Year-to-date, earnings per diluted share up

83%, or 52% on an adjusted basis*

Second quarter comparable store sales

increased 3.3%

Citi Trends, Inc. (NASDAQ:CTRN) today reported results for the

second quarter of fiscal 2018.

Financial Highlights – Second quarter

ended August 4, 2018

Total sales in the second quarter ended August 4, 2018 increased

9.5% to $182.0 million, compared with $166.2 million in the second

quarter ended July 29, 2017. The year-over-year comparison of total

quarterly sales included a benefit of approximately $6.7 million

due to a shift in the weeks that were included in the second fiscal

quarter this year in relation to last year. With a 53-week fiscal

year in 2017, each quarter of fiscal 2018 starts one week later

than in the prior year, resulting in the second quarter of fiscal

2018 adding a strong back-to-school week at the beginning of August

and losing a smaller sales week at the beginning of the quarter.

Comparable store sales increased 3.3%, comparing the 13 weeks ended

August 4, 2018 with the 13 weeks ended August 5, 2017.

The Company had net income of $3.2 million in the second quarter

of 2018, compared with a net loss in last year’s second quarter of

($0.2) million on a GAAP basis, or net income of $0.4 million when

adjusted for proxy contest-related expenses* incurred in the second

quarter of 2017. Earnings per diluted share in this year’s second

quarter were $0.24, compared with a loss per diluted share in the

second quarter of 2017 of $(0.01) on a GAAP basis, or earnings per

diluted share of $0.03 when adjusted for proxy contest-related

expenses*.

During the second quarter, the Company opened three new stores,

relocated or expanded four stores and closed two stores.

Financial Highlights – First half ended

August 4, 2018

Total sales in the first half of fiscal 2018 increased 7.3% to

$393.0 million, compared with $366.2 million in the first half of

fiscal 2017. Comparable store sales increased 2.7% in the first

half of this year, comparing the 26 weeks ended August 4, 2018 with

the 26 weeks ended August 5, 2017.

Net income was $14.5 million in the first half of 2018, compared

with net income in last year’s first half of $8.7 million on a GAAP

basis, or $10.4 million when adjusted for proxy contest-related

expenses*. Earnings per diluted share in the first half of 2018

were $1.08, compared with earnings per diluted share in the first

half of 2017 of $0.59 on a GAAP basis, or $0.71 when adjusted for

proxy contest-related expenses*.

Bruce Smith, President and Chief Executive Officer, commented,

“Our second quarter reflected a significant improvement in

earnings, highlighted by a 3.3% increase in comparable store sales

and a benefit to total sales from a shift in the fiscal calendar in

relation to 2017, together with healthy gross margin expansion and

expense leverage.”

Smith further noted, “Importantly, the comparable store sales

increase included positive contributions from all five of our major

merchandise categories, as well as higher transaction counts and

increases in the average unit sale and units per transaction. In

addition, the earnings improvement reflected a much lower income

tax rate due to the enactment of the Tax Cuts and Jobs Act. The

second quarter results, combined with a similarly strong first

quarter, led to an 83% increase in earnings per diluted share, or a

52% increase in earnings per diluted share on an adjusted basis*,

during the first half of 2018.”

Guidance

The Company provided the following guidance for the remainder of

fiscal 2018:

- The Company is raising its full year

fiscal 2018 earnings per diluted share expectations to a range of

$1.65 to $1.75, up from previous guidance of $1.55 to $1.70.

- Comparable store sales are expected to

increase in a range of 2% to 3% in both the third and fourth

quarters. Thus far, in the fiscal month of August, comparable store

sales have increased 9%; however, the Company believes a range of

2% to 3% is an appropriate expectation for the second half of the

year, similar to the actual results in the first half of the

year.

- Total sales are expected to increase in

a range of 2% to 3% in the third quarter. While the second quarter

included a benefit to total sales from the shift in the fiscal

calendar, the third quarter year-over-year comparison of total

sales is expected to be adversely impacted by approximately $5

million, due to a strong back-to-school week at the beginning of

August shifting from the third quarter last year to the second

quarter this year. The week at the beginning of November that will

shift into the third quarter this year is typically a lower sales

week than the week at the beginning of August.

- Total sales are expected to decrease in

a range of 2% to 3% in the fourth quarter due to having one fewer

week this year than in last year’s 14-week fourth quarter of a

53-week year.

- Earnings (loss) per diluted share are

expected to be in a range of ($0.03) to $0.02 in the third quarter,

compared to $0.05 in last year’s third quarter, and a range of

$0.60 to $0.65 in the fourth quarter, compared to $0.38 in the

fourth quarter of 2017.

Capital Return Program

The Company announced that its Board of Directors has declared a

quarterly cash dividend of $0.08 per common share, payable on

September 18, 2018, to shareholders of record as of the close of

business on September 4, 2018.

During the first half of 2018, the Company repurchased 731,000

shares of its common stock at an aggregate cost of $21.0 million.

On August 4, 2018, $4.0 million remained available under the

existing stock repurchase authorization.

Investor Conference Call and

Webcast

Citi Trends will host a conference call today at 9:00 a.m. ET.

The number to call for the live interactive teleconference is

(303) 223-4366. A replay of the conference call will be

available until August 30, 2018, by dialing (402) 977-9140 and

entering the passcode, 21893704.

The live broadcast of Citi Trends' conference call will be

available online at the Company's website, www.cititrends.com,

under the Investor Relations section, beginning today at 9:00 a.m.

ET. The online replay will follow shortly after the call and will

be available for replay for one year.

During the conference call, the Company may discuss and answer

questions concerning business and financial developments and trends

that have occurred after quarter-end. The Company’s responses to

questions, as well as other matters discussed during the conference

call, may contain or constitute information that has not been

disclosed previously.

About Citi Trends

Citi Trends, Inc. is a value-priced retailer of urban fashion

apparel and accessories for the entire family. The Company operates

554 stores located in 31 states. Citi Trends’ website address is

www.cititrends.com. CTRN-G

*Non-GAAP Financial

Measure

The non-GAAP financial measures discussed herein are reconciled

to their corresponding GAAP measures at the end of this press

release.

Forward-Looking

Statements

All statements other than historical facts contained in this

news release, including statements regarding the Company’s future

financial results and position, business policy and plans,

objectives of management for future operations and our intentions

and ability to pay dividends and complete any share repurchase

authorizations, are forward-looking statements that are subject to

material risks and uncertainties. The words "believe," "may,"

"could," "plans," "estimate," "continue," "anticipate," "intend,"

"expect" and similar expressions, as they relate to the Company,

are intended to identify forward-looking statements, although not

all forward-looking statements contain such language. Statements

with respect to earnings guidance are forward-looking statements.

Investors are cautioned that any such forward-looking statements

are subject to the finalization of the Company’s quarter-end

financial and accounting procedures, are not guarantees of future

performance or results and are inherently subject to risks and

uncertainties, some of which cannot be predicted or quantified.

Actual results or developments may differ materially from those

included in the forward-looking statements as a result of various

factors which are discussed in the Company’s filings with the

Securities and Exchange Commission, including those set forth under

the heading “Item 1A. Risk Factors” in the Company’s Form 10-K for

the fiscal year ended February 3, 2018. These risks and

uncertainties include, but are not limited to, uncertainties

relating to economic conditions, growth risks, consumer spending

patterns, competition within the industry, competition in our

markets and the ability to anticipate and respond to fashion

trends. Any forward-looking statements by the Company, with respect

to earnings guidance, the Company’s intention to declare and pay

dividends, the repurchase of shares pursuant to a share repurchase

program, or otherwise, are intended to speak only as of the date

such statements are made. Except as required by applicable law,

including the securities laws of the United States and the rules

and regulations of the Securities and Exchange Commission, the

Company does not undertake to publicly update any forward-looking

statements in this news release or with respect to matters

described herein, whether as a result of any new information,

future events or otherwise.

CITI TRENDS, INC. CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited) (in

thousands, except per share data) Thirteen

Weeks Ended Thirteen Weeks Ended August 4, 2018

July 29, 2017 (unaudited) (unaudited) Net sales $ 181,999 $

166,200 Cost of sales (exclusive of depreciation shown

separately below) (110,398) (102,175) Selling, general and

administrative expenses (62,285) (59,834) Depreciation (4,676)

(4,589) Asset impairment (942) (77) Income (loss)

from operations 3,698 (475) Interest income 363 215 Interest

expense (38) (37) Income (loss) before income taxes

4,023 (297) Income tax (expense) benefit (788) 87 Net

income (loss) $ 3,235 $ (210) Basic net income (loss) per

common share $ 0.24 $ (0.01) Diluted net income (loss) per common

share $ 0.24 $ (0.01) Weighted average number of shares

outstanding Basic 13,314 14,382 Diluted 13,351

14,382

Twenty-Six

Weeks Ended Twenty-Six Weeks Ended August 4, 2018

July 29, 2017 (unaudited) (unaudited) Net sales $ 393,031 $

366,155 Cost of sales (exclusive of depreciation shown

separately below) (239,811) (224,565) Selling, general and

administrative expenses (125,290) (120,321) Depreciation (9,650)

(8,887) Asset impairment (942) (77) Income from

operations 17,338 12,305 Interest income 658 401 Interest expense

(75) (74) Income before income taxes 17,921 12,632

Income tax expense (3,389) (3,952) Net income $

14,532 $ 8,680 Basic net income per common share $ 1.08 $

0.60 Diluted net income per common share $ 1.08 $ 0.59

Weighted average number of shares outstanding Basic 13,446

14,550 Diluted 13,491 14,598

CITI TRENDS, INC. CONDENSED

CONSOLIDATED BALANCE SHEETS (unaudited) (in thousands)

August 4, 2018 July 29, 2017 (unaudited)

(unaudited) Assets: Cash and cash equivalents $ 40,992 $ 30,195

Short-term investment securities 36,009 32,669 Inventory 138,801

131,989 Prepaid and other current assets 17,701 16,783 Property and

equipment, net 57,154 63,795 Long-term investment securities 13,020

26,748 Other noncurrent assets 7,105 7,485 Total assets $ 310,782 $

309,664 Liabilities and Stockholders' Equity: Accounts

payable $ 72,096 $ 67,256 Accrued liabilities 27,358 26,788 Other

current liabilities 2,005 1,803 Noncurrent liabilities 8,338 8,705

Total liabilities 109,797 104,552 Total stockholders' equity

200,985 205,112 Total liabilities and stockholders' equity $

310,782 $ 309,664

CITI

TRENDS, INC. RECONCILIATION OF GAAP BASIS OPERATING

RESULTS TO ADJUSTED NON-GAAP OPERATING RESULTS

(unaudited) (in thousands, except per share data)

The Company makes reference in this

release to net income adjusted for proxy contest expenses and

earnings per diluted share adjustedfor proxy contest expenses for

the thirteen and twenty-six week periods ended July 29, 2017. The

Company believes that excludingproxy contest expenses and their

related tax effects from its financial results reflects operating

results that are more indicative of theCompany's ongoing operating

performance while improving comparability to prior and future

periods, and as such, may provide investorswith an enhanced

understanding of the Company's past financial performance and

prospects for the future. This information is notintended to be

considered in isolation or as a substitute for net income or

earnings per diluted share prepared in accordance with

generallyaccepted accounting principles (GAAP).

Thirteen Weeks Ended July 29, 2017 As Reported

Adjustment (1) As Adjusted (unaudited)

(unaudited) (unaudited) Net sales $ 166,200 $ - $ 166,200

Cost of sales (exclusive of depreciation shown separately

below) (102,175) - (102,175) Selling, general and administrative

expenses (59,834) 926 (58,908) Depreciation (4,589) - (4,589) Asset

impairment (77) - (77) (Loss)

income from operations (475) 926 451 Interest income 215 - 215

Interest expense (37) - (37)

(Loss) income before income taxes (297) 926 629 Income tax benefit

(expense) 87 (271) (184) Net

(loss) income $ (210) $ 655 $ 445 Basic net

(loss) income per common share $ (0.01) $ 0.03 Diluted net (loss)

income per common share $ (0.01) $ 0.03 Weighted average

number of shares outstanding Basic 14,382 14,382

Diluted 14,382 14,417

Twenty-Six

Weeks Ended July 29, 2017 As Reported

Adjustment (1) As Adjusted (unaudited)

(unaudited) (unaudited) Net sales $ 366,155 $ - $ 366,155

Cost of sales (exclusive of depreciation shown separately

below) (224,565) - (224,565) Selling, general and administrative

expenses (120,321) 2,516 (117,805) Depreciation (8,887) - (8,887)

Asset impairment (77) - (77)

Income from operations 12,305 2,516 14,821 Interest income 401 -

401 Interest expense (74) - (74)

Income before income taxes 12,632 2,516 15,148 Income tax expense

(3,952) (787) (4,739) Net income

$ 8,680 $ 1,729 $ 10,409 Basic net income per

common share $ 0.60 $ 0.72 Diluted net income per common share $

0.59 $ 0.71 Weighted average number of shares outstanding

Basic 14,550 14,550 Diluted 14,598

14,598 (1) Proxy contest expenses and related tax effects

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180823005123/en/

Citi Trends, Inc.Bruce Smith, 912-443-2075President and Chief

Executive Officer

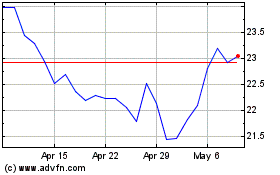

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Apr 2023 to Apr 2024