|

As filed with the Securities and Exchange Commission

on August 3, 2018

|

|

Registration No. 333-

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM F-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

PLATINUM GROUP METALS LTD.

(Exact name of Registrant as Specified in its Charter)

|

British Columbia

|

N/A

|

|

(State or other jurisdiction of Incorporation or

Organization)

|

(I.R.S. Employer Identification No.)

|

Bentall Tower 5

Suite 788 – 550 Burrard

Street

Vancouver, British Columbia

Canada

(604)

899-5450

(Address and Telephone Number of Registrant’s Principal

Executive Offices)

DL Services, Inc.

Columbia Center

701 5th Avenue, Suite

6100

Seattle, WA 98104-7043

(Name, address, and telephone

number of agent for service)

____________________

Copies to:

Christopher L. Doerksen

Randal R. Jones

Dorsey & Whitney

LLP

701 Fifth Avenue, Suite 6100

Seattle, Washington 98104

Approximate date of commencement of proposed sale to the

public:

From time to time after the effective date of this registration

statement

.

If the only securities being registered on this Form are being

offered pursuant to dividend or interest reinvestment plans, please check the

following box. [ ]

If any of the securities being registered on this Form are to

be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, please check the following box.

[X]

If this Form is filed to register additional securities for an

offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the

earlier effective registration statement for the same

offering. [ ]

If this Form is a post-effective amendment filed pursuant to

Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective

registration statement for the same offering.

[ ]

If this Form is a registration statement pursuant to General

Instruction I.C. or a post-effective amendment thereto that shall become

effective upon filing with the Commission pursuant to Rule 462(e) under the

Securities Act, check the following box. [

]

If this Form is a post-effective amendment to a registration

statement filed pursuant to General Instruction I.C. filed to register

additional securities or additional classes of securities pursuant to Rule

413(b) under the Securities Act, check the following

box. [ ]

Inidcate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of

1933. [X]

If an emerging growth company that prepares its financial

statements in accordance with U.S. GAAP, indicate by check mark if the

registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards† provided pursuant to

Section 7(a)(2)(B) of the Securities Act. [

]

†The term “new or revised financial accounting standard”

refers to any update issued by the Financial Accounting Standards Board to its

Accounting Standards Codification after April 5, 2012.

CALCUL

ATION OF REGISTRATION FEE

|

Title of each class of securities

|

Amount to be registered (1)

|

Proposed maximum

|

Proposed maximum

|

Amount of registration fee

|

|

to be registered

|

|

aggregate price per unit

|

aggregate offering price

|

|

|

|

|

(1)

|

(2)

|

|

|

|

|

|

|

|

|

Common Shares

|

117,453,862

|

$0.17

|

$19,967,157

|

$2,485.91

|

|

Total

|

|

|

|

$2,485.91

|

|

(1)

|

Represents 117,453,862 common shares of the registrant

issuable upon the exercise of 117,453,862 outstanding warrants originally

issued by the registrant pursuant to a public offering of units (whereby

each unit was comprised of one common share and one common share purchase

warrant exercisable at a price of $0.17 per common share). The securities

that may be offered pursuant to this registration statement also include,

pursuant to Rule 416 of the Securities Act of 1933, as amended, such

additional number of common shares of the registrant that may become

issuable as a result of any stock split, stock dividends or similar

event.

|

___________________________________

The registrant hereby amends this registration statement

on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment that specifically states that this

registration statement shall thereafter become effective in accordance with

Section 8(a) of the Securities Act of 1933, or until the registration statement

shall become effective on such date as the Securities and Exchange Commission,

acting pursuant to Section 8(a), may determine.

PART I

INFORMATION REQUIRED IN THE PROSPECTUS

I-1

The information contained in this prospectus is not complete

and may be changed. We may not sell these securities until the registration

statement filed with the Securities and Exchange Commission is effective. This

prospectus is not an offer to sell these securities and we are not soliciting an

offer to buy these securities in any state where the offer or sale is not

permitted.

Subject To Completion, Dated August 3, 2018

PROSPECTUS

PLATINUM GROUP METALS LTD.

117,453,862 Common Shares

This

prospectus of Platinum Group Metals Ltd. relates to the issuance of up to

117,453,862 of our common shares. The common shares are issuable from time to

time on the exercise of 117,453,862 warrants, each sold on May 15, 2018. Each

warrant entitles the holder to acquire one of our common shares at a price of

US$0.17 per common share until 4:00 p.m. (Vancouver time) on November 15, 2019.

This

prospectus registers the issuance of the common shares upon exercise of the

warrants under the United States Securities Act of 1933, as amended.

Neither the United States Securities and Exchange Commission nor any state or

Canadian securities regulator has approved or disapproved of the securities

offered hereby, passed upon the accuracy or adequacy of this prospectus or

determined if this prospectus is truthful or complete. Any representation to the

contrary is a criminal offence.

Our

outstanding common shares are listed for trading on the Toronto Stock Exchange

(the “

TSX

”) under the symbol “

PTM

” and on the NYSE American LLC

(the “

NYSE American

”) under the symbol “

PLG

”. The outstanding

Warrants are listed for trading on the TSX under the symbol “PTM.TW.U”. On

August 2, 2018, the closing price of the common shares on the TSX was CAN$0.155,

the closing price of the common shares on the NYSE American was US$0.12 and the

closing price of the warrants on the TSX was CAN$0.01

An

investment in our common shares is highly speculative and involves a high degree

of risk. See “Cautionary Note Regarding Forward Looking Statements” on page

I-4

and “Risk Factors” on page I-22

of this prospectus.

The date of this prospectus

is

, 2018

_______________________

I-2

TABLE OF CONTENTS

I-3

ABOUT THIS PROSPECTUS

Platinum

Group Metals Ltd. (the “

Company

”, “

we

” or “

us

”) filed: (i)

a registration statement with the SEC on Form F-10 (Registration No.

333-213985), as subsequently amended by Amendment No. 1, which was declared

effective by the SEC on October 14, 2016 (the “

Form F-10 Registration

Statement

”); and (ii)(A)(1) a preliminary prospectus supplement dated May 3,

2018 and (2) a final prospectus supplement dated May 11, 2018 with the

securities commission or similar regulatory authority in each of the provinces

in Canada, except Quebec, and (B)(1) a preliminary prospectus supplement dated

May 3, 2018 and (2) a final prospectus supplement dated May 11, 2018 to the Form

F-10 Registration Statement with the United States Securities and Exchange

Commission (the “

SEC

”), relating to the offering (the “

Unit

Offering

”) by the Company of up to 131,100,000 units (the “

Units

”).

The Unit Offering was completed on May 15, 2018 (the “

Closing Date

”).

Each

Unit consisted of one common share of the Company (“

Common Shares

”, and

with respect to each Common Share of a Unit, sometimes referred to as an

“

Offered Share

”) and one common share purchase warrant (a

“

Warrant

”). Each Warrant entitles the holder to acquire, subject to

adjustment in certain circumstances, one Common Share at a price of US$0.17 per

Common Share (the “

Warrant Exercise Price

”) until the date that is 18

months following the Closing Date (as defined herein) (the “

Expiry

Date

”).

The

Company then filed a prospectus supplement to the Form F-10 Registration

Statement on May 14, 2018 pursuant to General Instruction II.L of Form F-10

relating to the issuance of up to 131,100,000 Common Shares issuable pursuant to

up to 131,100,000 Warrants that were to be issued and sold as part of the Unit

Offering (sometimes referred to as the “

Warrant Shares

”).

The

Company issued and sold 117,453,862 Warrants in the Unit Offering, thereby

reserving 117,453,862 Common Shares for issuance pursuant to the exercise of the

Warrants. None of the Warrants have been exercised, and all of the Warrants

remain outstanding and exercisable for Common Shares. This registration

statement on Form F-3 (the “

Form F-3 Registration Statement

”) is being

filed by the Company to register the offer and sale by the Company of up to

117,453,862 Common Shares issuable pursuant to the exercise of the Warrants in

place of the registration of the same pursuant to the Form F-10 Registration

Statement. Upon the effectiveness of the Form F-3 Registration Statement, the prospectus that forms a part of this Form F-3 Registration Statement is intended to supersede the prospectus supplement to the Form F-10 Registration Statement filed on May 14, 2018 relating to the exercise of the Warrants. For clarity, no additional securities are being registered under this

Form F-3 Registration Statement that were not registered under the Form F-10

Registration Statement.

Investors should rely only on the information contained in or incorporated by

reference in this prospectus (the “Prospectus”). The Company has not authorized

anyone to provide investors with different information. The Company is not

making an offer of the Warrant Shares in any jurisdiction where such offer is

not permitted. An investor should assume that the information appearing in this

Prospectus is accurate only as of the date on the front of those documents and

that information contained in any document incorporated by reference herein or

therein is accurate only as of the date of that document unless specified

otherwise. The Company’s business, financial condition, results of operations

and prospects may have changed since those dates.

Market

data and certain industry forecasts used in this Prospectus and the documents

incorporated by reference herein were obtained from market research, publicly

available information and industry publications. The Company believes that these

sources are generally reliable, but the accuracy and completeness of this

information is not guaranteed. The Company has not independently verified such

information, and it does not make any representation as to the accuracy of such

information.

The

Company’s annual consolidated financial statements that are incorporated by

reference into this Prospectus have been prepared in accordance with

International Financial Reporting Standards, as issued by the International

Accounting Standards Board (“

IFRS

”).

Unless

the context otherwise requires, references in this Prospectus to the “Company”

include Platinum Group Metals Ltd. and each of its subsidiaries.

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This

Prospectus and the documents incorporated by reference herein contain “forward

looking statements” within the meaning of the United States Private Securities

Litigation Reform Act of 1995 and “forward looking information” within the meaning of applicable Canadian

securities legislation (collectively, “

Forward Looking Statements

”). All

statements, other than statements of historical fact, that address activities,

events or developments that the Company believes, expects or anticipates will,

may, could or might occur in the future are Forward Looking Statements. The

words “expect”, “anticipate”, “estimate”, “may”, “could”, “might”, “will”,

“would”, “should”, “intend”, “believe”, “target”, “budget”, “plan”, “strategy”,

“goals”, “objectives”, “projection” or the negative of any of these words and

similar expressions are intended to identify Forward Looking Statements,

although these words may not be present in all Forward Looking Statements.

Forward Looking Statements included or incorporated by reference in this

Prospectus and the documents incorporated by reference herein include, without

limitation, statements with respect to:

I-4

|

|

•

|

the realization of proceeds from the Share

Transaction (as defined below) component of the Maseve Sale Transaction

(as defined below);

|

|

|

|

|

|

|

•

|

the use of proceeds upon exercise of the

Warrants;

|

|

|

|

|

|

|

•

|

the timely completion of additional required

financings and the potential terms thereof;

|

|

|

|

|

|

|

•

|

the Company regaining compliance with the

continued listed criteria and the potential of the NYSE American

initiating delisting procedures;

|

|

|

|

|

|

|

•

|

the repayment and compliance with the terms of

indebtedness;

|

|

|

|

|

|

|

•

|

any potential exercise by Impala Platinum

Holdings Ltd. (“

Implats

”) of the Purchase and Development Option

(as defined below);

|

|

|

|

|

|

|

•

|

the use of proceeds from the HCI Private Placement

(defined below) and any board appointments or participation in future

financings of the Company involving the issuance of equity or securities

convertible into equity by Hosken Consolidated Investments Ltd.

(“

HCI

”);

|

|

|

|

|

|

|

•

|

the completion of the Definitive Feasibility

Study (“

DFS

”) and filing of a mining right application for, and

other developments related to, the Waterberg Project (as defined below);

|

|

|

|

|

|

|

•

|

the adequacy of capital, financing needs and

the availability of and potential for obtaining further capital;

|

|

|

|

|

|

|

•

|

revenue, cash flow and cost estimates and

assumptions;

|

|

|

|

|

|

|

•

|

future events or future performance;

|

|

|

|

|

|

|

•

|

governmental and securities exchange laws,

rules, regulations, orders, consents, decrees, provisions, charters,

frameworks, schemes and regimes, including interpretations of and

compliance with the same;

|

|

|

|

|

|

|

•

|

developments in South African politics and laws

relating to the mining industry;

|

|

|

|

|

|

|

•

|

anticipated exploration, development,

construction, production, permitting and other activities on the Company’s

properties;

|

|

|

|

|

|

|

•

|

project economics;

|

|

|

|

|

|

|

•

|

future metal prices and exchange rates;

|

|

|

|

|

|

|

•

|

mineral reserve and mineral resource estimates;

and

|

|

|

|

|

|

|

•

|

potential changes in the ownership structures

of the Company’s projects.

|

Forward

Looking Statements reflect the current expectations or beliefs of the Company

based on information currently available to the Company. Forward Looking

Statements in respect of capital costs, operating costs, production rate, grade

per tonne and concentrator and smelter recovery are based upon the estimates in

the technical report referred to in this Prospectus and in the documents

incorporated by reference herein and ongoing cost estimation work, and the Forward Looking Statements in

respect of metal prices and exchange rates are based upon the three year

trailing average prices and the assumptions contained in such technical report

and ongoing estimates.

I-5

Forward

Looking Statements are subject to a number of risks and uncertainties that may

cause the actual events or results to differ materially from those discussed in

the Forward Looking Statements, and even if events or results discussed in the

Forward Looking Statements are realized or substantially realized, there can be

no assurance that they will have the expected consequences to, or effects on,

the Company. Factors that could cause actual results or events to differ

materially from current expectations include, among other things:

|

|

•

|

the Company’s additional financing

requirements;

|

|

|

|

|

|

|

•

|

risks relating to delays in or the Company’s inability to

realize on the proceeds of, or possible litigation resulting from, the

Share Transaction component of the sale of the Maseve platinum and

palladium mine (“

Maseve Mine

”), also known as Project 1

(“

Project 1

”) and Project 3 (“

Project 3

”) of what was

formerly the Western Bushveld Joint Venture (the “

WBJV

”);

|

|

|

|

|

|

|

•

|

the inability of the Company to generate sufficient cash

flow or raise sufficient additional capital to make payment on its

indebtedness, and to comply with the terms of such indebtedness, and the

restrictions imposed by such indebtedness;

|

|

|

|

|

|

|

•

|

the LMM Facility (as defined below) is, and any new

indebtedness may be, secured and the Company has pledged its shares of

Platinum Group Metals (RSA) Proprietary Limited (“

PTM RSA

”) and PTM

RSA has pledged its shares of Waterberg JV Resources (Pty) Limited

(“

Waterberg JV Co.

”) to Liberty Metals & Mining Holdings, LLC,

a subsidiary of Liberty Mutual Insurance (“

LMM

”) under the LMM

Facility, which potentially could result in the loss of the Company’s

interest in PTM RSA and the Waterberg Project in the event of a default

under the LMM Facility or any new secured indebtedness;

|

|

|

|

|

|

|

•

|

risks relating to the Company’s ability to

continue as a going concern;

|

|

|

|

|

|

|

•

|

the Company’s history of losses;

|

|

|

|

|

|

|

•

|

the Company’s negative cash flow;

|

|

|

|

|

|

|

•

|

uncertainty of estimated production,

development plans and cost estimates for the Waterberg Project;

|

|

|

|

|

|

|

•

|

discrepancies between actual and estimated mineral

reserves and mineral resources, between actual and estimated development

and operating costs, between actual and estimated metallurgical recoveries

and between estimated and actual production;

|

|

|

|

|

|

|

•

|

fluctuations in the relative values of the U.S.

Dollar, the South African Rand and the Canadian Dollar;

|

|

|

|

|

|

|

•

|

volatility in metals prices;

|

|

|

|

|

|

|

•

|

the failure of the Company or the other

shareholders to fund their pro rata share of funding obligations for the

Waterberg Project;

|

|

|

|

|

|

|

•

|

any disputes or disagreements with the other

shareholders of Waterberg JV Co. or Mnombo Wethu Consultants (Pty) Ltd.

(“

Mnombo

”) or the former shareholders of Maseve Investments 11

Proprietary Limited (“

Maseve

”);

|

|

|

|

|

|

|

•

|

completion of the DFS for the Waterberg

Project, which is subject to resource upgrade and economic analysis

requirements;

|

|

|

|

|

|

|

•

|

the ability of the Company to retain its key

management employees and skilled and experienced personnel;

|

|

|

|

|

|

|

•

|

contractor performance and delivery of

services, changes in contractors or their scope of work or any disputes

with contractors;

|

I-6

|

|

•

|

conflicts of interest among the Company’s

officers and directors;

|

|

|

|

|

|

|

•

|

litigation or other legal or administrative

proceedings brought against the Company;

|

|

|

|

|

|

|

•

|

actual or alleged breaches of governance

processes or instances of fraud, bribery or corruption;

|

|

|

|

|

|

|

•

|

the possibility that the Company may become

subject to the Investment Company Act of 1940, as amended (the

“

Investment Company Act

”);

|

|

|

|

|

|

|

•

|

exploration, development and mining risks and the

inherently dangerous nature of the mining industry, including

environmental hazards, industrial accidents, unusual or unexpected

formations, safety stoppages (whether voluntary or regulatory), pressures,

mine collapses, cave ins or flooding and the risk of inadequate insurance

or inability to obtain insurance to cover these risks and other risks and

uncertainties;

|

|

|

|

|

|

|

•

|

property and mineral title risks including

defective title to mineral claims or property;

|

|

|

|

|

|

|

•

|

changes in national and local government legislation,

taxation, controls, regulations and political or economic developments in

Canada, South Africa or other countries in which the Company does or may

carry out business in the future;

|

|

|

|

|

|

|

•

|

equipment shortages and the ability of the

Company to acquire the necessary access rights and infrastructure for its

mineral properties;

|

|

|

|

|

|

|

•

|

environmental regulations and the ability to

obtain and maintain necessary permits, including environmental

authorizations and water use licences;

|

|

|

|

|

|

|

•

|

extreme competition in the mineral exploration

industry;

|

|

|

|

|

|

|

•

|

delays in obtaining, or a failure to obtain,

permits necessary for current or future operations or failures to comply

with the terms of such permits;

|

|

|

|

|

|

|

•

|

any adverse decision in respect of the

Company’s mineral rights and projects in South Africa under the Mineral

and Petroleum Resources Development Act (the “

MPRDA

”);

|

|

|

|

|

|

|

•

|

risks of doing business in South Africa, including but

not limited to, labour, economic and political instability, potential

changes to and failures to comply with legislation and interruptions or

shortages in the supply of electricity or water;

|

|

|

|

|

|

|

•

|

the failure to maintain or increase equity participation

by historically disadvantaged South Africans in the Company’s prospecting

and mining operations and to otherwise comply with the Amended Broad Based

Socio Economic Empowerment Charter for the South African Mining Industry

(the “

Mining

Charter

”) or any subsequent mining charter;

|

|

|

|

|

|

|

•

|

certain potential adverse Canadian tax

consequences for foreign-controlled Canadian companies that acquire the

Common Shares;

|

|

|

|

|

|

|

•

|

the risk that the Company’s Common Shares may

be delisted, or that the Company may be required to effect a reverse stock

split in order to maintain the listing of the Common Shares on the NYSE

American;

|

|

|

|

|

|

|

•

|

volatility in the price of the Common Shares;

|

|

|

|

|

|

|

•

|

the lack of a public market for the Warrants,

and the potential inability of prospective investors to resell the Warrant

Shares at or above the Warrant Exercise Price, if at all;

|

|

|

|

|

|

|

•

|

possible dilution to holders of Common Shares

upon the exercise or conversion of outstanding stock options, warrants or

convertible notes, as applicable;

|

I-7

|

|

•

|

any designation of the Company as a “passive

foreign investment company” and potential adverse U.S. federal income tax

consequences for U.S. shareholders; and

|

|

|

|

|

|

|

•

|

the other risks disclosed under the heading

“Risk Factors” in this Prospectus and in the Form 20-F (as defined

herein), as well as in the documents incorporated by reference herein and

therein.

|

These

factors should be considered carefully, and investors should not place undue

reliance on the Forward Looking Statements. In addition, although the Company

has attempted to identify important factors that could cause actual actions or

results to differ materially from those described in the Forward Looking

Statements, there may be other factors that cause actions or results not to be

as anticipated, estimated or intended.

The

mineral resource and mineral reserve figures referred to in this Prospectus and

the documents incorporated herein by reference are estimates and no assurances

can be given that the indicated levels of platinum, palladium, rhodium and gold

will be produced. Such estimates are expressions of judgment based on knowledge,

mining experience, analysis of drilling results and industry practices. Valid

estimates made at a given time may significantly change when new information

becomes available. By their nature, mineral resource and mineral reserve

estimates are imprecise and depend, to a certain extent, upon statistical

inferences which may ultimately prove unreliable. Any inaccuracy or future

reduction in such estimates could have a material adverse impact on the Company.

Any

Forward Looking Statement speaks only as of the date on which it is made and,

except as may be required by applicable securities laws, the Company disclaims

any intent or obligation to update any Forward Looking Statement, whether as a

result of new information, future events or results or otherwise.

CAUTIONARY NOTE REGARDING MINERAL RESERVE AND MINERAL

RESOURCE DISCLOSURE

Estimates of mineralization and other technical information included or

incorporated by reference herein have been prepared in accordance with Canada’s

National Instrument 43-101 –

Standards of Disclosure for Mineral Projects

(“

NI 43-101

”). The definitions of proven and probable reserves used in NI

43-101 differ from the definitions in SEC Industry Guide 7 of the SEC. Under SEC

Industry Guide 7 standards, a “final” or “bankable” feasibility study is

required to report reserves, the three-year historical average price is used in

any reserve or cash flow analysis to designate reserves and the primary

environmental analysis or report must be filed with the appropriate governmental

authority. As a result, the reserves reported by the Company in accordance with

NI 43-101 may not qualify as “reserves” under SEC standards. In addition, the

terms “mineral resource”, “measured mineral resource”, “indicated mineral

resource” and “inferred mineral resource” are defined in and required to be

disclosed by NI 43-101; however, these terms are not defined terms under SEC

Industry Guide 7 and normally are not permitted to be used in reports and

registration statements filed with the SEC. Mineral resources that are not

mineral reserves do not have demonstrated economic viability. Investors are

cautioned not to assume that any part or all of the mineral deposits in these

categories will ever be converted into reserves. “Inferred mineral resources”

have a great amount of uncertainty as to their existence, and great uncertainty

as to their economic and legal feasibility. It cannot be assumed that all or any

part of an inferred mineral resource will ever be upgraded to a higher category.

Under Canadian securities laws, estimates of inferred mineral resources may not

form the basis of feasibility or prefeasibility studies, except in rare cases.

See “Reserve and Mineral Resource Disclosure”. Additionally, disclosure of

“contained ounces” in a resource is permitted disclosure under Canadian

securities laws; however, the SEC normally only permits issuers to report

mineralization that does not constitute “reserves” by SEC standards as in place

tonnage and grade without reference to unit measurements. Accordingly,

information contained in this Annual Report and the documents incorporated by

reference herein containing descriptions of the Company’s mineral deposits may

not be comparable to similar information made public by U.S. companies subject

to the reporting and disclosure requirements of United States federal securities

laws and the rules and regulations thereunder.

The Company has not disclosed

or determined any mineral reserves under SEC Industry Guide 7 standards in

respect of any of its properties.

Due to

the uncertainty that may be attached to inferred mineral resource estimates, it

cannot be assumed that all or any part of an inferred mineral resource estimate

will be upgraded to an indicated or measured mineral resource estimate as a

result of continued exploration. Confidence in an inferred mineral resource

estimate is insufficient to allow meaningful application of the technical and

economic parameters to enable an evaluation of economic viability sufficient for

public disclosure, except in certain limited circumstances set out NI 43-101.

Inferred mineral resource estimates are excluded from estimates forming the

basis of a feasibility study.

I-8

NI

43-101 requires mining companies to disclose reserves and resources using the

subcategories of proven reserves, probable reserves, measured resources,

indicated resources and inferred resources. Mineral resources that are not

mineral reserves do not have demonstrated economic viability.

A

“mineral reserve” is the economically mineable part of a measured or indicated

mineral resource demonstrated by at least a preliminary feasibility study. This

study must include adequate information on mining, processing, metallurgical,

infrastructure, economic, marketing, legal, environmental, social, governmental

and other relevant factors that demonstrate, at the time of reporting, that

economic extraction can be justified. A mineral reserve includes diluting

materials and allowances for losses which may occur when the material is mined

or extracted. A “proven mineral reserve” is the economically mineable part of a

measured mineral resource for which quantity, grade or quality, densities, shape

and physical characteristics are estimated with confidence sufficient to allow

the appropriate application of technical and economic parameters to support

detailed mine planning and final evaluation of the economic viability of the

deposit. A “probable mineral reserve” is the economically mineable part of an

indicated, and in some circumstances, a measured mineral resource for which

quantity, grade or quality, densities, shape and physical characteristics are

estimated with sufficient confidence to allow the appropriate application of

technical and economic parameters in sufficient detail to support mine planning

and evaluation of the economic viability of the deposit.

A

“mineral resource” is a concentration or occurrence of solid material in or on

the Earth’s crust in such form, grade or quality and quantity that there are

reasonable prospects for eventual economic extraction. The location, quantity,

grade or quality, continuity and other geological characteristics of a mineral

resource are known, estimated or interpreted from specific geological evidence

and knowledge, including sampling. A “measured mineral resource” is that part of

a mineral resource for which quantity, grade or quality, densities, shape, and

physical characteristics are estimated with confidence sufficient to allow the

appropriate application of technical and economic parameters to support detailed

mine planning and final evaluation of the economic viability of the deposit.

Geological evidence is derived from detailed and reliable exploration, sampling

and testing and is sufficient to confirm geological and grade or quality

continuity between points of observation. An “indicated mineral resource” is

that part of a mineral resource for which quantity, grade or quality, densities,

shape and physical characteristics are estimated with sufficient confidence to

allow the application of technical and economic parameters in sufficient detail

to support mine planning and evaluation of the economic viability of the

deposit. Geological evidence is derived from adequately detailed and reliable

exploration, sampling and testing and is sufficient to assume geological and

grade continuity between points of observation. Mineral resources that are not

mineral reserves do not have demonstrated economic viability. An “inferred

mineral resource” is that part of a mineral resource for which quantity and

grade or quality are estimated on the basis of limited geological evidence and

sampling. Geological evidence is sufficient to imply but not verify geological

and grade or quality continuity. An inferred mineral resource is based on

limited information and sampling gathered through appropriate sampling

techniques from locations such as outcrops, trenches, pits, workings and drill

holes.

A

“feasibility study” is a comprehensive technical and economic study of the

selected development option for a mineral project that includes appropriately

detailed assessments of applicable mining, processing, metallurgical,

infrastructure, economic, marketing, legal, environmental, social, governmental

and other relevant operational factors and detailed financial analysis that are

necessary to demonstrate, at the time of reporting, that extraction is

reasonably justified (economically mineable). The results of the study may serve

as the basis for a final decision by a proponent or financial institution to

proceed with, or finance, the development of the project. A “preliminary

feasibility study” or “pre-feasibility study” is a comprehensive study of a

range of options for the technical and economic viability of a mineral project

that has advanced to a stage where a preferred mining method, in the case of

underground mining, or the pit configuration, in the case of an open pit, is

established and an effective method of mineral processing is determined. It

includes a financial analysis based on reasonable assumptions on the applicable

mining, processing, metallurgical, infrastructure, economic, marketing, legal,

environmental, social, governmental and other relevant operational factors and

the evaluation of any other relevant factors which are sufficient for a

qualified person, acting reasonably, to determine if all or part of the mineral

resource may be converted to a mineral reserve at the time of reporting.

“Cut-off grade” means (a) in respect of mineral resources, the lowest grade

below which the mineralized rock currently cannot reasonably be expected to be

economically extracted, and (b) in respect of mineral reserves, the lowest grade

below which the mineralized rock currently cannot be economically extracted as

demonstrated by either a preliminary feasibility study or a feasibility study.

Cut-off grades vary between deposits depending upon the amenability of ore to

mineral extraction and upon costs of production and metal prices.

I-9

DESCRIPTION OF EXISTING INDEBTEDNESS

LMM Facility

The

Company is party to a secured credit facility (the “

LMM Facility

”) in

favor of LMM, as agent and a lender, and the other lenders from time to time

party thereto (collectively, the “

LMM Lenders

”) dated as of November 2,

2015, as most recently amended and restated as of February 12, 2018 and as

further amended (the “

LMM Facility Agreement

”). The LMM Facility is a

US$40.0 million facility and was drawn down in full in a single advance in

November 2015. The LMM Facility matures on October 31, 2019 (the “

LMM

Maturity Date

”), because the Company (i) completed the Required Financing

(defined below) before May 31, 2018, (ii) used the first US$12.0 million of

gross proceeds from the Required Financing to reduce outstanding indebtedness

under the LMM Facility and (iii) was not otherwise in default under the LMM

Facility Agreement (collectively, the “

Required Financing

Conditions

”).

Interest

at LIBOR plus 9.5% is accrued under the LMM Facility monthly and capitalized.

Payment and performance of the Company’s obligations under the LMM Facility are

guaranteed by PTM RSA and secured by a security interest in favor of LMM, on

behalf of the LMM Lenders, in all of the Company’s present and after-acquired

real and personal property, together with the proceeds thereof, and a pledge

over all of the issued shares in the capital of PTM RSA and the shares that PTM

RSA holds in Waterberg JV Co. The LMM Facility contains various representations,

warranties and affirmative and negative covenants of the Company, and provisions

regarding default and events of default, in each case relating to the Company

and related entities, including Waterberg JV Co. and Mnombo.

The

Company was a party to a first secured credit facility (the “

Sprott

Facility

”) in favor of Sprott Resource Lending Partnership, as agent (in

such capacity, the “

Sprott Agent

”) and a lender, and the other lenders

from time to time party thereto, (collectively, the “

Sprott Lenders

”)

dated as of February 13, 2015 and as later amended and restated. On March 20,

2018, the Company made a payment of US$107,755 to reduce the indebtedness under

the Sprott Facility. Later, on April 10, 2018 the Company used US$46.98 million

from the proceeds of the Plant Sale Transaction (as defined below) to

immediately repay all remaining indebtedness under the Sprott Facility,

consisting of the outstanding principal amount of US$40.0 million, a bridge loan

of US$5.0 million, all accrued and unpaid interest of approximately US$1.78

million and, pursuant to the third amendment to the Sprott Facility, a fee of

US$200,000 due upon the repayment of the Sprott Facility.

For more

information regarding the Sprott Facility, see the Interim MD&A (as defined

below) and the Form 20-F.

From the

remaining proceeds of the Plant Sale Transaction, pursuant to the fifth

amendment to the original LMM Facility Agreement, the Company then paid an

amount of US$6.32 million to LMM on April 10, 2018. A further payment of Rand

3.26 million (US$271,667) was received from Royal Bafokeng Platinum Limited

(“

RBPlat

”) on April 9, 2018, for the exchange rate variance through the

closing process of the Plant Sale Transaction from April 4, 2018 to April 5,

2018, and the amount in U.S. dollars was paid to LMM on April 13, 2018. These

payments totaling US$6.59 million have been applied to reduce outstanding

indebtedness under the LMM Facility, consisting of a US$400,000 fee due to LMM

upon the repayment of the Sprott Facility and US$6.19 million to reduce the PPA

Termination Payment (as defined below). Following the closing of the Unit

Offering and the HCI Private Placement, the Company paid an additional US$12.0

million to reduce outstanding indebtedness under the LMM Facility, including

paying the remaining amount of the PPA Termination Payment.

The LMM

Facility was originally in second secured position relative to the Sprott

Facility. Once the Sprott Facility was fully repaid, the LMM Facility assumed

the first secured position.

With

respect to the RBPlat (as defined below) shares received by the Company in the

Share Transaction, the Company has agreed to pledge such shares under the LMM

Facility, complete the sale of such shares in a commercially reasonable and

prompt manner and in any event within 120 days of receipt, with the proceeds of

such sale to be used to reduce the outstanding indebtedness under the LMM

Facility.

The

Company agreed to raise US$15.0 million in subordinated debt (in form and

substance satisfactory to LMM), equity or securities convertible into equity

before May 31, 2018 (the “

Required Financing

”). The first US$12.0 million

of gross proceeds of the Required Financing was to be used to reduce the

outstanding indebtedness under the LMM Facility. Assuming the Required Financing

Conditions are met, the Company also agreed to use 50% of the proceeds from the

exercise of any warrants or other convertible securities issued by the Company

for repayment of outstanding indebtedness under the LMM Facility.

However, if the Required Financing Conditions were not met, then in addition to

completing the Required Financing prior to May 31, 2018 and using the first

US$12.0 million of gross proceeds to reduce outstanding indebtedness under the

LMM Facility, the Company was to be required to raise, from and after May 31,

2018 and prior to July 31, 2018, an additional US$20.0 million in Common Shares

or subordinated debt (in form and substance satisfactory to LMM) (the

“

Additional Required Financing

”), from which the first US$20.0 million of

net proceeds was to be used to reduce outstanding indebtedness under the LMM

Facility. The Company has satisfied the conditions of the Required Financing

and, accordingly, will not be required to complete the Additional Required

Financing.

I-10

The

Company has also agreed to use 50% of the net proceeds from any equity or debt

financings in excess of US$500,000 in the aggregate (excluding intercompany

financings, the Required Financing and the Additional Required Financing, as

applicable) for repayment of outstanding indebtedness under the LMM Facility.

See the risk factor entitled “The Company will require additional financing,

which may not be available on acceptable terms, if at all.” The Company has also

agreed under the LMM Facility to limit its use of cashless exercise features in

warrants and convertible securities that it may issue, excluding securities

already outstanding and the cashless exercise of Warrants to be issued in the

Unit Offering in accordance with their terms.

In

connection with the second amendment and restatement of the LMM Facility

Agreement, certain events of default were added to the LMM Facility Agreement,

including, without limitation, the occurrence of any of the following: the

Company fails to remain listed on the TSX; RBPlat fails to remain listed on the

Johannesburg Stock Exchange Limited (the “

JSE Limited

”); the RBPlat

shares are cease traded (or equivalent) for a period of 30 days or more; the

Company fails to apply the proceeds from the sale of RBPlat shares received upon

completion of the Share Transaction to reduce indebtedness under the LMM

Facility within three days of receipt; RBPlat makes an indemnity claim or seeks

to reduce the amounts payable to the Company; Africa Wide Mineral Prospecting

and Exploration Proprietary Limited (“

Africa Wide

”) is paid in connection

with the Maseve Sale Transaction an amount greater than 347,056 shares of RBPlat

or the South African Rand equivalent of US$854,935.01; or the Company fails to

apply the Maseve rehabilitation deposit (the “

Environmental Deposit

Amount

”) to reduce its indebtedness under the LMM Facility within three

business days of receipt. The Company has agreed to maintain consolidated,

unrestricted cash and cash equivalents of at least US$2.0 million and working

capital in excess of US$1.0 million beginning May 31, 2018.

In

connection with the LMM Facility, in November 2015 the Company and LMM entered

into a production payment agreement pursuant to which the Company agreed to pay

LMM a production payment of 1.5% of net proceeds received on concentrate sales

or other minerals from the Maseve Mine (the “

PPA

”). The Company, PTM RSA

and LMM entered into a Production Payment Agreement Termination Agreement, dated

as of October 30, 2017 and amended as of February 12, 2018, May 1, 2018, and May

10, 2018, pursuant to which the Company was required to pay LMM either US$15.0

million before May 31, 2018 or US$25.0 million from May 31, 2018 to the LMM

Maturity Date (the applicable payment, the “

PPA Termination Payment

”).

The PPA Termination Payment was considered to be indebtedness under the LMM

Facility and was secured by the same collateral as the LMM Facility.

After

applying approximately US$6.19 million toward the PPA Termination Payment, as

described above, and after applying US$12.0 million of the proceeds from the

Unit Offering and HCI Private Placement first towards the PPA Termination

Payment (and then towards the remaining outstanding indebtedness under the LMM

Facility), the PPA Termination Payment was satisfied in the amount of US$15.0

million before May 31, 2018.

On May

29, 2018, the Company received the Environmental Deposit Amount in the amount of

Rand 57.51 million (approximately US$4.57 million as of such date). Such amount

was applied to reduce the Company’s indebtedness under the LMM Facility. As of

August 2, 2018, the Company’s indebtedness under the LMM Facility was US$46.9

million.

For more

information regarding the LMM Facility and the PPA Termination Payment, see the

Interim MD&A and the Form 20-F.

Convertible Notes

On June

30, 2017, the Company issued and sold to certain institutional investors US$20.0

million in aggregate principal amount of 6 7/8% convertible senior subordinated

notes due July 1, 2022 (the “

Notes

”). The Notes are governed by an

indenture between the Company and The Bank of New York Mellon dated June 30,

2017, as supplemented on January 31, 2018 (together, the “

Note

Indenture

”). The Notes bear interest at a rate of 6 7/8% per annum, payable semi-annually on January 1 and July 1 of

each year, beginning on January 1, 2018, in cash or at the election of the

Company, in Common Shares or a combination of cash and Common Shares, and will

mature on July 1, 2022, unless, subject to certain exceptions, such notes are

earlier repurchased, redeemed or converted.

I-11

Subject

to certain exceptions, the Notes will be convertible at any time at the option

of the holder, and may be settled, at the Company’s election, in cash, Common

Shares, or a combination of cash and Common Shares. If any Notes are converted

on or prior to the three and one-half year anniversary of the issuance date, the

holder of the Notes will also be entitled to receive an amount equal to the

remaining interest payments on the converted Notes to the three and one-half

year anniversary of the issuance date, discounted by 2%, payable in Common

Shares. The initial conversion rate of the Notes is 1,001.1112 Common Shares per

US$1,000 principal amount of Notes, which is equivalent to an initial conversion

price of approximately US$0.9989 per Common Share, representing a conversion

premium of approximately 15% above the NYSE American closing sale price for the

Company’s Common Shares of US$0.8686 per share on June 27, 2017. The conversion

rate will be subject to adjustment upon the occurrence of certain events. If the

Company pays interest in Common Shares, such shares will be issued at a price

equal to 92.5% of the simple average of the daily volume-weighted average price

of the Common Shares for the 10 consecutive trading days ending on the second

trading day immediately preceding the payment date, on the NYSE American

exchange or, if the Common Shares are not then listed on the NYSE American

exchange, on the principal U.S. national or other securities exchange or market

on which the Common Shares are then listed or admitted for trading.

Notwithstanding the foregoing, no holder will be entitled to receive Common

Shares upon conversion of Notes to the extent that such receipt would cause the

converting holder or persons acting as a “group” to become, directly or

indirectly, a “beneficial owner” (as defined in the Note Indenture) of more than

19.9% of the Common Shares outstanding at such time or, in the case of Citadel

Equity Fund Ltd. (one of the note holders), if it or its affiliates would become

a “beneficial owner” of more than 4.9% of the Common Shares outstanding at such

time. In addition, the Company will not issue an aggregate number of Common

Shares pursuant to the Notes that exceeds 19.9% of the total number of Common

Shares outstanding on June 30, 2017.

On or

after July 1, 2018 and before July 1, 2019, the Company shall have the right to

redeem all or part of the Notes at a price, payable in cash, of 110.3125% of the

principal amount of the Notes to be redeemed, plus accrued and unpaid interest,

if any, to, but excluding, the redemption date; on or after July 1, 2019 and

before July 1, 2020, the Company shall have the right to redeem all or part of

the outstanding Notes at a price, payable in cash, of 105.15625% of the

principal amount of the Notes to be redeemed, plus accrued and unpaid interest,

if any, to but excluding, the redemption date; and on or after July 1, 2020,

until the maturity date, the Company shall have the right to redeem all or part

of the outstanding Notes at a price, payable in cash, of 100% of the principal

amount of the Notes to be redeemed, plus accrued and unpaid interest, if any,

to, but excluding, the redemption date.

Upon the

occurrence of a fundamental change as defined in the Note Indenture, the Company

must offer to purchase the outstanding Notes at a price, payable in cash, equal

to 100% of the principal amount of the Notes, plus accrued and unpaid interest,

if any.

The

Company agreed in the Note Indenture to cause a prospectus and a registration

statement to be filed with Canadian securities regulatory authorities and with

the U.S. Securities and Exchange Commission, as applicable, and become usable

and effective within six months after June 30, 2017, and to remain usable and

effective for certain periods. The Note Indenture provides that if the Company

does not do so, it shall pay additional interest on the Notes at a rate of 0.25%

per annum for the first 90 days and at a rate of 0.50% per annum thereafter,

until the Notes are freely tradable by holders other than affiliates and certain

other events have occurred. The Company has not filed the prospectus and

registration statement and, accordingly, currently pays additional interest as

provided for in the Note Indenture.

The

Notes are unsecured senior subordinated obligations and are subordinated in

right of payment to the prior payment in full of all of the Company’s existing

and future senior indebtedness pursuant to the Note Indenture. The Company may

issue additional Notes in accordance with the terms and conditions set forth in

the Note Indenture. The Note Indenture contains certain additional covenants,

including covenants restricting asset dispositions, issuances of capital stock

by subsidiaries, incurrence of indebtedness, business combinations and share

exchanges.

On July

25, 2017, US$10,000 of Notes were converted into 13,190 Common Shares of the

Company. On January 1, 2018, the Company made the first semi-annual interest

payment on the Notes, issuing 2,440,629 Common Shares of the Company in payment

of US$691,110 of interest. On July 1, 2018, the Company made the second semi-annual interest payment on the Notes,

issuing 7,579,243 Common Shares of the Company in payment of US$724,776 of

interest. As at August 2, 2018, US$19.99 million principal amount of the Notes

remain outstanding.

I-12

DOCUMENTS INCORPORATED BY REFERENCE

Copies of the documents incorporated by reference in this Prospectus and not

delivered with this Prospectus may be obtained on written or oral request

without charge from Frank Hallam at Suite 788, 550 Burrard Street, Vancouver,

British Columbia, Canada, V6C 2B5, telephone (604) 899-5450 and are also

available electronically at www.sedar.com and www.sec.gov.

The

following documents, filed or furnished by the Company with the SEC, are

specifically incorporated by reference into, and form an integral part of, this

Prospectus:

|

|

(a)

|

the Form 20-F annual report of the Company for the

financial year ended August 31, 2017 (the “

Form 20-F

”), filed with

the SEC on December 29, 2017;

|

|

|

|

|

|

|

(b)

|

the description of the Company’s Common Shares set forth

in the Company’s annual report on Form 20-F/A filed with the SEC on May

22, 2007 and as further set forth in the Amendment No. 1 to the Company’s

registration statement on Form 8-A (File No. 001-33562) filed with the SEC

on February 3, 2016;

|

|

|

|

|

|

|

(c)

|

Exhibit 99.1 to the Company’s Report of Foreign Private

Issuer on Form 6-K, furnished to the SEC on April 12, 2018, containing the

unaudited condensed consolidated interim financial statements of the

Company for the three and six months ended February 28, 2018, together

with the notes thereto (the “

February Financial

Statements

”);

|

|

|

|

|

|

|

(d)

|

Exhibit 99.1 to the Company’s Report of Foreign Private

Issuer on Form 6-K, furnished to the SEC on July 16, 2018, containing the

unaudited condensed consolidated interim financial statements of the

Company for the three and nine months ended May 31, 2018, together with

the notes thereto (the “

May Financial Statements

”);

|

|

|

|

|

|

|

(e)

|

Exhibit 99.1 to the Company’s Report of Foreign Private

Issuer on Form 6-K, furnished to the SEC on August 2, 2018, containing the

unaudited pro forma condensed consolidated income statements of the

Company for the nine months ended May 31, 2018 and the year ended August

31, 2017 relating to the disposition of Maseve (the “

Pro Forma

Financial Statements

”);

|

|

|

|

|

|

|

(f)

|

Exhibit 99.1 to the Company’s Report of Foreign Private

Issuer on Form 6-K, furnished to the SEC on January 12, 2018, containing

the unaudited condensed consolidated interim financial statements of the

Company for the three months ended November 30, 2017, together with the

notes thereto (together with the Annual Financial Statements, the February

Financial Statements, the May Financial Statements and the Pro Forma

Financial Statements, the “

Financial Statements

”);

|

|

|

|

|

|

|

(g)

|

Exhibit 99.2 to the Company’s Report of Foreign Private

Issuer on Form 6-K, furnished to the SEC on April 12, 2018, containing the

management’s discussion and analysis of the Company for the three and six

months ended February 28, 2018 (the “

February MD&A

”);

|

|

|

|

|

|

|

(h)

|

Exhibit 99.2 to the Company’s Report of Foreign Private

Issuer on Form 6-K, furnished to the SEC on July 16, 2018, containing the

management’s discussion and analysis of the Company for the three and nine

months ended May 31, 2018 (the “

May MD&A

”);

|

|

|

|

|

|

|

(i)

|

Exhibit 99.2 to the Company’s Report of Foreign Private

Issuer on Form 6-K, furnished to the SEC on January 12, 2018, containing

the management’s discussion and analysis of the Company for the three

months ended November 30, 2017 (together with the February MD&A and

the May MD&A, the “

Interim MD&A

”);

|

|

|

|

|

|

|

(j)

|

Exhibit 99.1 to the Company’s Report of Foreign Private

Issuer on Form 6-K, furnished to the SEC on January 17, 2018, containing

the management information circular of the Company

dated January 2, 2018 prepared for the

purposes of the annual general meeting of the Company held on February 23, 2018;

|

I-13

|

|

(k)

|

Exhibit 99.3 to the Company’s Report of Foreign Private

Issuer on Form 6-K, furnished to the SEC on October 20, 2016, containing

the NI 43-101 technical report entitled “Independent Technical Report on

the Waterberg Project Including Mineral Resource Update and

Pre-Feasibility Study — Project Areas located on the Northern Limb of the

Bushveld Igneous Complex, South Africa” dated October 19, 2016 (the

“

Waterberg PFS

”);

|

|

|

|

|

|

|

(l)

|

Exhibit 99.2 to the Company’s Report of Foreign Private

Issuer on Form 6-K, furnished to the SEC on September 6, 2017, containing

the material change report of the Company announcing that the Company had

entered into a term sheet with RBPlat to sell Maseve in a transaction

involving the Plant Sale Transaction and the Share Transaction (together,

the “

Maseve Sale Transaction

”) valued at approximately US$74.0

million;

|

|

|

|

|

|

|

(m)

|

Exhibit 99.2 to the Company’s Report of Foreign Private

Issuer on Form 6-K, furnished to the SEC on October 16, 2017, containing

the material change report of the Company announcing that Implats had

entered into definitive agreements (the “

Implats Transaction

”) with

the Company, Japan Oil, Gas and Metals National Corporation

(“

JOGMEC

”), Mnombo and Waterberg JV Co.;

|

|

|

|

|

|

|

(n)

|

Exhibit 99.2 to the Company’s Report of Foreign Private

Issuer on Form 6-K, furnished to the SEC on November 6, 2017, containing

the material change report of the Company announcing the closing of the

first phase of the Implats Transaction;

|

|

|

|

|

|

|

(o)

|

Exhibit 99.1 to the Company’s Report of Foreign Private

Issuer on Form 6-K, furnished to the SEC on January 31, 2018, containing

the material change report of the Company announcing the completion of due

diligence and the execution of binding legal agreements for the Maseve

Sale Transaction;

|

|

|

|

|

|

|

(p)

|

Exhibit 99.2 to the Company’s Report of Foreign Private

Issuer on Form 6-K, furnished to the SEC on February 14, 2018, containing

the material change report of the Company announcing that all remaining

conditions precedent to the sale of the Maseve concentrator plant and

certain surface rights to RBPlat in connection with the Maseve Sale

Transaction have been fulfilled;

|

|

|

|

|

|

|

(q)

|

Exhibit 99.2 to the Company’s Report of Foreign Private

Issuer on Form 6-K, furnished to the SEC on April 6, 2018, containing the

material change report of the Company announcing the closing of the sale

of the Maseve concentrator plant and certain surface rights to RBPlat in

connection with the Maseve Sale Transaction;

|

|

|

|

|

|

|

(r)

|

Exhibit 99.2 to the Company’s Report of Foreign Private

Issuer on Form 6-K, furnished to the SEC on May 2, 2018, containing the

material change report of the Company announcing certain amendments to the

LMM Facility;

|

|

|

|

|

|

|

(s)

|

Exhibit 99.2 to the Company’s Report of Foreign Private

Issuer on Form 6-K, furnished to the SEC on May 3, 2018, containing the

material change report of the Company announcing the execution of a

subscription agreement with HCI for a private placement sale of units to

HCI or a subsidiary of HCI;

|

|

|

|

|

|

|

(t)

|

Exhibit 99.2 to the Company’s Report of Foreign Private

Issuer on Form 6-K, furnished to the SEC on May 11, 2018, containing the

material change report of the Company announcing certain amendments to the

LMM Facility and HCI Private Placement;

|

|

|

|

|

|

|

(u)

|

Exhibit 99.2 to the Company’s Report of Foreign Private

Issuer on Form 6-K, furnished to the SEC on May 11, 2018, containing the

material change report of the Company regarding the Unit Offering;

and

|

|

|

|

|

|

|

(v)

|

Exhibit 99.1 to the Company’s Report of Foreign Private

Issuer on Form 6-K, furnished to the SEC on May 22, 2018, containing the

material change report of the Company regarding the closing of the HCI

Private Placement and the Unit Offering.

|

I-14

In

addition, all subsequent annual reports filed by the Company on Form 20-F, Form

40-F or Form 10-K, and all subsequent filings on Forms 10-Q and 8-K filed by the

Company pursuant to the United States Securities Exchange Act, as amended (the

“

Exchange Act

”), prior to the termination of the offering, shall be

deemed to be incorporated by reference into this Prospectus. Also, the Company

may incorporate by reference future reports on Form 6-K that the Company

furnishes subsequent to the date of this Prospectus by stating in those Form

6-Ks that they are being incorporated by reference into this Prospectus.

Any

statement contained in this Prospectus or a document incorporated or deemed to

be incorporated by reference herein or therein shall be deemed to be modified or

superseded for the purposes of this Prospectus to the extent that a statement

contained herein or in any subsequently filed document which also is or is

deemed to be incorporated by reference herein modifies or supersedes that prior

statement. The modifying or superseding statement need not state that it has

modified or superseded a prior statement or include any other information set

forth in the document that it modifies or supersedes. The making of a modifying

or superseding statement shall not be deemed an admission for any purposes that

the modified or superseded statement, when made, constituted a

misrepresentation, an untrue statement of a material fact or an omission to

state a material fact that is required to be stated or that is necessary to make

a statement not misleading in light of the circumstances in which it was made.

Any statement so modified or superseded shall not be considered in its

unmodified or superseded form to constitute a part of this Prospectus, except as

so modified or superseded.

ADDITIONAL INFORMATION

Statements included or incorporated by reference in this Prospectus about the

contents of any contract, agreement or other documents referred to are not

necessarily complete, and in each instance an investor should refer to any such

contracts, agreements or other documents incorporated by reference for a more

complete description of the matter involved. Each such statement is qualified in

its entirety by such reference.

The

Company is subject to the information requirements of the Exchange Act, and

applicable Canadian securities legislation, and in accordance therewith files

and furnishes reports and other information with the SEC and with the securities

regulators in Canada. As a foreign private issuer, certain documents and other

information that the Company files and furnishes with the SEC may be prepared in

accordance with the disclosure requirements of Canada, which are different from

those of the United States. In addition, as a foreign private issuer, the

Company is exempt from the rules under the Exchange Act prescribing the

furnishing and content of proxy statements, and its officers, directors and

principal shareholders are exempt from the reporting and short-swing profit

recovery provisions contained in Section 16 of the Exchange Act. In addition,

the Company is not required to publish financial statements as promptly as U.S.

companies.

An

investor may read any document that the Company has filed with or furnished to

the SEC at the SEC’s public reference room in Washington, D.C. An investor may

also obtain copies of those documents from the public reference room of the SEC

at 100 F Street, N.E., Washington, D.C. 20549 by paying a fee. An investor

should call the SEC at 1-800-SEC-0330 or access its website at

www.sec.gov

for further information about the public reference rooms. An

investor may read and download the documents the Company has filed with the SEC

under the Company’s corporate profile at

www.sec.gov

. An investor may

read and download any public document that the Company has filed with the

Canadian securities regulatory authorities under the Company’s corporate profile

on the SEDAR website at

www.sedar.com

.

ENFORCEABILITY OF CIVIL LIABILITIES

The

Company is a company organized and existing under the

Business Corporations

Act

(British Columbia). A majority of the Company’s directors and officers,

and some or all of experts named in this Prospectus and the documents

incorporated by reference herein, are residents of Canada or otherwise reside

outside the United States, and all or a substantial portion of their assets, and

a substantial portion of the Company’s assets, are located outside the United

States. The Company has appointed an agent for service of process in the United

States, but it may be difficult for investors who reside in the United States to

effect service within the United States upon those directors, officers and

experts who are not residents of the United States. It may also be difficult for

investors who reside in the United States to realize in the United States upon

judgments of courts of the United States predicated upon the Company’s civil

liability and the civil liability of the Company’s directors, officers and

experts under the United States federal securities laws. A final judgment for a

liquidated sum in favour of a private litigant granted by a United States court

and predicated solely upon civil liability under United States federal

securities laws would, subject to certain exceptions identified in the law of

individual provinces and territories of Canada, likely be enforceable in Canada if the United States court in which the

judgment was obtained had a basis for jurisdiction in the matter that would be

recognized by the domestic Canadian court for the same purposes. There is a

significant risk that a given Canadian court may not have jurisdiction or may

decline jurisdiction over a claim based solely upon United States federal

securities law on application of the conflict of laws principles of the province

or territory in Canada in which the claim is brought.

I-15

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION

Unless

stated otherwise or the context otherwise requires, all references to dollar

amounts in this Prospectus are references to Canadian dollars. All references to

“CAN$” are to Canadian dollars, references to “US$” are to United States dollars

and references to “R” or “Rand” are to South African Rand.

The

following table sets forth the rate of exchange for the United States dollar

expressed in Canadian dollars in effect at the end of each of the periods

indicated, the average of the exchange rates in effect on the last day of each

month during each of the periods indicated, and the high and low exchange rates

during each of the periods indicated in each case, prior to and including April

28, 2017 based on the noon rate of exchange and, subsequent to April 28, 2017,

based on the daily exchange rate, as reported by the Bank of Canada for the

conversion of United States dollars into Canadian dollars.

|

|

|

Fiscal Year Ended August 31,

|

|

|

|

|

2017

|

|

|

2016

|

|

|

Average rate for period

|

|

CAN$1.3178

|

|

|

CAN$1.3265

|

|

|

Rate at end of period

|

|

CAN$1.2536

|

|

|

CAN$1.3124

|

|

|

High for period

|

|

CAN$1.3743

|

|

|

CAN$1.4589

|

|

|

Low for period

|

|

CAN$1.2447

|

|

|

CAN$1.2544

|

|

|

|

|

Nine Months Ended May 31,

|

|

|

|

|

2018

|

|

|

2017

|

|

|

Average rate for period

|

|

CAN$1.2732

|

|

|

CAN$1.3349

|

|

|

Rate at end of period

|

|

CAN$1.2948

|

|

|

CAN$1.3500

|

|

|

High for period

|

|

CAN$1.3088

|

|

|

CAN$1.3743

|

|

|

Low for period

|

|

CAN$1.2128

|

|

|

CAN$1.2843

|

|

The

daily rate of exchange on August 2, 2018 as reported by the Bank of Canada for

the conversion of United States dollars into Canadian dollars was US$1.00 equals

CAN$1.3014.

The

following table sets forth the rate of exchange for the Rand expressed in

Canadian dollars in effect at the end of each of the periods indicated, the

average of the exchange rates in effect on the last day of each month during

each of the periods indicated, and the high and low exchange rates during each

of the periods indicated in each case, prior to and including April 28, 2017

based on the noon rate of exchange and, subsequent to April 28, 2017, based on

the daily exchange rate, as reported by the Bank of Canada for the conversion of

Rand into Canadian dollars.

|

|

|

Fiscal Year Ended August 31,

|

|

|

|

|

2017

|

|

|

2016

|

|

|

Average rate for period

|

|

CAN$0.0984

|

|

|

CAN$0.0902

|

|

|

Rate at end of period

|

|

CAN$0.0968

|

|

|

CAN$0.0893

|

|

|

High for period

|

|

CAN$0.1076

|

|

|

CAN$0.0993

|

|

|

Low for period

|

|

CAN$0.0892

|

|

|

CAN$0.0821

|

|

|

|

|

Nine Months Ended May 31,

|

|

|

|

|

2018

|

|

|

2017

|

|

|

Average rate for period

|

|

CAN$0.1006

|

|

|

CAN$0.0989

|

|

|

Rate at end of period

|

|

CAN$0.1023

|

|

|

CAN$0.1027

|

|

|

High for period

|

|

CAN$0.1106

|

|

|

CAN$0.1076

|

|

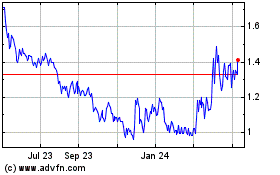

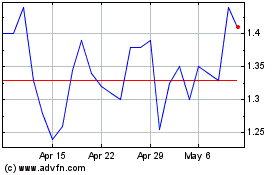

|