Blackstone group uses a $13.5 billion financing to acquire a

stake in a Thomson Reuters unit

By Sam Goldfarb and Soma Biswas

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 19, 2018).

One of the largest-ever sales of speculative-grade debt was

completed with ease on Tuesday, a sign of the favorable environment

for U.S. borrowers at a time of robust economic growth and strong

demand from investors.

The $13.5 billion sale -- which a Blackstone Group LP-led

investor group is using to acquire a 55% stake in a Thomson Reuters

Corp. data business called Refinitiv -- comprised $9.25 billion of

loans and $4.25 billion of secured and unsecured bonds, with

different pieces denominated in U.S. dollars and euros.

Including a $750 million revolving credit line, the

bond-and-loan deal amounted to the ninth-largest leveraged

financing on record in the U.S. and Europe, and was the

fourth-largest since the financial crisis, according to LCD, a unit

of S&P Global Market Intelligence.

Refinitiv's cash-raising effort was viewed on Wall Street as a

test for how much debt companies with poor credit ratings can issue

in the current market and how aggressively they can set the terms

of such deals.

While they have been rare in recent years, supersized buyouts

inevitably stir memories of the years immediately preceding the

financial crisis, when there was a rash of such deals that were

quickly followed in some cases by bankruptcy or other forms of

distress.

Refinitiv's debt offering was "reminiscent of the kind of deal I

would have seen in 2006 and 2007," said Scott Roberts, head of

high-yield investments at Invesco.

Along with the total debt being issued, "you have a covenant

package that's extremely weak" and ambitious assumptions about

future cost savings, he added.

Still, Refinitiv was able to issue most pieces of its debt

package at yields comfortably below what it initially proposed to

investors. Among those were $1.575 billion of eight-year unsecured

bonds issued at par with an 8.25% coupon, down from original

guidance in the low-9% area. The unsecured bonds are rated Caa2 by

Moody's Investors Service and B- by S&P Global Ratings, near

the bottom of the ratings spectrum.

On Monday, the company had increased the total size of the loans

by $1.25 billion and shrunk the size of the bonds by the same

amount. In a gesture to investors, it also adjusted the terms of

its loans to reduce the amount of future debt it can issue relative

to its initial proposal.

Institutional investors led by Blackstone are paying $17 billion

to take the 55% stake in Refinitiv, which serves banks, money

managers and other financial institutions. Thomson Reuters will

retain the remaining 45%.

Excluding $650 million of annual projected cost cuts,

Refinitiv's debt will amount to a little more than seven times its

adjusted earnings before interest, taxes, depreciation and

amortization, or Ebitda, according to the research firm

CreditSights. Some investors estimate leverage is above eight times

Ebitda.

Lending guidelines issued by U.S. regulators in 2013 tried to

discourage banks from underwriting deals where debt totaled more

than six times Ebitda. Regulators, however, have softened their

stance over the past year, emphasizing that the guidelines are

nonbinding and suggesting they would ease efforts to keep banks

from straying from them.

High leverage wasn't the only way Refinitiv has tested

investors. Under the proposed terms of its bonds, the company could

pay dividends to its owners even if it came under severe financial

distress, a provision that the research firm Covenant Review

described as "wildly off market."

At the same time, Refinitiv boasts a relatively stable base of

customers and generated free cash flow of more than $1 billion over

the 12-month period ended June 30, according to CreditSights. That

number should go up if Blackstone can cut costs and if it can use

its connections on Wall Street to reach new customers, investors

said. That, in turn, should allow it to reduce leverage.

Even before regulators softened their stance on lending

guidelines, companies interested in taking on a lot of debt could

go to unregulated banks. Regulated banks also sometimes exceeded

the six-times leverage test on deals where they could argue there

was a clear path to reducing leverage in the future.

In the second quarter of this year, nearly 15% of new U.S. loans

backing leveraged buyouts were issued by companies with

debt-to-Ebitda ratios of at least seven times, the highest

percentage since the third quarter of 2014, when 20% of deals were

in that category, according to LCD.

The recent uptick in highly leveraged deals comes as overall

corporate leverage has been on a modest downward trend. The

slowdown in borrowing is one reason why investors say there has

been a warm reception to companies such as Refinitiv, as investors

look to put their cash to work in the face of limited supply of new

debt.

As of Monday, the average yield on speculative-grade bonds was

3.18 percentage points above Treasurys, compared with 3.43

percentage points at the end of last year, based on Bloomberg

Barclays data. The drop indicates healthy demand for the asset

class.

The success of Refinitiv's debt offering bodes well for other

large, private-equity deals that are currently in the market and in

the pipeline. Among those: a EUR10.1 billion ($11.8 billion)

purchase including debt of Dutch paints giant Akzo Nobel NV's

specialty-chemicals unit by a consortium led by Carlyle Group LP

that is being funded in part by EUR6.5 billion of bonds and loans,

which are expected to include euro and U.S. dollar tranches.

--Miriam Gottfried contributed to this article.

Write to Sam Goldfarb at sam.goldfarb@wsj.com and Soma Biswas at

soma.biswas@wsj.com

(END) Dow Jones Newswires

September 19, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

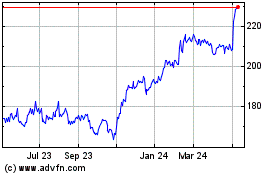

Thomson Reuters (TSX:TRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

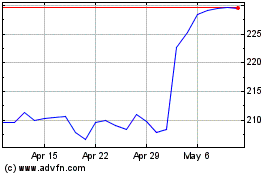

Thomson Reuters (TSX:TRI)

Historical Stock Chart

From Apr 2023 to Apr 2024