By Rob Taylor and Rachel Pannett

When Papua New Guinea joined the ranks of the world's

significant energy exporters four years ago, the government was

betting on a revenue windfall it hoped would transform the

impoverished South Pacific nation better-known for jungles,

violence and corruption.

But the payday from a $19 billion Exxon Mobil Corp.-led

natural-gas project has so far been a trickle, crimped by a

downturn in gas prices that allowed Exxon and its partners to claim

losses against royalty payments. A 7.5-magnitude earthquake in

February that killed more than 100 people and left 300,000 homeless

further strained government resources.

To bridge the revenue gap and revive its slowing economy, Papua

New Guinea has increasingly turned to China. The government now

owes the state-owned Export-Import Bank of China close to $1.9

billion in low-cost loans for infrastructure and other construction

projects, almost a quarter of its total debt. That has raised

concerns the country's growing indebtedness is allowing Beijing to

further expand its influence in the Pacific.

China's stamp on Papua New Guinea will be on show in November

when Pacific Rim leaders, including President Trump and China's

President Xi Jinping, gather in the capital, Port Moresby.

Delegates attending the Asia-Pacific Economic Cooperation forum

will meet in a convention center built by Chinese workers and paid

for with a Chinese grant. Official motorcades will travel on a

six-lane boulevard constructed and financed by Chinese loans.

"We took on APEC knowing it would be a massive challenge for

such a small country," said Charles Abel, Papua New Guinea's

treasurer and deputy prime minister. "It is a bold undertaking by

our small country to introduce ourselves to the world."

A former Australian colony of eight million, Papua New Guinea

has long relied on foreign aid. The country has minimal

infrastructure outside Port Moresby and companies typically

negotiate terms with local landowners to gain access to resources

-- a knotty problem in a country with hundreds of ethnic

groups.

The government has historically looked to Australia for

assistance. The country, along with other APEC members, is also

chipping in for the summit, covering about a third of the cost.

Australia's foreign minister, Julie Bishop, said the country wants

to be the "natural partner of choice" for Papua New Guinea and

other Pacific countries.

But China's presence is becoming much more visible. Chinese

loans have helped redevelop a port and airport in the second

largest city, Lae. In November, China promised to build $3.5

billion of roads, a commitment that if realized would make it the

country's biggest aid donor, according to the Sydney-based Lowy

Institute's Pacific program. It also imports natural gas from Papua

New Guinea and has invested in nickel mines, power stations and

other projects.

During a visit by Prime Minister Peter O'Neill to Beijing in

June, Papua New Guinea became the first Pacific country to sign up

to China's One Belt One Road, an initiative to build a global

network of ports, railways, roads and pipelines. For Beijing, the

program is a way to expand business and trade and extend strategic

influence, in part by distributing loans.

Mr. Xi said during the visit that relations between the two

countries had "entered a fast track, and political mutual trust and

mutually beneficial cooperation have both reached a new level in

history." In July, Mr. O'Neill invited Pacific leaders to a meeting

with Mr. Xi in Papua New Guinea ahead of APEC.

But China's infrastructure push in the region has raised some

alarms. A Chinese-financed building spree in Pakistan has been

dogged by concerns about the country's growing debt burden to

Beijing. Sri Lanka's government, unable to repay a Chinese loan for

a port, last year granted a Chinese state company a 99-year lease

on the facility.

The International Monetary Fund said Pacific nations including

Tonga, Samoa and Vanuatu have significant debts to China and face

repayment pressures. Papua New Guinea is no exception.

"The speed and scale with which China is acquiring natural

resources and amassing debt raise long-term concerns,"

foreign-policy scholars Gabrielle Chefitz and Sam Parker wrote in a

May paper for Harvard Kennedy School's Belfer Center for Science

and International Affairs.

Standard & Poor's in April lowered Papua New Guinea's credit

rating to B from B-plus, citing slower economic growth and

expanding government deficits. It expects the ratio of government

debt to gross domestic product to reach 40% by 2021 from 30%

now.

Papua New Guinea's Treasurer, Mr. Abel, said he has been closely

following the loans offered by China to small Pacific nations.

"There remains some concerns about the way that they do conduct

business," he said. "But in PNG's case, we quite strictly manage

our debt."

China's Ministry of Foreign Affairs said its assistance to Papua

New Guinea and other Pacific Island nations has been welcomed by

their governments. "China has provided assistance, especially

assistance without any political conditions, to the Pacific Island

nations, including Papua New Guinea," the ministry said. "It is not

targeting on any third party.

Mr. Abel, speaking of the Exxon-led gas project, conceded that

for the hundreds of millions the government paid for its stake --

through a state-owned oil company -- "we have not had the

corresponding revenue growth."

Before production began in 2014, the country's Treasury

department estimated the project would boost government revenue by

roughly $600 million, or two billion Kina, a year through 2021,

rising to more than $1 billion, or 3.5 billion Kina, a year between

2022 and 2030. Instead, as of September 2017, roughly $45 million

in royalties and development levies had been paid, according to the

IMF.

"When commodity prices are depressed like they have been for the

last few years, revenues to all joint venture participants,

including government, are reduced," Exxon said in a statement.

The shortfall has weighed on the commodity-dependent economy.

The IMF in a December report estimated GDP grew 2.2% in 2017, down

from 2.4% in 2016, far below the government's predictions a few

years ago that the country would grow 21%.

--Chunying Zhang contributed to this article.

Write to Rob Taylor at rob.taylor@wsj.com and Rachel Pannett at

rachel.pannett@wsj.com

(END) Dow Jones Newswires

August 11, 2018 10:14 ET (14:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

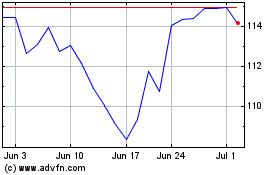

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

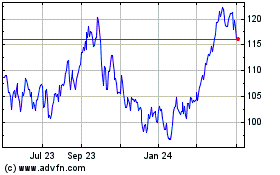

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024