Danish Bank Knew of Russia Clients -- WSJ

September 19 2018 - 3:02AM

Dow Jones News

By Patricia Kowsmann, Drew Hinshaw and Bradley Hope

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 19, 2018).

Bank officials at the center of one of Europe's largest money

laundering scandals knew earlier than previously indicated about

problems at its tiny Estonian branch, including that it held

accounts for blacklisted Russian clients, according to

correspondence seen by The Wall Street Journal and Estonia's

financial regulator.

It is the latest indication that officials at Danske Bank were

aware almost two years before it started shutting questionable

accounts that the small but highly profitable branch was involved

in potentially illicit money flows.

Danske Bank, Denmark's biggest bank, is being probed by U.S.

authorities who want to know why its tiny branch in the former

Soviet republic of Estonia processed as much as $150 billion in

transactions from 2007 to 2015 from foreign countries, mainly

Russia. Denmark's politicians -- and a falling share price -- have

put pressure on the bank to disclose how much its executives knew

about any suspicious money shifting through there. The bank is

scheduled to disclose findings from an internal probe on

Wednesday.

A Danske spokesman declined to comment.

In an April 2013 email, Danske Bank's anti-money-laundering

chief, based in Denmark, asked colleagues in the Estonia branch

about client accounts whose owners appeared on a blacklist

generated by Russia's central bank. Russia's central bank keeps a

database of individuals and companies suspected of financial

wrongdoing -- about 500,000 presently -- and shares it across

borders.

Estonian authorities had repeatedly complained to Denmark's

banking supervisor, the email said: "They have the impression that

we do not take the issue very seriously," wrote Niels Thor

Mikkelsen, the bank's then-compliance executive.

The Danish Financial Supervisory Authority -- in charge of

making sure Denmark's banks obey anti-money-laundering rules -- was

"very worried because they have confirmed to U.S. authorities that

we comply with Danish [anti-money-laundering] requirements," he

wrote, copying the email to several employees of the branch. "The

Danish FSA has helped the Bank in a critical situation. They are

now very worried that any situation may arise."

It wasn't clear, Mr. Mikkelsen wrote, if Danske Bank's Estonia

branch was indeed in compliance. He asked a series of questions

about the blacklisted clients, such as "How do we handle their

relationship?"

Mr. Mikkelsen declined to comment, citing legal secrecy. In an

email Tuesday, Estonia's Financial Supervision Authority confirmed

it repeatedly complained to Danish counterparts about the branch's

blacklisted customers.

A spokesman for the Danish FSA referred to a paragraph in a

reprimand ruling it issued against Danske in May, which says it

received "misleading" information from the bank between 2012 and

2014. Danske says the information it received came from the

branch.

The Russian Central Bank didn't immediately respond to requests

for comment.

The email about the Russian blacklist indicates Danske Bank

officials were aware of problems in the first half of 2013.

According to a statement it published in July, Danske Bank said it

got word of serious problems at its Estonia branch when a

whistleblower tipped them off in December 2013.

Banking blacklisted clients could put Danske afoul of regulators

in Russia, where the Danish bank has a subsidiary.

"The Russian Central Bank is by Russian standards relatively

reputable," said Mark Galeotti, an expert on Russian financial

crime at Prague's Institute of International Relations. "You take

the names that are on that list seriously."

Danske is Denmark's largest bank, holding over a third of the

country's customer deposits. It expanded in recent decades across

Northern Europe and the Baltics.

The Estonia branch was one of its profit drivers, making EUR63

million ($73.5 million) in 2012 in net profits, the branch's most

lucrative year, according to the bank supervisor's records. That

year, the entire bank, still wrestling with the aftermath of the

2008 financial crisis, reported EUR636.6 million in net

profits.

Write to Patricia Kowsmann at patricia.kowsmann@wsj.com, Drew

Hinshaw at drew.hinshaw@wsj.com and Bradley Hope at

bradley.hope@wsj.com

(END) Dow Jones Newswires

September 19, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

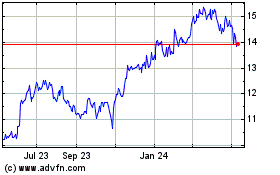

Danske Bank AVS (PK) (USOTC:DNKEY)

Historical Stock Chart

From Mar 2024 to Apr 2024

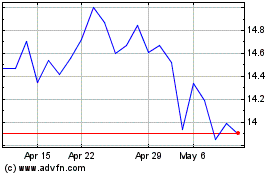

Danske Bank AVS (PK) (USOTC:DNKEY)

Historical Stock Chart

From Apr 2023 to Apr 2024