Sanofi Pays $25 Million to Settle Bribery Charges

September 04 2018 - 1:48PM

Dow Jones News

By Samuel Rubenfeld

French pharmaceutical company Sanofi agreed to pay $25.2 million

to resolve Securities and Exchange Commission allegations that its

subsidiaries made bribery payments to win business.

The schemes spanned multiple countries and involved bribes to

government procurement officials and health-care providers to

receive tenders and increase prescriptions of the company's

products, the SEC said.

The payments violated the Foreign Corrupt Practices Act, which

bars bribes of foreign officials for business purposes, the SEC

said.

Sanofi has strengthened its compliance program in the wake of

the investigation, Olivier Brandicourt, the company's chief

executive, said in a statement. "We will continue to strengthen

internal controls, antibribery and corruption compliance programs,

and our oversight and training of teams world-wide," he said.

The company neither admits nor denies the SEC's allegations. It

agreed to a cease-and-desist order and agreed to pay $17.5 million

in disgorgement, $2.7 in interest and a $5 million civil

penalty.

Earlier this year, the company said that the Justice Department

had ended its yearslong investigation into potential FCPA

violations by Sanofi.

The probe began after the company received a series of anonymous

allegations that wrongdoing had occurred between 2007 and 2012 in

parts of the Middle East and East Africa, the company said in 2014.

In subsequent annual reports, the company had said alleged

wrongdoing may have happened as recently as 2015.

Write to Samuel Rubenfeld at samuel.rubenfeld@wsj.com

(END) Dow Jones Newswires

September 04, 2018 13:33 ET (17:33 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

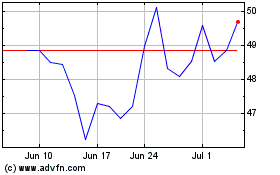

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Mar 2024 to Apr 2024

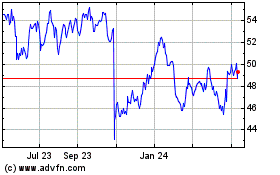

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Apr 2023 to Apr 2024