Kelso Technologies Inc. (“Kelso” or the “Company”), (TSX: KLS),

(NYSE American: KIQ) reports that it has released its unaudited

interim consolidated financial statements and Management Discussion

and Analysis for the three and six months ended June 30, 2018.

The unaudited interim consolidated financial

statements were prepared in accordance with International Financial

Reporting Standards (“IFRS”) as issued by the International

Accounting Standards Board (“IASB”). All amounts herein are

expressed in United States dollars (the Company’s functional

currency) unless otherwise indicated.

SUMMARY OF FINANCIAL PERFORMANCE

|

|

Three months ended June 30, |

Six months ended June 30, |

|

|

|

2018 |

|

|

2017 |

|

|

2018 |

|

|

2017 |

|

|

Revenues |

$ |

2,535,235 |

|

$ |

1,433,663 |

|

$ |

5,047,113 |

|

$ |

2,996,980 |

|

| Gross

profit |

$ |

1,038,455 |

|

$ |

325,821 |

|

$ |

1,927,684 |

|

$ |

1,025,755 |

|

|

Income tax expense (recovery) |

$ |

- |

|

$ |

17,856 |

|

$ |

(3,213 |

) |

$ |

17,856 |

|

| Net

income (Loss) |

$ |

(162,911 |

) |

$ |

(897,513 |

) |

$ |

(442,054 |

) |

$ |

(1,423,009 |

) |

|

EBITDA (Loss) |

$ |

(88,334 |

) |

$ |

(830,291 |

) |

$ |

(321,386 |

) |

$ |

(1,320,090 |

) |

| EPS

(basic and diluted) |

$ |

(0.00 |

) |

$ |

(0.02 |

) |

$ |

(0.01 |

) |

$ |

(0.03 |

) |

LIQUIDITY AND CAPITAL

RESOURCES

At June 30, 2018 the Company had cash on deposit

in the amount of $107,529, accounts receivable of $1,237,178,

prepaid expenses of $92,951 and inventory of $3,629,901 compared to

cash on deposit in the amount of $411,223, accounts receivable of

$653,445, prepaid expenses of $183,966 and inventory of $3,980,243

at December 31, 2017.

The working capital position of the Company at

June 30, 2018 was $3,318.212 compared to $3,628,911 at December 31,

2017. Accounts receivable are collected within 30 days from

invoicing shipments giving Kelso $1,344,707 of available cash to

discharge liabilities of $1,040,061 recorded at June 30, 2018.

Net assets of the Company were $7,145,836 at

June 30, 2018 compared to $7,565,233 at December 31, 2017. At June

30, 2018 the Company had no interest bearing long-term liabilities

or debt.

OUTLOOK

Kelso has seen a consistent upside shift in rail

tank car production, retrofit and repair activity throughout 2018.

Since early 2017 we have implemented new business processes,

changed our corporate culture and revamped how we approach our

marketing and sales processes. The result is that sales growth and

business momentum is building. Management is encouraged that sales

and backlog purchase orders since June 30, 2018 have grown to

exceed $5,100,000 at the date of this report.

OEM and retrofit/repair activity that was

expected in 2015 before the collapse of oil prices is now occurring

in 2018. Crude oil, ethanol and chemicals are the key commodities

that are leading the way in this resurgence of market activity.

This stimulus has led rail tank car analysts to expect average

new-build production rates to grow to approximately 12,000 to

20,000 new rail tank cars annually for the next three years. Based

on these predictions Kelso expects to participate on approximately

6,000 to 8,000 rail tank cars annually.

A key dynamic for improved financial performance

is getting more of our tank car equipment portfolio adopted by the

hazardous materials shippers. Once this adoption trend can be

established we expect customers to begin to specify combinations of

our One-Bolt Manway, VRV and BOV along with our proven PRV. Our

long term goal is to improve tank car revenues from approximately

$1,400 per new or refitted tank car to in excess of $10,000 per

tank car.

The frustrating challenge for sales growth is

that full Association of American Railroads (AAR) regulatory

approvals are required for full commercial adoption. The AAR is

historically slow to respond to submitted applications for new

products and corresponding completed service trials. Although

customers have expressed considerable interest in our equipment

they maintain that they are either unable or reluctant to specify

any products that are under field service trial until full AAR

approvals are received. This is beyond our control and is the

primary challenge for the near-term growth of our rail tank car

equipment revenues.

Currently we are awaiting final AAR approval for

our VRV which is in the final stages of full approval. Once

received, sales of VRV are expected to commence. There is no AAR

requirement for any company to service trial new technology, which

means we have to source volunteer companies to participate in

service trial programs. Kelso has successfully found these

technology partners and full service trials on our ceramic ball

BOV, high pressure PRV and angle valve are in process. This is a

clear indication that these products will be in demand once

approvals are completed.

The Company will continue to make investments in

new products with the understanding that profits, assuming that

they develop as planned, can provide reliable future financial

growth from multiple transportation markets. The key focus of our

product development strategy is that we want to develop new

products that customers want and preferably do not require lengthy

regulatory approval processes. The goal is to shorten the elapsed

time from the design-production process to sales and distribution

activity, which goal is expected to be achieved.

This R&D process has delivered an array of

promising new products that include specialized truck tanker

equipment, rail wheel cleaning systems, fuel loading systems,

military applications, first responder emergency response kits and

an ASCS suspension system for motor vehicles being used in rugged

outback terrain applications.

Capital management remains challenging but

recent improvements in cash flows in 2018 have been adequate to

fund business activity. We continue to prioritize promising product

development initiatives to build future value propositions for

Kelso’s stakeholders, even though R&D projects are often

complex, expensive and the timing of revenue streams cannot be

predicted or guaranteed. Although many operational and human

resource expenses have been reduced, management must assess its

capital needs carefully. Management believes that for the time

being, the Company can continue operating without access to new

equity capital or debt. The Company remains free of interest

bearing long term debt.

The current improvement in the rail tank car

market and our diversified product program sets the Company in a

much better position to succeed financially over the longer term.

Paramount to our strategic plan is the eventual satisfaction of all

Kelso stakeholders with reliable growth of profitability, improved

financial health and market valuation.

About Kelso Technologies

Kelso is an engineering product development

company that specializes in the development, production and

distribution of proprietary service equipment used in

transportation applications. Our reputation has been earned as a

developer and reliable supplier of unique high performance rail

tank car equipment for the handling and containment of hazardous

and non-hazardous commodities during transport. All Kelso products

are developed with emphasis on economic and operational advantages

to customers while mitigating the impact of human error and

environmental release. The Company offers specialized truck tanker

equipment, rail wheel cleaning systems, fuel loading systems,

military applications, first responder emergency response kits and

suspension systems for motor vehicles being used in rugged outback

terrains.

For a more complete business and financial

profile of the Company, please view the Company's website at

www.kelsotech.com and public documents posted under the Company’s

profile on www.sedar.com in Canada and on EDGAR at www.sec.gov in

the United States.

On behalf of the Board of

Directors,

James R. Bond, CEO and President

Notice to Reader: References to

EBITDA refer to net earnings from continuing operations before

interest, taxes, amortization, unrealized foreign exchange and non

cash share-based expenses (Black Sholes option pricing model).

EBITDA is not an earnings measure recognized by IFRS and does not

have a standardized meaning prescribed by IFRS. Management believes

that EBITDA is an alternative measure in evaluating the Company's

business performance. Readers are cautioned that EBITDA should not

be construed as an alternative to net income as determined under

IFRS; nor as an indicator of financial performance as determined by

IFRS; nor a calculation of cash flow from operating activities as

determined under IFRS; nor as a measure of liquidity and cash flow

under IFRS. The Company's method of calculating EBITDA may differ

from methods used by other issuers and, accordingly, the Company's

EBITDA may not be comparable to similar measures used by any other

issuer.

Legal Notice Regarding Forward-Looking

Statements: This news release contains “forward-looking

statements” within the meaning of applicable securities

legislation. Forward-looking statements are indicated expectations

or intentions. Forward-looking statements in this news release

include that Kelso has seen a consistent upside shift in rail tank

car production, retrofit and repair activity throughout 2018; that

management is encouraged that in addition to our year-to-date

revenues new sales and backlog purchase orders since June 30, 2018

have grown to exceed $5,100,000 at the date of this report; that

OEM and retrofit/repair activity has led rail tank car analysts to

expect average new-build production rates to grow to approximately

12,000 to 20,000 new rail tank cars annually for the next three

years; that based on these predictions Kelso expects to participate

on approximately 6,000 to 8,000 rail tank cars annually; that we

expect customers to begin to specify combinations of our One-Bolt

Manway, VRV and BOV along with our proven PRV; that our long term

goal is to improve tank car revenues from approximately $1,400 per

tank car to in excess of $10,000 per tank car; that we are awaiting

final AAR approval for our VRV which is in the final stages of full

approval and once received sales of VRV are expected to commence;

that we expect to shorten the elapsed time from the

design-production process to sales and distribution activity; that

full service trials on our ceramic ball BOV, high pressure PRV and

angle valve may be a clear indication that these products will be

in demand once approvals are completed; that the Company can

continue operating without access to new equity capital or debt;

and the current improvement in the rail tank car market and our

diversified product program sets the Company in a much better

position to succeed financially over the longer term. Although

Kelso believes its anticipated future results, performance or

achievements expressed or implied by the forward-looking statements

and information are based upon reasonable assumptions and

expectations, they can give no assurance that such expectations

will prove to be correct. The reader should not place undue

reliance on forward-looking statements and information as such

statements and information involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of Kelso to differ materially from

anticipated future results, performance or achievement expressed or

implied by such forward-looking statements and information,

including without limitation the risk that regulatory deadlines for

compliance may be delayed or cancelled; the Company’s products may

not provide the intended economic or operational advantages; or

reduce the potential effects of human error and environmental harm

during the transport of hazardous materials; or grow and sustain

anticipated revenue streams; AAR approvals may not be finalized,

orders may be cancelled and competitors may enter the market with

new product offerings which could capture some of our market share;

and our new equipment offerings may not capture market share as

well as expected. Except as required by law, the Company does not

intend to update the forward-looking information and

forward-looking statements contained in this news release.

For further information, please contact:

| James R. Bond, CEO and PresidentEmail:

bond@kelsotech.com |

Richard Lee, Chief Financial OfficerEmail:

lee@kelsotech.com |

Corporate Address:13966 - 18B AvenueSouth Surrey, BC V4A

8J1www.kelsotech.com |

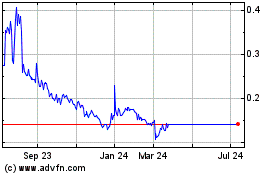

Kelso Technologies (AMEX:KIQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kelso Technologies (AMEX:KIQ)

Historical Stock Chart

From Apr 2023 to Apr 2024