AS FILED WITH THE SECURITIES AND EXCHANGE

COMMISSION ON AUGUST 27, 2018

Registration Statement

No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Wireless Telecom Group, Inc.

(Exact name of registrant as specified in

its charter)

New Jersey

(State or other jurisdiction of incorporation or organization)

|

22-2582295

(IRS Employer Identification No.)

|

25 Eastmans Road

Parsippany, New Jersey 07054

(Address, including zip code, of registrant’s

principal executive offices)

Registrant’s telephone number, including area code:

(973) 386-9696

Michael Kandell

Chief Financial Officer

Wireless Telecom Group, Inc.

25 Eastmans Road

Parsippany, New Jersey 07054

(973) 386-9696

(Name, address, including

zip code, and telephone number, including area code, of agent for service)

Copies to:

LaDawn Naegle, Esq.

Bryan Cave Leighton Paisner

llp

1155 F Street, N.W.

Washington, D.C. 20004

202-508-6000

Fax 202-508-6200

Approximate date of

commencement of proposed sale to the public:

From time to time after this Registration Statement becomes effective.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please

check the following box:

o

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, please

check the following box:

x

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check

the following box and list the Securities Act registration statement number of the earlier effective registration statement for

the same offering.

o

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering.

o

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become

effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, please check the following box.

o

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following

box.

o

Indicate by check mark

whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act (Check one):

|

|

Large accelerated filer

o

|

Accelerated filer

o

|

|

|

|

Non-accelerated filer

o

(Do not check if a smaller reporting company)

|

Smaller reporting company

x

|

|

|

|

|

Emerging growth company

o

|

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

o

CALCULATION OF REGISTRATION FEE

|

Title

of each class of securities to be registered

|

Proposed

maximum offering price

|

Amount

of registration fee (2)

|

|

Common

Stock, par value $0.01 per share (1)

|

$40,000,000

|

$4,980.00

|

|

(1)

|

Pursuant to Rule 416 under the Securities Act of 1933,

as amended (the “Securities Act”), the shares being registered hereunder

include such indeterminate number of shares of common stock as may be issuable with respect

to the shares being registered hereunder as a result of stock splits, stock dividends,

or similar transactions.

|

|

|

|

|

(2)

|

Calculated pursuant to Rule 457(o) of the Securities

Act based on the proposed maximum aggregate offering price of all shares of common stock

to be registered.

|

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment

that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act or until this Registration Statement shall become effective on such date as the Commission, acting pursuant

to said Section 8(a), may determine.

The information in this prospectus

is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities

and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to

buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED AUGUST 27,

2018

PROSPECTUS

$40,000,000

Wireless Telecom Group, Inc.

COMMON STOCK ($0.01 PAR VALUE)

From time to time, we

may offer and sell shares of our common stock with total gross proceeds of up to $40,000,000.

This prospectus provides

a general description of the terms that may apply to an offering of our common stock. Each time we offer shares of our common stock,

we will provide a supplement to this prospectus that contains specific information about the offering. We may also authorize one

or more free writing prospectuses to be provided to you in connection with these offerings. The prospectus supplement and any related

free writing prospectus may also add, update or change information contained in this prospectus. You should carefully read this

prospectus, the applicable prospectus supplement and any related free writing prospectus, as well as any documents incorporated

by reference, before you invest in our common stock.

This prospectus may

not be used to consummate a sale of our common stock unless accompanied by a prospectus supplement

Our common stock is listed on the NYSE American

under the symbol “WTT.” On August 24, 2018, the closing price of our common stock was $1.82

per

share.

As of July 16, 2018,

the aggregate market value of our outstanding common stock held by non-affiliates was approximately $41,426,564 based on 18,494,002

shares of common stock held by non-affiliates and the last reported sale price of our common stock on such date. Pursuant to General

Instruction I.B.6 of Form S-3, in no event will we sell shares pursuant to this prospectus with a value of more than one-third

of the aggregate market value of our common stock held by non-affiliates in any 12-month period, so long as the aggregate market

value of our common stock held by non-affiliates is less than $75,000,000. During the 12 calendar months prior to, and including,

the date of this prospectus, we have not sold any securities pursuant to General Instruction I.B.6 of Form S-3.

We may sell shares of

our common stock directly to investors, through agents designated from time to time or to or through underwriters or dealers, on

a continuous or delayed basis. For additional information on the methods of sale, you should refer to the section entitled “Plan

of Distribution” in this prospectus. If any agents or underwriters are involved in the sale of any shares of our common stock

with respect to which this prospectus is being delivered, the names of such agents or underwriters and any applicable fees, commissions,

discounts or over-allotment options will be set forth in a prospectus supplement. The price to the public of such shares and the

net proceeds we expect to receive from such sale will also be set forth in a prospectus supplement.

Investing in our common stock involves

a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors”

contained in the applicable prospectus supplement and any related free writing prospectus, and under similar headings in the other

documents that are incorporated by reference into this prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION

NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES, OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL

OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THE DATE

OF THIS PROSPECTUS IS , 2018.

TABLE

OF CONTENTS

ABOUT THIS

PROSPECTUS

This prospectus is part of a registration

statement that we filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration

process. Under this shelf registration process, we may, from time to time, sell shares of our common stock in one or more offerings

in amounts that we will determine from time to time, up to a total aggregate offering price of $40,000,000. This prospectus provides

you with a general description of our common stock.

In this prospectus, “we,” “us,”

“our,” and the “Company”” refer to Wireless Telecom Group, Inc., a New Jersey corporation, together

with its subsidiaries.

For further information about our business

and the securities, you should refer to the registration statement containing this prospectus and its exhibits. The exhibits to

our registration statement contain the full text of certain contracts and other important documents we have summarized in this

prospectus. Since these summaries may not contain all the information that you may find important in deciding whether to purchase

the securities we offer, you should review the full text of these documents. We have filed and plan to continue to file other documents

with the SEC that contain information about us and our business. Each time we sell shares of our common stock under this prospectus,

we will provide a prospectus supplement that will contain specific information about the terms of that offering. We may also authorize

one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings.

The prospectus supplement and any related free writing prospectus that we may authorize to be provided to you may also add, update

or change information contained in this prospectus or in any documents that we have incorporated by reference into this prospectus.

You should read this prospectus, any applicable prospectus supplement and any related free writing prospectus, together with the

information incorporated herein by reference as described under the heading “Incorporation of Certain Information by Reference,”

before investing in our common stock.

Neither we, nor any agent, underwriter, dealer,

salesperson or other person has authorized any person to give any information or to make any representations other than those contained

or incorporated by reference in this prospectus, any accompanying prospectus supplement or any related free writing prospectus

in connection with the offer made by this prospectus, any accompanying prospectus supplement or any related free writing prospectus.

You must not rely upon any information or representation not contained or incorporated by reference in this prospectus or any accompanying

prospectus supplement as if we had authorized it.

This prospectus, any accompanying prospectus

supplement or any related free writing prospectus do not constitute an offer to sell or the solicitation of an offer to buy any

securities other than the registered securities to which they relate, nor does this prospectus, any accompanying prospectus supplement

or any related free writing prospectus constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction

to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

You should not assume that the information

contained in this prospectus, any accompanying prospectus supplement or any related free writing prospectus is correct on any date

after their respective dates or that any information we have incorporated by reference is correct on any date after the date of

the document incorporated by reference, even though this prospectus, any accompanying prospectus supplement or any related free

writing prospectus may be delivered or securities may be sold on a later date.

Investing in our securities involves a high

degree of risk. You should carefully consider the section entitled “Risk Factors” in this prospectus, any accompanying

prospectus supplement and any related free writing prospectus before you invest in our securities.

You should also carefully read the additional

information described in the sections entitled “Incorporation of Certain Documents by Reference” and “Where You

Can Find More Information” before you invest in our securities.

Special

note REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, including the documents

that we incorporate by reference, contains forward-looking statements within the meaning of Section 27A of the Securities Act and

Section 21E of the Securities Exchange Act of 1934, as amended. Any statements about our expectations, beliefs, plans, objectives,

assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but

not always, made through the use of words or phrases such as “anticipate,” “estimate,” “plans,”

“projects,” “continuing,” “ongoing,” “expects,” “management believes,”

“we believe,” “we intend” and similar words or phrases. Accordingly, these statements involve estimates,

assumptions and uncertainties which could cause actual results to differ materially from those expressed in them. Any forward-looking

statements are qualified in their entirety by reference to the factors discussed in this prospectus or incorporated by reference.

Forward-looking statements are subject

to known and unknown risks and uncertainties that could cause actual results to differ materially from those expected or implied

by the forward-looking statements. Our actual results could differ materially from those anticipated in the forward-looking statements

for many reasons, including the factors described in the reports referenced in the section entitled “Risk Factors”

in this prospectus.

You should not unduly rely on these

forward-looking statements, which speak only as of the date on which it is made. We undertake no obligation to publicly revise

any forward-looking statement to reflect circumstances or events after the date of this prospectus or to reflect the occurrence

of unanticipated events. You should, however, review the factors and risks we describe in the reports we file from time to time

with the SEC after the date of this prospectus. The reports we file from time to time with the SEC are available to the public

over the Internet at the SEC’s website http://www.sec.gov as described under the heading “Where You Can Find More Information.”

Prospectus

summary

This summary highlights

certain information about us and information appearing elsewhere in this prospectus and in the documents we incorporate by reference.

This summary is not complete and does not contain all of the information that you should consider before investing in our securities.

The following summary is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing

elsewhere in this prospectus and the financial statements and notes thereto appearing in our Annual and Quarterly Reports, which

are incorporated herein by reference. Before you decide to invest in our securities, to fully understand this offering and its

consequences to you, you should carefully read this entire prospectus carefully, including the matters set forth under the caption

“Risk Factors,” any accompanying prospectus supplement and the other documents incorporated by reference herein and

therein.

Business Overview

Wireless Telecom Group

specializes in the design and manufacture of advanced radio frequency and microwave devices which enable the development, testing

and deployment of wireless technology. The Company provides unique, highly customized and configured solutions which drive innovation

across a wide range of traditional and emerging wireless technologies.

Wireless Telecom Group

is comprised of four brands – Microlab, Boonton, Noisecom, and CommAgility – organized into three reporting segments

– Network Solutions, Test and Measurement and Embedded Solutions.

Our customers include

wireless carriers, defense contractors, military and government agencies, satellite communication companies, network equipment

manufacturers, tower companies, semiconductor device manufacturers and system integrators.

Our products include

components, modules, systems and instruments used across the lifecycle of wireless connectivity and communication development,

deployment and testing. Our customers use these products in relation to commercial infrastructure development, the expansion and

upgrade of distributed antenna systems, deployment of small cell technology and private long term evolution (“LTE”)

networks. In addition, the Company’s products are used in the development and testing of satellite communication systems,

radar systems, semiconductor devices, automotive electronics and avionics.

Network Solutions

Our Network Solutions

segment is comprised of our

Microlab

business.

Microlab designs and

manufactures a wide selection of radio frequency components and integrated subsystems for signal conditioning and distribution

in the wireless infrastructure markets. Microlab products are used in small cell deployments, distributed antenna systems, in-building

wireless solutions and cellular base-stations. Microlab is a leader in low passive intermodulation (“PIM”) radio frequency

and microwave products for these purposes.

Microlab components

possess unique capabilities in the area of broadband frequency coverage, minimal loss and low passive intermodulation. High performance

components – such as power combiners, directional couplers, attenuators, terminators and filters – are developed for

broadband applications to support commercial in-building wireless networks, public safety networks, rail and transportation deployments,

corrosive salt/fog environment build-outs and global positioning system (“GPS”) signal distribution.

Along with components and integrated subsystems,

the Microlab portfolio also includes system performance monitoring and timing synchronization solutions. These products include

a portfolio of GPS digital repeaters and splitters for cellular timing synchronization as well as a passive systems monitor for

real-time diagnostics of an in-building distributed antenna system.

Test and Measurement

Our Test and Measurement

segment is comprised of the

Boonton

and

Noisecom

brands.

Boonton

Boonton is a leader

in high performance radio frequency (“RF”) and microwave test equipment for radar, avionics, electronic warfare, electromagnetic

interference compatibility, and satellite and wireless communications applications. Used across the semiconductor, military,

aerospace, medical and commercial communications industries, Boonton products enable a wide range of radio frequency power measurements

and signal analysis for radio frequency product design, production, maintenance and testing.

Boonton designs and

produces electronic test and measurement equipment including power meters, power sensors, voltmeters, and audio and modulation

analyzers. These products measure and analyze the performance of radio frequency and microwave systems used by the military and

commercial sectors. Boonton products are also used to test terrestrial and satellite communications, radar and telemetry. Certain

power meter products are designed for measuring signals based on wideband modulation formats, allowing a variety of measurements

to be made, including maximum power, peak power, average power and minimum power.

Noisecom

Noisecom is a leader

in radio frequency and microwave noise sources for signal jamming, system impairment, reference level comparison and calibration,

receiver robustness testing, and jitter injection. Noisecom designs and produces noise generation instruments, calibrated noise

sources, noise modules and diodes. Noisecom noise products are used to provide wide band interference and test signals for sophisticated

commercial communication and defense applications, and as a stable reference standard for advanced systems found in radar applications

and satellite communications. Noise source products:

|

|

·

|

simulate

challenging signaling conditions in data and radio frequency transmission systems, such

as jitter testing for high speed data lines used in modern computer architecture;

|

|

|

|

|

|

|

·

|

send

signals for noise measurement to allow wireless receivers and transmitters to be optimized;

|

|

|

|

|

|

|

·

|

are

used for jamming radio frequency signals, blocking or disturbing enemy radar and other

communications and insulating and protecting friendly communications; and

|

|

|

|

|

|

|

·

|

comprise

components in radar systems as part of built-in test equipment to continuously monitor

the radar receiver and in-satellite communications where the use of back-up receivers

are becoming more common.

|

Electronic noise generation

devices from Noisecom come in a variety of product types including noise diodes, built-in-test modules (“BITE”), calibrated

noise sources, jitter sources, cryogenic noise standards and programmable instruments. Calibrated noise sources are available from

audio to millimeter wavelengths in coaxial or waveguide modules. Programmable instruments are highly configurable and able

to generate precise carrier-to-noise, signal-to-noise and broadband white noise levels. Noisecom products are customizable to meet

the unique needs of challenging applications and can be designed for high power, high crest factor, and specific filtering.

Embedded Solutions

Our Embedded Solutions

segment consists of our subsidiary

CommAgility

.

CommAgility develops

embedded signal processing and radio frequency modules, as well as LTE physical layer and stack software, for 4G and emerging 5G

mobile network and related applications. Combining the latest digital signal processing (“DSP”), field programmable

gate array (“FPGA”) and radio frequency technologies with advanced, industry-leading software, CommAgility provides

compact, powerful and reliable products for integration into high performance test equipment, specialized radio and intelligence

systems, and R&D demonstrators.

CommAgility engineers

work closely with customers to provide hardware and software solutions for the most demanding real-time signal processing, test

and control challenges in wireless baseband, semiconductor processing, medical imaging, radar and sonar applications. Additionally,

CommAgility licenses, implements and customizes LTE physical layer and stack software for private LTE networks supporting satellite

communications, the military and aerospace industries, offering our customers unique implementation capabilities built on the LTE

standard.

Competitive Strengths

|

|

·

|

We

have long-standing relationships with a core group of diverse customers in the wireless,

telecommunication, satellite, military, aerospace, semiconductor and medical industries

|

|

|

|

|

|

|

·

|

We

are agile in providing highly customized and configured solutions to the customer’s

technical specifications

|

|

|

|

|

|

|

·

|

We

have long-standing, well-established sales channels and relationships which allow us

to bring new solutions to market quickly

|

|

|

|

|

|

|

·

|

We

are diversified across multiple customer segments, providing solutions to enable development,

testing and deployment

|

|

|

|

|

|

|

·

|

We

are an approved vendor at all four of the major US carriers with hundreds of approved

Network Solutions products

|

|

|

|

|

|

|

·

|

We

have an embedded base of products and instruments in our Test & Measurement segment

which leads to recurring purchases of our products

|

Strategy

We will drive organic

growth through investments in the development of new products and services for high growth opportunities and in optimization of

our core operations.

Network Solutions.

We are expanding our product lines to include more active solutions and continuing the evolution of our passive product

line. We are investing in the alignment of our RF conditioning solutions toward small cell densification initiatives and 5G development,

leveraging our smaller form factors and configuration agility. We will continue to specialize our solutions for wireless communication

deployment of new technologies in new markets and remain committed to high quality and high performance.

Test and Measurement.

We believe that the increasing complexity and quantity of wireless devices will require more sophisticated and higher throughput

test equipment, resulting in growth opportunities for both Boonton and Noisecom. We will continue to provide high performance instruments

for RF and microwave test and develop new millimeter wave solutions for the future of wireless connectivity. We expect our investments

in R&D will enable us to ensure that our industry leading hardware performance and software throughput capabilities remain

ahead of the competition as we target existing and emerging commercial and military applications such as 5G, advanced radar, internet

of things, satellite communications and semiconductor development. Our product strategy with both the Boonton and Noisecom product

lines is to target larger sections of the market by leveraging our current brand, specialist expertise and distribution channels.

Embedded Solutions.

We will continue to support the evolution of the LTE software stack, develop hardware for wider bandwidth applications

and take on project-specific customization for our customers. We will continue to invest in technical agility of our solution set

to address higher bandwidth requirements, increasing numbers of users, lower costs of ownership, and customization agility.

Corporate Information

We were incorporated in New Jersey in January

1985 under the name Noise Com, Inc. Our name was changed to Wireless Telecom Group, Inc. in November 1995.

O

ur principal

executive offices are located at 25 Eastmans Road, Parsippany, New Jersey 07054, and our telephone number is (973) 386-9696. Our

website is located at www.wirelesstelecomgroup.com.

Our website is included in this prospectus and any applicable prospectus

supplement as an inactive textual reference only. Except for the documents specifically incorporated by reference into this prospectus,

information contained on our website is not incorporated by reference into this prospectus and any applicable prospectus supplement

and should not be considered to be a part of this prospectus or any applicable prospectus supplement.

RISK FACTORS

Investing in our

securities involves a high degree of risk. Before making an investment decision, you should carefully consider the risks described

in (i) the sections entitled “Risk Factors” in our most recent Annual Report on Form 10-K and subsequent quarterly,

annual and other reports, each as filed with the SEC, which are incorporated by reference in this prospectus in their entirety;

(ii) the risk factors set forth below (“—Risks Relating to this Offering and Ownership of our Common Stock”)

and (iii) any amendment or updates to our risk factors reflected in subsequent filings with the SEC, including in any applicable

prospectus supplement or related free writing prospectus. For more information, see the sections entitled “Incorporation

of Certain Documents by Reference” and “Where You Can Find More Information.” Our business, financial condition

or results of operations could be materially adversely affected by any of these risks. In addition, the trading price of our securities

could decline due to any of these risks, and you may lose all or part of your investment. Additional risks and uncertainties not

presently known to us or that we currently deem immaterial may also affect our business, financial condition or results of operations.

Risks Relating to this Offering and Ownership of our Common

Stock

The price of our common stock may fluctuate significantly

and you could lose all or part of your investment.

Volatility in the market price of our common

stock may prevent you from being able to sell your common stock at or above the price you paid for your common stock in this offering.

The market price for our shares could fluctuate significantly for various reasons, including, without limitation:

|

|

·

|

our operating and financial performance and

prospects;

|

|

|

|

|

|

|

·

|

our

quarterly or annual earnings or earnings estimates, or those of other companies in our

industry;

|

|

|

|

|

|

|

·

|

failure

to meet external expectations or management guidance;

|

|

|

|

|

|

|

·

|

the

loss of one or more individually large customers, and its impact on our revenues, profitability

and financial condition;

|

|

|

|

|

|

|

·

|

our

creditworthiness, financial condition, performance and prospects;

|

|

|

|

|

|

|

·

|

actual

or anticipated growth rates relative to our competitors;

|

|

|

|

|

|

|

·

|

perceptions

of the investment opportunity associated with our common stock relative to other investment

alternatives;

|

|

|

|

|

|

|

·

|

future

announcements concerning our business or our competitors’ businesses;

|

|

|

|

|

|

|

·

|

the

public’s reaction to our press releases, other public announcements and filings

with the SEC;

|

|

|

|

|

|

|

·

|

our

inability to compete in our business with competitors who are significantly larger than

us and have much greater resources than us;

|

|

|

|

|

|

|

·

|

market

and industry perception of our success, or lack thereof, in pursuing our strategy;

|

|

|

|

|

|

|

·

|

strategic

actions by us or our competitors, such as acquisitions, restructurings, significant contracts

or joint ventures;

|

|

|

|

|

|

|

·

|

changes

in conditions or trends in our industry, geographies or customers;

|

|

|

|

|

|

|

·

|

general

market, economic and political conditions;

|

|

|

·

|

arrival

and departure of key personnel;

|

|

|

|

|

|

|

·

|

the

number of shares of common stock to be publicly traded after this offering;

|

|

|

|

|

|

|

·

|

sales

of common stock by us, our directors, executive officers or principal shareholders; and

|

|

|

|

|

|

|

·

|

adverse

resolution of litigation against us

.

|

In addition, stock markets, including the NYSE American, have

experienced price and volume fluctuations that have affected and continue to affect the market prices of equity securities issued

by many companies, including companies in our industry. As a result of the factors described above, shareholders may not be able

to resell their common shares at or above their purchase price or may not be able to resell them at all. These market and industry

factors may materially reduce the market price of our common shares, regardless of our operating performance.

Our stockholders may experience further dilution if we

issue additional shares of common stock in the future.

Any additional future

issuances of common stock by us will reduce the percentage of our common stock owned by investors purchasing shares in this offering

who do not participate in such future issuances. In most circumstances stockholders will not be entitled to vote on whether or

not we issue additional common stock. In addition, depending on the terms and pricing of an additional offering of our common stock

and the value of our assets, our stockholders may experience dilution in both the book value and fair value of their shares.

Additional acquisitions, investments, joint ventures and

other business initiatives may require substantial investment of funds or financings by the issuance of debt or additional equity

securities, which may negatively affect the market price of our common stock.

The growth of Wireless Telecom Group through

the successful acquisition and integration of complementary businesses is an important component of our corporate strategy. We

may also target future acquisitions to expand or add functionality and capabilities to our existing portfolio of products and services.

We may also consider, from time to time, opportunities to engage in joint ventures or other business collaborations with third

parties to address particular market segments. Any such acquisition, investment, joint ventures or other business collaborations

may require substantial investment of funds or financings by the issuance of debt or additional equity or equity-related securities.

Additionally, sales of substantial amounts

of shares of common stock (or securities that are convertible into or exercisable or exchangeable for shares of common stock) in

the public market, or the perception that these sales may occur, could cause the market price of our shares to decline and could

impair our ability to raise additional capital through the sale of our equity securities. To the extent we issue substantial additional

shares of common stock, the ownership and voting power of our existing shareholders would be diluted and our earnings per share

could be reduced, which may negatively affect the market prices for our shares. If we are unable to access capital markets on acceptable

terms or at all, we may not be able to consummate acquisitions, or may have to do so on the basis of a less than optimal capital

structure.

We will have broad discretion in the use of proceeds from

this offering and our existing cash, cash equivalents and short-term investments, and may invest or spend the proceeds in ways

with which you do not agree and in ways that may not yield a return.

We will have broad discretion in the application

of the net proceeds from this offering and our existing cash, cash equivalents and short-term investments. You may not agree with

our decisions, and our use of the proceeds and our existing cash, cash equivalents and short-term investments may not improve our

results of operation or enhance the value of our common stock. In addition, we may also use a portion of our net proceeds to acquire

and invest in complementary products or businesses; however, we currently have no agreements or commitments to complete any such

transaction. Investors will be relying on our judgment regarding the use of the net proceeds from this offering. You will not have

the opportunity to influence our management’s decisions on how to use the net proceeds from this offering. Our failure to

apply the net proceeds of this offering effectively could result in financial losses that could materially impair our ability to

pursue our strategy, cause the market price of our common stock to decline, or require us to raise additional capital.

Failure to maintain effective internal controls in accordance

with Sarbanes-Oxley could have a material adverse effect on our business and common stock price.

As a public company with SEC reporting obligations,

we are required to document and test our internal control procedures to satisfy the requirements of Section 404(b) of Sarbanes-Oxley,

which require annual assessments by management of the effectiveness of our internal control over financial reporting. As a smaller

reporting company, we are exempt from the auditor attestation requirement of Section 404(b) of Sarbanes-Oxley.

During the course of our assessment, we may

identify deficiencies that we are unable to remediate in a timely manner. Testing and maintaining our internal control over financial

reporting may also divert management’s attention from other matters that are important to the operation of our business.

We may not be able to conclude on an ongoing basis that we have effective internal control over financial reporting in accordance

with Section 404(b) of Sarbanes-Oxley. If we conclude that our internal control over financial reporting is not effective,

we cannot be certain as to the timing of completion of our evaluation, testing and remediation actions or its effect on our operations.

Moreover, any material weaknesses or significant deficiencies in our internal control over financial reporting may impede our ability

to file timely and accurate reports with the SEC. Any of the above could cause investors to lose confidence in our reported financial

information or our common stock listing on the NYSE American exchange to be suspended or terminated, which could have a negative

effect on the trading price of our common stock.

All of our debt obligations, and any future indebtedness

we may incur, will have priority over our shares with respect to payment in the event of a liquidation, dissolution or winding

up.

In any liquidation, dissolution or winding

up of the Company, our shares of common stock would rank below all debt claims against us. In addition, any convertible or exchangeable

securities or other equity securities (including preferred shares) that we may issue in the future may have rights, preferences

and privileges more favorable than those of our shares of common stock. Our share capital includes 2,000,000 authorized (but currently

unissued) shares of preferred stock. As a result, holders of shares of our common stock will not be entitled to receive any payment

or other distribution of assets upon the liquidation or dissolution until after our obligations to our debt holders and holders

of equity securities that rank senior to shares of our common stock, if any, have been satisfied.

If securities or industry analysts do not publish research

or reports about our business, or if they issue an adverse or misleading opinion regarding our stock, our stock price and trading

volume could decline.

The trading market for our common stock might

be influenced by the research and reports that industry or securities analysts publish about us or our business. If any analysts

issue adverse or misleading opinions regarding us, our business model, products or stock performance, out stock price could decline

and the trading volume of our stock could decline.

We are not currently paying dividends and will likely

not pay dividends for the foreseeable future.

We have never paid or declared any cash dividends

on our common stock. We currently intend to retain all available funds and any future earnings to fund the development and expansion

of our business, and we do not anticipate paying any cash dividends in the foreseeable future. In addition, our outstanding debt

restricts us from paying any dividends or making any other distribution or payment on account of our common stock. Any future determination

to pay dividends will be at the discretion of our board of directors and will depend on our financial condition, results of operations,

capital requirements, contractual restrictions and other factors that our board of directors deems relevant.

USE OF PROCEEDS

We will retain broad discretion over the

use of the net proceeds from the sale of our common stock offered hereby. Except as described in any prospectus supplement or any

related free writing prospectus that we may authorize to be provided to you, we currently intend to use the net proceeds from the

sale of our common stock offered hereby for working capital and general corporate purposes, which may include acquisitions or investing

in businesses, products or technologies that are complementary to our own, although we have no current plans, commitments or agreements

with respect to any such acquisitions as of the date of this prospectus. We may also use a portion of net proceeds for capital

expenditures, debt repayment, research and development, sales and marketing and general and administrative expenses. We will set

forth in the applicable prospectus supplement or free writing prospectus our intended use for the net proceeds received from the

sale of any common stock sold pursuant to the prospectus supplement or free writing prospectus.

Pending the application of the net proceeds,

we may invest the net proceeds in short-term, investment grade, interest-bearing securities, certificates of deposit or direct

or guaranteed obligations of the U.S. government.

PLAN OF

DISTRIBUTION

We may sell the securities

from time to time pursuant to underwritten public offerings, direct sales to the public, negotiated transactions, block trades,

“at the market” offerings as defined in Rule 415 promulgated under the Securities Act or a combination of these methods.

We may sell the securities to or through underwriters or dealers, through agents, or directly to one or more purchasers.

We may distribute securities

from time to time in one or more transactions:

|

|

·

|

at a fixed price or prices, which

may be changed;

|

|

|

·

|

at market prices prevailing at the time of sale;

|

|

|

·

|

at prices related to such prevailing market prices;

or

|

|

|

·

|

at negotiated prices.

|

Unless stated otherwise

in the applicable prospectus supplement, the obligations of any underwriter to purchase securities will be subject to certain conditions,

and an underwriter will be obligated to purchase all of the applicable securities if any are purchased. If a dealer is used in

a sale, we may sell the securities to the dealer as principal. The dealer may then resell the securities to the public at varying

prices to be determined by the dealer at the time of resale.

We or our agents may

solicit offers to purchase securities from time to time. Unless stated otherwise in the applicable prospectus supplement, any agent

will be acting on a best efforts basis for the period of its appointment.

In connection with the

sale of securities, underwriters or agents may receive compensation (in the form of discounts, concessions or commissions) from

us or from purchasers of securities for whom they may act as agents. Underwriters may sell securities to or through dealers, and

such dealers may receive compensation in the form of discounts, concessions or commissions from the underwriters and/or commissions

from the purchasers for whom they may act as agents. Underwriters, dealers and agents that participate in the distribution of securities

may be deemed to be underwriters, as that term is defined in the Securities Act, and any discounts or commissions received by them

from us and any profits on the resale of the securities by them may be deemed to be underwriting discounts and commissions under

the Securities Act. We will identify any such underwriter or agent, and we will describe any compensation paid to them, in the

related prospectus supplement.

Underwriters, dealers

and agents may be entitled under agreements with us to indemnification against and contribution toward certain civil liabilities,

including liabilities under the Securities Act.

If stated in the applicable

prospectus supplement, we will authorize agents and underwriters to solicit offers by certain specified institutions or other persons

to purchase securities at the public offering price set forth in the prospectus supplement under delayed delivery contracts providing

for payment and delivery on a specified date in the future. Institutions with which these contracts may be made include commercial

and savings banks, insurance companies, pension funds, investment companies, educational and charitable institutions, and other

institutions, but shall in all cases be subject to our approval. These contracts will be subject only to those conditions set forth

in the applicable prospectus supplement and the applicable prospectus supplement will set forth the commission payable for solicitation

of these contracts. The obligations of any purchaser under any such contract will be subject to the condition that the purchase

of the securities shall not be prohibited at the time of delivery under the laws of the jurisdiction to which the purchaser is

subject. The underwriters and other agents will not have any responsibility in respect of the validity or performance of these

contracts.

There is no established

trading market for any security other than our common stock, which is listed on the NYSE American (“NYSE”) under the

symbol “WTT.” No assurance can be given as to the liquidity of the trading market for our securities. Any underwriter

may make a market in these securities. However, no underwriter will be obligated to do so, and any underwriter may discontinue

any market making at any time, without prior notice.

If underwriters or dealers

are used in the sale, until the distribution of the securities is completed, SEC rules may limit the ability of any underwriters

and selling group members to bid for and purchase the securities. As an exception to these rules, representatives of any underwriters

are permitted to engage in certain transactions that

stabilize the price of the securities. These transactions may consist of bids

or purchases for the purpose of pegging, fixing or maintaining the price of the securities. If the underwriters create a short

position in the applicable securities in connection with any offering (in other words, if they sell more securities than are set

forth on the cover page of the applicable prospectus supplement) the representatives of the underwriters may reduce that short

position by purchasing securities in the open market. The representatives of the underwriters may also elect to reduce any short

position by exercising all or part of any over-allotment option we may grant to the underwriters, as described in the prospectus

supplement. The representatives of the underwriters may also impose a penalty bid on certain underwriters and selling group members.

This means that if the representatives purchase securities in the open market to reduce the underwriters’ short position

or to stabilize the price of the securities, they may reclaim the amount of the selling concession from the underwriters and selling

group members who sold those shares as part of the offering.

In general, purchases

of a security for the purpose of stabilization or to reduce a short position could cause the price of the security to be higher

than it might be in the absence of those purchases. The imposition of a penalty bid might also have an effect on the price of the

securities to the extent that it discourages resales of the securities. The transactions described above may have the effect of

causing the price of the securities to be higher than it would otherwise be. If commenced, the representatives of the underwriters

may discontinue any of the transactions at any time. In addition, the representatives of any underwriters may determine not to

engage in those transactions or that those transactions, once commenced, may be discontinued without notice.

Certain of the underwriters

or agents and their associates may engage in transactions with and perform services for us or our affiliates in the ordinary course

of their respective businesses.

In no event will the

commission or discount received by any Financial Industry Regulatory Authority (“FINRA”) member or independent broker-dealer

participating in a distribution of securities exceed eight percent of the aggregate principal amount of the offering of securities

in which that FINRA member or independent broker-dealer participates.

LEGAL MATTERS

Bryan Cave Leighton Paisner LLP, Washington,

D.C., will pass upon certain legal matters for us. The validity of the shares of common stock offered by this prospectus will be

passed upon for us by McCarter & English, LLP, Newark, New Jersey.

Additional legal matters may

be passed upon for any underwriters, dealers or agents by counsel that will be named in the applicable prospectus supplement.

EXPERTS

PKF O’Connor Davies, LLP, an independent

registered public accounting firm, has audited the consolidated financial statements of Wireless Telecom Group, Inc. included in

our Annual Report on Form 10-K, as of and for the years ended December 31, 2017 and 2016 as set forth in their report on our consolidated

financial statements, which is incorporated by reference in this prospectus and elsewhere in this registration statement. Such

consolidated financial statements of Wireless Telecom Group, Inc. are incorporated by reference in reliance on PKF O’Connor

Davies, LLP’s report, given on the authority of such firm as experts in accounting and auditing.

Incorporation

of Certain Documents by Reference

The SEC allows

us to “incorporate by reference” the information we file with it in this prospectus, which means that we can disclose

important information to you by referring you to those documents.

The information incorporated by reference is an important

part of this prospectus. Certain information that we subsequently file with the SEC will automatically update and supersede information

in this prospectus and in our other filings with the SEC. We incorporate by reference the documents listed below, which we have

already filed with the SEC and any future filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the

Securities

Exchange Act of 1934, as amended (the “Exchange Act”)

, until all securities offered by this prospectus have

been sold and all conditions to the consummation of such sales have been satisfied, except that we are not incorporating any information

included in a Current Report on Form 8-K that has been or will be furnished (and not filed) with the SEC, unless such information

is expressly incorporated herein by a reference in a furnished Current Report on Form 8-K or other furnished document:

|

|

·

|

Our Annual

Report on Form 10-K for the year ended December 31, 2017, filed with the SEC on March

12, 2018;

|

|

|

|

|

|

|

·

|

Our Quarterly

Reports on Form 10-Q for the quarters ended March 31, 2018 and June 30, 2018, filed with

the SEC on May 9, 2018 and August 9, 2018, respectively;

|

|

|

|

|

|

|

·

|

Our Current

Reports on Form 8-K filed on June 11, 2018 and August 27, 2018;

and

|

|

|

|

|

|

|

·

|

The

description of our Common Stock contained in our Current Report on Form 8-K filed with

the SEC on August 27, 2018.

|

For purposes of the registration statement

of which this prospectus is a part, any statement contained in a document incorporated or deemed to be incorporated by reference

shall be deemed to be modified or superseded to the extent that a statement contained herein or in any other subsequently filed

document which also is or is deemed to be incorporated herein by reference modifies or supersedes such statement in such document.

Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of the registration

statement of which this prospectus is a part.

You may receive a copy of any of the documents

incorporated by reference in this prospectus from the SEC on its web site (http://www.sec.gov), or you may read and copy any materials

we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information

on the operation of the public reference room by calling the SEC at 1-800-SEC-0330. You can also obtain these documents from us,

without charge, by writing or calling us at the following address:

Wireless Telecom Group, Inc.

25 Eastmans Road

Parsippany, New Jersey 07054

(973) 386-9696

We will provide to each person, including

any beneficial owner, to whom a prospectus is delivered, without charge upon written or oral request, a copy of any or all of the

documents that are incorporated by reference into this prospectus but not delivered with this prospectus. You may request a copy

of these filings by writing or calling us at the following address:

Wireless Telecom Group, Inc.

25 Eastmans Road

Parsippany, New Jersey 07054

(973) 386-9696

Our website is

http://www.wirelesstelecomgroup.com.

Our website is included in this prospectus and any applicable prospectus supplement

as an inactive textual reference only. Except for the documents specifically incorporated by reference into this prospectus, information

contained on our website is not incorporated by reference into this prospectus and any applicable prospectus supplement and should

not be considered to be a part of this prospectus or any applicable prospectus supplement.

WHERE YOU

CAN FIND MORE INFORMATION

We are subject to the informational requirements

of the Exchange Act. As a result, we file annual, quarterly and special reports, proxy statements and other information with the

SEC. You may read and copy any of these documents at the SEC’s public reference room in Washington, D.C., which is located

at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference

room. Our SEC filings are also available to the public at the SEC’s web site at http://www.sec.gov.

We have filed with the SEC a registration

statement under the Securities Act that registers the distribution of these securities. The registration statement, including the

attached exhibits and schedules, contains additional relevant information about us and the securities. The rules and regulations

of the SEC allow us to omit certain information included in the registration statement from this prospectus. You can get a copy

of the registration statement from the sources referred to above.

disclosure

of commission position on

indemnification for securities act liabilities

New Jersey Business Corporation Act

New Jersey’s Business Corporation Act

permits New Jersey corporations to include in their certificates of incorporation a provision eliminating or limiting the personal

liability of directors and officers for damages arising from certain breaches of

fiduciary

duty.

Our certificate of incorporation includes a provision eliminating the personal liability of our directors and officers of the company

and its stockholders for damages to the maximum extent permitted by New Jersey law, including exculpation for acts or omissions

in violation of directors’ and officers’ fiduciary duties of care. Under current New Jersey law, liability is not eliminated

in the case of a breach of a director’s or officer’s duty of loyalty (i.e., the duty to refrain from transactions involving

improper conflicts of interest) to the company or its stockholders, the failure to act in good faith, the knowing violation of

law or the obtainment of an improper personal benefit. Our certificate of incorporation does not have an effect on the availability

of equitable remedies (such as an injunction or rescissions) for breach of fiduciary duty. However, as a practical matter, equitable

remedies may

not

be available in particular circumstances. The Company also has in

effect a policy

of insurance covering all of its directors and officers against certain liabilities and reimbursing the company for obligations

for which it occurs as a result of its indemnification of such directors, officers and employees. The current policy covers the

period through November 30, 2018 and the Company intends to renew that coverage at the end of the existing policy period.

Disclosure of Commission Position on Indemnification for

Securities Act Liabilities

Insofar as indemnification for liabilities

arising under the Securities Act may be permitted to directors, officers or persons controlling the registrant pursuant to the

foregoing provisions, the Company has been informed that in the opinion of the SEC such indemnification is against public policy

as expressed in the Securities Act and is therefore unenforceable.

In the event that a claim for indemnification

against such liabilities is asserted by one of our directors, officers, or controlling persons in connection with the securities

being registered, we will either rely upon the opinion of counsel as to whether or not to pay indemnification, or submit the matter

to a court of appropriate jurisdiction.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

|

ITEM 14.

|

OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION

|

The following table sets forth the costs

and expenses payable by Wireless Telecom Group, Inc., except any underwriters’ fees and expenses, in connection with the

sale of the securities being registered hereby.

|

SEC registration fee

|

|

$

|

4,980.00

|

|

|

Printing expenses

|

|

|

*

|

|

|

Legal fees and expenses

|

|

|

*

|

|

|

Accounting fees and expenses

|

|

|

*

|

|

|

Miscellaneous expenses

|

|

|

*

|

|

|

Total

|

|

$

|

*

|

|

_______________

* These fees will be dependent on the number of offerings

conducted and, therefore, cannot be estimated at this time. In accordance with Rule 430B under the Securities Act, additional information

regarding estimated fees and expenses will be provided at the time information as to an offering is included in a prospectus supplement.

|

ITEM 15.

|

INDEMNIFICATION OF DIRECTORS AND OFFICERS

|

Under the Business Corporation Act of the

State of New Jersey (“New Jersey Law”), we can indemnify our directors and officers against liabilities they may incur

in such capacities, including liabilities under the Securities Act of 1933, as amended (the “Securities Act”). Our

certificate of incorporation includes a provision eliminating or limiting the personal liability of directors and officers for

damages arising from certain breaches of fiduciary duty. Our certificate of incorporation includes a provision eliminating the

personal liability of our directors and officers of the company and its stockholders for damages to the maximum extent permitted

by New Jersey law, including exculpation for acts or omissions in violation of directors’ and officers’ fiduciary duties

of care. Under current New Jersey law, liability is not eliminated in the case of a breach of a director’s or officer’s

duty of loyalty (i.e., the duty to refrain from transactions involving improper conflicts of interest) to the company or its stockholders,

the failure to act in good faith, the knowing violation of law or the obtainment of an improper personal benefit. Our certificate

of incorporation does not have an effect on the availability of equitable remedies (such as an injunction or rescissions) for breach

of fiduciary duty. However, as a practical matter, equitable remedies may not be available in particular circumstances.

|

Exhibit Number

|

Exhibit

|

|

1.1

|

Form of Underwriting Agreement*

|

|

|

|

|

4.1

|

Restated Certificate of Incorporation of Wireless Telecom Group, Inc. (incorporated herein by reference to Exhibit 3.1 to Wireless Telecom Group Inc.’s Annual Report on Form 10-K/A filed on April 22, 2005)

|

|

|

|

|

4.2

|

Amended and Restated By-laws (incorporated herein by reference to Exhibit 3.1 to Wireless Telecom Group, Inc.’s Current Report on Form 8-K, filed on July 1, 2016)

|

|

|

|

|

5.1

|

Opinion of McCarter & English, LLP, counsel to the registrant

|

|

|

|

|

23.1

|

Consent of PKF O’Connor Davies, LLP, Independent Registered Public Accounting Firm

|

|

|

|

|

23.2

|

Consent of McCarter & English, LLP (contained in Exhibit 5.1)

|

|

|

|

|

24.1

|

Power of attorney (contained on signature page)

|

_______________

* To the extent required, to be filed either by an amendment

to the Registration Statement or as an exhibit to a report filed under the Securities Exchange Act of 1934, as amended, and incorporated

herein by reference.

The undersigned registrant hereby undertakes:

(1) To file, during any period in which

offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus

required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus

any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment

thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in this registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of

securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum

offering range may be reflected in the form of prospectus filed with the Securities and Exchange Commission pursuant to Rule 424(b)

if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum aggregate offering

price set forth in the “Calculation of Registration Fee” table in the effective registration statement;

(iii) To include any material

information with respect to the plan of distribution not previously disclosed in the registration statement or any material change

to such information in the registration statement;

provided

,

however

,

that

the undertakings

set forth in paragraphs (1)(i), (1)(ii) and (1)(iii) above do not apply if the information required to be included in a post-effective

amendment by those paragraphs is contained in reports filed with or furnished to the Securities and Exchange Commission by the

registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in

the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration

statement.

(2) That, for the purpose of determining

any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement

relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide

offering thereof.

(3) To remove from registration by means

of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining

liability under the Securities Act of 1933 to any purchaser:

(i) Each prospectus filed by

the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus

was deemed part of and included in the registration statement; and

(ii) Each prospectus required

to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating

to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by Section

10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier

of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in

the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is

at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the

securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall

be deemed to be the initial

bona fide

offering thereof.

Provided

,

however

, that no statement made in a registration

statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by

reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with

a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement

or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(5) That, for the purpose of determining

liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities, in

a primary offering of securities of the undersigned registrant

pursuant to this registration statement, regardless of the underwriting

method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of

the following communications,

the undersigned registrant will be a seller to the purchaser and will be considered to offer

or sell such securities to such purchaser:

(i) Any preliminary prospectus

or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus

relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii) The portion of any other

free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities

provided by or on behalf of the undersigned registrant; and

(iv) Any other communication

that is an offer in the offering made by the undersigned registrant to the purchaser.

(6) That, for purposes of determining

any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or

Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual

report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration

statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such

securities at that time shall be deemed to be the initial bona fide offering thereof.

(9) Insofar as indemnification for liabilities

arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant

to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission

such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim

for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director,

officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such

director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the

opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the

question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final

adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing

on Form S-3 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized,

in the City of Parsippany, State of New Jersey, on this 27th day of August, 2018.

|

|

Wireless Telecom Group, Inc.

|

|

|

|

|

|

|

|

By:

|

/s/ Timothy Whelan

|

|

|

|

Name:

|

Timothy Whelan

|

|

|

|

Title:

|

Chief Executive Officer

|

|

KNOW ALL PERSONS BY THESE PRESENT, that each

person whose signature appears below constitutes and appoints Timothy Whelan and Michael Kandell and each or either of them, his

true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution, for him and in his name, place

and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments or any abbreviated registration

statement and any amendments thereto filed pursuant to Rule 462(b) increasing the number of securities for which registration is

sought) to this Registration Statement, and to file the same, with all exhibits thereto, and other documents in connection therewith,

with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and

authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith, as fully to

all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and

agents, or any of them, or their or his substitutes or substitute, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities

Act, this registration statement has been signed by the following persons in the capacities and on the dates indicated:

|

Signature

|

|

Title

|

|

Date

|

/s/ Timothy Whelan

|

|

Chief Executive Officer and Director

(Principal Executive Officer)

|

|

August 27, 2018

|

|

Timothy Whelan

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Michael Kandell

|

|

Chief Financial Officer

(Principal Financial Officer)

|

|

August 27, 2018

|

|

Michael Kandell

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Alan L. Bazaar

|

|

Chairman of the Board

|

|

August 27, 2018

|

|

Alan L. Bazaar

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Joseph Garrity

|

|

Director

|

|

August 27, 2018

|

|

Joseph Garrity

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Mitchell Herbets

|

|

Director

|

|

August 27, 2018

|

|

Mitchell Herbets

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Michael H. Millegan

|

|

Director

|

|

August 27, 2018

|

|

Michael H. Millegan

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Allan D. L. Weinstein

|

|

Director

|

|

August 27, 2018

|

|

Allan D. L. Weinstein

|

|

|

|

|

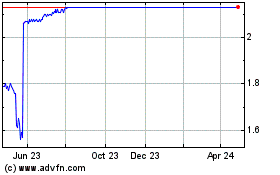

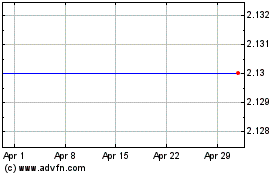

Wireless Telecom (AMEX:WTT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Wireless Telecom (AMEX:WTT)

Historical Stock Chart

From Apr 2023 to Apr 2024