Update: ING Groep CFO Koos Timmermans Steps Down After Settlement

September 11 2018 - 4:47PM

Dow Jones News

By Nina Trentmann and Mara Lemos Stein

ING Groep NV said its Chief Financial Officer Koos Timmermans is

stepping down, a week after the Dutch lender agreed to pay a record

penalty to settle an investigation on the failure of its

money-laundering controls.

Mr. Timmermans was a member of ING's management board and in

charge of its operations in the Netherlands for much of the period

covered by the investigation, ING said. Last week, the bank agreed

to pay EUR775 million ($897.2 million) to settle the investigation

by Dutch authorities on the shortcomings in its customer

due-diligence policies between 2010 and 2016.

The management change at ING comes amid increasing political

pressure for personal accountability for corporate misconduct,

analysts said. "Somebody had to go, there was a price to pay," said

Jean-Pierre Lambert, an analyst at investment bank Keefe, Bruyette

& Woods Inc.

Regulators focused on ING in part because the bank in 2008

received around EUR10 billion ($11.6 billion) of taxpayer money to

weather the global financial crisis, Mr. Lambert said. The bank

made its final repayment of the bailout money in 2014.

European regulators have been clamping down on financial

wrongdoings but are hampered by a patchwork of local legislation.

Fines imposed by European investigators since 2008 -- a total of

$1.7 billion -- have been much lower than the $23.5 billion levied

by the U.S., according to Fenergo Ltd., a consultancy firm.

Mr. Timmermans was well respected in the financial community and

his departure from ING will be a loss for the bank, Mr. Lambert

said.

Mr. Timmermans joined ING in 1996 and became its CFO last year.

He was previously made the first chief risk officer on ING's

executive board in 2007. He will remain in his post until a

replacement has been found, the bank said.

ING may need more than just a new CFO, Mr. Lambert said. "The

whole management board will have to be reshuffled," he said. "The

CEO [ Ralph Hamers] needs to be better surrounded for the running

of the bank," Mr. Lambert said.

The search for a successor might take a while because as ING

works on rebuilding its reputation, he added.

ING said there was no evidence that any of its employees

collaborated with customers using ING accounts for criminal

purposes, or benefited from the shortcomings of its

money-laundering controls. Instead, there had been a "collective"

failure across all levels, the bank said in a statement.

The investigators focused on four cases in which clients were

able to misuse their ING bank accounts. One involved Dutch-based

telecommunications company VimpelCom Ltd., which operates under the

name Veon Ltd since 2017.

Dutch prosecutors alleged the telecommunications company used

its ING bank accounts to transfer bribes worth tens of millions of

dollars to a company controlled by the daughter of the then

president of Uzbekistan. VimpelCom agreed in February 2016 to pay

$795 million in penalties to U.S. and Dutch authorities to settle a

bribery investigation.

An investigation into ING by U.S. regulators was closed last

week following the settlement in the Netherlands. The U.S.

Securities and Exchange had requested information from the bank in

relation to the investigations by the Dutch prosecutors.

Write to Nina Trentmann at Nina.Trentmann@wsj.com and Mara Lemos

Stein at mara.lemos-stein@wsj.com

(END) Dow Jones Newswires

September 11, 2018 16:32 ET (20:32 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

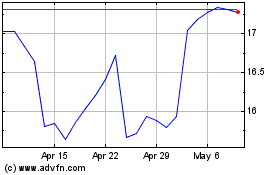

ING Groep NV (NYSE:ING)

Historical Stock Chart

From Mar 2024 to Apr 2024

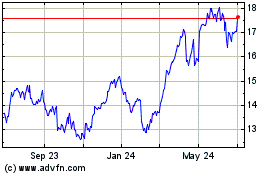

ING Groep NV (NYSE:ING)

Historical Stock Chart

From Apr 2023 to Apr 2024