Nestlé Puts Unit Under Review -- WSJ

September 21 2018 - 3:02AM

Dow Jones News

By Saabira Chaudhuri and Brian Blackstone

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 21, 2018).

Nestlé SA is exploring strategic options for its skin-health

unit, a business analysts say could fetch $4.1 billion, its latest

move to narrow its focus to food and beverages as it faces pressure

from an activist investor.

The Swiss consumer goods giant Thursday didn't specifically say

the unit, which generated 2017 revenue of 2.7 billion Swiss francs

($2.79 billion), was up for sale but such reviews often end with a

disposal. Nestlé recently sold its U.S. confectionery and Gerber

life-insurance businesses after similar reviews.

Nestlé didn't disclose an estimated value for the skin-health

division, which includes face-care products Cetaphil and Proactiv,

but it could fetch about 4 billion francs, according to Jefferies

analyst Martin Deboo. Mr. Deboo said the review was significant

because it showed a "willingness to slay sacred cows."

The move comes as Nestlé faces pressure from activist investor

Daniel Loeb who took a $3.5 billion stake in the company last year

and has made a string of demands, including that it sell its stake

in L'Oréal SA and the skin-health arm.

The review is likely to close the door on a business that Nestlé

just four years ago touted as one of its most promising. Nestlé

established its skin-health unit in 2014 after taking full control

of Galderma, which added acne and skin-cancer treatment to its

portfolio. Nestlé said at the time it wanted to take a more

holistic approach to health than "mere nutrition" and bolstered the

unit with several acquisitions including a $1.4 billion deal for

skin-care products from Valeant Pharmaceuticals Inc.

But as sales growth slowed, investors questioned how the unit

fit into Nestlé's broader business. Nestlé had until now worked to

fix problems at its skin-health business, which suffered after

investing aggressively in consumer skin-care products and as

patents on prescription products expired.

But Thursday, Nestlé said it had decided the unit's growth

opportunities "lie increasingly outside the group's strategic

scope." It expects the review to be completed by mid-2019.

Nestlé generated nearly 90 billion francs of sales last year but

is shuffling its huge portfolio of products, ranging from Maggi

noodles to Purina pet food and DiGiorno frozen pizza, to combat

slowing growth. Chief Executive Mark Schneider had committed to

shuffling 10% of Nestlé's portfolio but Thursday's announcement

goes 3% above that said Mr. Deboo.

Like other consumer-goods companies, Nestlé has struggled with

changing consumer tastes that favor local, organically produced

food and difficulty in raising its prices amid a low-inflation

environment. Mr. Schneider hopes that by narrowing its focus to

fast-growing parts of its business including coffee, bottled water

and pet food, he can lift sales growth, which last year weakened to

its slowest pace since at least the mid-1990s.

On Monday, Nestlé said it would sell its Gerber Life Insurance

unit to Western & Southern Financial Group for $1.55 billion in

cash. In January, it sold its U.S. confectionery business -- which

includes Butterfinger and Baby Ruth candy bars -- to Italian candy

maker Ferrero International SA for $2.8 billion in cash.

Mr. Loeb, since taking his stake, has been vocal in criticizing

Nestlé, noting just half its sales comes from the businesses Mr.

Schneider has said are key for growth: coffee, petcare, water and

infant nutrition. He said Nestlé could rid itself of frozen food,

ice cream, packaged meats, pasta and peanut milk in addition to

other assets.

"We expect Nestlé to further divest nonstrategic,

underperforming assets," said analysts at Vontobel, in reaction to

Thursday's announcement on skin health.

Meanwhile, Nestlé has made some splashy acquisitions,

particularly in coffee. In May, it bought the rights to market and

sell Starbucks coffee and tea products in grocery and retail stores

for more than $7 billion. Last year, Nestlé bought a majority stake

in U.S. premium coffee chain Blue Bottle.

Alberto Delclaux contributed to this article.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com and

Brian Blackstone at brian.blackstone@wsj.com

(END) Dow Jones Newswires

September 21, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

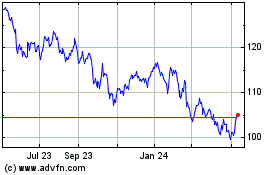

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Apr 2023 to Apr 2024