Home Depot Raises Guidance as Profit Soars - Update

August 14 2018 - 5:16PM

Dow Jones News

By Kimberly Chin

Home Depot Inc. raised its earnings and sales targets for the

year as it continued to benefit from robust home-improvement

activity and a strong U.S. economy in the latest quarter.

The Atlanta company on Tuesday said it is targeting sales growth

of about 7% and comparable-store sales growth of about 5.3%, above

its prior guidance of 6.7% and 5%, respectively. Home Depot also

raised its earnings target to $9.42 a share from its earlier

forecast of $9.31 a share.

Home Depot said its second-quarter profit jumped 31% to $3.5

billion, or $3.05 a share, from the year-ago period. Analysts

polled by Thomson Reuters had expected a profit of $2.84 a

share.

Revenue rose 8.4% from a year earlier to $30.5 billion. Analysts

polled by Thomson Reuters were expecting revenue of $30.03 billion.

Meanwhile, overall comparable-store sales rose 8%, with U.S.

comparable-store sales rising 8.1%.

Shares of Home Depot fell 0.5% to $193.10 in Tuesday trading.

The retailer's shares have gained 1.9% this year.

The report comes as a basket of retail companies from Walmart

Inc. to Macy's Inc. are due to report earnings this week.

Home Depot benefited from customers spending more money on each

transaction in the latest quarter. The average customer ticket rose

5% to $66.20, driven in part by inflation for lumber building

materials and copper.

Ted Decker, Home Depot's executive vice president of

merchandising, said on a conference call that the company is

dealing with inflation on multiple fronts as costs for raw

materials and transportation rise. However, RBC Capital Markets

analysts said in a client note that Home Depot would be largely

unaffected by rising commodity prices as product manufacturers

would have to bargain hard to pass on price increases to the

retailer.

The company's profit continues to soar on a favorable economic

backdrop, marked by rising home prices, stronger housing formation

and tight housing supply. Low inventory levels are expected to

drive home prices higher and home-related investment activity.

"We feel very positive about the strength of the home

improvement sector and the customers' willingness to spend," Chief

Executive Craig Menear said on the call.

Analysts were also concerned that the retailer's plan to

accelerate investments to improve its supply chain and integrate

online tools to improve customers' in-store shopping experiences

would weigh on earnings over the next couple of quarters. The

company reported cost of sales rose 7.8% to $20.1 billion.

The investments, however, were seen as necessary to

"future-proof Home Depot's business against online competition,"

RBC analysts said in a note.

Home-improvement retailer Lowe's Cos. is due to release its

quarterly report Aug. 22.

Write to Kimberly Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

August 14, 2018 17:01 ET (21:01 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

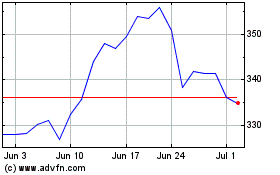

Home Depot (NYSE:HD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Home Depot (NYSE:HD)

Historical Stock Chart

From Apr 2023 to Apr 2024