Report of Foreign Issuer (6-k)

August 21 2018 - 7:35AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

Form 6-K

REPORT OF FOREIGN

PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR

15d-16 UNDER THE SECURITIES

EXCHANGE ACT OF

1934

For August 21,

2018

Harmony Gold Mining Company

Limited

Randfontein

Office Park

Corner Main Reef

Road and Ward Avenue

Randfontein,

1759

South

Africa

(Address of principal executive

offices)

*-

(Indicate by

check mark whether the registrant files or will file annual reports

under cover of Form 20- F or Form 40-F.)

(Indicate by

check mark whether the registrant by furnishing the information

contained in this form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities

Exchange Act of 1934.)

Harmony Gold

Mining Company Limited

Registration

number 1950/038232/06

Incorporated in

the Republic of South Africa

ISIN:

ZAE000015228

JSE share code:

HAR

(“Harmony”

and/or “the Company”)

HARMONY DELIVERS

Johannesburg, Tuesday, 21

August 2018.

Harmony Gold

Mining Company Limited (“Harmony” and/or “the

Company”) is pleased to announce

its operational and

financial results for the year ended 30 June 2018

(“FY18”).

“Our

growth aspiration to produce 1.5 million ounces and improve the

quality of our asset portfolio was realised with the

re-investment in

Hidden Valley (FY17) and acquisition of Moab Khotsong (FY18). These

operations will increase annual production by 450 000 to 500 000

ounces at an average life of mine all-in sustaining unit cost of

US$950/oz. In addition, our successful hedging strategy has

generated cash flows of R3.6 billion (US$276 million) since

implementation in FY16, securing cash flow margins and enabling

Harmony to repay debt and fund our quality growth strategy. Harmony

has delivered”, said Peter Steenkamp, chief executive officer

of Harmony.

Key features of FY18

●

Embedding our

safety culture through our various training and awareness

campaigns

●

Production

guidance achieved for third consecutive year; produced 1.228Moz of

gold at an all-in sustaining

cost of R508

970/kg (US$1 231/oz)

●

8% increase

in underground recovered grade (six consecutive years of increasing

grade)

●

Hidden Valley

delivers re-investment plan on schedule and within

budget

●

Successful

integration of Moab Khotsong operations

●

31% increase

in SA underground resources

●

11.6%

increase in SA underground reserves

●

R1.8 billion

(US$141 million) generated in cash flow through effective hedging

strategy

Headline

earnings per share for FY18 amounted to 171 SA cents per share (13

US cents per share) compared with 298 SA cents per share (22 US

cents) for FY17.

Strategy and FY19

Harmony’s

teams remain committed to delivering on Harmony’s strategy to

produce safe, profitable ounces and increasing margins. Key focus

areas in FY19 will be safety, repaying debt, delivering on our

operational plans and substantially progressing the permitting of

the Wafi-Golpu project.

Harmony’s full results are available on its

website (

www.harmony.co.za

).

For more details

contact:

Lauren

Fourie

Investor

Relations Manager

+27(0)71 607 1498

(mobile)

Marian van der

Walt

Executive:

Investor Relations

+27(0)82 888 1242

(mobile)

Johannesburg,

South Africa

21 August

2018

Sponsor:

J.P. Morgan

Equities South Africa Proprietary Limited

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly

caused

this report to be

signed on its behalf by the undersigned, thereunto duly

authorized.

|

|

Harmony Gold Mining Company

Limited

|

|

|

|

|

|

|

|

Date:

August 21,

2018

|

By:

|

/s/

Frank Abbott

|

|

|

|

|

Name

Frank

Abbott

|

|

|

|

|

Title

Financial

Director

|

|

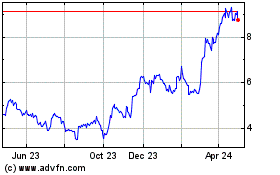

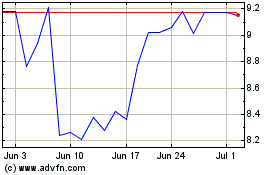

Harmony Gold Mining (NYSE:HMY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Harmony Gold Mining (NYSE:HMY)

Historical Stock Chart

From Apr 2023 to Apr 2024