By Sarah Nassauer and Josh Zumbrun

The U.S. decision to impose tariffs on Chinese bicycles,

handbags and thousands of other consumer goods won't hit most items

that will be in stores this holiday season, but retailers are

hustling to speed some shipments through ports and bracing for

higher costs next year.

President Trump said Monday he would slap the new tariffs on

about $200 billion in Chinese imports, including typical holiday

purchases such as Christmas lights and wrapping paper. The 10% duty

will take effect Sept. 24 and will rise to 25% at the end of the

year, according to administration officials.

The timing means most holiday goods for 2018 aren't likely to be

subject to big price increases, said industry consultants and

executives, because many leading chains like Walmart Inc. and J.C.

Penney Co. already have imported most of their winter items, and

the strong U.S. economy will allow retailers and their suppliers to

absorb much of the initial costs.

"Ten percent seems like a wash with the appreciation of the U.S.

dollar, " said Murali Gokki, managing director at consultancy

AlixPartners. But, he said, over the holidays the tariffs could

affect smaller retailers that ship seasonal items late or retailers

importing hot items at the last-minute.

"Most large retailers already have landed most of their holiday

goods by the first of October," said Chris Sultemeier, former

executive vice president of logistics for Walmart, who left the

world's largest retailer last year. He said the tariffs will have a

greater impact on goods that will arrive at U.S. ports in November,

December and beyond. Retailers probably will try to accelerate

spring products through customs before the potential 25% tariff

takes effect, he said.

The initial tariffs implemented by the U.S. earlier this year

have had mostly limited macroeconomic impacts because the goods

affected by them -- including washing machines and solar panels --

were a small part of the economy. The latest tariffs against China

significantly raise the stakes, with tariffs now hitting about 11%

of total U.S. imports and around half of all trade with China.

While some companies can shift their supply chains to avoid the

tariffs, the impact could be unavoidable for others, said Craig

Allen, the president of the U.S.-China Business Council, a

Washington trade group which represents American companies doing

business in China. "There's no doubt there's a huge amount of ships

on the water right now whose products will be affected by this," he

said.

An analysis from Moody's estimated the planned trade

restrictions would exact their greatest toll next year, reducing

the U.S. economy's growth rate by 0.25 percentage points in 2019.

Moody's estimates the economy will grow 2.3% in 2019, a sharp step

down from the 4.2% annualized rate reached in the second quarter of

this year.

Some products will be hit indirectly. The latest round will

affect some toy companies that finish their products in the U.S. as

a result of tariffs on dyes and some materials that are used in

packaging, said Steve Pasierb, president of the Toy Association

Inc., a trade group whose members include Mattel Inc. and Hasbro

Inc.

"It's survivable, not a crisis," Mr. Pasierb said. Finished toys

like Barbie dolls and Nerf guns haven't been hit by tariffs yet,

but Mr. Pasierb worries they will be as the trade tensions

escalate. "They're running out of things to put tariffs on."

The latest tariffs list will hit many consumer and household

goods, including knit hats and plastic raincoats, handbags and

wallets, toaster ovens and power tools. Other items, including

Apple Inc. smartwatches and Nike Inc. sneakers, aren't

included.

Many retailers said Tuesday they were still evaluating the list

of products subject to tariffs and talking with suppliers, saying

it was too soon to change course. They had warned ahead of the

decision they cannot easily shift suppliers and that for certain

items there aren't factories outside China ready to produce

them.

"This year's holiday orders have already been placed, and orders

for next Spring are well in process," lawyers for J.C. Penney wrote

earlier this month to the administration. They noted the department

store makes purchasing decisions up to a year in advance and that

it can take more than two years to find and audit new

suppliers.

The retailer said China accounts for 79% of imports of knit hats

and that the next biggest importer, Vietnam, accounts for 9%. "For

product after product, there is little to no production capacity

outside of China," the company said. A spokeswoman declined to

comment further.

Matt Priest, CEO of the Footwear Distributors and Retailers of

America, whose members include Nike and DSW Inc., said the tariffs

could hurt shoe sales even if footwear isn't included on the list.

"If you start driving up costs, it influences the amount of

discretionary income that consumers have," he said. "July was our

best month ever for shoe stores and then we move into this

uncertainty, which is very concerning to us."

As tariffs are implemented, retailers are likely to try to

minimize price increases for consumers, asking suppliers to bear

some of the cost, reducing their own margins slightly and passing

some of the cost along to consumers. "Retailers are sensitive to

who is going to be the first mover," and will work to cut costs to

limit price increases, said Mr. Gokki at AlixPartners.

"We are closely monitoring the tariff discussions and are

actively working on mitigation strategies," a Walmart spokesman

said. "One of those mitigation strategies is to understand what our

suppliers are doing and what their plans and alternatives are."

The latest action -- a 10% tariff on $200 billion of goods --

would increase costs by $20 billion. If that price increase

happened in one quarter, it would cause a one-time bump in the

inflation rate of about 0.5 percentage points, according to an

estimate from PNC Bank senior economist Bill Adams. Mr. Adams said

companies could import some goods from elsewhere, reduce profit

margins or pursue other strategies that partially mitigate the

price impact.

Customs brokers have been focused on working out which of their

customers will be subject to the new duties and whether their

shipments will beat the Sept. 24 deadline. The phone "hasn't

stopped ringing for weeks," said Mike Lahar, corporate compliance

manager at customs broker A.N. Deringer Inc. "If you're shipping

ocean you're probably going to be out of luck if it's not already

on the water."

--Paul Ziobro and Erica E. Phillips contributed to this

article.

Write to Sarah Nassauer at sarah.nassauer@wsj.com and Josh

Zumbrun at Josh.Zumbrun@wsj.com

(END) Dow Jones Newswires

September 18, 2018 15:45 ET (19:45 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

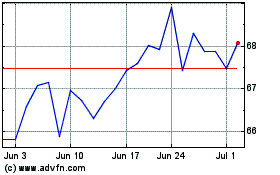

Walmart (NYSE:WMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

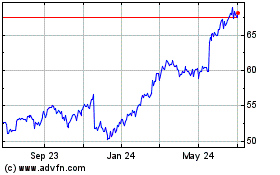

Walmart (NYSE:WMT)

Historical Stock Chart

From Apr 2023 to Apr 2024