By Khadeeja Safdar

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 17, 2018).

The Nike Inc. ad featuring NFL quarterback-turned-activist Colin

Kaepernick divided American shoe buyers, with some calling for a

boycott of the company and others vowing to buy more of its

sneakers.

Odds are the activism won't last.

Companies from Nordstrom Inc. to L.L. Bean have faced

controversies that prompted a segment of consumers to boycott or

stock up on their products. But research suggests the activism

fades quickly, and when it does shoppers tend to revert to their

previous behavior, leaving the companies no worse or better off

than before.

After Mr. Kaepernick's involvement in Nike's latest ad campaign

was revealed on Labor Day, investors sold shares, critics torched

their shoes and supporters raced to stores. The former Super Bowl

quarterback became a central figure in a political firestorm when

in 2016 he began kneeling on the field during the national anthem

to call attention to racial injustice. Some criticized his protest

as unpatriotic.

Kenyattia Hackworth, a 25-year-old track athlete in Mobile,

Ala., said she went to buy some Nike gear right after the ad was

unveiled and then made a second trip to a Nike store later in the

week with some friends, who also purchased clothes and sneakers.

"I'm going to wear Nike even more now," she said. "I want to show

my support."

For a few days, the ad generated more demand for Nike products

at Stadium Goods, which sells collectible sneakers through its

website and a store in New York, Chief Executive John McPheters

said. "The campaign resonated with a piece of our audience," he

said. "I wouldn't say it's made a massive difference, but there was

a little bit of an uptick in sales." Foot Locker said the response

from the shoe retailer's customers "has been largely positive."

Nike didn't respond to several requests for comment.

Data from a few days later show that the sales pop didn't last

long. Online sales jumped for two days, according to research firm

Edison Trends, which analyzed email receipts from 3 million users.

Sales rose 31% from Sunday through Tuesday, topping the 17%

increase in the same period a year earlier, but by the end of the

week they declined 18% compared with the peak on Tuesday, returning

to around the same level they were before the ad.

Similarly, calls for a boycott came quickly after the ad

appeared. Some people defaced their Nike gear. A few schools,

including College of the Ozarks and Truett McConnell University,

vowed to cut ties with Nike. President Trump wrote on Twitter,

"Just like the NFL, whose ratings have gone WAY DOWN, Nike is

getting absolutely killed with anger and boycotts. I wonder if they

had any idea that it would be this way?"

The reaction, however, cooled down a few days later. Mentions of

#NikeBoycott on Twitter and Instagram peaked one day after Labor

Day with a tally of more than 203,000 and then fell to less than

1,000 a week later, according to data from Brandwatch, a

social-media monitoring company. Nike shares, which had fallen

about 3% the day after the ad was first revealed, recovered all

their losses and Thursday hit an all-time intraday high of

$83.90.

Boycotts generate buzz and can sometimes cause companies to make

concessions if the negative attention poses a reputational risk,

but there is little evidence to suggest that they have a meaningful

impact on sales, said Brayden King, a Northwestern University

professor of management who studied the impact of more than 140

boycotts from 1990 to 2005.

"Consumers aren't as consistent with their behaviors and beliefs

as we think," he said. "People who say they've boycotted a product

might not be in the market for buying that product anyway."

Last year, shoppers promised to boycott L.L. Bean after the

company's heiress Linda Bean was revealed to be a Trump donor. The

same year, supporters of Mr. Trump called for a boycott of

Nordstrom after the department store dropped Ivanka Trump's fashion

line. Nordstrom has had three consecutive quarters of comparable

sales growth. L.L. Bean doesn't report sales figures as it is

privately held.

Nike has a history of making ads that court controversy,

including one in 1995 that featured an openly gay, HIV-positive

runner.

In recent years, Nike has been battling with Adidas AG and Under

Armour Inc. for the attention of young shoppers, who tend to be

more aligned with Mr. Kaepernick's cause. In total, 44% of U.S.

adults who have bought Nike apparel or sneakers in the past three

months fall between the ages of 18 and 34, according to YouGov. The

survey firm's research shows that recent Nike customers are also

more ethnically diverse than the country's population at large.

By featuring Mr. Kaepernick, Nike is making a long-term

investment in its brand, said Dave Cory, co-founder of footwear

brand Obra and formerly a product director at Nike brand

Converse.

"Adidas had been eating Nike's lunch," he said. "Even if the

young kids aren't actively in the market for a pair of sneakers,

Nike is back on their minds."

Greg James, a 31-year-old entrepreneur in Newport, R.I., said he

replaced his boat shoes with his first pair of Nike sneakers this

week. "If they're not going to get support from one side, they

should get it from the other side," he said, though he said he

would continue buying Nike products only if his new shoes perform

well.

Write to Khadeeja Safdar at khadeeja.safdar@wsj.com

(END) Dow Jones Newswires

September 17, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

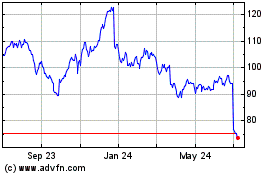

Nike (NYSE:NKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

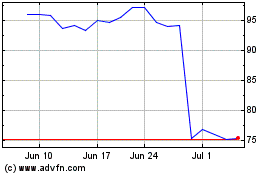

Nike (NYSE:NKE)

Historical Stock Chart

From Apr 2023 to Apr 2024