U.K. Pulls Brakes on Novartis' CAR-T Drug in First European Setback -- Update

September 19 2018 - 1:34PM

Dow Jones News

By Donato Paolo Mancini and Carlo Martuscelli

Novartis AG's (NOVN.EB) immunotherapy Kymriah is too expensive

to be recommended for use in adults with B-cell lymphoma that have

relapsed or haven't responded to first-line treatment, a U.K.

regulator said Wednesday, despite the Swiss pharma giant offering a

discount on its hefty list price--the first major setback for the

company's drug in Europe.

The National Institute for Health and Care Excellence earlier

this month recommended the therapy for use in pediatric patients

with a different kind of blood cancer.

In a statement, NICE recognized that Kymriah had significant

clinical benefits, with response rates of about 40% in two studies,

and overall survival rates of about one to two years. But it

justified its decision not to recommend the therapy for cancer

patients with limited options because there is currently no data

comparing Kymriah to salvage chemotherapy, the most common

treatment currently used for that group. A spokeswoman added

separately that cost was a determining factor in the decision.

"Although we could not recommend [Kymriah] for adults with

lymphoma, we welcome further discussions around the

cost-effectiveness of the treatment and engagement with

stakeholders," NICE said.

Kymriah's list price for this indication is 282,000 British

pounds ($371,000). Pharma companies typically offer sizeable

discounts to access the British market, and negotiations usually

see the U.K. succeeding in pushing those discounts further down. "I

wouldn't be surprised if Novartis offered a 30% or 40% discount [to

the list price]," said Bruno Bulic of Baader Helvea.

CAR-T is a kind of cell therapy that works by extracting blood

cells, modifying them, and then reinjecting them into the

bloodstream to attack the cancer. The infrastructure around the

treatment can be very expensive. In the U.S., the cost of the drug

can balloon to USD1 million, including hospital visits and other

costs.

Last month, the same regulator also rejected Gilead Sciences

Inc.'s (GILD) own homologue for similar indications because it was

too expensive.

Markets observers and analysts say that pharma giants are under

considerable pressure to price their drugs as evenly as possible

across world markets. Confidential negotiations between regulators

and companies help hedge against pressure, said Mr. Bulic. "There

would be a dangerous precedent [otherwise]", he said.

While the decision is important for patients and it reinforces

the idea that public health systems are driven to negotiate harder

on discounts, the move has no immediate financial impact on the

company, added Mr. Bulic, because sales aren't expected to reach

levels that affect profitability before the next decade.

Novartis said that while it was disappointed and surprised by

this preliminary decision, it recognizes that Kymriah is radically

different from other treatments, and that it may be challenging to

adequately compare it with existing therapies. The company said it

is working with NICE to define relevant studies and will continue

to support the recommendation of the treatment for patients with

limited treatment options.

NICE's decision isn't final. It said that it'll consider any new

evidence submitted to support the recommendation for Kymriah use in

this category of patients in late October.

--Jonathan D. Rockoff contributed to this article.

Write to Donato Paolo Mancini at

donatopaolo.mancini@dowjones.com and to Carlo Martuscelli at

carlo.martuscelli@dowjones.com

(END) Dow Jones Newswires

September 19, 2018 13:19 ET (17:19 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

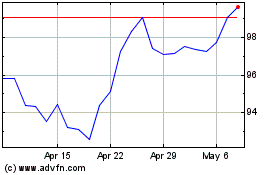

Novartis (NYSE:NVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

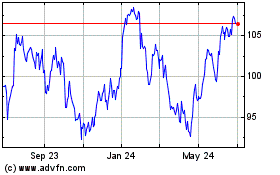

Novartis (NYSE:NVS)

Historical Stock Chart

From Apr 2023 to Apr 2024