Qualcomm, Taiwan Reach Settlement in Patent-Licensing Dispute

August 10 2018 - 12:08AM

Dow Jones News

By Tripp Mickle

Qualcomm Inc. notched a victory in its effort to preserve its

patent-licensing business, as it reached a settlement with the

Taiwanese government that revokes a previous finding against the

chip maker and saves the company nearly $700 million in fines.

The settlement comes as world's dominant supplier of chips for

smartphones seeks to chart a new path following a tumultuous year

that involved fending off a takeover effort by rival Broadcom Inc.

and abandoning its takeover of NXP Semiconductors NV amid trade

tensions between the U.S. and China. Chief Executive Steve

Mollenkopf is pursuing an ambitious plan to lift earnings and

reduce the company's dependence on smartphone-related chip sales,

all while battling legal challenges to its licensing business from

Apple Inc.

Qualcomm's issues in Taiwan spiked in October when Taiwan's Fair

Trade Commission fined the company $773 million and ruled Qualcomm

violated the country's laws by unfairly licensing its patents, a

decision that could have upended Qualcomm's business by forcing it

to license its intellectual property to other chip makers.

The settlement revokes Taiwan's ruling, Qualcomm said. In its

place, Qualcomm said it has pledged to negotiate in good faith with

Taiwanese handset makers including HTC and agreed to let Taiwanese

authorities intervene to resolve any negotiation-related

disputes.

Qualcomm also said it committed to invest an undisclosed amount

of money over the next five years in Taiwan by collaborating on 5G

technology with chip makers and others, funding

research-and-development projects with universities and developing

a Taiwanese center for operations and manufacturing

engineering.

Under the agreement, Taiwan will keep $93 million in payments

from Qualcomm toward the fine assessed last year, but the remaining

amount was waived, according to the chip maker.

Qualcomm continues to face regulatory challenges in the U.S.,

where the Federal Trade Commission sued it in early 2017, alleging

the company engaged in unlawful tactics to maintain a monopoly on

cellular-communications chips. It also is appealing an $853 million

fine by South Korea's Fair Trade Commission over alleged antitrust

violations.

In the U.S., the company remains mired in a legal battle with

Apple and several Taiwanese manufacturers, which have sought to end

the chip maker's practice of collecting royalties on the entire

sales price of a handset.

Write to Tripp Mickle at Tripp.Mickle@wsj.com

(END) Dow Jones Newswires

August 09, 2018 23:53 ET (03:53 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

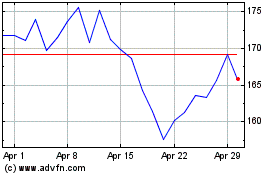

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Apr 2023 to Apr 2024