By Stu Woo and Ben Dummett

LONDON -- The same type of blind auction used to pick players in

fantasy football leagues could decide the fate of Sky PLC, a media

company that employs 30,000 people and has a stock-market value of

$36 billion.

Comcast Corp. on Saturday is slated to bid against a team of

Walt Disney Co. and 21st Century Fox Inc. in a day-long auction

here that -- if it goes down to the wire -- will culminate in the

two sides submitting secret bids to a British regulator. A winner

will be disclosed later in the day.

Blind-auction strategy is complex, as each side tries to figure

out how much it needs to pay to win while trying to avoid

overspending. It has fostered a cottage industry of auction

consultants, many of whom hold doctorates in game theory, a branch

of math that studies how players in strategic contests make

decisions. While investment bankers are used to engaging in such

high-dollar auctions, it is unusual to have a government-mandated

"sealed-bid" process for such a big, publicly traded company.

"Game theory as a topic is well-understood by academics and has

long been studied, but game theorists who also understand the

market context are not that common," said Steve Blythe, who

oversees cellular-airwave auctions for French wireless carrier

Orange SA.

Complicating matters in the Sky auction: Fox already owns 39% of

the London-based company, and Disney earlier this year agreed to

buy a big chunk of Fox, including its Sky stake.

That arrangement puts Disney and Fox on the same side of the

table, but with Disney calling the shots. It also gives Disney an

incentive to maximize bidding, even if it doesn't ultimately

prevail. A higher price would allow Disney to offload its Sky stake

at a premium -- though it doesn't necessarily have to sell.

Fox, Comcast and Sky declined to comment on the auction. Disney

didn't respond to requests for comment. Rupert Murdoch and his

family are major shareholders of Fox and News Corp, which publishes

The Wall Street Journal.

Mr. Murdoch has long sought to consolidate his holding in Sky.

Disney and Comcast see Sky as a way to expand internationally. The

broadcaster also sells wireless, TV and internet services

throughout Europe, and it is a media company that produces its own

news, entertainment and sports programming.

Both sides agreed to the auction's terms. The U.K Takeover

Panel, the agency running the auction, polices big deals involving

British companies. It has the power to force a formal auction to

prevent a never-ending series of bids and counterbids, and it

worked out the process with the companies.

Under the auction rules, only Fox can bid in the first round

because Comcast enters the processing having already made a higher

bid. In the second round, Comcast can counterbid. If that doesn't

determine a winner, each side can submit sealed-bid offers in the

third and final round.

Maher Said, a New York University Stern School of Business

professor who focuses on auctions, said the first step in an

auction like this is figuring out how much the asset is really

worth to you, and then what you think it's worth to your rival.

Next is gaming out a range of possible bids from your rival.

"The concern is you don't want to raise the price so high and

end up holding the bag," he said.

Fox initially bid GBP10.75 a share for Sky in December 2016.

Comcast's current offer, made in July, is GBP14.75 a share --

already 37% above Fox's first offer.

Blind auctions are more common in other industries. For example,

wireless carriers often hire outside, game-theory advisers when

bidding for rights to cellular airwaves, which governments

world-wide typically sell at auction.

Not all wireless auctions are blind, but the ones that are tend

to be the hardest kind to prepare for, Orange's Mr. Blythe

said.

"It's difficult to persuade your boss you did a good job," he

said. Here's the dilemma: Bid too low and lose. Bid too high and

risk spending much more money than needed.

For example, let's suppose you bid for a house. Your $450,000

offer wins. But then you learn the second-highest bid was $300,000.

Would you really feel like a winner?

Mr. Blythe's goal is to win cellular airwaves at a price at

which Orange would profit. Failing that, his goal is to make rivals

spend as much as possible, he said. With millions or billions of

dollars on the line, wireless carriers recruit the few top-tier

game theorists with experience.

The tricky part is that buyers might value assets differently.

Consider fantasy-football leagues. Many of these online games give

each player a budget to bid on free agents during the season. This

week, many players are bidding for Atlanta Falcons running back

Tevin Coleman, a second-string player now coveted after an injury

sidelined starter Devonta Freeman.

"If you're looking for a replacement running back, you're going

to be bidding for Tevin Coleman," said Adam Hoffer, a University of

Wisconsin at La Crosse economics professor who co-wrote a paper

about fantasy-football economics. "But you know the person who owns

Devonta Freeman is going to bid high," too.

Write to Stu Woo at Stu.Woo@wsj.com and Ben Dummett at

ben.dummett@wsj.com

(END) Dow Jones Newswires

September 21, 2018 05:44 ET (09:44 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

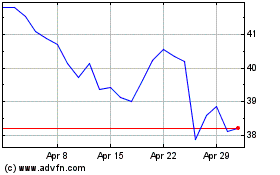

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024