Comcast Shares Slide After Regulators Accept Sky Bid --update

September 24 2018 - 1:48PM

Dow Jones News

By Kimberly Chin

Shares of Comcast Corp. fell Monday after the cable company won

a bid over the weekend to gain control of European pay-TV giant Sky

PLC.

Comcast's offer of GBP17.28 ($22.59) a share surpassed 21st

Century Fox Inc.'s highest bid of GBP15.67 a share after three

rounds of bidding Saturday, in a rare auction held by British

regulators.

Comcast's winning bid, valued at $38.8 billion, was up 40.1%

above its initial bid of GBP12.50 a share in February and Fox's

initial GBP10.75-a-share bid in December 2016.

Comcast's stock fell 7% to $35.24, bringing its decline so far

this year to 12%.

Sky sells phone, TV and internet services to 23 million European

customers and produces its own news, entertainment and sports

programming.

While the deal will ultimately shore up its defenses against a

rising threat from Silicon Valley giants such as Netflix Inc.,

MoffettNathanson analysts say Comcast "grossly overpaid" for the

assets.

Moreover, a large swath of Sky's business is still in satellite

television. In an era of cord-cutting, the satellite video

distribution model is "becoming increasingly obsolete,"

MoffettNathanson analysts said in a note. "Whatever growth Comcast

can generate in its new business will have to offset what we expect

to be inevitable declines in its core."

Analysts at Oppenheimer also said Comcast, while potentially

benefiting from Sky's offerings globally, has not won the battle

against streaming competition in its home market. Comcast, the

analysts said in a note, will still need to invest in its wireless

5G technology and streaming technology to buffer against a

shrinking U.S. cable industry.

This past summer, Comcast lost a bidding war to Walt Disney Co.

for Fox's entertainment assets. Disney agreed to pay $71 billion

for Fox's television studio and international assets, including a

39% stake in Sky that Fox had long held. That bigger deal is

expected to close in the coming months.

If Fox had won the weekend's auction for Sky, Disney would

ultimately have taken 100% control of the pay-TV company. Instead,

attention will now turn to whether Disney will sell the 39% stake

in Sky -- its value has increased by the bidding competition -- or

remain a minority partner for Comcast.

Fox said in a statement Sunday it was considering its options

regarding its 39% stake in Sky.

Comcast Chief Executive Brian Roberts has said he would be

prepared to jointly own Sky with a rival. Rupert Murdoch and his

family are major shareholders in Fox and Wall Street Journal parent

News Corp.

To seal control of Sky, Comcast needs more than 50% of Sky's

shareholders to support the offer. That seems likely given the wide

gap between the bids. But it could still prove challenging if

Disney and Fox decide against tendering to the offer.

Shares in Sky closed up 8.6% in London trading Monday.

Shares in Disney rose 1.4% to $112 in afternoon trading while

shares of 21st Century Fox climbed 1.3% to $44.68.

Write to Kimberly Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

September 24, 2018 13:33 ET (17:33 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

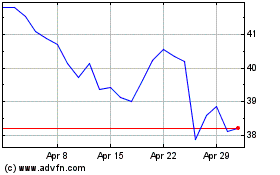

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024