Retail Technology Provider Narvar Raises $30 Million in New Funding

August 28 2018 - 6:30AM

Dow Jones News

By Erica E. Phillips

Retail logistics software specialist Narvar has raised $30

million in new funding to back what the company says will be

aggressive expansion of a business that supports e-commerce

platforms for companies including Costco Wholesale Corp., Gap Inc.

and Levi Strauss & Co.

The new funding round, led by venture capital firm Accel with

Battery Ventures, Salesforce Ventures and Scale Venture Partners,

brings the company's total raised to $64 million since the business

launched in Silicon Valley in 2012. Narvar said the funding will

support refining its technology, which is helping retailers manage

deliveries and returns for online orders, and an expansion into

Asia and Europe.

The company says its technology supports 500 retailers, helping

their online sales platforms offer services similar to those at

Amazon.com Inc. Narvar Chief Executive Amit Sharma said it handles

"all aspects of post-purchase customer engagement and messaging,"

and that demand for its technology has increased, particularly on

the returns side, as digital commerce has grown.

"As consumers shop more and more online, free returns is part

and parcel of their expectations," Mr. Sharma said. "Both for

consumer experience and operational efficiencies, this part of the

business needs be able to be solved pretty quickly."

The growth of Narvar and other e-commerce tracking and returns

technologies highlights how deliveries and reverse logistics have

become more important to retailers' customer service strategy.

Surveys have found customers are more likely to shop again at an

online retailer after an initial purchase if it's easy for them to

track shipments and return purchases.

According to a Forrester research report, U.S. internet retail

sales are expected to reach almost $540 billion this year and grow

11% annually over the next five years to account for one-fifth of

all retail sales by 2023.

Dale Rogers, a logistics and supply chain professor at Arizona

State University, said Narvar's software improves the online

shopping experience while providing retailers with better

information about their customers. For example, Narvar's software

could catch shoppers who return items frequently, highlighting

potentially fraudulent behavior, Mr. Rogers said.

"It's clever," he said. "You can really track what your

customers are doing."

Software startups aiming to solve common logistics problems have

drawn millions of dollars of venture-capital funding as e-commerce

has ballooned. According to industry tracker PitchBook Data Inc.,

logistics startups drew $404 million in new funding last year, more

than twice the previous peak of $185 million in 2015.

Several third-party software and logistics companies are

targeting the costly returns process. Optoro Inc. recently raised

$75 million to expand its development and sales in services known

as reverse logistics. Optoro estimates the annual U.S. market for

customer returns is $380 billion and growing.

Charlie Cole, chief digital officer for luggage brand Tumi, a

Narvar customer, said shipment tracking and better communication

after an online sale can help inspire confidence in a brand.

"Customer expectations have fundamentally changed, driven in no

small part by Amazon," Mr. Cole said, and brands have to do

"anything they can to, at the very least, level the playing field

for after-sales service."

Write to Erica E. Phillips at erica.phillips@wsj.com

(END) Dow Jones Newswires

August 28, 2018 06:15 ET (10:15 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

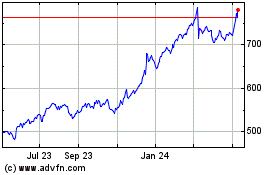

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Mar 2024 to Apr 2024

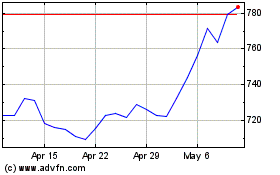

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Apr 2023 to Apr 2024