Estée Lauder Sales Take Off From Airports -- WSJ

August 21 2018 - 3:02AM

Dow Jones News

By Sharon Terlep

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 21, 2018).

Sales at Estée Lauder Cos. jumped in the latest quarter due to

growing demand for high-end skin-care products and increased

business at travel outlets in airports, providing a rare spot of

robust growth in the stagnating consumer-products industry.

The New York-based cosmetics company reported a 12% sales

increase on a constant-currency basis.

Chief Executive Fabrizio Freda said he is confident the company

will maintain sold growth despite looming troubles at department

stores throughout Europe. Estée Lauder has been hit hard by the

decline of U.S. department stores, which have historically

accounted for the bulk of sales.

"Even if there was the same worrying trend in bricks-and-mortar

[in Europe] that we're seeing in the U.S., it would not have

anywhere near the similar impact," as in the U.S. he said.

The company is less dependent on department-store sales in both

Eastern and Western Europe than it is in the U.S., and there is

more room in the region to expand online sales, he said.

House of Fraser, an iconic British department store chain sold

to Sports Direct International PLC earlier this month after

entering a U.K. equivalent of bankruptcy protection, accounts for

roughly 10% of Estée Lauder's sales in the U.K., the company

said.

Mr. Freda said he believes the retailer will avoid an all-out

liquidation like the process under way now at Bon Ton Stores Inc.

in the U.S.

"Some doors will close but not the whole business," he said.

In results for the fiscal fourth quarter ended June 30, the

company said profit fell 19% and net income fell to $186 million,

or 49 cents a share, from $229 million, or 61 cents a share, in the

prior-year period.

Excluding certain items, Estée Lauder reported an adjusted

profit of 61 cents a share compared with 51 cents a year ago. Sales

rose 14% to $3.3 billion for the quarter.

For the current quarter, Estée Lauder expects sales to rise

between 5% and 6% compared with the same period a year ago, with

adjusted earnings of $1.18 to $1.22 a share.

Full-year earnings for 2019 are seen at $4.38 to $4.51 a share

with adjusted earnings of $4.62 to $4.71 a share. Sales are

expected increase 4% to 5%.

Shares of Estée Lauder rose 2.9% to $139.87 in early afternoon

trading Monday in New York.

--Kimberly Chin contributed to this article.

Write to Sharon Terlep at sharon.terlep@wsj.com

(END) Dow Jones Newswires

August 21, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

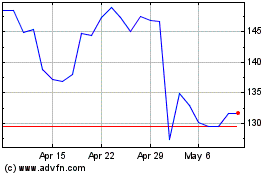

Estee Lauder Companies (NYSE:EL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Estee Lauder Companies (NYSE:EL)

Historical Stock Chart

From Apr 2023 to Apr 2024