RWE Reports Lower 1st Half Earnings, Backs 2018 View -- Update

August 14 2018 - 2:58AM

Dow Jones News

(Includes consolidated group figures, outlook adjustments.)

By Max Bernhard

RWE AG (RWE.XE) said Tuesday that its first-half earnings fell

and that it has adjusted its financial reporting following the deal

to sell its stake in Innogy SE (IGY.XE) to E.ON SE (EOAN.XE).

"As a result of this change, the consolidated figures for the

RWE Group are only of limited informational value," RWE said.

RWE said it therefore provided key figures for its stand-alone

business, excluding Innogy, in addition to its consolidated group

figures.

For its stand-alone business, excluding Innogy, RWE reported

adjusted earnings before interest, taxes, depreciation, and

amortization of 1.1 billion euros ($1.25 billion) compared with

EUR1.4 billion the prior-year period. Adjusted net income was

EUR683 million compared with EUR883 million in the first six months

of 2017, RWE said.

RWE reported group revenue of EUR6.83 billion, down from EUR7.47

billion a year ago. Accounting changes resulted in a lower reported

revenue for 2018, RWE said. Group net profit in the period dropped

to EUR162 million from EUR2.67 billion, the company said.

RWE said changes to its financial reporting would also affect

full-year results and therefore its outlook.

Excluding Innogy's business, the company expects adjusted Ebitda

of between EUR1.5 billion and EUR1.8 billion in 2018.

RWE said it still plans a dividend increase for fiscal 2018 to

EUR0.70 from EUR0.50.

Write to Max Bernhard at max.bernhard@dowjones.com;

@mxbernhard

(END) Dow Jones Newswires

August 14, 2018 02:43 ET (06:43 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

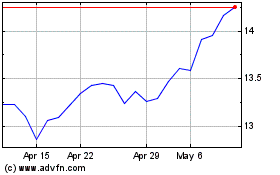

E ON (PK) (USOTC:EONGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

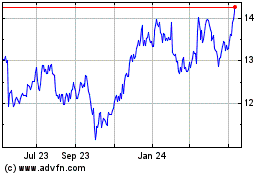

E ON (PK) (USOTC:EONGY)

Historical Stock Chart

From Apr 2023 to Apr 2024