Labor Unrest Strikes Mining Giants

August 09 2018 - 3:50AM

Dow Jones News

By Rhiannon Hoyle

SYDNEY--Already grappling with challenges including U.S. tariffs

and rising costs, global mining companies face another: worker

walkouts.

In Australia, roughly 1,500 employees at alumina refineries and

bauxite mines owned by Alcoa Corp., the largest U.S. aluminum

maker, are striking over pay and working conditions. That follows

labor unrest at sites including mines run by Glencore PLC in South

Africa and BHP Billiton Ltd. in Chile.

Strikes stoke volatility in global commodity markets, affecting

the prices of products from guitar strings to semiconductors.

Copper is especially prone to wild swings, given that supply is

typically in line with global demand. Loss of production from a

megapit such as Escondida in Chile or Grasberg in Indonesia, both

hit by long walkouts last year, can swing a tight market into a

shortfall.

Rising labor costs also threaten mining giants' profits, just

recovering from a deep downturn. Moody's Investors Service said if

workers strike again at Escondida--they voted in favor of a walkout

this month--it could lead to a material fall in the BHP-led

venture's production and margins.

For the aluminum industry, the strikes in Australia are

happening at an especially sensitive time.

Producers and buyers were early casualties of the Trump

administration's aggressive trade policy, as the U.S. imposed a 10%

tariff on imported aluminum earlier in the year. Alcoa, which cited

tariffs in cutting its profit outlook last month, on Monday asked

for an exemption from tariffs on aluminum imported from Canada.

The market has also been jolted this year by U.S. sanctions

against Oleg Deripaska and his Rusal aluminum empire, and by higher

electricity costs--aluminum production is energy-intensive--as oil

and coal prices rise.

Alumina, produced from bauxite, is smelted to make aluminum.

Alcoa's three refineries in Western Australia account for roughly

7% of global alumina supply, so the strike risks driving up prices,

ultimately of the products from cars to beer cans that contain

aluminum.

It is "a sufficiently large supply shock" to rattle the market,

said Macquarie. Aluminum rose 3.3% on the London Metal Exchange on

Wednesday to US$2,106 a metric ton. It surged as high as US$2,146 a

ton intraday in Asia Thursday, its highest in more than a

month.

In a statement, Alcoa said its operations in Western Australia,

which employ about 3,750 people, are continuing to run as normal,

and that it doesn't forecast reduced output.

"Our sites have contingency plans to ensure they can continue to

operate during industrial action," said Alcoa. Still, it said the

1,500 union members are expected to remain on strike until Aug. 17

and vote on a new agreement later in the month. The two sides have

been in wage talks for 18 months.

Alumina's price was already high before the strike, having risen

about 35% in 2018, said Morgan Stanley analyst Susan Bates, an

increase linked to earlier cuts at refineries in Brazil and

China.

"Since alumina accounts for 40% of aluminum smelter cash costs,

a price spike would be likely to put upward pressure on aluminum's

price," Ms. Bates said.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

August 09, 2018 03:35 ET (07:35 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

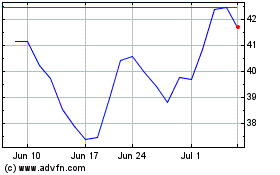

Alcoa (NYSE:AA)

Historical Stock Chart

From Mar 2024 to Apr 2024

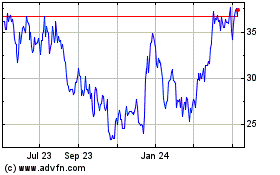

Alcoa (NYSE:AA)

Historical Stock Chart

From Apr 2023 to Apr 2024