Annaly Capital Management, Inc. (NYSE:NLY) (“Annaly” or the

“Company”) today announced that it has added senior hires across

its investment groups and within its corporate infrastructure, as

profiled below. Kevin Keyes, Annaly’s Chairman, Chief Executive

Officer and President, commented: “The addition of these seasoned

professionals amplifies the reach of our four investment groups and

broadens Annaly’s risk, strategy, IT and governance expertise. Each

of these individuals bring unique experience which strengthen their

respective groups, and further solidifies Annaly as an industry

leader. Our ongoing investment in our talent, along with our unique

and expansive employee stock ownership guidelines, continue to be

essential elements of our success.”

Additions to Investment Groups

Commercial Real Estate

Timothy (Tim) Gallagher has joined Annaly as Head of the

Commercial Real Estate Group. Tim has over 20 years of commercial

real estate lending and capital markets experience at leading real

estate finance and investment firms. Prior to joining Annaly, Tim

spent time in senior roles at Prima Capital, Morgan Stanley and

Goldman Sachs. Tim is a member of the Executive Committee of the

Board of Governors for the Commercial Real Estate Finance Council

(“CREFC”) and previously served as the Chairman of CREFC’s Board

and a member of the Advisory Board of the Center for Real Estate at

the Fisher College of Business at The Ohio State University.

David Sotolov has joined Annaly as a Managing Director,

Commercial Real Estate Group. Prior to joining Annaly, David was an

Executive Vice President at iStar, Inc. and head of iStar’s West

Coast Investments. Prior to that, David worked as a Senior Vice

President, Loan Originator at Fremont Investment & Loan and

started his real estate career as an Associate at Southern Pacific

Bank. David has almost 20 years of experience in commercial real

estate loan origination.

Nishant Nadella has joined Annaly as a Director,

Commercial Real Estate Group. Prior to joining Annaly, Nishant was

a Senior Vice President and Partner at H/2 Capital Partners, where

he was responsible for trading and risk management of a

multibillion dollar portfolio of commercial mortgage backed

securities (“CMBS”). Prior to H/2, Nishant held various CMBS

related trading positions at Citigroup. In his time at Citigroup,

Nishant was instrumental in starting both the Agency CMBS and Build

America Bond trading businesses.

Agency and Residential Credit

Jay DeLong has joined Annaly as a Director, Agency and

Residential Credit Groups. Jay joins Annaly from Sovarnum Capital

LP (“Sovarnum”), where he was a Portfolio Manager and Head of

Research. Prior to Sovarnum, Jay held the position of Head of

Securitized Products Research at PointState Capital LP and Duquesne

Capital Management LLC with previous experience at Lehman Brothers,

Inc. as a mortgage strategist and quantitative researcher.

Middle Market Lending

Mark McNally has joined Annaly as a Director, Middle

Market Lending Group. Mark has over 20 years of middle market

lending experience. Mark joins Annaly from Bank of Ireland’s

Leveraged Acquisition Finance Group, where he was a Director

focused on underwriting transactions and participated in the Bank

of Ireland’s selective Future Leaders program.

Additions to Corporate

Infrastructure

Tanya Rakpraja has joined Annaly as a Managing Director,

Government Relations and Social Responsibility Group. Prior to

joining Annaly, Tanya was a Senior Director of Strategic Lending

Initiatives at Capital Impact Partners (“CIP”), the Community

Development Financial Institution with which Annaly has a social

impact joint venture. Prior to CIP, Tanya oversaw Mortgage

Operations and Trading for the Federal Reserve’s Large Scale Asset

Purchase Program.

Danielle Cooper has joined Annaly as a Director,

Corporate Development and Strategy Group. Danielle joins Annaly

from Bank of America Merrill Lynch, where she was a Vice President

in the Mergers and Acquisitions Structured Solutions Group and

focused on advising clients on a broad range of complex financing

and advisory solutions. Earlier this year, Danielle was named to

Forbes’ 30 Under 30 Finance professionals list.

Christian Greco has joined Annaly as a Director, Legal

and Compliance Group, supporting the Agency and Residential Credit

Groups. Prior to joining Annaly, Christian was an Associate General

Counsel at Goldman Sachs & Co. LLC. Prior to Goldman, Christian

held the position of Assistant General Counsel in the Securitized

Products Group at JPMorgan Chase & Co., with previous

experience at Sidley Austin LLP. Christian has over 16 years of

experience in the securitized products and structured finance

industry.

Suet Fung Lau has joined Annaly as a Director,

Information Technology Group. Suet joins Annaly from Sovarnum and

previously held senior positions at PointState Capital LP, Duquesne

Capital Management and Lehman Brothers, Inc. Suet brings over 20

years of experience in design and development of models, pricing

and analytics tools, risk management, quantitative trading

strategies and trading systems for fixed income instruments.

Gregory (Greg) Insinga has joined Annaly as a Director,

Treasury Group. Prior to joining Annaly, Greg worked as a risk

management and reporting compliance consultant assisting both

Deutsche Bank and Goldman Sachs. Prior to consulting, Greg was a

Vice President in Barclays Capital Inc.’s Securitized Products

Middle Office Group, where he oversaw the group’s daily treasury,

credit, repo and derivative trading operations. Greg also has

additional previous mortgage related experience from his time at

Morgan Stanley.

Annaly’s Employee Stock Ownership

Guidelines

Each of the professionals listed above are subject to the

Company’s broad-based employee stock ownership guidelines, which

were expanded to cover over 40% of Annaly’s employees in 2016.

Pursuant to these guidelines, and as a reflection of our commitment

to aligning the interests of our employees and our shareholders,

Director-level and above employees are asked to purchase

predetermined amounts of Annaly shares in the open market based on

certain criteria including seniority, compensation level and role.

In July 2017, Annaly’s Chairman, Chief Executive Officer and

President Kevin Keyes voluntarily increased his stock ownership

commitment by 50% to an aggregate of $15 million. In addition to

Mr. Keyes, other members of senior management, including Chief

Investment Officer David Finkelstein, Chief Credit Officer Timothy

Coffey, Chief Financial Officer Glenn Votek and Chief Legal Officer

Anthony Green, have also committed to voluntarily increase their

stock ownership positions beyond the amounts required pursuant to

the employee stock ownership guidelines. As of June 30, 2018, 100%

of employees subject to the Company’s expanded stock ownership

guidelines either met, or within the applicable period are expected

to meet, such guidelines.

About Annaly

Annaly is a leading diversified capital manager that invests in

and finances residential and commercial assets. Annaly’s principal

business objective is to generate net income for distribution to

its stockholders and to preserve capital through the prudent

selection of investments and continued management of its portfolio.

Annaly has elected to be taxed as a real estate investment trust,

or REIT, for federal income tax purposes. Annaly is externally

managed by Annaly Management Company LLC (the “Manager”). Each of

the individuals named in this release is employed by the Manager or

a subsidiary of Annaly and provides services to Annaly pursuant to

the management agreement between Annaly and the Manager. Additional

information is available at www.annaly.com.

Forward-Looking Statements

This news release and our public documents to which we refer

contain or incorporate by reference certain forward-looking

statements which are based on various assumptions (some of which

are beyond our control) and may be identified by reference to a

future period or periods or by the use of forward-looking

terminology, such as "may," "will," "believe," "expect,"

"anticipate," "continue," or similar terms or variations on those

terms or the negative of those terms. Actual results could differ

materially from those set forth in forward-looking statements due

to a variety of factors, including, but not limited to, changes in

interest rates; changes in the yield curve; changes in prepayment

rates; the availability of mortgage-backed securities and other

securities for purchase; the availability of financing and, if

available, the terms of any financings; changes in the market value

of our assets; changes in business conditions and the general

economy; our ability to grow our commercial business; our ability

to grow our residential mortgage credit business; credit risks

related to our investments in credit risk transfer securities,

residential mortgage-backed securities and related residential

mortgage credit assets, commercial real estate assets and corporate

debt; risks related to investments in mortgage servicing rights;

our ability to consummate any contemplated investment

opportunities; changes in government regulations affecting our

business; our ability to maintain our qualification as a REIT for

U.S. federal income tax purposes; our ability to maintain our

exemption from registration under the Investment Company Act of

1940, as amended; and any potential business disruption following

the acquisition of MTGE Investment Corp., which we completed on

September 7, 2018. For a discussion of the risks and uncertainties

which could cause actual results to differ from those contained in

the forward-looking statements, see "Risk Factors" in our most

recent Annual Report on Form 10-K and any subsequent Quarterly

Reports on Form 10-Q. We do not undertake, and specifically

disclaim any obligation, to publicly release the result of any

revisions which may be made to any forward-looking statements to

reflect the occurrence of anticipated or unanticipated events or

circumstances after the date of such statements, except as required

by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180911005758/en/

Annaly Capital Management, Inc.Investor

Relations1-888-8Annalywww.annaly.com

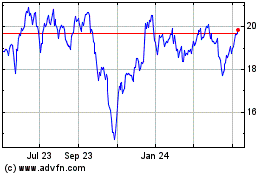

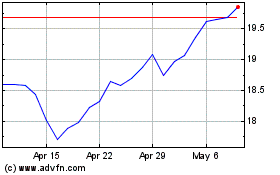

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Apr 2023 to Apr 2024