obtained, they may include significant limitations on the indicated uses for which a product may be marketed. In addition, a marketed product is subject to continual FDA review. Later discovery of previously unknown problems or the failure to comply with the applicable regulatory requirements may result in restrictions on the marketing of a product, or even the removal of the product from the market, as well as possible civil or criminal sanctions. Failure to obtain marketing approval for any of our products under development on a timely basis, or FDA withdrawal of marketing approval once obtained, could have a material adverse effect on the business, financial condition and results of operations.

Any party that manufactures therapeutic or pharmaceutical products is required to adhere to applicable standards for manufacturing practices and to engage in extensive record keeping and reporting. Any of the manufacturing facilities are subject to periodic inspection by state and federal agencies, including the FDA and comparable agencies in foreign countries.

The effect of governmental regulation may be to delay the marketing of new products for a considerable period of time, to impose costly requirements on the activities or to provide a competitive advantage to other companies that compete with us. There can be no assurance that FDA or other regulatory approval for any products developed by us will be granted on a timely basis, if at all or, if granted, that compliance with regulatory standards will be maintained. Adverse clinical results by our products could have a negative impact on the regulatory process and timing. A delay in obtaining, or failure to obtain, regulatory approvals could preclude or adversely affect the marketing of products and the liquidity and capital resources. The extent of potentially adverse governmental regulation that might result from future legislation or administrative action cannot be predicted.

Additionally, we will be subject to regulatory authorities in Germany and other countries governing clinical trials and product sales. Even if FDA approval is obtained, approval of a product by the comparable regulatory authorities of other countries must be obtained prior to the commencement of marketing the product in those countries. The approval process varies from country to country and the time required may be longer or shorter than that required for FDA approval. The foreign regulatory approval process includes all of the risks associated with obtaining FDA approval set forth above, and approval by the FDA does not ensure approval by the health authorities of any other country. There can be no assurance that any foreign regulatory agency will approve any product submitted for review.

We are subject to various federal, state and local laws, regulations and recommendations relating to safe working conditions, laboratory and manufacturing practices, the experimental use of animals and the use and disposal of hazardous or potentially hazardous substances, including radioactive compounds and infectious disease agents, used in connection with its research work. The

extent and character of governmental regulation that might result from future legislation or administrative action cannot be accurately predicted.

Intense Competition

Competition in the biotechnology, pharmaceutical, and cosmetic industries is intense and is expected to increase. In the field of medical and cosmetic products we, and our subsidiary, compete directly with the research departments of biotechnology and pharmaceutical companies, chemical companies and, possibly, joint collaborations between chemical companies and research and academic institutions. Management is aware that other companies and businesses have developed and are in the process of developing technologies and products, which may be competitive with the products and technologies developed and offered by us. Eventually, this might include the field of blood additives where there is no known direct competition at present. The biotechnology and pharmaceutical industries continue to undergo rapid change. There can be no assurance that competitors have not or will not succeed in developing technologies and products that are more effective than any which have been or are being developed by us or which would render our technology and products obsolete. Many of our competitors have substantially greater experience, financial and technical resources and production, marketing and development capabilities than us. Accordingly, certain of those competitors may succeed in obtaining regulatory approval for products more rapidly or effectively.

Uncertainties Associated With Patents and Proprietary Rights

Our success may depend in part on the ability to obtain patents for our technologies and products, if any, resulting from the application of such technologies, to defend patents once obtained and to maintain trade secrets, both in the United States and in foreign countries.

Our success will also depend on avoiding the infringement of patents issued to competitors. There can be no assurance that we will be able to obtain patent protection for products based upon the technology. Moreover, there can be no assurance that any patents issued will not be challenged, invalidated or circumvented or that the rights granted there under would provide competitive advantages to us. Litigation, which could result in substantial cost may be necessary to enforce the patent and license rights or to determine the scope and validity of our and others' proprietary rights.

Due to the length of time and expense associated with bringing new products through development and the length of time required for the governmental approval process, the biotechnology and pharmaceutical industries have traditionally placed considerable importance on obtaining and maintaining patent and trade secret protection for significant new technologies, products and processes. The enforceability of patents issued to biotechnology and pharmaceutical firms can be highly uncertain. U.S. Federal court decisions establishing legal standards for determining the validity and scope of patents in the field are in transition. In addition, there can be no assurance that patents will be issued or, if issued, any such patents will afford us protection from infringing patents granted to others.

A number of biotechnology and pharmaceutical companies, and research and academic institutions, have developed technologies, filed patent applications or received patents on various technologies that may be related to our business. Some of these technologies, applications or patents may conflict with our technologies. Such conflicts could also limit the scope of the patents, if any, that we may be able to obtain or result in the denial of our patent applications.

Many of our competitors are, have, or are affiliated with companies having, substantially greater resources than us, and such competitors may be able to sustain the costs of complex patent litigation to a greater degree and for longer periods of time than us. Uncertainties resulting from the initiation and continuation of any patent or related litigation could have a material adverse effect on the ability of us to compete in the marketplace pending resolution of the disputed matters. Moreover, an adverse outcome could subject us to significant liabilities to third parties and require us to license

disputed rights from third parties or cease using the technology. In the event that third parties have or obtain rights to intellectual property or technology used or needed by us, there can be no assurance that any licenses would be available or would be available on terms reasonably acceptable to us.

We may rely on certain proprietary technologies, trade secrets, and know-how that are not patentable. Although we have taken steps to protect their unpatented trade secrets and technology, in part through the use of confidentiality agreements with their employees, consultants and certain of its contractors, there can be no assurance that: (i) these agreements will not be breached; (ii) we would have adequate remedies for any breach; or (iii) our proprietary trade secrets and know-how will not otherwise become known or be independently developed or discovered by competitors.

Risk of Product Liability; Potential Unavailability of Insurance

Our business will expose it to potential product liability risks that are inherent in the testing, manufacturing and marketing of human pharmaceutical and therapeutic products. We do not currently have product liability insurance, and there can be no assurance that we will be able to obtain or maintain such insurance on acceptable terms or, if obtained, that such insurance will be adequate to cover potential product liability claims or that a loss of insurance coverage or the assertion of a product liability claim or claims would not materially adversely affect the business, financial condition and results of operations. We face an inherent business risk of exposure to product liability and other claims in the event that the development or use of its technology or products is alleged to have resulted in adverse effects. Such risk exists even with respect to those products that are manufactured in licensed and regulated facilities or that otherwise possess regulatory approval for commercial sale. There can be no assurance that we will avoid significant product liability exposure.

While we have taken, and will continue to take, what it believes are appropriate precautions, there can be no assurance that it will avoid significant liability exposure. An inability to obtain product liability insurance at acceptable cost or to otherwise protect against potential product liability claims could prevent or inhibit the commercialization of products developed. A product liability claim could have a material adverse effect on the business, financial condition and results of operations.

Uncertainties Relating to Pricing and Third-Party Reimbursement

Our operating results may depend in part on the availability of adequate reimbursement for our products from third-party payers, such as government entities, private health insurers and managed care organizations. Third-party payers are increasingly seeking to negotiate the pricing of medical services and products. In some cases, third-party payers will pay or reimburse a user or supplier of a product for only a portion of the purchase price of the product. In the case of the products, payment or reimbursement by third-party payers of only a portion of the cost of such products could make such products less attractive, from a cost perspective, to users, suppliers and physicians. There can be no assurance that reimbursement, if available, will be adequate. Moreover, certain of the products may not be of the type generally eligible for third-party reimbursement. If adequate reimbursement levels are not provided by government entities or other third-party payers for the products, the business, financial condition and results of operations would be materially adversely affected. A number of legislative and regulatory proposals aimed at changing the United States

’

health care system have been proposed in recent years. While we cannot predict whether any such proposals will be adopted, or the effect that any such proposal may have on its business, such proposals, if enacted, could have a material adverse effect on the business, financial condition or results of operations.

Risk of Product Recall; Product Returns

Product recalls may be issued at our discretion, the FDA or other government agencies having regulatory authority for product sales and may occur due to disputed labeling claims, manufacturing issues, quality defects or other reasons. No assurance can be given that product recalls will not occur

in the future. Any product recall could materially adversely affect the business, financial condition or results of operations. There can be no assurance that future recalls or returns would not have a material adverse effect upon the business, financial condition and results of operations.

Risks of International Sales and Operations

Our results of operations are subject to fluctuations in the value of the Euro against the U.S. Dollar due to our German subsidiary. Although management will monitor exposure to currency fluctuations, there can be no assurance that exchange rate fluctuations will not have a material adverse effect on the results of operations or financial condition. In the future, we could be required to sell its products in other currencies, which would make the management of currency fluctuations more difficult and expose us to greater risks in this regard.

Our products will be subject to numerous foreign government standards and regulations that are continually being amended. Although we will endeavor to satisfy foreign technical and regulatory standards, there can be no assurance that our products will comply with foreign government standards and regulations, or changes thereto, or that it will be cost effective for us to redesign its products to comply with such standards or regulations. The inability of us to design or redesign products to comply with foreign standards could have a material adverse effect on our business, financial condition and results of operations.

Lack of Commercial Manufacturing and Marketing Experience

We have not yet manufactured products in commercial quantities. The Company and its manufacturing contractors and partners will be engaged in manufacturing pharmaceutical products which will be subject to stringent regulatory requirements. No assurance can be given that we, on a timely basis, will be able to make the transition from manufacturing clinical trial quantities to commercial production quantities successfully or be able to arrange for contract manufacturing. The Company and our subsidiary have limited experience in the sales, marketing and distribution of products. There can be no assurance that we will be able to establish sales, marketing and distribution capabilities or make arrangements with collaborators, licensees or others to perform such activities or that such effort will be successful.

The manufacture of the products involves a number of steps and requires compliance with stringent quality control specifications imposed by us and by the FDA or similar regulatory bodies under the law of the respective countries. Typically, our products can only be manufactured in a facility that has undergone a satisfactory inspection by the FDA or similar regulatory bodies under the law of the respective countries. For these reasons, we would not be able to quickly replace its manufacturing capacity if one of our manufacturing contractors or partners were unable to use their manufacturing facilities as a result of a fire, natural disaster, equipment failure or other difficulty, or if such facilities are deemed not in compliance with the FDA's Good Manufacturing Practice (

“

GMP

”

) requirements and the non-compliance could not be rapidly rectified. The inability or reduced capacity to manufacture their products would have a material adverse effect on our business and results of operations.

We have entered and may enter into arrangements with contract manufacturing companies to expand its production capacities in order to satisfy requirements for its products, or to attempt to improve manufacturing efficiency. If we choose to contract for manufacturing services and encounters delays or difficulties in establishing relationships with manufacturers to produce, package and distribute its finished products, clinical trials, market introduction and subsequent sales of such products would be adversely affected. Further, contract manufacturers must also operate in compliance with the FDA's GMP requirements; failure to do so could result in, among other things, the disruption of product supplies.

Currently, we have our products manufactured by contract manufacturers in Germany. No assurance can be given, that the vendors will be willing or able to produce the products in the required quality or quantities or at prices which will enable us to sell the end products as requested by its customers.

Risks resulting from investing and financing activities

We may from time to time in the ordinary course of business carry out certain investing or financing transactions including extending loans to non-related third parties or the purchase of treasury stocks. Such transactions are subject to certain risks including but not limited to the inability of borrowers to redeem interest and principal of such loans, the inability of the company to capitalize on collaterals provided by the borrowers if any, or the devaluation of the treasury stock. In the event that one or more of these risks actually occur, the company may be confronted with the situation that it in turn may not be able to refinance its ongoing operations.

Hazardous Materials and Environmental Matters

Our research and development processes involve the controlled storage, use and disposal of hazardous materials. We are subject to federal, state and local laws and regulations governing the use, generation, manufacturing, storage, handling, and disposal of such materials and certain waste products. Although we do not currently manufacture commercial quantities of product candidates, we produce limited quantities of such products for clinical or preclinical trials or comparable laboratory testing necessary for research or product development and we may eventually intend to manufacture commercial quantities of our products. Although we believe that our safety procedures for handling and disposing of such materials comply with the standards prescribed by the ISO 9001:2000 (General Quality Management System) and ISO 13485:2003 (Medical Products Quality Management System), the risk of accidental contamination or injury from these materials cannot be completely eliminated. In the event of such an accident, we could be held liable for any damages that result, and any such liability could exceed our resources. There can be no assurance that we will not be required to incur significant costs to comply with current or future environmental laws and regulations nor that the operations, business or assets will not be materially or adversely affected by current or future environmental laws or regulations.

Fluctuations in Foreign Currency Exchange Rates could have an Adverse Impact

Because a portion of our total income is derived from international operations that are conducted in foreign currencies, changes in value of these foreign currencies relative to the US dollar may affect our results of operation and financial position. If for any reason exchange or price controls or other restriction on the conversion of foreign currencies were imposed, our business could be adversely affected.

Risks Related to Our Securities

Trading and limited market

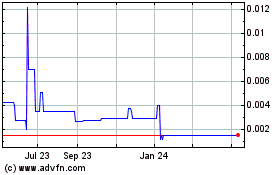

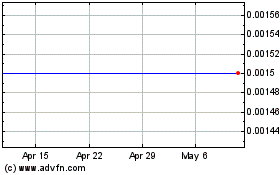

At the present time, the Company

’

s common stock is traded on the OTCQB under the symbol SGBI. There is currently a limited public market for the Common Stock and there can be no assurance that an active trading market will develop or, if one does develop, that it will be maintained. If such a market arise, the possibility or actual sale into the market of shares of the Company's Common Stock may adversely affect prevailing market prices for the Company's Common Stock and could impair the Company's ability to raise capital through the sale of its equity securities. In order to qualify for resale of our Common Stock under Rule 144, certain criteria must be met. There is no assurance that investors will be able to rely on its provisions of Rule 144 now or in the future.

No dividends

No cash dividends have been paid. Payment of dividends on the Common Stock is within the discretion of the Board of Directors, is subject to state law, and will depend upon the Company's earnings, if any, its capital requirements, financial condition and other relevant factors.

Possible volatility of stock price

The market price of the Company

’

s securities is likely to be highly volatile. Factors such as the market acceptance of the Company's products, success of distribution channels or its competitors, announcements of technological innovations or new commercial products by the Company or its competitors, developments in trademark, patent or other proprietary rights of the Company or its competitors, and fluctuations in the Company's operating results may have a significant effect on the market price of the Common Stock. In addition, the stock market has experienced and continues to experience extreme price and volume fluctuations which have affected the market price of many companies and which have often been unrelated to the operating performance of these companies. These broad market fluctuations, as well as general economic and political conditions, may adversely affect the market price, if a market develops, of the Common Stock. See

“

Description of Capital Stock

”

.

We are subject to the periodic reporting requirements of the Securities Exchange Act of 1934, which require us to incur audit fees and legal fees in connection with the preparation of such reports. These additional costs could reduce or eliminate our ability to earn a profit

We are required to file periodic reports with the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934 and the rules and regulations promulgated thereunder. In order to comply with these requirements, our independent registered public accounting firm has to review our financial statements on a quarterly basis and audit our financial statements on an annual basis. Moreover, our legal counsel will have to review and assist in the preparation of such reports. The costs charged by these professionals for such services cannot be accurately predicted at this time because factors such as the number and type of transactions that we engage in and the complexity of our reports cannot be determined at this time and will have a major effect on the amount of time to be spent by our auditors and attorneys. However, the incurrence of such costs will obviously be an expense to our operations and thus have a negative effect on our ability to meet our overhead requirements and earn a profit. We may be exposed to potential risks resulting from new requirements under Section 404 of the Sarbanes-Oxley Act of 2002. If we cannot provide reliable financial reports or prevent fraud, our business and operating results could be harmed, investors could lose confidence in our reported financial information, and the trading price of our common stock, if a market ever develops, could drop significantly.

We do not have a sufficient number of employees to segregate responsibilities and may be unable to afford increasing our staff or engaging outside consultants or professionals to overcome our lack of employees. During the course of our testing, we may identify other deficiencies that we may not be able to remediate in time to meet the deadline imposed by the Sarbanes-Oxley Act for compliance with the requirements of Section 404. In addition, if we fail to achieve and maintain the adequacy of our internal controls, as such standards are modified, supplemented or amended from time to time, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act. Moreover, effective internal controls, particularly those related to revenue recognition, are necessary for us to produce reliable financial reports and are important to help prevent financial fraud. If we cannot provide reliable financial reports or prevent fraud, our business and operating results

could be harmed, investors could lose confidence in our reported financial information, and the trading price of our common stock, if a market ever develops, could drop significantly.