2Q18 Net Product Sales of $21.3M Driven

by Galafold®

(Migalastat) Expansion

Amicus Therapeutics (Nasdaq: FOLD), a global biotechnology company

focused on discovering, developing and delivering novel medicines

for rare metabolic diseases, today announced financial results for

the second quarter ended June 30, 2018. The Company also summarized

recent program updates, raised its full-year 2018 revenue guidance

and updated its net cash spend guidance for the year.

John F. Crowley, Chairman and Chief Executive

Officer of Amicus Therapeutics, Inc. stated, “In the first half of

2018, we have made tremendous progress advancing Galafold,

expanding access to patients with amenable mutations across the

world. Given the continued strong momentum of the Galafold launch,

the early commercial launch in Japan, and the pending accelerated

approval in the U.S., we are raising our 2018 revenue guidance to

$80 million to $90 million. We have also continued to advance our

Pompe clinical, manufacturing and regulatory activities and look

forward to providing an update later this quarter on the pivotal

study design and best and fastest regulatory path in the United

States for this important program. Additionally, we are also

extraordinarily focused on assembling a portfolio of technologies,

programs and partnerships in the gene therapy space. Our goal

beginning in the second half of this year is a bold one: to build

one of the most robust gene therapy pipelines in the field of rare,

metabolic disorders. We are well positioned to achieve our vision

to impact as many people as possible who are living with rare

metabolic diseases as we continue to build a leading global rare

disease biotech company.”

Second Quarter 2018 Financial Results

and Full-Year 2018 Financial Guidance

- Total revenue in the second quarter 2018 was $21.3 million, a

year-over-year increase of 198% from total revenue of $7.2 million

in the second quarter of 2017.

- Cash, cash equivalents, and marketable securities totaled

$552.8 million at June 30, 2018, compared to $358.6 million at

December 31, 2017.

- Total operating expenses increased to $65.1 million for the

second quarter 2018 compared to $53.2 million in the second quarter

2017, reflecting an increased investment in Pompe clinical and

manufacturing activities as well as Galafold commercial launch and

launch preparations.

- Net cash spend was $51.0 million for the second quarter 2018.

Net loss was $61.8 million, or $0.33 per share, for the second

quarter 2018 compared to a net loss of $48.1 million, or $0.34 per

share, for the second quarter 2017.

“The second quarter of 2018 marked another

period of continued growth for Galafold,” said Bradley L. Campbell,

President and COO of Amicus Therapeutics. “We are raising our

full-year 2018 Galafold global revenue guidance given the current

and anticipated increase in patient and physician adoption in our

existing markets, the ongoing launch in Japan, and our anticipated

PDUFA date and launch in the U.S. this quarter. And we’re

pleased to announce that we’ve hired 100% of our US launch team

comprised of passionate professionals with significant rare disease

experience.”

2018 Financial Guidance

For the full-year 2018 the Company is increasing its total

Galafold revenue guidance to $80 million to $90 million from the

previous range of $75 million to $85 million. This reflects global

revenue from all expected 2018 commercial markets.

Based on the increase in expected 2018 revenue

and operating expenses that are trending favorably to budget, the

Company is updating its full-year 2018 net cash spend to $220 to

$250 million from the previous range of $230 to $260 million. The

current cash position, including proceeds from the February 2018

equity offering and expected Galafold revenues, is sufficient to

fund ongoing Fabry and Pompe program operations into at least 2021.

Potential future business development collaborations, pipeline

expansion, and investment in biologics manufacturing capabilities

could impact the Company’s future capital requirements.

Program Highlights

Migalastat for Fabry

DiseaseAmicus is committed to advancing the highest

quality therapies for all people living with Fabry disease.

Migalastat, the Company’s first therapy, is an oral precision

medicine. Regulatory authorities in Australia, Canada, EU, Israel,

Japan, South Korea and Switzerland have granted full approval for

migalastat under the trade name Galafold to treat Fabry disease in

patients 16 years or older who have amenable genetic mutations. In

the U.S., the FDA accepted the Company’s new drug application (NDA)

for migalastat under Subpart H priority review with a six-month

PDUFA goal date of August 13, 2018.

For people with non-amenable mutations who are

not eligible for migalastat as an oral precision medicine, the

strategy is to advance next-generation therapies such as a novel

Fabry ERT (ATB101) co-formulated with migalastat or other

innovative technologies that continue to be evaluated.

Global Fabry Updates:

- Pricing and reimbursement secured in 19 countries with first

commercial patients treated in multiple new countries in 2018

- Approvals secured in Australia, Canada, EU, Israel, Japan,

South Korea and Switzerland

- Commercial launch initiated in Japan during the second

quarter

- U.S. leadership and field team now in place to support planned

U.S. launch

Anticipated Milestones:

- U.S. FDA regulatory decision (3Q18)

AT-GAA for Pompe Disease

AT-GAA is a novel treatment paradigm that

consists of ATB200, a unique recombinant human acid

alpha-glucosidase (rhGAA) enzyme with optimized carbohydrate

structures, particularly mannose 6-phosphate (M6P), to enhance

uptake, co-administered with AT2221, a pharmacological chaperone to

stabilize ATB200 while in the circulation to deliver active

therapeutic enzyme.

The Company is engaged in collaborative

discussions with U.S. and EU regulators regarding a

number of key topics including a registration-directed study for

full approval, manufacturing activities, and the best and fastest

pathway forward for this novel treatment regimen. The Company

believes that the evolving regulatory paths in both the

U.S. and EU will include a series of iterative discussions

with regulators as the program advances and as additional data are

collected, including data from existing patients in ongoing

studies, data from new patients being enrolled into ongoing

studies, and the results of a formal retrospective natural history

study of Pompe patients receiving current standard of care ERT.

Amicus expects to provide an FDA update in the third quarter 2018

after receipt of written minutes from a scheduled Type C

meeting.

Manufacturing activities to support the needs of

the Pompe community are also ongoing.

Pompe Manufacturing Updates:

- Release of 1,000L GMP material for use in the planned pivotal

study.

- Feedback from German regulatory authorities (BfArM) indicating

general agreement with the manufacturing strategy for ATB200,

including the strategy to demonstrate comparability of drug

substance and drug product between the 1,000 liter scale and the

250 liter scale.

Anticipated Pompe Program Milestones in

2H18:

- Pompe US regulatory update (3Q18).

- Completion of a retrospective natural history study in ~100

ERT-treated Pompe patients.

- 18-month data from ATB200-02 clinical study to be presented at

the 23rd International Congress of the World Muscle Society

(4Q18).

- Commence pivotal study in 2H18.

Conference Call and

WebcastAmicus Therapeutics will host a conference call and

audio webcast today, August 7, 2018, at 8:30 a.m. ET to discuss the

second quarter 2018 financial results and corporate updates.

Interested participants and investors may access the conference

call by dialing 877-303-5859 (U.S./Canada) or 678-224-7784

(international), conference ID: 5887047.

An audio webcast can also be accessed via the

Investors section of the Amicus Therapeutics corporate website at

http://ir.amicusrx.com/, and will be archived for 30 days. Web

participants are encouraged to go to the website 15 minutes prior

to the start of the call to register, download, and install any

necessary software. A telephonic replay of the call will be

available for seven days beginning at 11:30 a.m. ET on August 7,

2018. Access numbers for this replay are 855-859-2056 (U.S./Canada)

and 404-537-3406 (international); conference ID: 5887047.

Non-GAAP Financial MeasuresIn

addition to the United States generally accepted accounting

principles (GAAP) results, this earnings release contains non-GAAP

financial measures that we believe, when considered together with

the GAAP information, provides useful information to investors that

promotes a more complete understanding of our operating results and

financial position for the current period. Management uses these

non-GAAP financial measures internally for planning, forecasting,

evaluating and allocating resources to the Company's

programs.

EU Important Safety

InformationTreatment with GALAFOLD should be initiated and

supervised by specialists experienced in the diagnosis and

treatment of Fabry disease. GALAFOLD is not recommended for use in

patients with a nonamenable mutation.

- GALAFOLD is not intended for concomitant use with enzyme

replacement therapy.

- GALAFOLD is not recommended for use in patients with Fabry

disease who have severe renal impairment (<30 mL/min/1.73 m2).

The safety and efficacy of GALAFOLD in children 0–15 years of age

have not yet been established.

- No dosage adjustments are required in patients with hepatic

impairment or in the elderly population.

- There is very limited experience with the use of this medicine

in pregnant women. If you are pregnant, think you may be pregnant,

or are planning to have a baby, do not take this medicine until you

have checked with your doctor, pharmacist, or nurse.

- While taking GALAFOLD, effective birth control should be used.

It is not known whether GALAFOLD is excreted in human milk.

- Contraindications to GALAFOLD include hypersensitivity to the

active substance or to any of the excipients listed in the

PRESCRIBING INFORMATION.

- It is advised to periodically monitor renal function,

echocardiographic parameters and biochemical markers (every 6

months) in patients initiated on GALAFOLD or switched to

GALAFOLD.

- OVERDOSE: General medical care is recommended in the case of

GALAFOLD overdose.

- The most common adverse reaction reported was headache, which

was experienced by approximately 10% of patients who received

GALAFOLD. For a complete list of adverse reactions, please review

the SUMMARY OF PRODUCT CHARACTERISTICS.

- Call your doctor for medical advice about side effects.

For further important safety information for Galafold, including

posology and method of administration, special warnings, drug

interactions and adverse drug reactions, please see the European

SmPC for Galafold available from the EMA website at

www.ema.europa.eu.

About Amicus Therapeutics

Amicus Therapeutics (Nasdaq: FOLD) is a global, patient-centric

biotechnology company focused on discovering, developing and

delivering novel high-quality medicines for people living with rare

metabolic diseases. The cornerstone of the Amicus portfolio is

Galafold, an oral precision medicine for people living with Fabry

disease who have amenable genetic mutations. The lead biologics

program in the Amicus pipeline is AT-GAA, a novel, late-stage

treatment for Pompe disease. Amicus is committed to advancing and

expanding a robust pipeline of cutting-edge, first- or

best-in-class medicines for rare metabolic diseases.

Forward-Looking StatementsThis

press release contains "forward-looking statements" within the

meaning of the Private Securities Litigation Reform Act of 1995

relating to preclinical and clinical development of our product

candidates, the timing and reporting of results from preclinical

studies and clinical trials, the prospects and timing of the

potential regulatory approval of our product candidates,

commercialization plans, manufacturing and supply plans, financing

plans, and the projected revenues and cash position for the

Company. The inclusion of forward-looking statements should not be

regarded as a representation by us that any of our plans will be

achieved. Any or all of the forward-looking statements in this

press release may turn out to be wrong and can be affected by

inaccurate assumptions we might make or by known or unknown risks

and uncertainties. For example, with respect to statements

regarding the goals, progress, timing, and outcomes of discussions

with regulatory authorities, and in particular the potential goals,

progress, timing, and results of preclinical studies and clinical

trials, actual results may differ materially from those set forth

in this release due to the risks and uncertainties inherent in our

business, including, without limitation: the potential that results

of clinical or preclinical studies indicate that the product

candidates are unsafe or ineffective; the potential that it may be

difficult to enroll patients in our clinical trials; the potential

that regulatory authorities, including the FDA, EMA, and PMDA, may

not grant or may delay approval for our product candidates; the

potential that we may not be successful in commercializing Galafold

in Europe and other geographies or our other product candidates if

and when approved; the potential that preclinical and clinical

studies could be delayed because we identify serious side effects

or other safety issues; the potential that we may not be able to

manufacture or supply sufficient clinical or commercial products;

and the potential that we will need additional funding to complete

all of our studies and manufacturing. Further, the results of

earlier preclinical studies and/or clinical trials may not be

predictive of future results. With respect to statements regarding

projections of the Company's revenue and cash position, actual

results may differ based on market factors and the Company's

ability to execute its operational and budget plans. In addition,

all forward-looking statements are subject to other risks detailed

in our Annual Report on Form 10-K for the year ended December 31,

2017 as well as our Quarterly Report on Form 10-Q for the quarter

ended June 30, 2018 to be filed August 7, 2018 with the Securities

and Exchange Commission. You are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

of the date hereof. All forward-looking statements are qualified in

their entirety by this cautionary statement, and we undertake no

obligation to revise or update this news release to reflect events

or circumstances after the date hereof.

CONTACTS:

Investors/Media:Amicus

TherapeuticsAndrew FaughnanAssociate Director, Investor

Relationsafaughnan@amicusrx.com (609) 662-3809

Media:Pure CommunicationsJennifer Paganelli

jpaganelli@purecommunications.com (347) 658-8290

FOLD–G

| |

| TABLE 1 |

| Amicus

Therapeutics, Inc.Consolidated Statements of

Operations(in thousands, except share and per

share amounts) |

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

2018 |

|

2017 |

|

2018 |

|

2017 |

| Revenue: |

|

|

|

|

|

|

|

| Net product sales |

$ |

21,309 |

|

|

$ |

7,158 |

|

|

$ |

38,005 |

|

|

$ |

11,327 |

|

| Cost of goods sold |

3,135 |

|

|

1,061 |

|

|

5,750 |

|

|

1,836 |

|

| Gross Profit |

18,174 |

|

|

6,097 |

|

|

32,255 |

|

|

9,491 |

|

| Operating

Expenses: |

|

|

|

|

|

|

|

| Research

and development |

34,660 |

|

|

31,985 |

|

|

75,458 |

|

|

62,861 |

|

| Selling,

general and administrative |

29,172 |

|

|

19,311 |

|

|

56,568 |

|

|

38,443 |

|

| Changes

in fair value of contingent consideration payable |

300 |

|

|

1,050 |

|

|

1,400 |

|

|

5,628 |

|

|

Depreciation |

973 |

|

|

812 |

|

|

1,942 |

|

|

1,636 |

|

| Total operating

expenses |

65,105 |

|

|

53,158 |

|

|

135,368 |

|

|

108,568 |

|

| Loss from

operations |

(46,931 |

) |

|

(47,061 |

) |

|

(103,113 |

) |

|

(99,077 |

) |

| Other income

(expense): |

|

|

|

|

|

|

|

| Interest

income |

2,913 |

|

|

753 |

|

|

4,650 |

|

|

1,512 |

|

| Interest

expense |

(4,560 |

) |

|

(4,179 |

) |

|

(9,048 |

) |

|

(8,469 |

) |

| Change in

fair value of derivatives |

(7,600 |

) |

|

— |

|

|

(2,739 |

) |

|

— |

|

| Other

(expense) income |

(5,316 |

) |

|

2,400 |

|

|

(2,554 |

) |

|

3,010 |

|

| Loss before income

tax |

(61,494 |

) |

|

(48,087 |

) |

|

(112,804 |

) |

|

(103,024 |

) |

| Income tax benefit

(expense) |

(339 |

) |

|

(49 |

) |

|

1,053 |

|

|

(105 |

) |

| Net loss attributable

to common stockholders |

$ |

(61,833 |

) |

|

$ |

(48,136 |

) |

|

$ |

(111,751 |

) |

|

$ |

(103,129 |

) |

| Net loss attributable

to common stockholders per common share — basic and

diluted |

$ |

(0.33 |

) |

|

$ |

(0.34 |

) |

|

$ |

(0.61 |

) |

|

$ |

(0.72 |

) |

| Weighted-average common

shares outstanding — basic and diluted |

188,621,423 |

|

|

143,000,718 |

|

|

182,303,128 |

|

|

142,886,614 |

|

| TABLE 2 |

| Amicus

Therapeutics, Inc. Consolidated Balance

Sheets (in thousands, except share and per

share amounts) |

| |

|

|

|

| |

June 30, |

|

December 31, |

| |

2018 |

|

2017 |

|

Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and

cash equivalents |

$ |

73,311 |

|

|

$ |

49,060 |

|

|

Investments in marketable securities |

465,641 |

|

|

309,502 |

|

| Accounts

receivable |

15,077 |

|

|

9,464 |

|

|

Inventories |

7,769 |

|

|

4,623 |

|

| Prepaid

expenses and other current assets |

14,432 |

|

|

19,316 |

|

| Total current

assets |

576,230 |

|

|

391,965 |

|

|

Investments in marketable securities |

13,836 |

|

|

|

— |

|

| Property

and equipment, less accumulated depreciation of $14,415 and $12,515

at June 30, 2018 and December 31, 2017, respectively |

9,111 |

|

|

9,062 |

|

|

In-process research & development |

23,000 |

|

|

23,000 |

|

|

Goodwill |

197,797 |

|

|

197,797 |

|

| Other

non-current assets |

5,915 |

|

|

5,200 |

|

| Total

Assets |

$ |

825,889 |

|

|

$ |

627,024 |

|

| Liabilities and

Stockholders’ Equity |

|

|

|

| Current

liabilities: |

|

|

|

| Accounts

payable, accrued expenses, and other current liabilities |

$ |

41,613 |

|

|

$ |

53,890 |

|

| Deferred

reimbursements |

2,750 |

|

|

7,750 |

|

|

Contingent consideration payable |

8,600 |

|

|

8,400 |

|

| Total current

liabilities |

52,963 |

|

|

70,040 |

|

| Deferred

reimbursements |

14,156 |

|

|

14,156 |

|

|

Convertible notes |

169,440 |

|

|

164,167 |

|

|

Contingent consideration payable |

18,200 |

|

|

17,000 |

|

| Deferred

income taxes |

6,465 |

|

|

6,465 |

|

| Other

non-current liability |

2,770 |

|

|

2,346 |

|

| Total liabilities |

263,994 |

|

|

274,174 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders’

equity: |

|

|

|

| Common stock, $0.01 par

value, 500,000,000 and 250,000,000 shares authorized, 189,053,214

and 166,989,790 shares issued and outstanding at June 30, 2018 and

December 31, 2017, respectively |

1,939 |

|

|

1,721 |

|

| Additional paid-in

capital |

1,723,865 |

|

|

1,400,758 |

|

| Accumulated other

comprehensive loss: |

|

|

|

| Foreign

currency translation adjustment |

(1,539 |

) |

|

(1,659 |

) |

|

Unrealized gain on available-for-sale securities |

(455 |

) |

|

(436 |

) |

| Warrants |

13,063 |

|

|

16,076 |

|

| Accumulated

deficit |

(1,174,978 |

) |

|

(1,063,610 |

) |

| Total stockholders’

equity |

561,895 |

|

|

352,850 |

|

| Total

Liabilities and Stockholders’ Equity |

$ |

825,889 |

|

|

$ |

627,024 |

|

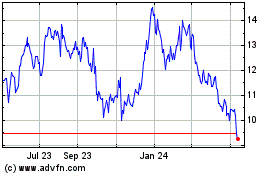

Amicus Therapeutics (NASDAQ:FOLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

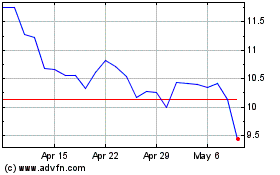

Amicus Therapeutics (NASDAQ:FOLD)

Historical Stock Chart

From Apr 2023 to Apr 2024