Tech Bulls Brush Off Price Fears -- WSJ

August 20 2018 - 3:02AM

Dow Jones News

Stocks' high multiples fuel investor anxiety, but sector fans

say they overstate risks

By Michael Wursthorn

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 20, 2018).

The buoyant performance of U.S. tech stocks is driving some fund

managers and others to dismiss longstanding valuation concerns as

short-sighted.

While shares of companies including Amazon.com Inc., Netflix

Inc. and Salesforce.com Inc. have surged this year to

price/earnings ratios that are several times the market's longtime

average, many fans of these investments contend that such metrics

can overstate risks. They say they prefer a broader assessment of

financial and strategic progress, arguing that this view can be

more germane to those expecting to hold the shares for a longer

period.

"I don't talk about multiples. That's where the conversation

stops," Jonathan Curtis, a portfolio manager at Franklin

Templeton's Franklin Equity Group, says of discussions with others

about tech companies. "I tell them, 'Help me understand what this

business looks like at maturity.'"

The question of how to value popular technology shares is coming

into sharp focus because major indexes are on track to set a new

intraday record for the longest U.S. bull market in stocks

Wednesday. The nine-year advance recently has been led by furious,

sustained rallies in Amazon, Apple Inc. and Google parent Alphabet

Inc., among others.

Skeptics say high valuations and a lack of "breadth" -- that is,

outsize gains concentrated in a small number of popular stocks --

leave the broader market vulnerable to a pullback. An analysis of

data going back to 1964 shows that higher multiples have tended to

be followed by weaker returns over 10-year stretches, according to

Credit Suisse Group AG.

But some investors who say they see these investments as

long-term holdings are digging in their heels. In their view, the

scrutiny of valuations risks overlooking the future value of

current investment spending at firms with substantial edges in key

markets, such as Amazon's expansion of its cloud-computing business

and other firms' acquisition of valuable subscribers in fields they

lead.

Believers in this approach may have some market math on their

side: The valuation of the average stock in the S&P 500 is now

in the 97th percentile of historical levels, according to Goldman

Sachs Group Inc., which analyzed 40 years of data. While that is

down from the 99th percentile at one point last year, it shows that

the concerns about valuation could be applied to a vast swath of

the market, not just tech. Even consumer-staples firms, seen as

defensive plays expected to do well in an economic slowdown, appear

overpriced to many investors.

Of course, few question that higher multiples raise the risk of

a near-term share-price decline in response to any given negative

development, be it an earnings shortfall or a shock in a far-off

market that hits sentiment. Investors in tech favorites Netflix and

Facebook were reminded of this last month in the wake of sharp

stock declines that followed profit-report disappointments.

"Valuations matter a lot more as you extend the time horizon,"

said John Prichard, president of Knightsbridge Asset Management,

who expects rising interest rates to lead to a shakeout at some

point that "will depress high-P/E stocks."

But the rise of interest rates this year has been slow and tech

remains popular, with fund managers most heavily tilted toward tech

of all 11 major S&P 500 industry sectors. The average portfolio

manager holds about 1.2% of its fund in tech and internet stocks,

according to a Bank of America Merrill Lynch report last month.

In part, that is because many of the largest tech firms have

carried outsize multiples throughout a run to record highs, and

have shown impressive earnings gains during recent years that have

brought down their price/earnings ratios even as shares notch large

gains.

Take Amazon, up more than 60% this year and trading at a lofty

85 times future earnings: Improving earnings in recent quarters

have driven the firm's price/earnings ratio down from its average

level over the past three years of around 115 times, according to

FactSet. In comparison, the S&P 500 trades at about 16 times

earnings expected over the next 12 months.

Less than five years ago, Facebook was trading at more than 50

times forward earnings as it outspent rivals to dominate social

media's advertising landscape. Increased profits have brought its

valuation down to 23 times today, even after the record

market-value decline last month.

Salesforce is up more than 40% this year, yet fans contend the

market is undervaluing its capacity to win long-term customers and

penalizing the software firm for up-front marketing and sales

costs.

"It's very easy to analyze this year's costs and say, Look at

all this spend, it's unprofitable," said Matt Sabel, a portfolio

manager for MFS Investments.

Write to Michael Wursthorn at Michael.Wursthorn@wsj.com

(END) Dow Jones Newswires

August 20, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

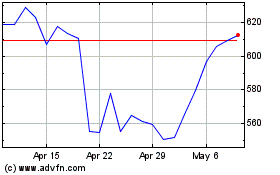

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

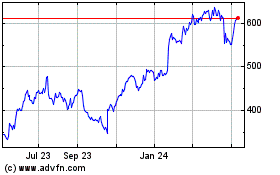

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Apr 2023 to Apr 2024