Applied Materials' Stock Falls on Guidance -- Earnings Review

August 16 2018 - 4:51PM

Dow Jones News

By Maria Armental

Applied Materials Inc. (AMAT) reported third-quarter results on

Thursday. Here's what you need to know:

PROFIT: Net income rose 27% to $1.17 billion, or $1.17 a share.

On an adjusted basis, profit rose to $1.20 a share from 86 cents a

share a year earlier. The company had forecast an adjusted profit

between $1.13 a share and $1.21 a share. Analysts surveyed by

Thomson Reuters were predicting $1.17 a share.

REVENUE: Net sales rose 19% to $4.47 billion, compared with the

company's forecast of $4.33 billion to $4.53 billion, and analysts'

projected $4.43 billion.

PROFIT MARGIN: Gross profit margin was roughly flat from the

year earlier at 45.4%.

COMMENTARY: "While we have seen some near-term adjustments in

customer spending, fiscal 2018 is on track to be another

record-setting year for Applied Materials and we expect each of our

major businesses to deliver strong double-digit growth," Chief

Executive Gary Dickerson said in a statement. "Our future outlook

remains positive as the A.I.-Big Data era requires new

breakthroughs in technology, from materials to systems, providing

Applied with a great opportunity to play a larger and more valuable

role in the ecosystem."

OUTLOOK: The semiconductor-equipment supplier projects 92 cents

a share to $1 a share in adjusted profit and $3.85 billion to $4.15

billion in revenue this quarter, compared with analysts' projected

$1.17 a share on $4.46 billion in revenue.

STOCK: Shares, which are lagging the market with a 7% decline

this year, fell 3.5% to $45.77 in after-hours trading.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

August 16, 2018 16:36 ET (20:36 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

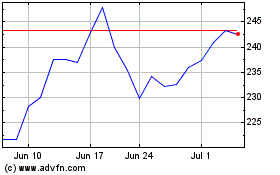

Applied Materials (NASDAQ:AMAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

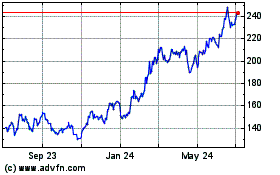

Applied Materials (NASDAQ:AMAT)

Historical Stock Chart

From Apr 2023 to Apr 2024