Net Revenues of $1.47 Billion Grew 12%

Year-over-Year

- Product revenue grew 20%

year-over-year

- All-flash array annualized net revenue

run rate of $2.2 billion increased 50% year-over-year

- Free cash flow was 18% of revenue and

increased 22% year-over-year

- $605 million returned to shareholders

in share repurchases and cash dividends

Please replace the release with the following corrected version

due to multiple revisions.

The corrected release reads:

NETAPP REPORTS FIRST QUARTER FISCAL YEAR

2019 RESULTS

Net Revenues of $1.47 Billion Grew 12%

Year-over-Year

- Product revenue grew 20%

year-over-year

- All-flash array annualized net revenue

run rate of $2.2 billion increased 50% year-over-year

- Free cash flow was 18% of revenue and

increased 22% year-over-year

- $605 million returned to shareholders

in share repurchases and cash dividends

NetApp (NASDAQ: NTAP) today reported financial results for the

first quarter of fiscal year 2019, which ended July 27, 2018.

“We delivered a very strong first quarter with revenue, gross

margin, operating margin, and earnings per share all above our

guidance. In Q1, we introduced substantial innovation across our

portfolio, expanding our industry-leading cloud data services and

introducing new partnerships, products and solutions to help

data-driven organizations thrive,” said George Kurian, chief

executive officer. “Enterprises are signaling strong confidence in

NetApp by making long-term investments to enable the NetAppTM Data

Fabric across their entire enterprise.”

First Quarter Fiscal Year 2019 Financial Results

- Net Revenues: $1.47 billion,

increased 12% year-over-year from $1.32 billion* in the first

quarter of fiscal 2018

- Net Income: GAAP net income of

$283 million, compared to GAAP net income of $131 million* in the

first quarter of fiscal 2018; non-GAAP net income1 of $281 million,

compared to non-GAAP net income of $166 million* in the first

quarter of fiscal 2018

- Earnings per Share: GAAP

earnings per share2 of $1.05 compared to GAAP earnings per share of

$0.47* in the first quarter of fiscal 2018; non-GAAP earnings per

share of $1.04, compared to non-GAAP earnings per share of $0.60*

in the first quarter of fiscal 2018

- Cash, Cash Equivalents and

Investments: $4.8 billion at the end of the first quarter of

fiscal 2019

- Cash from Operations: $326

million, compared to $250 million in the first quarter of fiscal

2018

- Share Repurchase and Dividend:

Returned $605 million to shareholders through share repurchases and

cash dividends

* In the first quarter of fiscal 2019, NetApp adopted Revenue

from Contracts with Customers (ASC 606), a new accounting standard

which establishes a comprehensive new revenue recognition model

designed to depict the transfer of goods or services to a customer

in an amount that reflects the consideration the entity expects to

receive in exchange for those goods or services. The full

retrospective method of adoption was employed. Accordingly,

NetApp’s condensed consolidated balance sheet as of April 27, 2018,

condensed consolidated statements of operations and cash flows for

all prior periods presented, and all related financial statement

metrics included herein, have been restated to conform to the new

rules. The adoption of the standard had no impact to cash provided

by or used in operating, investing or financing activities as

presented on the condensed consolidated statement of cash

flows.

Second Quarter Fiscal Year 2019 Financial Outlook

The Company provided the following financial guidance for the

second quarter of fiscal year 2019:

- Net revenues are expected to be in the

range of $1.450 billion to $1.550 billion

GAAP

Non-GAAP

- Earnings per share is expected to be in the range of:

$0.79-$0.85 $0.94-$1.00

Dividend

Next cash dividend of $0.40 per share to be paid on October 24,

2018, to shareholders of record as of the close of business on

October 5, 2018.

First Quarter Fiscal Year 2019 Business Highlights

NetApp Expands the Industry's Most

Complete Cloud Data Services

- Azure NetApp Files is now

available in public preview. Jointly developed by Microsoft and

NetApp, Azure NetApp Files is a native Azure service powered by

NetApp’s leading ONTAP technology and storage expertise.

- NetApp announced NetApp Cloud

Volumes Services for Google Cloud Platform offering customers a

fully-managed, cloud-native file storage service that is integrated

with Google Cloud Platform.

New Products and Solutions that will

Help Data-Driven Organizations Thrive

- NetApp introduced the AFF A800

array, a high performance, cloud-connected flash system to power

artificial intelligence and compute-intensive applications. The

NetApp AFF A800 is the first available end-to-end NVMe enterprise

grade all flash array and boasts the industry’s first support of

30TB solid state drives.

- The latest update to our

flagship NetApp ONTAPTM 9 software

includes enhancements to FabricPool and improves hybrid cloud data

tiering and adds support for Microsoft Azure. ONTAP will

automatically move inactive data to a lower-cost storage tier to

save money and bring data back when needed.

- NetApp Active IQTM

technology provides new cloud-based analytics for all NetApp

systems that predicts future performance needs and identifies

unprotected data to optimize operations.

- NetApp StorageGRID object-based

storage solution now provides superior next-generation,

cloud-architected infrastructure for financial and personal data

retention compliance as one integrated resource across public and

private clouds.

Cisco and NetApp Simplify the Delivery

of Cloud Infrastructure and Industry-Specific

Applications

- The new Managed Private Cloud

solution built on FlexPodTM enables customers to realize a

cloud-like, As-a-Service model for their on-premises IT with remote

management, securing critical customer data and advancing

cloud-capabilities for both partners and their customers.

- New FlexPod industry solutions provide

a proven platform to quickly deploy key applications across

industries that are challenged by the increasingly diverse, dynamic

and distributed nature of data. The initial industry solution,

FlexPod Datacenter for Epic EHR, simplifies IT

infrastructure for healthcare customers, helping them move faster

and improve patient care.

Recognition for Industry Leading

Products

- NetApp all-flash array technology was

recognized as a Leader in Gartner’s 2018 Magic Quadrant for

Solid-State Arrays.3 NetApp has improved its position in the

Leaders Quadrant with a higher rating for its ability to

execute.

- NetApp StorageGRID named a Leader in

IDC’s MarketScape for Object-Based Storage.4 IDC recognizes the

strength of applying StorageGRID capabilities across our broader

NetApp portfolio, and specifically praises a few capabilities in

the report, including integration with NetApp FabricPool

technology.

- According to a new Storage

Performance Council SPC-1 Result,5 tests of the AFF A800 system

places it as number 1 overall in terms of SPC-1 Response Time and

makes it the top-performing enterprise all-flash array among the

industry’s leading storage providers. The AFF A800 is also in the

top 4 on the SPC-1 Performance list. The SPC-1 tests of the AFF

A800 were conducted with compression and deduplication enabled,

just as they would be under real-world conditions.

Webcast and Conference Call Information

NetApp will host a conference call to discuss these results

today at 2:30 p.m. Pacific Time. To access the live webcast of this

event, visit the NetApp Investor Relations website at

investors.netapp.com. In addition, this press release, historical

supplemental data tables, and other information related to the call

will be posted on the Investor Relations website. An audio replay

will also be available on the website after 4:30 p.m. Pacific Time

today.

About NetApp

NetApp is the data authority for hybrid cloud. We provide a full

range of hybrid cloud data services that simplify management of

applications and data across cloud and on-premises environments to

accelerate digital transformation. Together with our partners, we

empower global organizations to unleash the full potential of their

data to expand customer touchpoints, foster greater innovation, and

optimize their operations. For more information, visit

www.netapp.com. #DataDriven

“Safe Harbor” Statement Under U.S. Private Securities

Litigation Reform Act of 1995

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements include, but are not limited to, all of the

statements made under the Second Quarter Fiscal Year 2019 Financial

Outlook section and statements about enterprise customers making

long term investments in the NetApp Data Fabric. All of these

forward-looking statements involve risk and uncertainty. Actual

results may differ materially from these statements for a variety

of reasons, including, without limitation, general global

political, macroeconomic and market conditions, changes in U.S.

government spending, revenue seasonality and matters specific to

our business, such as our ability to expand our total available

market and grow our portfolio of products, customer demand for and

acceptance of our products and services, our ability to

successfully execute new business models, our ability to

successfully execute on our Data Fabric strategy to generate

profitable growth and stockholder return and our ability to manage

our gross profit margins. These and other equally important factors

are described in reports and documents we file from time to time

with the Securities and Exchange Commission, including the factors

described under the section titled “Risk Factors” in our most

recently submitted report on 10-K. We disclaim any obligation to

update information contained in this press release whether as a

result of new information, future events, or otherwise.

NetApp and the NetApp logo and the marks listed at

http://www.netapp.com/TM are trademarks of NetApp, Inc. Other

company and product names may be trademarks of their respective

owners.

Footnotes

1Non-GAAP net income excludes, when applicable,

(a) amortization of intangible assets, (b) stock-based

compensation expenses, (c) litigation settlements, (d)

acquisition-related expenses, (e) restructuring charges, (f) asset

impairments, (g) gains/losses on the sale of properties, and (h)

our GAAP tax provision, but includes a non-GAAP tax provision based

upon our projected annual non-GAAP effective tax rate for the first

three quarters of the fiscal year and an actual non-GAAP tax

provision for the fourth quarter of the fiscal year. NetApp makes

additional adjustments to the non-GAAP tax provision for certain

tax matters as described below. A detailed reconciliation of our

non-GAAP to GAAP results can be found at

http://investors.netapp.com. NetApp’s management uses these

non-GAAP measures in making operating decisions because it believes

the measurements provide meaningful supplemental information

regarding NetApp’s ongoing operational performance.

2GAAP earnings per share and non-GAAP earnings per share are

calculated using the diluted number of shares.

3Leader in Gartner’s 2018 Magic Quadrant for Solid-State Arrays,

Gartner Magic Quadrant for Solid-State Arrays, by Valdis Filks,

John Monroe, Joseph Unsworth, Santhosh Rao, July 23, 2018

4Leader in IDC’s MarketScape for Object-Based Storage, “IDC

MarketScape: Worldwide Object-Based Storage 2018 Vendor

Assessment,” by Amita Potnis, June 2018. IDC #US42665518

5Storage Performance Council SPC-1 Result,

http://spcresults.org/benchmarks/results/spc1-spc1e#A32007

NetApp Usage of Non-GAAP Financial Information

To supplement NetApp’s condensed consolidated financial

statement information presented in accordance with generally

accepted accounting principles in the United States (GAAP), NetApp

provides investors with certain non-GAAP measures, including, but

not limited to, historical non-GAAP operating results, non-GAAP net

income, non-GAAP effective tax rate and free cash flow, and

historical and projected non-GAAP earnings per diluted share.

NetApp believes that the presentation of non-GAAP net income,

non-GAAP effective tax rates, and non-GAAP earnings per share data

when shown in conjunction with the corresponding GAAP measures,

provides useful information to investors and management regarding

financial and business trends relating to its financial condition

and results of operations. NetApp believes that the presentation of

free cash flow, which it defines as the net cash provided by

operating activities less cash used to acquire property and

equipment, to be a liquidity measure that provides useful

information to management and investors because it reflects cash

that can be used to, among other things, invest in its business,

make strategic acquisitions, repurchase common stock, and pay

dividends on its common stock. As free cash flow is not a measure

of liquidity calculated in accordance with GAAP, free cash flow

should be considered in addition to, but not as a substitute for,

the analysis provided in the statement of cash flows.

NetApp’s management uses these non-GAAP measures in making

operating decisions because it believes the measurements provide

meaningful supplemental information regarding NetApp’s ongoing

operational performance. These non-GAAP financial measures are used

to: (1) measure company performance against historical results, (2)

facilitate comparisons to our competitors’ operating results and

(3) allow greater transparency with respect to information used by

management in financial and operational decision making.

NetApp excludes the following items from its non-GAAP measures

when applicable:

A. Amortization of intangible assets. NetApp records

amortization of intangible assets that were acquired in connection

with its business combinations. The amortization of intangible

assets varies depending on the level of acquisition activity.

Management finds it useful to exclude these charges to assess the

appropriate level of various operating expenses to assist in

budgeting, planning and forecasting future periods and in measuring

operational performance.

B. Stock-based compensation expenses. NetApp excludes

stock-based compensation expenses from its non-GAAP measures

primarily because they are non-cash expenses. While management

views stock-based compensation as a key element of our employee

retention and long-term incentives, we do not view it as an

expense to be used in evaluating operational performance in any

given period.

C. Litigation settlements. NetApp may periodically incur charges

or benefits related to litigation settlements. NetApp excludes

these charges and benefits, when significant, because it does not

believe they are reflective of ongoing business and operating

results.

D. Acquisition-related expenses. NetApp excludes

acquisition-related expenses, including (a) due diligence, legal

and other one-time integration charges and (b) write down of assets

acquired that NetApp does not intend to use in its ongoing

business, from its non-GAAP measures, primarily because they are

not related to our ongoing business or cost base and, therefore,

cannot be relied upon for future planning and forecasting.

E. Restructuring charges. These charges consist of restructuring

charges that are incurred based on the particular facts and

circumstances of restructuring decisions, including employment and

contractual settlement terms, and other related charges, and can

vary in size and frequency. We therefore exclude them in our

assessment of operational performance.

F. Asset impairments. These are non-cash charges to write down

assets when there is an indication that the asset has become

impaired. Management finds it useful to exclude these non-cash

charges due to the unpredictability of these events in its

assessment of operational performance.

G. Gains/losses on the sale of properties. These are

gains/losses from the sale of our properties. Management believes

that these transactions do not reflect the results of our

underlying, on-going business and, therefore, cannot be relied upon

for future planning or forecasting.

H. Income tax adjustments. NetApp’s non-GAAP tax provision is

based upon a projected annual non-GAAP effective tax rate for the

first three quarters of the fiscal year and an actual non-GAAP tax

provision for the fourth quarter of the fiscal year. The non-GAAP

tax provision also excludes, when applicable, (a) tax charges or

benefits in the current period that relate to one or more prior

fiscal periods that are a result of events such as changes in tax

legislation, authoritative guidance, income tax audit settlements

and/or court decisions, (b) tax charges or benefits that are

attributable to unusual or non-recurring book and/or tax accounting

method changes, (c) tax charges that are a result of a non-routine

foreign cash repatriation, (d) tax charges or benefits that are a

result of infrequent restructuring of the Company’s tax structure,

(e) tax charges or benefits that are a result of a change in

valuation allowance, and (f) tax charges resulting from the

integration of intellectual properties from acquisitions.

Management believes that the use of non-GAAP tax provisions

provides a more meaningful measure of the Company’s operational

performance.

These non-GAAP measures are not in accordance with, or an

alternative for, measures prepared in accordance with GAAP, and may

be different from non-GAAP measures used by other companies. In

addition, these non-GAAP measures are not based on any

comprehensive set of accounting rules or principles. NetApp

believes that non-GAAP measures have limitations in that they do

not reflect all of the amounts associated with the Company’s

results of operations as determined in accordance with GAAP and

that these measures should only be used to evaluate the Company’s

results of operations in conjunction with the corresponding GAAP

measures. NetApp management compensates for these limitations by

analyzing current and projected results on a GAAP basis as well as

a non-GAAP basis. The presentation of non-GAAP financial

information is not meant to be considered in isolation or as a

substitute for the directly comparable financial measures prepared

in accordance with generally accepted accounting principles in the

United States. The non-GAAP financial measures are meant to

supplement, and be viewed in conjunction with, GAAP financial

measures.

NETAPP, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In millions)

(Unaudited)

July 27,2018

April 27,2018

ASSETS Current assets: Cash, cash equivalents

and investments $ 4,811 $ 5,391 Accounts receivable 616 1,047

Inventories 97 122 Other current assets 329 392 Total

current assets 5,853 6,952 Property and equipment, net 768

756 Goodwill and purchased intangible assets, net 1,820 1,833 Other

non-current assets 464 450 Total assets $ 8,905 $

9,991

LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities: Accounts payable $ 425 $ 609 Accrued expenses

592 825 Commercial paper notes 200 385 Short-term deferred revenue

and financed unearned services revenue 1,623 1,712

Total current liabilities 2,840 3,531 Long-term debt 1,542 1,541

Other long-term liabilities 964 992 Long-term deferred revenue and

financed unearned services revenue 1,637 1,651 Total

liabilities 6,983 7,715 Stockholders' equity

1,922 2,276 Total liabilities and stockholders'

equity $ 8,905 $ 9,991

NETAPP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(In millions, except per share

amounts)

(Unaudited)

Three Months Ended

July 27,2018

July 28,2017

Revenues: Product $ 875 $ 727 Software maintenance 229 223

Hardware maintenance and other services 370 371 Net

revenues 1,474 1,321 Cost of revenues: Cost of

product 398 376 Cost of software maintenance 7 7 Cost of hardware

maintenance and other services 106 114 Total cost of

revenues 511 497 Gross profit 963 824

Operating expenses: Sales and marketing 409 423 Research and

development 208 193 General and administrative 73 68 Restructuring

charges 19 — Total operating expenses 709

684 Income from operations 254 140 Other

income, net 18 5 Income before income taxes

272 145 Provision (benefit) for income taxes (11 )

14 Net income $ 283 $ 131 Net income per

share: Basic $ 1.08 $ 0.49 Diluted $ 1.05 $ 0.47

Shares used in net income per share calculations: Basic 262

270 Diluted 269 278 Cash

dividends declared per share $ 0.40 $ 0.20

NETAPP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(In millions)

(Unaudited)

Three Months Ended

July 27,2018

July 28,2017

Cash flows from operating activities: Net income $ 283 $ 131

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization 49 51 Stock-based compensation 40 48

Deferred income taxes (26 ) — Other items, net 8 5 Changes in

assets and liabilities, net of acquisitions of businesses: Accounts

receivable 423 226 Inventories 25 24 Accounts payable (177 ) (58 )

Accrued expenses (221 ) (135 )

Deferred revenue and financed unearned

services revenue

(87 ) (102 ) Long-term taxes payable 5 — Changes in other operating

assets and liabilities, net 4 60 Net cash provided by

operating activities 326 250

Cash flows from

investing activities: Redemptions of investments, net 248 112

Purchases of property and equipment (64 ) (36 ) Acquisitions of

businesses, net of cash acquired — (24 ) Other investing

activities, net 2 1 Net cash provided by investing

activities 186 53

Cash flows from financing

activities:

Proceeds from issuance of common stock

under employee stock award plans

63 48

Payments for taxes related to net share

settlement of stock awards

(84 ) (57 )

Repurchase of common stock

(500 ) (150 )

Proceeds from (repayments of) commercial

paper notes, net

(185 ) 394

Dividends paid

(105 ) (54 )

Other financing activities, net

(1 ) — Net cash provided by (used in) financing

activities (812 ) 181

Effect of exchange

rate changes on cash, cash equivalents and restricted cash (14

) 19

Net increase (decrease) in cash, cash equivalents

and restricted cash (314 ) 503

Cash, cash equivalents and

restricted cash: Beginning of period 2,947 2,450

End of period $ 2,633 $ 2,953

SELECTED CONDENSED CONSOLIDATED BALANCE

SHEET LINE ITEMS

(In millions)

(Unaudited)

As of April 27, 2018

As PreviouslyReported

Impact of ASC606

Adoption

As Adjusted ASSETS Accounts receivable $ 1,009

$ 38 $ 1,047 Inventories 126 (4 ) 122 Other current assets 330 62

392 Other non-current assets 420 30 450

LIABILITIES AND

STOCKHOLDERS' EQUITY Short-term deferred revenue and financed

unearned services revenue $ 1,804 $ (92 ) $ 1,712 Other long-term

liabilities 961 31 992 Long-term deferred revenue and financed

unearned services revenue 1,673 (22 ) 1,651 Total stockholders'

equity 2,067 209 2,276

NETAPP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (In

millions, except per share amounts) (Unaudited)

Three Months Ended July 28, 2017

As Previously Reported

Impact of ASC

606Adoption

As Adjusted Revenues: Product $ 723 $ 4 $ 727

Software maintenance 234 (11 ) 223 Hardware maintenance and other

services 368 3 371 Net revenues 1,325

(4 ) 1,321 Cost of revenues: Cost of product

371 5 376 Cost of software maintenance 7 — 7 Cost of hardware

maintenance and other services 113 1 114 Total

cost of revenues 491 6 497 Gross profit

834 (10 ) 824 Operating expenses: Sales and

marketing 425 (2 ) 423 Research and development 193 — 193 General

and administrative 68 — 68 Total operating

expenses 686 (2 ) 684 Income from

operations 148 (8 ) 140 Other income, net 5 —

5 Income before income taxes 153 (8 ) 145

Provision for income taxes 17 (3 ) 14

Net income $ 136 $ (5 ) $ 131 Net income per share: Basic $

0.50 $ (0.01 ) $ 0.49 Diluted $ 0.49 $ (0.02 ) $ 0.47

Shares used in net income per share calculations: Basic 270

270 270 Diluted 278 278

278

NETAPP, INC. CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (In millions, except per share

amounts) (Unaudited) Three Months Ended

October 27, 2017

As Previously Reported

Impact of ASC

606Adoption

As Adjusted Revenues: Product $ 807 $ 12 $ 819

Software maintenance 240 (16 ) 224 Hardware maintenance and other

services 375 (3 ) 372 Net revenues

1,422 (7 ) 1,415 Cost of revenues: Cost of

product 399 (2 ) 397 Cost of software maintenance 6 — 6 Cost of

hardware maintenance and other services 115 (3 )

112 Total cost of revenues 520 (5 ) 515

Gross profit 902 (2 ) 900 Operating

expenses: Sales and marketing 420 1 421 Research and development

194 — 194 General and administrative 69 — 69

Total operating expenses 683 1 684

Income from operations 219 (3 ) 216 Other income, net

6 — 6 Income before income taxes 225 (3 ) 222

Provision for income taxes 50 (2 ) 48

Net income $ 175 $ (1 ) $ 174 Net income per share:

Basic $ 0.65 $ — $ 0.65 Diluted $ 0.64 $ (0.01 ) $ 0.63

Shares used in net income per share calculations: Basic

269 269 269 Diluted 275

275 275

NETAPP, INC. CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except

per share amounts) (Unaudited) Three

Months Ended January 26, 2018

As Previously Reported

Impact of ASC

606Adoption

As Adjusted Revenues: Product $ 920 $ 32 $ 952

Software maintenance 237 (16 ) 221 Hardware maintenance and other

services 366 — 366 Net revenues 1,523

16 1,539 Cost of revenues: Cost of product 468

1 469 Cost of software maintenance 6 — 6 Cost of hardware

maintenance and other services 108 — 108 Total

cost of revenues 582 1 583 Gross profit

941 15 956 Operating expenses: Sales and

marketing 423 (4 ) 419 Research and development 193 — 193 General

and administrative 72 — 72 Gain on sale of properties (218 )

— (218 ) Total operating expenses 470

(4 ) 466 Income from operations 471 19 490

Other income, net 14 — 14 Income before

income taxes 485 19 504 Provision for income taxes

991 (8 ) 983 Net loss $ (506 ) $ 27 $ (479 )

Net loss per share: Basic $ (1.89 ) $ 0.10 $ (1.79 )

Diluted $ (1.89 ) $ 0.10 $ (1.79 ) Shares used in net loss

per share calculations: Basic 268 268 268

Diluted 268 268 268

NETAPP, INC. CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (In millions, except per share amounts)

(Unaudited) Three Months Ended April 27,

2018

As Previously Reported

Impact of ASC

606Adoption

As Adjusted Revenues: Product $ 1,011 $ 16 $

1,027 Software maintenance 247 (13 ) 234 Hardware maintenance and

other services 383 — 383 Net revenues

1,641 3 1,644 Cost of revenues: Cost of

product 500 (4 ) 496 Cost of software maintenance 6 — 6 Cost of

hardware maintenance and other services 113 —

113 Total cost of revenues 619 (4 ) 615 Gross

profit 1,022 7 1,029 Operating

expenses: Sales and marketing 461 (18 ) 443 Research and

development 203 — 203 General and administrative 71 —

71 Total operating expenses 735 (18 )

717 Income from operations 287 25 312 Other income,

net 16 — 16 Income before income taxes

303 25 328 Provision for income taxes 32 6

38 Net income $ 271 $ 19 $ 290 Net income per

share: Basic $ 1.02 $ 0.07 $ 1.09 Diluted $ 0.99 $ 0.07 $

1.06 Shares used in net income per share calculations: Basic

265 265 265 Diluted 273

273 273

NETAPP, INC. CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except

per share amounts) (Unaudited) Year

Ended April 27, 2018 As Previously Reported

Impact of ASC

606Adoption

As Adjusted Revenues: Product $ 3,461 $ 64 $

3,525 Software maintenance 958 (56 ) 902 Hardware maintenance and

other services 1,492 — 1,492 Net revenues

5,911 8 5,919 Cost of revenues: Cost of

product 1,738 — 1,738 Cost of software maintenance 25 — 25 Cost of

hardware maintenance and other services 449 (2 )

447 Total cost of revenues 2,212 (2 )

2,210 Gross profit 3,699 10 3,709

Operating expenses: Sales and marketing 1,729 (23 ) 1,706 Research

and development 783 — 783 General and administrative 280 — 280 Gain

on sale of properties (218 ) — (218 ) Total

operating expenses 2,574 (23 ) 2,551

Income from operations 1,125 33 1,158 Other income

(expense), net 41 — 41 Income before

income taxes 1,166 33 1,199 Provision for income taxes

1,090 (7 ) 1,083 Net income $ 76 $ 40 $

116 Net income per share: Basic $ 0.28 $ 0.15 $ 0.43

Diluted $ 0.28 $ 0.14 $ 0.42 Shares used in net income per

share calculations: Basic 268 268 268

Diluted 276 276 276

NETAPP,

INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In millions, except per share amounts) (Unaudited)

Year Ended April 28, 2017 As Previously

Reported

Impact of ASC

606Adoption

As Adjusted Revenues: Product $ 3,006 $ 54 $

3,060 Software maintenance 965 (60 ) 905 Hardware maintenance and

other services 1,548 (22 ) 1,526 Net revenues

5,519 (28 ) 5,491 Cost of revenues:

Cost of product 1,614 (2 ) 1,612 Cost of software maintenance 28 —

28 Cost of hardware maintenance and other services 487

— 487 Total cost of revenues 2,129 (2 )

2,127 Gross profit 3,390 (26 ) 3,364

Operating expenses: Sales and marketing 1,633 18 1,651

Research and development 779 — 779 General and administrative 271 —

271 Restructuring charges 52 — 52 Gain on sale of properties

(10 ) — (10 ) Total operating expenses 2,725

18 2,743 Income from operations 665 (44 ) 621

Other income (expense), net — — —

Income before income taxes 665 (44 ) 621 Provision

for income taxes 156 (16 ) 140 Net

income $ 509 $ (28 ) $ 481 Net income per share: Basic $

1.85 $ (0.10 ) $ 1.75 Diluted $ 1.81 $ (0.10 ) $ 1.71

Shares used in net income per share calculations: Basic 275

275 275 Diluted 281 281

281

NETAPP, INC. SUPPLEMENTAL DATA

(In millions except net income per share, percentages, DSO, DIO,

DPO, CCC and Inventory Turns) (Unaudited)

Q1 FY'19 Q4 FY'18

Q3 FY'18 Q2 FY'18 Q1 FY'18 FY 2018 FY 2017

Revenues

Product

$ 875 $ 1,027 $ 952 $ 819 $ 727 $ 3,525 $

3,060 Strategic

$ 612 $ 747 $ 657 $ 566 $ 498 $ 2,468

$ 2,000 Mature

$ 263 $ 280 $ 295 $ 253 $ 229 $ 1,057

$ 1,060 Software Maintenance

$ 229 $ 234 $ 221 $ 224

$ 223 $ 902 $ 905 Hardware Maintenance and Other Services

$

370 $ 383 $ 366 $ 372 $ 371 $ 1,492 $ 1,526 Hardware

Maintenance Support Contracts

$ 303 $ 310 $ 300 $ 306

$ 298 $ 1,214 $ 1,258 Professional and Other Services

$

67 $ 73 $ 66 $ 66 $ 73 $ 278 $ 268

Net Revenues

$ 1,474 $ 1,644 $ 1,539 $ 1,415 $ 1,321 $ 5,919 $

5,491

Geographic Mix % of Q1 FY'19

Revenue % of Q4 FY'18 Revenue % of Q3 FY'18 Revenue % of Q2

FY'18 Revenue % of Q1 FY'18

Revenue

% of FY 2018

Revenue

% of FY 2017

Revenue

Americas

57 % 54 % 53 % 56 % 55 % 54 % 55 % Americas

Commercial

46 % 42 % 43 % 40 % 42 % 41 % 42 % U.S.

Public Sector

11 % 12 % 10 % 16 % 13 % 13 % 13 % EMEA

29 % 33 % 33 % 30 % 30 % 32 % 32 % Asia Pacific

14 % 13 % 14 % 14 % 15 % 14 % 13 %

Pathways Mix % of Q1 FY'19 Revenue % of Q4 FY'18

Revenue % of Q3 FY'18 Revenue % of Q2 FY'18 Revenue % of Q1 FY'18

Revenue

% of FY 2018

Revenue

% of FY 2017

Revenue

Direct

29 % 21 % 22 % 22 % 20 % 21 % 22 % Indirect

71 % 79 % 78 % 78 % 80 % 79 % 78 %

Non-GAAP Gross Margins Q1 FY'19 Q4 FY'18 Q3 FY'18 Q2

FY'18 Q1 FY'18 FY 2018 FY 2017 Non-GAAP Gross Margin

66.2

% 63.3 % 63.0 % 64.5 % 63.3 % 63.5 % 62.1 % Product

55.7 % 52.7 % 51.8 % 52.7 % 49.5 % 51.8 % 48.4 %

Software Maintenance

96.9 % 97.4 % 97.3 % 97.3 % 96.9

% 97.2 % 96.9 % Hardware Maintenance and Other Services

72.2

% 71.0 % 71.3 % 70.4 % 70.1 % 70.7 % 68.9 %

Non-GAAP Income from Operations, Income before Income Taxes

& Effective Tax Rate Q1 FY'19 Q4 FY'18 Q3 FY'18 Q2

FY'18 Q1 FY'18 FY 2018 FY 2017 Non-GAAP Income from Operations

$ 326 $ 360 $ 329 $ 269 $ 201 $ 1,159 $ 906 % of Net

Revenues

22.1 % 21.9 % 21.4 % 19.0 % 15.2 % 19.6 %

16.5 % Non-GAAP Income before Income Taxes

$ 344 $

376 $ 343 $ 275 $ 206 $ 1,200 $ 906 Non-GAAP Effective Tax Rate

18.3 % 18.4 % 15.7 % 19.6 % 19.4 % 18.1 % 18.4 %

Non-GAAP Net Income Q1 FY'19 Q4

FY'18 Q3 FY'18 Q2 FY'18 Q1 FY'18 FY 2018 FY 2017 Non-GAAP Net

Income

$ 281 $ 307 $ 289 $ 221 $ 166 $ 983 $ 739

Non-GAAP Weighted Average Common Shares Outstanding, Diluted

269 273 276 275 278 276 281 Non-GAAP Income per Share,

Diluted

$ 1.04 $ 1.12 $ 1.05 $ 0.80 $ 0.60 $ 3.56 $

2.63

Select Balance Sheet Items Q1

FY'19 Q4 FY'18 Q3 FY'18 Q2 FY'18 Q1 FY'18 Deferred Revenue and

Financed Unearned Services Revenue

$ 3,260 $ 3,363 $

3,143 $ 3,059 $ 3,127 DSO (days)

38 58 46 39 37 DIO (days)

17 18 14 18 25 DPO (days)

76 90 71 67 53 CCC (days)

(20 ) (14 ) (12 ) (10 ) 8 Inventory Turns

21

20 26 21 15 Days sales outstanding (DSO) is defined as

accounts receivable divided by net revenues, multiplied by the

number of days in the quarter. Days inventory outstanding (DIO) is

defined as net inventories divided by cost of revenues, multiplied

by the number of days in the quarter. Days payables outstanding

(DPO) is defined as accounts payable divided by cost of revenues,

multiplied by the number of days in the quarter. Cash conversion

cycle (CCC) is defined as DSO plus DIO minus DPO. Inventory turns

is defined as annualized cost of revenues divided by net

inventories.

Select Cash Flow Statement Items

Q1 FY'19 Q4 FY'18 Q3 FY'18 Q2 FY'18 Q1 FY'18 FY 2018 FY 2017

Net Cash Provided by Operating Activities

$ 326 $ 494

$ 420 $ 314 $ 250 $ 1,478 $ 986 Purchases of Property and Equipment

$ 64 $ 48 $ 32 $ 29 $ 36 $ 145 $ 175 Free Cash Flow

$ 262 $ 446 $ 388 $ 285 $ 214 $ 1,333 $ 811 Free Cash

Flow as a % of Net Revenues

17.8 % 27.1 % 25.2 % 20.1

% 16.2 % 22.5 % 14.8 % Free cash flow is a non-GAAP measure

and is defined as net cash provided by operating activities less

purchases of property and equipment. Some items may not add

or recalculate due to rounding.

NETAPP, INC.

RECONCILIATION OF NON-GAAP TO GAAP INCOME STATEMENT

INFORMATION (In millions, except net income (loss) per share

amounts)

Q1'FY19 Q4'FY18 Q3'FY18 Q2'FY18

Q1'FY18 FY2018 FY2017 NET INCOME

(LOSS) $ 283 $ 290 $ (479 ) $ 174 131 $ 116 $ 481 Adjustments:

Amortization of intangible assets 13 12 14 14 13 53 48 Stock-based

compensation 40 36 38 39 48 161 195 Litigation settlements — — 5 —

— 5 — Restructuring charges 19 — — — — — 52 Gain on sale of

properties — — (218 ) — — (218 ) (10 ) Income tax effects (40 ) (31

) 73 (6 ) (26 ) 10 (27 ) Income tax benefit of ASC 606 adoption (34

) — — — — — — Tax reform — — 856 —

— 856 —

NON-GAAP NET INCOME $ 281 $ 307

$ 289 $ 221 $ 166 $ 983 $ 739

COST OF REVENUES $ 511

$ 615 $ 583 $ 515 $ 497 $ 2,210 $ 2,127 Adjustments: Amortization

of intangible assets (9 ) (9 ) (10 ) (9 ) (8 ) (36 ) (29 )

Stock-based compensation (4 ) (3 ) (3 )

(3 ) (4 ) (13 ) (17 )

NON-GAAP COST OF

REVENUES $ 498 $ 603 $ 570 $ 503 $ 485 $ 2,161 $ 2,081

COST OF PRODUCT REVENUES $ 398 $ 496 $ 469 $ 397 $ 376 $

1,738 $ 1,612 Adjustments: Amortization of intangible assets (9 )

(9 ) (10 ) (9 ) (8 ) (36 ) (29 ) Stock-based compensation (1

) (1 ) — (1 ) (1 ) (3 )

(4 )

NON-GAAP COST OF PRODUCT REVENUES $ 388 $ 486 $ 459 $

387 $ 367 $ 1,699 $ 1,579

COST OF HARDWARE MAINTENANCE

AND OTHER SERVICES REVENUES $ 106 $ 113 $ 108 $ 112 $ 114 $ 447

$ 487 Adjustment: Stock-based compensation (3 ) (2 )

(3 ) (2 ) (3 ) (10 ) (13 )

NON-GAAP COST OF HARDWARE MAINTENANCE AND OTHER SERVICES

REVENUES $ 103 $ 111 $ 105 $ 110 $ 111 $ 437 $ 474

GROSS PROFIT $ 963 $ 1,029 $ 956 $ 900 $ 824 $ 3,709 $ 3,364

Adjustments: Amortization of intangible assets 9 9 10 9 8 36 29

Stock-based compensation 4 3 3 3

4 13 17

NON-GAAP GROSS PROFIT $ 976 $ 1,041 $

969 $ 912 $ 836 $ 3,758 $ 3,410

NETAPP, INC.

RECONCILIATION OF NON-GAAP TO GAAP INCOME STATEMENT

INFORMATION (In millions, except net income (loss) per share

amounts)

Q1'FY19 Q4'FY18 Q3'FY18 Q2'FY18

Q1'FY18 FY2018 FY2017 SALES AND

MARKETING EXPENSES $ 409 $ 443 $ 419 $ 421 $ 423 $ 1,706 $

1,651 Adjustments: Amortization of intangible assets (4 ) (3 ) (4 )

(5 ) (5 ) (17 ) (19 ) Stock-based compensation (17 )

(15 ) (16 ) (16 ) (21 ) (68 )

(84 )

NON-GAAP SALES AND MARKETING EXPENSES $ 388 $ 425 $

399 $ 400 $ 397 $ 1,621 $ 1,548

RESEARCH AND DEVELOPMENT

EXPENSES $ 208 $ 203 $ 193 $ 194 $ 193 $ 783 $ 779 Adjustment:

Stock-based compensation (12 ) (11 ) (11 )

(12 ) (15 ) (49 ) (59 )

NON-GAAP

RESEARCH AND DEVELOPMENT EXPENSES $ 196 $ 192 $ 182 $ 182 $ 178

$ 734 $ 720

GENERAL AND ADMINISTRATIVE EXPENSES $ 73

$ 71 $ 72 $ 69 $ 68 $ 280 $ 271 Adjustment: Stock-based

compensation (7 ) (7 ) (8 ) (8 ) (8 ) (31 ) (35 ) Litigation

settlements — — (5 ) — —

(5 ) —

NON-GAAP GENERAL AND ADMINISTRATIVE EXPENSES $

66 $ 64 $ 59 $ 61 $ 60 $ 244 $ 236

RESTRUCTURING

CHARGES $ 19 $ — $ — $ — $ — $ — $ 52 Adjustment: Restructuring

charges (19 ) — — — — —

(52 )

NON-GAAP RESTRUCTURING CHARGES $ — $ — $ — $ —

$ — $ — $ —

GAIN ON SALE OF PROPERTIES $ — $ — $ (218

) $ — $ — $ (218 ) $ (10 ) Adjustment: Gain on sale of properties

— — 218 — — 218 10

NON-GAAP GAIN ON SALE OF PROPERTIES $ — $ — $ — $ — $ — $ —

$ —

OPERATING EXPENSES $ 709 $ 717 $ 466 $ 684 $ 684

$ 2,551 $ 2,743 Adjustments: Amortization of intangible assets (4 )

(3 ) (4 ) (5 ) (5 ) (17 ) (19 ) Stock-based compensation (36 ) (33

) (35 ) (36 ) (44 ) (148 ) (178 ) Litigation settlements — — (5 ) —

— (5 ) — Restructuring charges (19 ) — — — — — (52 ) Gain on sale

of properties — — 218 — —

218 10

NON-GAAP OPERATING EXPENSES $ 650 $ 681 $ 640

$ 643 $ 635 $ 2,599 $ 2,504

NETAPP, INC.

RECONCILIATION OF NON-GAAP TO GAAP INCOME STATEMENT

INFORMATION (In millions, except net income (loss) per share

amounts)

Q1'FY19 Q4'FY18 Q3'FY18 Q2'FY18

Q1'FY18 FY2018 FY2017 INCOME FROM

OPERATIONS $ 254 $ 312 $ 490 $ 216 $ 140 $ 1,158 $ 621

Adjustments: Amortization of intangible assets 13 12 14 14 13 53 48

Stock-based compensation 40 36 38 39 48 161 195 Litigation

settlements — — 5 — — 5 — Restructuring charges 19 — — — — — 52

Gain on sale of properties — — (218 ) —

— (218 ) (10 )

NON-GAAP INCOME FROM

OPERATIONS $ 326 $ 360 $ 329 $ 269 $ 201 $ 1,159 $ 906

INCOME BEFORE INCOME TAXES $ 272 $ 328 $ 504 $ 222 $ 145 $

1,199 $ 621 Adjustments: Amortization of intangible assets 13 12 14

14 13 53 48 Stock-based compensation 40 36 38 39 48 161 195

Litigation settlements — — 5 — — 5 — Restructuring charges 19 — — —

— — 52 Gain on sale of properties — — (218 )

— — (218 ) (10 )

NON-GAAP INCOME

BEFORE INCOME TAXES $ 344 $ 376 $ 343 $ 275 $ 206 $ 1,200 $ 906

PROVISION FOR INCOME TAXES $ (11 ) $ 38 $ 983 $ 48 $

14 $ 1,083 $ 140 Adjustments: Income tax effects 40 31 (73 ) 6 26

(10 ) 27 Income tax benefit of ASC 606 adoption 34 — — — — — — Tax

reform — — (856 ) — —

(856 ) —

NON-GAAP PROVISION FOR INCOME TAXES $ 63 $

69 $ 54 $ 54 $ 40 $ 217 $ 167

NET INCOME (LOSS) PER

SHARE $ 1.05 $ 1.06 $ (1.79 ) $ 0.63 $ 0.47 $ 0.42 $ 1.71

Adjustments: Amortization of intangible assets 0.05 0.04 0.05 0.05

0.05 0.19 0.17 Stock-based compensation 0.15 0.13 0.14 0.14 0.17

0.58 0.69 Litigation settlements — — 0.02 — — 0.02 — Restructuring

charges 0.07 — — — — — 0.19 Gain on sale of properties — — (0.81 )

— — (0.79 ) (0.04 ) Income tax effects (0.15 ) (0.11 ) 0.27 (0.02 )

(0.09 ) 0.04 (0.10 ) Income tax benefit of ASC 606 adoption (0.13 )

— — — — — — Tax reform — — 3.19 —

— 3.10 —

NON-GAAP NET INCOME PER SHARE

$ 1.04 $ 1.12 $ 1.05 $ 0.80 $ 0.60 $ 3.56 $ 2.63 In Q3'FY18,

our GAAP net loss per share was calculated using basic shares of

268 million, as the impact of common stock equivalents would have

been anti-dilutive. Additionally, each adjustment presented in the

reconciliation was computed using basic shares. However, because we

reported net income on a non-GAAP basis, non-GAAP net income per

share was computed using diluted shares of 276 million. As a result

of the difference in the number of shares, the summation of GAAP

net loss per share and the adjustments does not equal non-GAAP net

income per share.

RECONCILIATION OF NON-GAAP TO

GAAP GROSS MARGIN ($ in millions)

Q1'FY19 Q4'FY18 Q3'FY18

Q2'FY18 Q1'FY18 FY2018

FY2017 Gross margin-GAAP 65.3 % 62.6 % 62.1 %

63.6 % 62.4 % 62.7 % 61.3 % Cost of revenues adjustments 0.9

% 0.7 % 0.8 % 0.8 % 0.9 % 0.8 %

0.8 %

Gross margin-Non-GAAP 66.2 % 63.3 % 63.0 % 64.5

% 63.3 % 63.5 % 62.1 % GAAP cost of revenues $ 511 $ 615 $

583 $ 515 $ 497 $ 2,210 $ 2,127 Cost of revenues adjustments:

Amortization of intangible assets (9 ) (9 ) (10 ) (9 ) (8 ) (36 )

(29 ) Stock-based compensation (4 ) (3 ) (3 )

(3 ) (4 ) (13 ) (17 ) Non-GAAP cost of

revenues $ 498 $ 603 $ 570 $ 503 $ 485 $ 2,161 $ 2,081 Net

revenues $ 1,474 $ 1,644 $ 1,539 $ 1,415 $ 1,321 $ 5,919 $ 5,491

RECONCILIATION OF NON-GAAP TO GAAP PRODUCT

GROSS MARGIN ($ in millions)

Q1'FY19 Q4'FY18 Q3'FY18

Q2'FY18 Q1'FY18 FY2018 FY2017

Product gross margin-GAAP 54.5 % 51.7 % 50.7 % 51.5 %

48.3 % 50.7 % 47.3 % Cost of product revenues adjustments

1.1 % 1.0 % 1.1 % 1.2 % 1.2 %

1.1 % 1.1 %

Product gross margin-Non-GAAP 55.7 % 52.7

% 51.8 % 52.7 % 49.5 % 51.8 % 48.4 % GAAP cost of product

revenues $ 398 $ 496 $ 469 $ 397 $ 376 $ 1,738 $ 1,612 Cost of

product revenues adjustments: Amortization of intangible assets (9

) (9 ) (10 ) (9 ) (8 ) (36 ) (29 ) Stock-based compensation

(1 ) (1 ) — (1 ) (1 ) (3 )

(4 ) Non-GAAP cost of product revenues $ 388 $ 486 $ 459 $

387 $ 367 $ 1,699 $ 1,579 Product revenues $ 875 $ 1,027 $

952 $ 819 $ 727 $ 3,525 $ 3,060

RECONCILIATION OF

NON-GAAP TO GAAP HARDWARE MAINTENANCE AND OTHER SERVICES

GROSS MARGIN ($ in millions)

Q1'FY19 Q4'FY18 Q3'FY18

Q2'FY18 Q1'FY18 FY2018 FY2017

Hardware maintenance and other services gross

margin-GAAP 71.4 % 70.5 % 70.5 % 69.9 % 69.3 % 70.0 % 68.1 %

Cost of hardware maintenance and other services revenues adjustment

0.8 % 0.5 % 0.8 % 0.5 % 0.8 %

0.7 % 0.9 %

Hardware maintenance and other

services gross margin-Non-GAAP 72.2 % 71.0 % 71.3 % 70.4 % 70.1

% 70.7 % 68.9 % GAAP cost of hardware maintenance and other

services revenues $ 106 $ 113 $ 108 $ 112 $ 114 $ 447 $ 487 Cost of

hardware maintenance and other services revenues adjustment:

Stock-based compensation (3 ) (2 ) (3 )

(2 ) (3 ) (10 ) (13 ) Non-GAAP cost of

hardware maintenance and other services revenues $ 103 $ 111 $ 105

$ 110 $ 111 $ 437 $ 474 Hardware maintenance and other

services revenues $ 370 $ 383 $ 366 $ 372 $ 371 $ 1,492 $ 1,526

RECONCILIATION OF NON-GAAP TO GAAP

EFFECTIVE TAX RATE

Q1'FY19 Q4'FY18 Q3'FY18

Q2'FY18 Q1'FY18 FY2018 FY2017

GAAP effective tax rate

(4.0 )% 11.6 % 195.0 % 21.6 % 9.7 % 90.3 % 22.5 % Adjustment:

Income tax effects 9.8 % 6.8 % (9.5 )% (2.0 )% 9.8 % (0.8 )% (4.1

)% Income tax benefit of ASC 606 adoption 12.5 % — % — % — % — % —

% — % Tax reform — % — % (169.8 )% — %

— % (71.4 )% — %

Non-GAAP effective tax

rate 18.3 % 18.4 % 15.7 % 19.6 % 19.4 % 18.1 % 18.4 %

RECONCILIATION OF NET CASH PROVIDED BY OPERATING

ACTIVITIES TO FREE CASH FLOW (NON-GAAP) (In

millions) Q1'FY19

Q4'FY18 Q3'FY18 Q2'FY18

Q1'FY18 FY2018 FY2017 Net cash provided by

operating activities $ 326 $ 494 $ 420 $ 314 $ 250 $ 1,478 $ 986

Purchases of property and equipment (64 ) (48 )

(32 ) (29 ) (36 ) (145 ) (175 )

Free cash flow $ 262 $ 446 $ 388 $ 285 $ 214 $ 1,333 $ 811

Some items may not add or recalculate due

to rounding.

NETAPP, INC. RECONCILIATION OF NON-GAAP

GUIDANCE TO GAAP EXPRESSED AS EARNINGS PER SHARE

SECOND QUARTER FISCAL 2019 Second

Quarter Fiscal 2019 Non-GAAP Guidance -

Net Income Per Share $0.94 - $1.00 Adjustments of Specific

Items to Net Income Per Share for the Second Quarter Fiscal 2019:

Amortization of intangible assets (0.05 ) Stock-based compensation

expense (0.14 ) Income tax effects 0.04 Total

Adjustments (0.15 ) GAAP Guidance - Net Income Per Share

$0.79 - $0.85

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180815005608/en/

NetAppPress Contact:Madge Miller, 1

408-419-5263madge.miller@netapp.comorInvestor Contact:Kris

Newton, 1 408-822-3312kris.newton@netapp.com

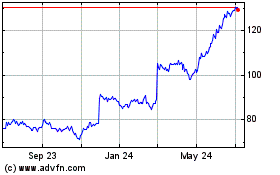

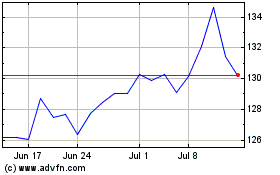

NetApp (NASDAQ:NTAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

NetApp (NASDAQ:NTAP)

Historical Stock Chart

From Apr 2023 to Apr 2024