UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

|

|

![[TKLSS11.JPG]](https://content.edgar-online.com/edgar_conv_img/2018/08/02/0001393905-18-000234_TKLSS11.JPG)

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

Nevada

|

|

(State or other jurisdiction of incorporation or organization)

|

|

|

|

3630

|

|

(Primary Standard Industrial Classification Code Number)

|

|

|

|

26-2137574

|

|

(I.R.S. Employer Identification Number)

|

|

|

|

15720 N. Greenway Hayden Loop, Suite 2

|

|

Scottsdale, AZ 85260

|

|

(480) 275-7572

|

|

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

|

|

|

|

Robertson J. Orr, CEO

|

|

15720 N. Greenway Hayden Loop, Suite 2

|

|

Scottsdale, AZ 85260

|

|

(480) 275-7572

|

|

(Name, address, including zip code, and telephone number, including area code, of agent for service)

|

Approximate date of commencement of proposed sale to the public

: As soon as practicable after the registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: [ ]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

Indicate by check mark whether the registrant is a large accelerated file, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

| |

|

Large accelerated filer

|

[ ]

|

|

Accelerated filer

|

[ ]

|

|

Non-accelerated filer

|

[ ]

|

|

Smaller reporting company

|

[X]

|

|

(Do not check if a smaller reporting company)

|

|

Emerging growth company

|

[ ]

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. [ ]

ii

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Title of Each Class of

securities to be registered

|

|

Amount of

shares of

common

stock to be

registered (1)

|

|

|

Proposed

Maximum

Offering

Price Per

Share (2)

|

|

|

Proposed

Maximum

Aggregate

Offering

Price

|

|

|

Amount of

Registration

Fee (3)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

|

9,000,000(4)

|

|

|

|

$0.75

|

|

|

|

$6,750,000

|

|

|

|

$840.38

|

|

(1)

In accordance with Rule 416(a), this registration statement shall also cover an indeterminate number of shares that may be issued and resold resulting from stock splits, stock dividends or similar transactions.

(2)

Based on the offering price of each unit registered in this offering.

(3)

The fee is calculated by multiplying the aggregate offering amount by 0.0001245, pursuant to Section 6(b) of the Securities Act of 1933.

(4)

This number includes 4,500,000 shares and 4,500,000 shares underlying the warrants.

We hereby amend this registration statement on such date or dates as may be necessary to delay our effective date until the registrant shall file a further amendment which specifically states that this registration statement shall, thereafter, become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the registration statement shall become effective on such date as the Commission, acting pursuant to Section 8(a) may determine.

iii

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION DATED JULY ____, 2018

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Trutankless, Inc.

4,500,000 Units

This prospectus relates to the sale of 4,500,000 units, each unit consisting of one share of common stock, par value $0.001 (“Common Stock”) and one warrant to purchase one share of Common Stock of Trutankless, Inc. (referred to herein as the “Company”), at a public offering price of $0.75 per unit (the “Primary Offering”). The warrants included within the units are exercisable immediately, have an exercise price of $0.50 per share, and expire five years from the date of execution. The Primary Offering terminates 12 months after commencement of this offering on _____, 2019. The Company is offering the shares on a self-underwritten, “best efforts” basis through our officers and directors. The total proceeds from the Primary Offering will not be escrowed or segregated but will be available to the Company immediately. Mr. Orr has no experience conducting “best efforts” offerings, and there is no minimum amount of Common Stock required to be purchased, and, therefore, the total Primary Offering proceeds received by the Company might not be enough to fund the Company’s planned operations. Further, the trading market for our Shares has been extremely limited and there have only been minimal and sporadic public quotations for our Shares. No commission or other compensation related to the sale of Common Stock in the Primary Offering will be paid. For more information, see the section titled “Plan of Distribution” and “Use of Proceeds” herein.

An investment in our common stock involves a high degree of risk. You should purchase our common stock only if you can afford a complete loss of your purchase.

We urge you to read carefully the “Risk Factors” section beginning on page ___ where we describe specific risks associated with an investment in Trutankless, Inc., and these securities before you make your investment decision.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

THE DATE OF THIS PROSPECTUS IS __________, 2018.

iv

TABLE OF CONTENTS

v

PROSPECTUS SUMMARY

This summary contains basic information about us and the offering. Because it is a summary, it does not contain all the information that you should consider before investing. You should read the entire prospectus carefully, including the risk factors and our financial statements and the related notes to those statements included in this prospectus. Except as otherwise required by the context, references in this prospectus to "we," "our," "us" and “TKLS” refer to Trutankless Inc.

Our Company

Trutankless Inc. was incorporated in the state of Nevada on March 7, 2008. The Company is headquartered in Scottsdale, Arizona and currently operates through its wholly-owned subsidiary, Bollente, Inc., a Nevada corporation incorporated on December 3, 2009. We are involved in sales, marketing, research and development of a new high quality, whole-house, electric tankless water heater that is more energy efficient than conventional products.

We manufacture and distribute trutankless® water heaters, a line of new, high-quality, highly efficient electric tankless water heaters. Our trutankless® water heaters are engineered to outperform and outlast both its tank and tankless predecessors in energy efficiency, output, and durability. It provides endless hot water on demand for a whole household and it also integrates with home automation systems. We have several features and design innovations which are new to the electric tankless water heater market that we believe will give our products a sustainable competitive advantage over our rivals in the market. Our trutankless® water heaters are available through wholesale plumbing distributors, including Ferguson, Hajoca, Hughes Supply, WinSupply locations, Morrison Supply, and several regional distributors. A partial listing of wholesalers may be found on our website (www.trutankless.com).

Our trutankless® water heaters were officially launched in the first quarter of 2014 and is sold throughout the wholesale plumbing distribution channel. We began generating revenue in the first quarter of 2014. As of the fiscal year ended December 31, 2014, we generated $238,912 in revenue. As of the fiscal year ended December 31, 2015, we generated $265,504 in revenue. As of the fiscal year ended December 31, 2016, we generated $429,582 in revenue. As of the fiscal year ended December 31, 2017, we generated $695,857 in revenue.

On August 13, 2015, we formed a wholly-owned subsidiary, Bollente International, Inc. (“Bollente International”), to begin international manufacturing and sales expansion for our trutankless® line of water hearters. The Company no longer operates Bollente International and on July 30, 2018, the Company caused Bollente International to be dissolved.

No member of our management or any of our affiliates have been previously involved in the management or ownership of a development stage company that has not implemented its business plan, engaged in a change of control or similar transaction or has generated no or minimal resources to date.

As of the date of this prospectus we have two officers who also serve as our board of directors and who we anticipate will devote 30 to 40 hours a week to the company going forward. We currently have nine full-time employees, including our two officers and two part-time employees. Additionally, even with the sale of securities offered hereby, we will not have the financial resources needed to hire additional employees or meaningfully expand our business. It is possible we will sustain operating losses for at least the next 12 months. Even if we sell all the securities offered, a substantial portion of the proceeds of the offering will be spent for costs associated with the offering, fees associated with SEC reporting requirements, and working capital. Investors should realize that following this offering we will be required to raise additional capital to cover the costs associated with our business plan.

1

TKLS’s address and phone number are:

Trutankless, Inc.

15720 N. Greenway Hayden Loop

Suite 2

Scottsdale, AZ 85260

(480) 275-7572

SUMMARY OF THE OFFERING

|

| |

|

Securities Offered(1)

|

4,500,000 units, each unit consisting of one share of Common Stock and one warrant to purchase one share of Common Stock. Each warrant is exercisable immediately, will have an exercise price of $0.50 per share, and expire five years from the date of execution.

|

|

|

|

|

Price Per Unit (2)

|

$0.75

|

|

|

|

|

Common Stock Outstanding before Offering

|

31,799,906 shares of common stock

|

|

|

|

|

Common Stock Outstanding after Offering (4)

|

36,299,906 shares of common stock

|

|

|

|

|

Estimated Total Proceeds

|

$3,375,000

|

|

|

|

|

Offering Expenses(3)

|

$22,500

|

|

|

|

|

Net Proceeds after Offering Expenses

|

$3,352,500

|

|

|

|

|

Use of Proceeds

|

Other than the expenses of the offering, the proceeds of the offering will be used for; accounting, marketing, product development, legal, and general working capital.

|

|

|

|

|

Subscriptions

|

Subscriptions are to be made payable to “Trutankless Inc.”

|

(1)

Management may not, and will not purchase any shares in this offering.

(2)

Our common stock is presently traded on the OTCQB marketplace, operated by OTC Markets Group under the symbol TKLS. July 26, 2018, the last sale price of our shares as reported by the OTC Markets was $0.495 per share.

(3)

Total reflects an estimate of costs including: accounting and audit $5,000, legal $15,000, copy and printing $500, and $2,000 for transfer agent and EDGAR/XBRL services.

(4)

These 36,299,906 shares do not include the shares underlying the warrants to be issued as part of the units offered by us in this offering.

2

SUMMARY FINANCIAL INFORMATION

The following table sets forth summary financial data derived from our financial statements. The data should be read in conjunction with the financial statements, related notes and other financial information included in this prospectus.

|

|

|

|

|

|

|

|

| |

|

|

For the years ended

|

|

|

December 31, 2017

|

|

December 31, 2016

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

$

|

695,857

|

|

$

|

429,582

|

|

|

|

|

|

|

|

|

Cost of goods sold

|

|

(530,593)

|

|

|

(490,276)

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

165,264

|

|

|

(60,694)

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

General and administrative

|

|

1,710,117

|

|

|

1,031,644

|

|

|

|

Research and development

|

|

165,218

|

|

|

-

|

|

|

|

Professional fees

|

|

694,736

|

|

|

1,797,048

|

|

|

|

|

Total operating expenses

|

|

2,570,071

|

|

|

2,828,692

|

|

|

|

|

|

|

|

|

Other expenses

|

|

|

|

|

|

|

|

|

Other (expense) income

|

|

-

|

|

|

193

|

|

|

|

Interest expense

|

|

(467,164)

|

|

|

(383,641)

|

|

|

|

|

Total expenses

|

|

(467,164)

|

|

|

(383,448)

|

|

|

|

|

|

|

|

|

Net loss

|

$

|

(2,871,971)

|

|

$

|

(3,272,834)

|

|

|

|

|

|

|

|

|

Net loss per common share - basic

|

$

|

(0.11)

|

|

$

|

(0.15)

|

|

|

|

|

|

|

|

|

Weighted average number of common shares

outstanding - basic

|

$

|

25,086,788

|

|

$

|

21,139,129

|

|

|

|

|

|

| |

|

|

For the years ended

|

|

|

December 31, 2017

|

|

December 31, 2016

|

|

Balance Sheet Data:

|

(audited)

|

|

(audited)

|

|

|

|

|

|

|

Total assets

|

$

|

702,345

|

|

$

|

509,794

|

|

Total liabilities

|

$

|

2,135,977

|

|

$

|

1,136,419

|

|

Total liabilities and stockholders' equity

|

$

|

702,345

|

|

$

|

509,794

|

3

|

|

|

|

|

|

|

|

| |

|

|

For the three months ended

|

|

|

March 31,

2018

|

|

March 31,

2017

|

|

Income Statement Data:

|

(unaudited)

|

|

(unaudited)

|

|

|

|

|

|

|

Revenue

|

$

|

425,046

|

|

$

|

115,308

|

|

|

|

|

|

|

|

|

Cost of goods sold

|

|

(321,447)

|

|

|

(63,945)

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

103,599

|

|

|

51,363

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

General and administrative

|

|

275,034

|

|

|

173,952

|

|

|

|

Research and development

|

|

-

|

|

|

52,149

|

|

|

|

Professional fees

|

|

144,794

|

|

|

166,608

|

|

|

|

|

Total operating expenses

|

|

419,828

|

|

|

392,709

|

|

|

|

|

|

|

|

|

Other expenses

|

|

|

|

|

|

|

|

|

Interest expense

|

|

(108,523)

|

|

|

(140,449)

|

|

|

|

|

Total expenses

|

|

(108,523)

|

|

|

(140,449)

|

|

|

|

|

|

|

|

|

Net loss

|

$

|

(424,752)

|

|

$

|

(481,795)

|

|

|

|

|

|

|

|

|

Net loss per common share - basic

|

$

|

(0.01)

|

|

$

|

(0.02)

|

|

|

|

|

|

|

|

|

Weighted average number of common shares

outstanding - basic

|

$

|

28,652,385

|

|

$

|

24,008,295

|

|

|

| |

|

|

March 31,

2018

|

|

Balance Sheet Data:

|

(unaudited)

|

|

|

|

|

Total assets

|

$

|

1,003,391

|

|

Total liabilities

|

|

2,295,025

|

|

Total liabilities and stockholders' equity

|

$

|

1,003,391

|

4

RISK FACTORS

Investors in TKLS should be particularly aware of the inherent risks associated with our business. As of the date of this filing our management is aware of the following material risks.

Risks Relating to our Business

If we are unable to attract and retain key personnel, our business could be harmed.

If any of our key employees were to leave, we could face substantial difficulty in hiring qualified successors and could experience a loss in productivity while any successor obtains the necessary training and experience. Our employment relationships are generally at-will. We cannot assure that one or more key employees will not leave in the future. We intend to continue to hire additional highly qualified personnel, but may not be able to attract, assimilate or retain qualified personnel in the future. Any failure to attract, integrate, motivate and retain these employees could harm our business.

We are subject to significant competition from large, well-funded companies.

The industry we compete in is characterized by intense competition and rapid and significant technological advancements. Many companies are working in a number of areas similar to our primary field of interest to develop new products; some of which may be similar and/or competitive to our products.

Most of the companies with which we compete have substantially greater financial, technical, manufacturing, marketing, sales and distribution and other resources than us. If a competitor enters the tankless water heater industry and establishes a greater market share in the direct-selling channel, our business and operating results will be adversely affected.

Our auditors have substantial doubt about our ability to continue as a going concern. Additionally, our auditor’s report reflects that the ability of the Company to continue as a going concern is dependent upon our ability to raise additional capital from the sale of common stock and, ultimately, the achievement of significant operating revenues.

Our financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. Our auditor’s report reflects that the ability of the Company to continue as a going concern is dependent upon our ability to raise additional capital from the sale of common stock and, ultimately, the achievement of significant operating revenues. If we are unable to continue as a going concern, stockholders will lose their investment. We will be required to seek additional capital to fund future growth and expansion. No assurance can be given that such financing will be available or, if available, that it will be on commercially favorable terms. Moreover, favorable financing may be dilutive to investors.

We will require additional financing in order to implement our business plan. In the event we are unable to acquire additional financing, we may not be able to implement our business plan resulting in a loss of revenues and ultimately the loss of your investment.

Due to our very recent start-up nature, we will have to incur the costs of product development, import expenses, advertising, in addition to hiring new employees and commencing additional marketing activities for product sales and distribution. To fully implement our business plan we will require substantial additional funding.

5

We will need to raise additional funds to expand our operations. We plan to raise additional funds through private placements, registered offerings, debt financing or other sources to maintain and expand our operations. Adequate funds for this purpose on terms favorable to us may not be available, and if available, on terms significantly more adverse to us than are manageable. Without new funding, we may be only partially successful or completely unsuccessful in implementing our business plan, and our stockholders may lose part or all of their investment.

Our internal controls may be inadequate, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public.

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. As defined in Exchange Act Rule 13a-15(f), internal control over financial reporting is a process designed by, or under the supervision of, the principal executive and principal financial officer and effected by the board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that: (i) pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the Company; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and directors of the Company, and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company’s assets that could have a material effect on the financial statements.

We have two individuals performing the functions of all officers and directors. Mr. Orr, our CEO, and Mr. Stebbins, our president, have developed our internal control procedures and are responsible for monitoring and ensuring compliance with those procedures. As a result, our internal controls may be inadequate or ineffective, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public. Investors relying upon this misinformation may make an uninformed investment decision.

We depend on certain key employees, and believe the loss of any of them would have a material adverse effect on our business.

We will be dependent on the continued services of our management team, as well as our outside consultants. While we have no assurance that our current management will produce successful operations, the loss of such personnel could have an adverse effect on meeting our production and financial performance objectives. We have no assurance that we will not lose the services of these or other key personnel and may not be able to timely replace any personnel if we do lose their services.

Our ability to attract qualified sales and marketing personnel is critical to our future success, and any inability to attract such personnel could harm our business.

Our future success may also depend on our ability to attract and retain additional qualified design and sales and marketing personnel. We face competition for these individuals and may not be able to attract or retain these employees, which could have a material adverse effect on our results of operations and financial condition.

6

We depend on contract manufacturers, and our production and products could be harmed if it is unable to meet our volume and quality requirements and alternative sources are not available.

We rely on contract manufacturers to provide manufacturing services for our products. If these services become unavailable, we would be required to identify and enter into an agreement with a new contract manufacturer or take the manufacturing in-house. The loss of our contract manufacturers could significantly disrupt production as well as increase the cost of production, thereby increasing the prices of our products. These changes could have a material adverse effect on our business and results of operations.

Risks Related to Our Intellectual Property and Technology

If we fail to secure or protect our intellectual property rights, our products and competitors may be able to use our designs, each of which could harm our reputation, reduce our revenues and increase our costs.

We will rely on intellectual property laws to protect our proprietary rights with respect to our trademarks and pending patent. We are susceptible to injury from patent infringement, which may harm our reputation for producing high-quality products or force us to incur additional expense in enforcing our rights. It is difficult and expensive to detect and prevent patent infringement. Despite our efforts to protect our intellectual property, some may attempt to violate our intellectual property rights by using our trademarks and imitating our products, which could potentially harm our brand, reputation and financial condition.

We may face significant expenses and liability in connection with the protection of our intellectual property rights. Infringement claims and lawsuits likely would be expensive to resolve and would require substantial management time and resources. Any adverse determination in litigation could subject us to the loss of our rights to a particular trademark, which could prevent us from manufacturing, selling or using certain aspects of our products or could subject us to substantial liability, any of which would harm our results of operations. Aside from infringement claims against us, if we fail to secure or protect our intellectual property rights, our competitors may be able to use our designs. If we are unable to successfully protect our intellectual property rights or resolve any conflicts, our results of operations may be harmed.

Our reliance on intellectual property and other proprietary information subjects us to the risk that these key ingredients of our business could be copied by competitors.

Our success depends, in significant part, on the proprietary nature of our technology. If a competitor is able to reproduce or otherwise capitalize on our technology, despite the safeguards we have in place, it may be difficult, expensive or impossible for us to obtain necessary legal protection.

In addition to patent protection of intellectual property rights, we consider elements of our product designs and processes to be proprietary and confidential. We rely upon employee, consultant and vendor non-disclosure agreements and contractual provisions and a system of internal safeguards to protect our proprietary information. However, any of our registered or unregistered intellectual property rights may be challenged or exploited by others in the industry, which might harm our operating results.

7

Risks Relating to Our Units and this Offering

The Units in the Primary Offering are being offered and sold on a “self-underwritten, best efforts” basis.

The Units in the Primary Offering are being offered and sold in a direct public offering on a “self-underwritten, best efforts” basis, which means (a) no minimum number of Units need be subscribed for in order for the Company to consummate the sale of any of the Units and utilize the proceeds therefrom; and (b) the Company will not use the services of an underwriter and our executive officers and directors will attempt to sell the Units directly to investors. Subscription proceeds for Units sold in the Primary Offering will be paid directly to the Company and will not be held in a segregated or escrow account. Moreover, the Primary Offering is self-underwritten and accordingly, there is no lead underwriter who would undertake a due diligence or comparable examination of the Company, its business and affairs.

Because our management will have broad discretion over the use of the net proceeds from the sale of Shares in the Primary Offering, you may not agree with how we use them.

We intend to use the net proceeds from the sale for the Units in the Primary Offering to support our business operations, working capital and other general corporate purposes. Therefore, our management will have broad discretion as to the use of the net proceeds from the Primary Offering. Accordingly, you will be relying on the judgement of our management with regard to the use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether th such proceeds are being used appropriately.

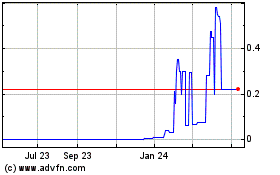

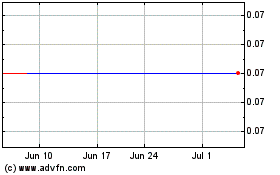

A liquid trading market for our Common Stock may not develop and be sustained.

Our Common Stock is quoted on the OTCQB tier of the over-the counter market operated by OTC Markets Group under the symbol “TKLS.” However, the market for our Common Stock has been extremely limited and there have only been mimimal and sporadic public quotations for our Common Stock. A liquid trading market for our Common Stock may never develop or be sustained following the Primary Offering. If a liquid market for our common stock does not develop, or if developed, is not sustained, it may be difficult for you to sell Common Stock you purchase in the Primary Offering without depressing the market price for the Common Stock or at all.

The market price for our common stock, assuming a liquid trading market develops and is sustained, may be particularly volatile given our status as a relatively unknown company with a small and thinly traded public float, limited operating history and lack of profits which could lead to wide fluctuations in our Share price. You may be unable to sell your Common Stock at or above your purchase price, which may result in substantial losses to you.

The market for our common stock, assuming a liquid trading market develops and is sustained may be characterized by significant price volatility when compared to seasoned issuers, and we expect that our Share price will continue to be more volatile than a seasoned issuer for the indefinite future. The volatility in our Share price is attributable to a number of factors. First, as noted above, our common stock is sporadically and thinly traded. As a consequence of this lack of liquidity, the trading of relatively small quantities of Common Stock by our stockholders may disproportionately influence the price of those Common Stock in either direction. The price for our Common Stock could, for example, decline precipitously in the event that a large number of our common stock are sold on the market without commensurate demand, as compared to a seasoned issuer which could better absorb those sales without adverse impact on its share price.

8

Secondly, we are a speculative or “risky” investment due to our limited operating history and lack of profits to date, and uncertainty of future market acceptance for our potential products and services. As a consequence of this enhanced risk, more risk-adverse investors may, under the fear of losing all or most of their investment in the event of negative news or lack of progress, be more inclined to sell their Common Stock on the market more quickly and at greater discounts than would be the case with the stock of a seasoned issuer. Many of these factors are beyond our control and may decrease the market price of our common stock, regardless of our operating performance. We cannot make any predictions or projections as to what the prevailing market price for our common stock will be at any time, including as to whether our common stock will sustain their current market prices, or as to what effect that the sale of Common Stock or the availability of common stock for sale at any time will have on the prevailing market price.

Because our common stock could remain under $5.00 per share, it could continue to be deemed a low-priced “Penny” stock, an investment in our common stock should be considered high risk and subject to marketability restrictions.

Since our common stock is currently under $5.00 per share, it is considered a penny stock, as defined in Rule 3a51-1 under the Securities Exchange Act, it will be more difficult for investors to liquidate their investment even if and when a market develops for the common stock. If the trading price of the common stock stays below $5.00 per share, trading in the common stock is subject to the penny stock rules of the Securities Exchange Act specified in rules 15g-1 through 15g-10. Those rules require broker-dealers, before effecting transactions in any penny stock, to:

·

Deliver to the customer, and obtain a written receipt for, a disclosure document;

·

Disclose certain price information about the stock;

·

Disclose the amount of compensation received by the broker-dealer or any associated person of the broker-dealer;

·

Send monthly statements to customers with market and price information about the penny stock; and

·

In some circumstances, approve the purchaser

’

s account under certain standards and deliver written statements to the customer with information specified in the rules.

Consequently, the penny stock rules may restrict the ability or willingness of broker-dealers to accept the common stock for deposit into an account or, if accepted for deposit, to sell the common stock and these restrictions may affect the ability of holders to sell their common stock in the secondary market and the price at which such holders can sell any such securities. These additional procedures could also limit our ability to raise additional capital in the future.

FINRA sales practice requirements may also limit a stockholder's ability to buy and sell our stock.

In addition to the “penny stock” rules described above, the Financial Industry Regulatory Authority (FINRA) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

9

About this Prospectus

You should only rely on the information contained in this prospectus. We have not authorized anyone to provide information different from that contained in this prospectus. We are offering to sell, and seeking offers to buy, shares of our common stock on a “direct public offering,” “all or nothing,” basis only in jurisdictions where offers and sales are permitted. Offers and sales of our securities are only permitted in those jurisdictions where statutes exist, “blue sky statutes” allowing for such offers and sales.

Available Information

Our periodic reports filed with the SEC, which include Form 10-K, Form 10-Q, Form 8-K and amendments thereto, may be accessed by the public free of charge from the SEC. Electronic copies of these reports can be accessed at the SEC’s website (http://www.sec.gov). Copies of these reports may also be obtained, free of charge, upon written request to: Trutankless Inc., 15720 N Greenway-Hayden Loop, Unit 2, Scottsdale, AZ 85260, Attn: Corporate Secretary. The public may read or obtain copies of these reports from the SEC at the SEC’s Public Reference Room at 450 Fifth Street N.W., Washington, D.C. 20549 (1-800-SEC-0330).

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements under “Prospectus Summary”, “Risk Factors”, “Plan of Operation”, “Our Business”, and elsewhere in this prospectus constitute forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimated”, “predicts”, “potential”, or “continue” or the negative of such terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause our actual results, levels of activity, performance, or achievements to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by such forward-looking statements. These factors include, among other things, those listed under “Risk Factors” and elsewhere in this prospectus. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. We undertake no obligation to update or revise any of the forward-looking statements after the date of this prospectus to conform forward-looking statements to actual results, except as required by the Federal securities laws or as required to meet our obligations set forth in the undertakings to this registration statement.

USE OF PROCEEDS

The amounts and timing of expenditures described in the table for each purpose may vary significantly depending on numerous factors, including, without limitation, the progress of our marketing. We anticipate, based on currently proposed plans and assumptions relating to our plan of operations, that the net proceeds of this offering of $3,352,500 and cash flow from operations, if any, will be adequate to satisfy our capital needs for approximately 12 months following consummation of this offering. We have based our assumptions on the fact that we will not incur additional obligations for personnel, office, etc. until such time as we either raise additional equity or debt, or generate revenues to support such expenditures. The net proceeds from the sale of the units offered hereby are estimated to be approximately $3,352,500. We intend to utilize the estimated net proceeds following the offering for the following purposes:

10

|

| |

|

|

Amount

|

|

Total Proceeds

|

$3,375,000

|

|

|

|

|

Less: Offering Expenses

|

|

|

Accounting and Audit

|

$5,000

|

|

Legal

|

$15,000

|

|

Copying

|

$500

|

|

Transfer Agent Fees

|

|

|

EDGAR Fees

|

$2,000

|

|

|

|

|

Net Proceeds from Offering

|

$3,352,500

|

|

|

|

|

Use of Net Proceeds

|

|

|

|

|

|

Accounting Fees (1)

|

$36,000

|

|

Legal(2)

|

$15,000

|

|

Working Capital (3)

|

$3,301,500

|

(1)

Accounting Fees

. We have allocated up to $36,000 in services in assisting us in our SEC reports and preparation of our financial statements for a twelve month period.

(2)

Legal Fees.

We have allocated up to $15,000 in services for assistance in our SEC reports for a twelve month period.

(3)

Working Capital

. Includes any application deemed appropriate for the company to commence operations, including but not limited to the expenses relating to our marketing and website maintenance.

DETERMINATION OF OFFERING PRICE

In determining the public offering price of the shares we considered several factors including the following:

·

our operating status;

·

prevailing market conditions, including the history and prospects for the industry in which we compete;

·

our future prospects; and

·

our capital structure.

Therefore, the public offering price of the shares does not necessarily bear any relationship to established valuation criteria and may not be indicative of prices that may prevail at any time or from time to time in the public market for the common stock. You cannot be sure that a public market for any of our securities will develop and continue or that the securities will ever trade at a price at or higher than the offering price in this offering.

11

DILUTION

The difference between our public offering price per share of common stock and the pro forma net tangible book value per share of common stock after this offering constitutes the dilution to investors in this offering. Our net tangible book value per share is determined by dividing our net tangible book value (total tangible assets less total liabilities) by the number of outstanding shares of common stock.

At March 31, 2018, our common stock had a net negative tangible book value of approximately ($1,306,077) or ($0.045) per share. After giving effect to the receipt of the net proceeds from the units offered in this prospectus at an assumed initial offering price of $0.75 per unit, our pro forma net tangible book value at March 31, 2018, would have been $2,046,423 or $0.061 per share. This results in immediate dilution per share to investors of $0.69 or 8%. The following table illustrates dilution to investors on a per share basis:

|

|

|

| |

|

Per Share Offering Price

|

|

$

|

0.75

|

|

Number of Shares Sold

|

|

|

4,500,000

|

|

Net Tangible Book Value Per Share Prior to Sale

|

|

$

|

(0.045)

|

|

Pro Form Net Tangible Value Per Share After Sale

|

|

$

|

0.061

|

|

Increase in Net Book Value Per Share Due to Sale

|

|

$

|

0.107

|

|

Net Dilution (Purchase Price of $0.75 Less

Pro Forma net Tangible Book Value Per Share

|

|

$

|

0.689

|

PLAN OF DISTRIBUTION AND TERMS OF THE OFFERING

Units Offered By Us

We are offering to the public 4,500,000 units, each unit consisting of one share of common stock, par value $0.001 (“Common Stock”) and one warrant to purchase one share of Common Stock of Trutankless, Inc. (referred to herein as the “Company”), at a public offering price of $0.75 per unit (the “Primary Offering”). The warrants included within the units are exercisable immediately, have an exercise price of $0.50 per share, and expire five years from the date of execution. shares of common stock, at $0.50 per share, in a direct public offering, on a “self-underwritten, best efforts” basis, which means (a) no minimum number of Units need be subscribed for in order for the Company to consummate the sale of any of the Units and utilize the proceeds therefrom; and (b) the Company will not use the services of an underwriter and our executive officers and directors will attempt to sell the Units directly to investors. The intended methods of communication with potential investors include, without limitation, telephone and personal contacts. The Company’s executive officers and directors may also reach out to personal contacts such as family, friends and acquaintances and may conduct investment presentations in the form of a roadshow at various industry and investor conferences. Subscription proceeds for Units sold in the Primary Offering will be paid directly to the Company and will not be held in a segregated or escrow account. Our executive officers and directors will not receive commissions or any other remuneration from any such sales.

In offering the Units in the Primary Offering on our behalf, our executive officers and directors will rely on the “safe harbor” provisions of SEC Rule 3a4-1, promulgated under the Exchange. Generally speaking, Rule 3a4-1 provides an exemption from the broker-dealer registration requirements of the Exchange Act for persons associated with an issuer that participate in the sale of the securities of such issuer.

12

Our executive officers and directors meet the conditions of the Rule 3a4-1 exemption, as: (a) they are not subject to any statutory disqualification, as that term is defined in Section 3(a)(39) of the Exchange Act; (b) they will not be compensated in connection with their participation in the direct public offering or resale offering by the payment of commissions or other remuneration based either directly or indirectly on transactions in our securities; and (c) they will not be associated persons of a broker or dealer at the time of their participation in the direct public offering and resale offering. Further, our officers and directors: (a) at the end of the offerings, will continue to primarily perform substantial duties for the Company or on its behalf otherwise than in connection with transactions in securities; (b) are not, nor have been within the preceding twelve (12) months, a broker or dealer, and they are not, nor have they been within the preceding twelve (12) months, an associated person of a broker or dealer; and (c) they have not participated in another offering of securities pursuant to the Exchange Act Rule 3a4-1 in the past twelve (12) months and they have not and will not participate in selling an offering of securities for any issuer more than once every twelve (12) months other than in reliance on the Exchange Act Rule 3a4-1(a)(4)(i) or (iii).

In order to comply with the applicable securities laws of certain states, the securities will be offered or sold in those states only if they have been registered or qualified for sale, an exemption from such registration is available, or if qualification requirement is available and with which the Company has complied. In addition, and without limiting the foregoing, the Company will be subject to applicable provisions, rules and regulations under the Exchange Act with regard to security transactions during the period of time when this Registration Statement is effective.

Offering Period and Expiration Date

The Units in the Primary Offering will be offered for sale for a period of 12 months after the date of effectiveness of this registration, on ___________________, 2019 (“Termination Date”).

Procedures for Subscribing

If you decide to subscribe for any Units in the Primary Offering, you must:

·

execute and deliver a Subscription Agreement; and

·

deliver the subscription price to the Company by cashier

’

s check or wire transfer of immediately available funds.

The Subscription Agreement requires you to disclose your name, address, social security number, telephone number, email address, number of Units you are purchasing, and the price you are paying for your Units.

Acceptance of Subscriptions

Upon the Company’s acceptance of a subscription and receipt of full payment, and subject to the timing qualification set forth above, the Company shall countersign the Subscription Agreement and issue a stock certificate along with a copy of the Subscription Agreement.

13

Right to Reject Subscriptions

We have the right to accept or reject subscriptions in whole or in part, for any reason or for no reason. All monies from rejected subscriptions will be returned immediately by us to the subscriber, without interest or deductions. Subscriptions for securities will be accepted or rejected within three (3) business days after we receive them.

LEGAL PROCEEDINGS

We may from time to time be involved in routine legal matters incidental to our business; however, at this point in time we are currently not involved in any litigation, nor are we aware of any threatened or impending litigation.

DIRECTOR, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

The members of our board of directors serve for one year terms and are elected at the next annual meeting of stockholders, or until their successors have been elected. The officers serve at the pleasure of the board of directors.

Information as to our current directors and executive officers is as follows:

|

|

|

| |

|

Name

|

Age

|

Title

|

Since

|

|

Robertson James Orr

|

44

|

Chief Executive Officer, Secretary, Treasurer & Director

|

May 12, 2010

|

|

Michael Stebbins

|

36

|

President and Director

|

June 23, 2016

|

Duties, Responsibilities and Experience

Robertson James Orr

, has been our Chief Executive Officer, Treasurer, Secretary and a Director since May 12, 2010. Mr. Orr attended Arizona State University and graduated with a BA in Business Management. In 1998, Mr. Orr assisted in the founding of bluemedia, Inc., a successful large format digital printing company based in Tempe, Arizona. Mr. Orr led bluemedia to profitability 9 years ago while overseeing the company's sales department and business development, and since then the company has continued to grow by more than 28% annually. In 2005, Mr. Orr and his Partners in bluemedia started a non-traditional ad agency called Blind Society, which is responsible for the direct to consumer marketing efforts of companies like AT&T, K-Swiss, and Activision. In addition to his entrepreneurial successes, Mr. Orr has been involved with supporting numerous local charitable causes through his work with the Boys & Girls Clubs of Phoenix, St. Joseph the Worker, the MDA and the ADA. He is also on the Board of Directors for the Tempe Chamber of Commerce and is active in the Phoenix 40.

Michael Stebbins

, has been our President since February 2, 2017 and a Director since June 23, 2016. Mr. Stebbins is also the president and a director of Bollente, Inc., a Nevada corporation and wholly owned subsidiary of the Company. In 2009, Mr. Stebbins assisted in the founding of Bollente, Inc. Mr. Stebbins helped lead the design team that created our trutankless water heater. He oversaw virtually every aspect of launching our trutankless line of water heaters. Working directly with engineering and development teams, he developed several innovations and was instrumental in working on Bollente Inc.’s intellectual property and patents consisting of 29 proprietary claims related to our products. Since substantially completing R/D efforts in 2013, Mr. Stebbins has worked with the rest of management to lead branding, marketing, and sales initiatives, which has resulted in substantial sales growth and business development opportunities. Mr. Stebbins’ experience in the water heater industry dates back to 2003. Prior to co-founding Bollente, Inc., Mr. Stebbins spent time consulting on several product development projects. Mr. Stebbins was named Top 35 Entrepreneurs under 35 by the Arizona Republic.

14

Indemnification of Directors and Officers

Our Articles of Incorporation and Bylaws both provide for the indemnification of our officers and directors to the fullest extent permitted by Nevada law.

Limitation of Liability of Directors

Pursuant to the Nevada General Corporation Law, our Articles of Incorporation exclude personal liability for our Directors for monetary damages based upon any violation of their fiduciary duties as Directors, except as to liability for any breach of the duty of loyalty, acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, or any transaction from which a Director receives an improper personal benefit. This exclusion of liability does not limit any right which a Director may have to be indemnified and does not affect any Director’s liability under federal or applicable state securities laws. We have agreed to indemnify our directors against expenses, judgments, and amounts paid in settlement in connection with any claim against a Director if he acted in good faith and in a manner he believed to be in our best interests.

Election of Directors and Officers

Directors are elected to serve until the next annual meeting of stockholders and until their successors have been elected and qualified. Officers are appointed to serve until the meeting of the Board of Directors following the next annual meeting of stockholders and until their successors have been elected and qualified.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires our executive officers and directors, and persons who beneficially own more than ten percent of our common stock, to file initial reports of ownership and reports of changes in ownership with the SEC. Executive officers, directors and greater-than-ten-percent beneficial owners are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file. Based upon a review of the copies of such forms furnished to us and written representations from our executive officers and directors, we believe that as of the date of this filing they were current in their filings.

Code of Ethics

A code of ethics relates to written standards that are reasonably designed to deter wrongdoing and to promote:

1.

Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships;

2.

Full, fair, accurate, timely and understandable disclosure in reports and documents that are filed with, or submitted to, the Commission and in other public communications made by an issuer;

3.

Compliance with applicable governmental laws, rules and regulations;

4.

The prompt internal reporting of violations of the code to an appropriate person or persons identified in the code; and

5.

Accountability for adherence to the code.

15

We have not adopted a corporate code of ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions.

Our decision to not adopt such a code of ethics results from our having a small management for the Company. We believe that the limited interaction which occurs having such a small management structure for the Company eliminates the current need for such a code, in that violations of such a code would be reported to the party generating the violation.

Corporate Governance

We currently do not have standing audit, nominating and compensation committees of the board of directors, or committees performing similar functions. Until formal committees are established, our entire board of directors, perform the same functions as an audit, nominating and compensation committee.

Involvement in Certain Legal Proceedings

To the best of our knowledge, none of our directors or executive officers has, during the past five years:

·

been convicted in a criminal proceeding or been subject to a pending criminal proceeding (excluding traffic violations and other minor offences);

·

had any bankruptcy petition filed by or against the business or property of the person, or of any partnership, corporation or business association of which he was a general partner or executive officer, either at the time of the bankruptcy filing or within two years prior to that time;

·

been subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction or federal or state authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting, his involvement in any type of business, securities, futures, commodities, investment, banking, savings and loan, or insurance activities, or to be associated with persons engaged in any such activity;

·

been found by a court of competent jurisdiction in a civil action or by the SEC or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated;

·

been the subject of, or a party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated (not including any settlement of a civil proceeding among private litigants), relating to an alleged violation of any federal or state securities or commodities law or regulation, any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order, or any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or

·

been the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

16

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information, as of the date of this prospectus, and as adjusted giving effect to the sale of 4,500,000 shares of common stock in this offering (and does not include the shares underlying the warrants to be issued if execised by the warrant holders), relating to the beneficial ownership of our common stock by those persons known to us to beneficially own more than 5% of our capital stock, by our director and executive officer, and by all of our directors, proposed directors and executive officers as a group.

Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and does not necessarily indicate beneficial ownership for any other purpose. Under these rules, beneficial ownership includes those shares of common stock over which the stockholder has sole or shared voting or investment power. It also includes shares of common stock that the stockholder has a right to acquire within 60 days after July 26, 2018 pursuant to options, warrants, conversion privileges or other right. The percentage ownership of the outstanding common stock, however, is based on the assumption, expressly required by the rules of the Securities and Exchange Commission, that only the person or entity whose ownership is being reported has converted options or warrants into shares of our common stock.

|

|

|

| |

|

Name of Beneficial Owner(1)

|

Number

Of Shares

|

Percent

Before

Offering

|

Percent

After

Offering

|

|

Robertson James Orr - CEO and Director(2)

|

1,076,327

|

3.38%

|

2.97%

|

|

Michael Stebbins - President and Director(2)(3)

|

1,714,309(3)

|

5.39%

|

4.72%

|

|

All Directors, Officers and Principal Stockholders as a Group

|

2,790,636

|

8.78%

|

7.69%

|

(1)

As used in this table, “beneficial ownership” means the sole or shared power to vote, or to direct the voting of, a security, or the sole or shared investment power with respect to Common Stock (i.e., the power to dispose of, or to direct the disposition of, a security).

(2)

The address of each Officer and Director is c/o Trutankless, Inc., 1

5720 N. Greenway Hayden Loop, Suite 2, Scottsdale, AZ 85260

.

(3)

Of the total shares of Common Stock owned or controlled by Mr. Stebbins, 350,000 shares are held by White Isle Holdings, Inc. and 15,000 shares are held by Core Financial Companies LLC.

DESCRIPTION OF SECURITIES

Common Stock

Our Articles of Incorporation authorizes the issuance of 100,000,000 shares of common stock, $0.001 par value per share, 31,799,906 shares were outstanding as of the date of this prospectus. Upon sale of the 4,500,000 units offered herein, we will have outstanding 36,299,906 shares of common stock. This number does not include the shares underlying the warrants to be issued if exercised by the warrant holders. Holders of shares of common stock are entitled to one vote for each share on all matters to be voted on by the stockholders. Holders of common stock have no cumulative voting rights, but are entitled to one vote for each shares of common stock they hold. Holders of shares of common stock are entitled to share ratably in dividends, if any, as may be declared, from time to time by the Board of Directors in its discretion, from funds legally available to be distributed. In the event of a liquidation, dissolution or winding up of TKLS, the holders of shares of common stock are entitled to share pro rata all assets remaining after payment in full of all liabilities and the prior payment to the preferred stockholders if any. Holders of common stock have no preemptive rights to purchase our common stock. There are no conversion rights or redemption or sinking fund provisions with respect to the common stock.

17

Preferred Stock

Our Articles of Incorporation authorize the issuance of 10,000,000 shares of preferred stock, $0.001 par value per share.

On September 1, 2016, the Company filed a Certificate of Designation (the “Certificate of Designation”) with the Secretary of State of the State of Nevada to establish the preferences, limitations and relative rights of its 6% Series A Convertible Preferred Stock, convertible, at any time, at the option of the holder, into five shares of our common stock and one warrant to purchase one share of our common stock at $1.00 per share. All Preferred Stock will be automatically converted into shares of the Company’s common stock and warrants after three years from the original issue date of the Preferred Stock.

Nevada Laws

The Nevada Business Corporation Law contains a provision governing “Acquisition of Controlling Interest.” This law provides generally that any person or entity that acquires 20% or more of the outstanding voting shares of a publicly-held Nevada corporation in the secondary public or private market may be denied voting rights with respect to the acquired shares, unless a majority of the disinterested stockholders of the corporation elects to restore such voting rights in whole or in part. The control share acquisition act provides that a person or entity acquires “control shares” whenever it acquires shares that, but for the operation of the control share acquisition act, would bring its voting power within any of the following three ranges:

·

20 to 33%

·

33% to 50%

·

more than 50%.

A

“

control share acquisition

”

is generally defined as the direct or indirect acquisition of either ownership or voting power associated with issued and outstanding control shares. The stockholders or board of directors of a corporation may elect to exempt the stock of the corporation from the provisions of the control share acquisition act through adoption of a provision to that effect in the articles of incorporation or bylaws of the corporation. Our articles of incorporation and bylaws do exempt our common stock from the control share acquisition act.

INTEREST OF NAMED EXPERTS AND COUNSEL

The audited financial statements of TKLS, as of December 31, 2017, are included in this prospectus and have been audited by AMC Auditing, LLC, a PCAOB registered accounting firm, as set forth in their audit report thereon appearing elsewhere herein and are included in reliance upon such reports given upon the authority of such individual as an expert in accounting and auditing.

The legality of the shares offered under this registration statement is being passed upon by Brunson Chandler, & Jones, PLLC.

18

DISCLOSURE OF COMMISSION’S POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

Insofar as indemnification for liabilities arising under the Securities Act of 1933 (the “Act”) may be permitted to our directors, officers and controlling persons pursuant to the foregoing provisions, or otherwise, we have been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable.

No director of TKLS will have personal liability to us or any of our stockholders for monetary damages for breach of fiduciary duty as a director involving any act or omission of any such director since provisions have been made in our Articles of Incorporation limiting such liability. The foregoing provisions shall not eliminate or limit the liability of a director for:

·

any breach of the director

’

s duty of loyalty to us or our stockholders

·

acts or omissions not in good faith or, which involve intentional misconduct or a knowing violation of law

·

or under applicable Sections of the Nevada Revised Statutes

·

the payment of dividends in violation of Section 78.300 of the Nevada Revised Statutes or,

·

for any transaction from which the director derived an improper personal benefit.

The Bylaws provide for indemnification of our directors, officers, and employees in most cases for any liability suffered by them or arising out of their activities as directors, officers, and employees if they were not engaged in willful misfeasance or malfeasance in the performance of his or her duties; provided that in the event of a settlement the indemnification will apply only when the Board of Directors approves such settlement and reimbursement as being for our best interests. The Bylaws, therefore, limit the liability of directors to the maximum extent permitted by Nevada law (Section 78.751).

Our officers and directors are accountable to us as fiduciaries, which means, they are required to exercise good faith and fairness in all dealings affecting TKLS. In the event that a stockholder believes the officers and/or directors have violated their fiduciary duties, the stockholder may, subject to applicable rules of civil procedure, be able to bring a class action or derivative suit to enforce the stockholder’s rights, including rights under certain federal and state securities laws and regulations to recover damages from and require an accounting by management. Stockholders, who have suffered losses in connection with the purchase or sale of their interest in TKLS in connection with such sale or purchase, including the misapplication by any such officer or director of the proceeds from the sale of these securities, may be able to recover such losses from us.

DESCRIPTION OF BUSINESS

Trutankless Inc. was incorporated in the state of Nevada on March 7, 2008. The Company is headquartered in Scottsdale, Arizona and currently operates through its wholly-owned subsidiary, Bollente, Inc., a Nevada corporation incorporated on December 3, 2009.

Bollente is involved in sales, marketing, research and development of a high quality, whole-house, smart electric tankless water heater that is more energy efficient than conventional products.

On August 13, 2015, the Company formed a wholly-owned subsidiary, Bollente International, Inc. (“Bollente International”) to begin international manufacturing and sales expansion for our trutankless® line of water heaters. The Company no longer operates Bollente International and on July 30, 2018, the Company caused Bollente International to be dissolved.

19

Products

Trutankless®

We manufacture and distribute trutankless® water heaters, a line of new, high-quality, highly efficient electric tankless water heaters. Our trutankless® water heaters are engineered to outperform and outlast both its tank and tankless predecessors in energy efficiency, output, and durability. It provides endless hot water on demand for a whole household and it also integrates with home automation systems. We have several features and design innovations which are new to the electric tankless water heater market that we believe will give our products a sustainable competitive advantage over our rivals in the market. Our trutankless® water heaters are available through wholesale plumbing distributors, including Ferguson, Hajoca, Hughes Supply, WinSupply locations, Morrison Supply, and several regional distributors. A partial listing of wholesalers may be found on our website (www.trutankless.com).

Our trutankless® water heaters are designed to provide an endless hot water supply because they are designed to heat water as it flows through the system. We believe that our products are capable of higher temperature rise than competitive units at given flow rates because of its improved design and greater efficiency. Our trutankless® water heaters can save energy and reduce operating costs compared to tank systems because unlike tanks, if there is no hot water demand, no energy is being used. In addition, we intend to improve life-cycle costs with an improved design conceived not only to increase efficiency, but also the longevity of our products versus competitive units. Generally, a typical tank water heater lasts about 11 years, whereas gas tankless systems may last longer, but requires more routine maintenance. Our product line is designed to last longer than tank water heaters without any routine maintenance required under most conditions.

We created a custom heat exchanger for our trutankless® product line that utilizes our patent pending Velix technology to heat water as it flows through the system, which means customers need not worry about running out of hot water. We believe we’ve selected the best materials available and a collection of exclusive design elements and features to maximize capacity, minimize energy use, and provide a truly maintenance free experience.

Our trutankless® water heaters were officially launched in the first quarter of 2014 and is sold throughout the wholesale plumbing distribution channel. We began generating revenue in the first quarter of 2014. As of the fiscal year ended December 31, 2014, we generated $238,912 in revenue. As of the fiscal year ended December 31, 2015, we generated $265,504 in revenue. As of the fiscal year ended December 31, 2016, we generated $429,582 in revenue. As of the fiscal year ended December 31, 2017, we generated $695,857 in revenue. As of the three months ended March 31, 2018, we generated $425,046 in revenue.

In July of 2014, we launched MYtankless.com, a customizable online control panel for our trutankless® line of smart electric water heaters. From the dashboard, residential and commercial users can obtain real-time status reports, adjust unit temperature settings, view up to three years of water usage data, and change notification settings from anywhere in the world, using a computer or web-enabled smart device at www.mytankless.com.

Additionally, service professionals can also use the dashboard to monitor system status on every unit they install, allowing them to proactively contact their customers if a service or warranty appointment is needed.

20

Our primary markets, Florida, Texas, Arizona, and the rest of the Sunbelt region are centers of growth in the U.S. construction industry with green building at an all-time high, and an unprecedented appliance replacement cycle. We intend to take advantage of these powerful macro-economic trends.

MYTankless.com is available as a service to consumers of trutankless® water heaters. We have applications available for download from the Google Play and Apple iOS stores, which like the online control panels, allows monitoring and control of the tankless systems.

On March 21, 2017, we announced our exclusive partnership with Mr. Rooter®.

On April 4, 2017, we announced that our trutankless line of smart electric tanless water heaters is the exclusive water heating solution for luxury communities built by the award –winning Arizona home builder Cullum Homes.

On April 11, 2017, we announced that our trutankless line of smart water heaters has been chosen for both a retrofit project and new construction of townhomes at Friendship Village, a retirement community touted as “senior living for the at heart,” located in Tempe, Arizona.

In June 2017, we announced that we have signed a manufacturing agreement with SINBON Electronics, a leading solution provider of electronic component integration design and manufacturing with a global presence in the U.S., Taiwan, China, Japan, the U.K., Germany, Hungary and the Czech Republic.

In September 2017, we announced that our trutankless® line of electric water heaters has launched a nationwide distribution program with Ferguson, the largest distributor of commercial and residential plumbing supplies, and pipe, valves, and fittings (PVF) in the United States.

In March 2018, we announced our sales and installation expansion into the Florida water heating market, which is over 90% electric, with our trutankless® line of electric water heaters.

Industry Recognition and Awards

Bollente’s trutankless® received the Best of IBS 2014 Award for Best Home Technology Product from the National Association of Home Builders (NAHB) at that year’s International Builders Show (IBS) in Las Vegas. The IBS is produced by NAHB and is the largest annual light construction show in the world - featuring more than 1,100 exhibitors and attracting 75,000 attendees including high level decision makers from some of the largest home builders in the world as well as plumbing and HVAC professionals from top outfits in major markets.