CVS Chief Defends Benefit Managers -- WSJ

August 09 2018 - 3:02AM

Dow Jones News

By Patrick Thomas

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 9, 2018).

CVS Health Corp. Chief Executive Larry Merlo said Wednesday that

industry middlemen aren't responsible for increasing U.S. drug

prices, noting that prices are rising faster for medicines with

smaller manufacturer rebates.

CVS owns Caremark, one of the biggest pharmacy-benefit managers,

which process prescriptions for insurers or companies that pay for

medicines and use their size to negotiate with drugmakers and

pharmacies. Mr. Merlo said CVS expects 3%, or about $300 million,

of its 2018 earnings to come from rebates it pockets.

President Donald Trump has periodically criticized high drug

prices and recently pressured drugmaker Pfizer Inc. to abandon

plans to raise list prices. In May, the president proposed various

initiatives to curb drug prices. The administration has said that

rebates paid to PBMs lead to higher drug prices.

Drug companies have sought to shift blame for the high prices,

and have been increasingly vocal in blaming PBMs for drug-price

increases and high out-of-pocket costs confronting patients.

"Drug manufacturers want you to believe that increasing drug

prices are a result of them happy to pay rebates and that PBMs are

retaining these rebates. And this is simply not true," Mr. Merlo

said on a conference call Wednesday. "Our data showed that list

price is increasing faster for drugs with small rebates than it is

for medications with substantial rebates."

Mr. Merlo said that his company has generated tens of billions

of dollars in rebates and that 98% of those funds are passed

through to its clients, which are insurers, companies and groups

that pay for medicines. He said drug prices rose 0.2% for its

clients on a per capita basis last year.

The new Health and Human Services Secretary Alex Azar is a

former drug company executive, and in an effort to control prices,

HHS has been proposing moves that analysts say would target

middlemen more than drugmakers.

CVS is becoming a bigger target as it expands beyond its retail

pharmacy origins and tries to capture more of what consumers spend

on health care. In December the Woonsocket, R.I.-based company

reached a deal to buy insurer Aetna Inc. for $69 billion in cash

and stock. It expects the transaction to close later this year.

On Wednesday, CVS reported its second-quarter revenue rose 2.2%

to $46.71 billion. The unit that includes Caremark reported $33.2

billion in revenue, up 2.8% from a year ago.

For the quarter, CVS posted a loss of $2.56 billion, compared

with a profit of $1.1 billion a year earlier. The second quarter

included a $3.9 billion impairment charge for its Omnicare

long-term care business.

CVS has struggled to grow the Omnicare business, which is

acquired in 2015, due to lower occupancy rates in skilled nursing

facilities and low client retention rates. Omnicare provides

pharmacy services to nursing homes and other clients.

CVS is also facing fresh competition from new entrants into its

business, notably Amazon.com Inc. which spent $1 billion to buy

online pharmacy startup PillPack back in June.

CVS, which operates about 9,800 pharmacies and offers mail-order

medicines, enlisted the U.S. Postal Service earlier this summer for

a new home delivery service where customers will be charged $4.99

per delivery.

Jonathan D. Rockoff contributed to this article.

Write to Patrick Thomas at patrick.thomas@wsj.com

(END) Dow Jones Newswires

August 09, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

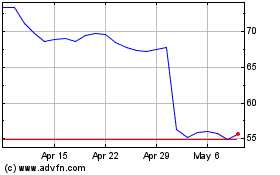

CVS Health (NYSE:CVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

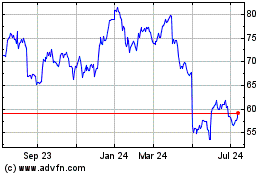

CVS Health (NYSE:CVS)

Historical Stock Chart

From Apr 2023 to Apr 2024