Webtec Files Proxy Statement for Proposed GE Deal

September 17 2018 - 9:08AM

Dow Jones News

Wabtec Corp. (WAB) on Monday reiterated its strategic and

financial reasons behind its deal to combine with GE

Transportation.

General Electric Co. (GE) agreed in May to merge its railroad

business with Wabtec in a deal valued at roughly $11 billion.

Wabtec on Monday filed an amended preliminary proxy statement

with the Securities and Exchange Commission for the GE

Transportation deal.

The railroad-equipment company said it sees the deal closing by

the first quarter of 2019.

Wabtec reiterated it expects to have approximately $8 billion in

revenue, a more diversified business mix and higher margins.

The amended preliminary proxy statement includes an adjustment

to harmonize GE Transportation's historical financial information

with Wabtec's revenue recognition accounting policies to prepare

required pro forma financial statements. This is expected to result

in a $63 million decrease in forecasted combined consolidated net

revenue and EBIT in 2019, with no material effect in future

years.

Shares of Wabtec were up 0.3% pre-market to $98.50 in low

volume.

Write to Michael Dabaie at michael.dabaie@wsj.com

(END) Dow Jones Newswires

September 17, 2018 08:53 ET (12:53 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

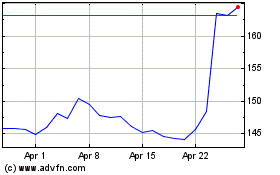

Wabtec (NYSE:WAB)

Historical Stock Chart

From Mar 2024 to Apr 2024

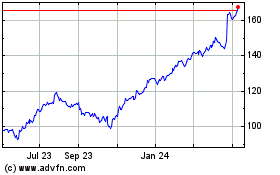

Wabtec (NYSE:WAB)

Historical Stock Chart

From Apr 2023 to Apr 2024